Purchasing a home takes careful planning, and for many people, the planning part of the journey takes several years. Make sure you’re prepared financially with the following steps:

Save for a down payment.

The minimum down payment for a conventional mortgage is usually 5% of the purchase price, but the preferred down payment for a home purchase is 20%. This means for a home that costs $200,000, the down payment would be $40,000 and the amount financed for the mortgage is $160,000.

If you don’t have a 20% down payment, you still may be able to buy a home:

• Many lenders will offer mortgages with a 5% down payment.

• VA or FHA programs can be available with a down payment as low as 3.5%.

However, if you have a lower down payment, you will likely have to settle for less-favorable mortgage terms that could include:

• Higher fees

• Higher interest rate

• Private Mortgage Insurance (PMI)

• Mortgage Insurance Premiums (MIP) for FHA loans

Research neighborhoods and communities.

Take time to become familiar with the options in the area where you hope to purchase a home. Research the school district to make sure it is acceptable for your present or future children and consider whether your commute to work will be acceptable.

Also, think about your personal plans and feelings. Before buying a home, it’s best to make sure you plan to stay put for several years. In addition, if the prospect of buying a home makes you feel stressed and fills you with dread, it’s probably not the right time. Home ownership is a big commitment, and it will work best if you feel excitement and pride about it rather than stress.

Keep track of interest rates.

As you save for a down payment and plan for your home purchase, keep an eye on the current interest rates. Rate fluctuations are common, but buying when interest rates are high will cost you significantly more over the life of your mortgage loan. If possible, aim to purchase when interest rates are lower and lock in a lower monthly mortgage payment for the long term.

Track your credit.

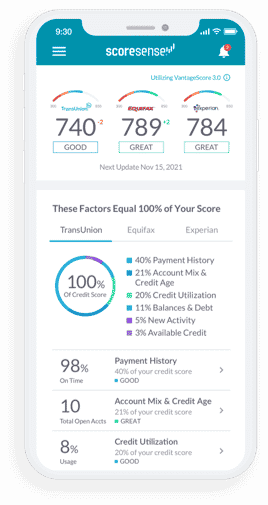

Review your credit reports and scores from Equifax, Experian, and TransUnion. Carefully comb through your credit reports to make sure the details are correct for each of your credit lines. Double-check that your personal information—such as your name and address—is accurate.

Because your credit score will affect your ability to get a mortgage as well as the interest rate you’ll have to pay, it’s important to regularly monitor your credit to check for errors and make sure your score is within the range needed to get a mortgage with the interest rate you expect.

Also, regularly review your credit reports for accuracy, including your payment history. Make sure there is no suspicious activity on your report, such as accounts that you didn’t open or inquiries you didn’t approve. If you find any errors, you’ll need to file a dispute with the credit bureau to have them corrected before applying for a mortgage.

ScoreSense® offers on-demand access to your credit scores and reports from all three credit bureaus, along with daily credit monitoring and access to Credit Specialists who can answer your credit questions. If you’re not a member, try a 7-day trial today.

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores and reports from all three bureaus show you where you stand.

- Understand your scores. Credit Insights pinpoint what’s most affecting your scores, so you can make informed decisions.

- Know when things change. Daily Monitoring alerts you to suspicious activity that may pose a threat.

- Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.