For most people, purchasing a home is not a quick transaction. When you’ve got a down payment in hand and you’re ready to start shopping for a home, you’ll need to take several steps to get financing lined up, purchase, and close on your new residence.

Refresh your credit reports and scores.

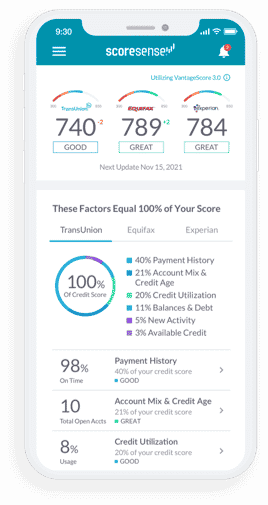

Review your latest credit reports and scores from Equifax, Experian, and TransUnion. If you requested a correction to misinformation, check your reports to make sure action has been taken by the bureaus.

Avoid applying for and using new credit.

To maintain the best credit score possible, don’t apply for any loans or credit cards for six months prior to applying for a mortgage. These are considered hard inquiries and may affect your credit score. Also, minimize credit card spending during the month before you apply for your mortgage. Even if the credit card is paid off completely at the end of the month, the statement balance is reported to the bureau and will be used to calculate your credit utilization.

Determine the right type of mortgage for you.

Your down payment will likely play a role in determining if you qualify for a conventional mortgage or if you should pursue other options such as a VA or FHA mortgage.

There are also different terms that can impact your interest rate and fees and help determine your final decision, such as:

• Fixed-rate or adjustable-rate mortgage (ARM)

• 30-year term or 15-year term

• Jumbo loans if the loan is over a certain amount

Use an online mortgage calculator to get an idea of what your monthly payment should be based on your credit score, down payment amount, and price range of homes you’re considering. By doing your own research upfront, you can make a more informed decision about which lender to use and which loan to choose.

Get pre-approved for a mortgage.

The first official step in the mortgage process is getting preapproved by a mortgage lender. To become prequalified, or preapproved, you’ll need to supply the lender with your overall financial information, including your debts, income, and assets. Using that information, the lender can give you an idea of the size of mortgage and terms for which you qualify. You can typically complete this step over the phone or online, and it should be free of charge.

By completing this step, you can shop for homes with a preapproval letter in hand. This shows sellers that you’re qualified to purchase and may be helpful in the negotiation process.

Look for homes in your price range.

After you’ve been pre-approved for a mortgage, you should have a definite idea of the home price you can afford and how much you’ll have to pay in monthly payments. Avoid touring or even looking at photos of homes that are out of your price range, so you won’t be tempted to expand your house budget. Consider working with a professional real estate agent who can help locate properties that will be a good fit for you.

Calculate total cost of ownership.

In addition to your mortgage payment, you’ll also be responsible for paying for homeowner’s insurance, property taxes, potential HOA fees, utility bills, and home maintenance and repairs. Before making an offer on a home, take time to determine your potential true monthly cost to buy the home.

Because home maintenance and repair needs fluctuate from year to year, most experts recommend setting aside about 1% to 2% of the price of the home annually to cover upkeep. Some years you may need a new HVAC unit and you’ll use more, while other years you’ll just need new light bulbs. To plan for true housing costs, simply budget 1% to 2% of the home’s price each year. For a $200,000 home, you’d set aside about $3,000 per year, or $250 per month, for home maintenance and repairs.

Make an offer and negotiate wisely.

When you find the home you want, it’s time to make an offer. Your real estate agent can help you determine the right offer to make and help you through the potential negotiations with the seller. Keep in mind that your ability to negotiate depends on the current market and location; even if you can’t negotiate on the price, you may be able to negotiate the closing date, furnishings, and other items.

Apply for a mortgage and wait it out.

Once you have a signed real estate contract in hand, your mortgage lender can start the process of putting together your loan. The underwriting process can take time, as it typically includes a professional appraisal, inspection, and title search. You can help speed up the process by providing any needed information or documents as quickly as possible.

Continue to watch your credit during this waiting period. Be sure to avoid credit events that may have an impact on your loan approval process (such as opening a new credit card or taking out another loan).

Close on your new home.

When your mortgage is through underwriting, your closing will be scheduled. Before closing day, you’ll need to wire funds or bring a money order with you to closing to cover your down payment and any other funds you’re required to pay. When you arrive at closing, be ready to sign lots of paperwork. Then, prepare to celebrate your new home!

ScoreSense® offers on-demand access to your credit scores and reports from all three credit bureaus, along with daily credit monitoring and access to Credit Specialists who can answer your credit questions. If you’re not a member, try a 7-day trial today.

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores and reports from all three bureaus show you where you stand.

- Understand your scores. Credit Insights pinpoint what’s most affecting your scores, so you can make informed decisions.

- Know when things change. Daily Monitoring alerts you to suspicious activity that may pose a threat.

- Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.