When you become a homeowner, you’ve probably reached one of your biggest financial goals. Congratulations! However, to continue succeeding financially, you’ll need to take additional financial steps:

Create a new budget.

Now that you’re a homeowner, your budget will probably need to be adjusted. Revisit your budget and make sure you include ongoing home costs, as well as setting aside at least 1% of your home’s value per year for home repairs and maintenance.

Revisit insurance policies.

Now that you own a home, you’ll need homeowner’s insurance. But that’s not all. You may also want to consider additional insurance policies, such as a life insurance policy that would cover your mortgage rather than leave your heirs with a home they may struggle to pay for. Also consider disability insurance that would cover your mortgage payments if you became unable to work.

Keep saving.

Maybe you no longer need to save for a down payment, but it’s wise to continue your saving habit. Work toward building an emergency fund, saving for future home updates, or other financial goals.

Continue tracking your credit.

Having a new mortgage loan will likely cause a temporary dip in your credit score, but after several months of regular, on-time payments, it will stabilize. As your lender experiences your ability to repay the loan, the mortgage can positively influence your credit.

Continue to regularly monitor your credit to catch any potential errors and to make sure your scores are ready when you need to access credit again for future needs.

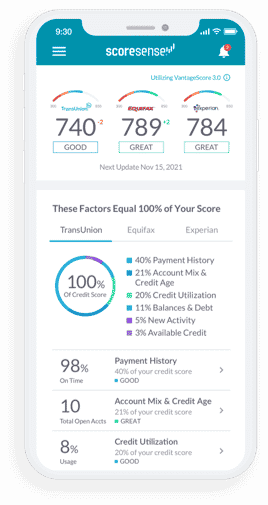

ScoreSense® offers on-demand access to your credit scores and reports from all three credit bureaus, along with daily credit monitoring and access to Credit Specialists who can answer your credit questions. If you’re not a member, try a 7-day trial today.

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores and reports from all three bureaus show you where you stand.

- Understand your scores. Credit Insights pinpoint what’s most affecting your scores, so you can make informed decisions.

- Know when things change. Daily Monitoring alerts you to suspicious activity that may pose a threat.

- Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.