Your Journey of Paying for College

College costs continue to skyrocket. Over the past 10 years:

- The average annual cost of attendance at U.S. colleges and universities rose 37%.

- U.S. student loan debt increased 10% from $772 billion to $1.6 trillion.

- The average amount individual students borrowed increased by 26%, from $24,000 to more than $30,000. (1)

Help your child get a college education: Stay on top of your finances at every step of the way.

Paying for college may be the biggest investment you ever make. Currently, the average annual cost of tuition and fees have risen to $54,800 for private four-year institutions and $27,330 for in-state residents at public four-year colleges, according to the College Board. (2)

A college education can help your child create a brighter future, but it’s important to avoid damaging your own financial future in an effort to help your child. Most parents (85%) pay for a portion of their child’s college tuition (3), but even a portion of the total college bill can add up to thousands of dollars per year.

The good news is that there are several options to help you pay for college, including:

- Scholarships

- Grants

- Federal loans

- Private loans

- Tax-advantaged savings

- Work-study programs

Your journey will include you determining which options are right for your family and taking the right steps to take advantage of those options on the right timeline. At ScoreSense®, we’d like to help you and your family learn more about the right financial steps to take at every stage of your journey to paying for college.

Before College

During College

After College

1. Average Total Cost of Attendance, National Center for Education Statistics’ Integrated Postsecondary Education Data System: Average total cost of attendance for first-time, full-time undergraduate students in degree-granting postsecondary institutions, by control and level of institution, living arrangement, and component of student costs: Selected years, 2010-11 through 2019-20. 2. Trends in College Pricing, College Board: https://research.collegeboard.org/trends/college-pricing. 3.How America Pays for College 2021, Sallie Mae: https:// www.salliemae.com/about/leading-research/how-america-pays-for-college/.

Put Your Credit

to Work for You

Get Started with ScoreSense®

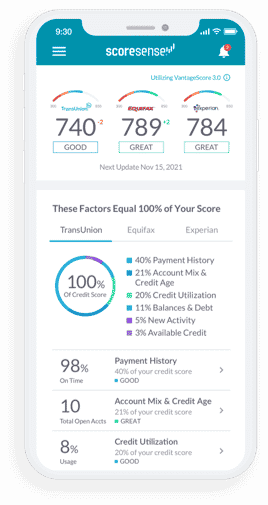

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores

and reports from all three bureaus show you where you stand. - Understand your scores. Credit Insights pinpoint what’s most affecting

your scores, so you can make informed decisions. - Know when things change. Daily Monitoring alerts you to suspicious

activity that may pose a threat. - Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.