Your Home Buying Journey

Buying a home may be the biggest investment you’ll ever make, so it’s important to be prepared for each step of the journey.

Over time

Owning a home can result in significant financial returns. For example, the average U.S. house value increased 4.59% per year from 1992 until 2023. The all-time high was 19.2% in July 2021 and the record low was -10.6% in November 2008.

While housing values regularly move up and down, they typically increase over the long term. That means if you buy a home today with a 30-year mortgage, the value of your home will likely have increased exponentially by the time you finish paying the mortgage. Home ownership is one of the most effective ways to build wealth that can be passed down through generations.

In addition to the financial return on your investment, buying a home also offers social and emotional benefits that are difficult to quantify. Owning your home can build a sense of security, rootedness, and years of memories for your family and friends.

To become and remain a successful homeowner, you’ll need to pay attention to these important financial steps throughout the journey.

Before You Buy a Home

Buying a home takes careful planning and saving. Learn the steps to prepare financially for making one of the biggest investments of your life.

Ready to Buy a Home

When you have a down payment and you’re ready to buy a home, there are several steps involved in getting a mortgage, preparing for the purchase, and closing on your new home.

After You Buy a Home

By purchasing a home, you’ve reached an important financial milestone. Stay on the right track by continuing to make smart financial moves.

Put Your Credit

to Work for You

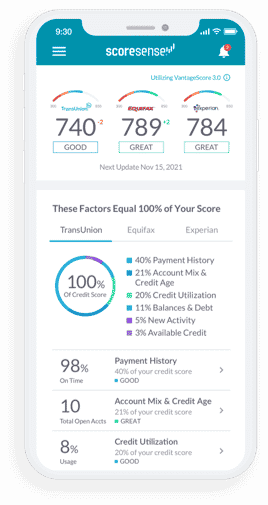

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores and reports from all three bureaus show you where you stand.

- Understand your scores. Credit Insights pinpoint what’s most affecting your scores, so you can make informed decisions.

- Know when things change. Daily Monitoring alerts you to suspicious activity that may pose a threat.

- Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.