Available Features

With ScoreSense®, no matter which bureau lenders use to check your credit, you’ll know where you stand.

Available Features

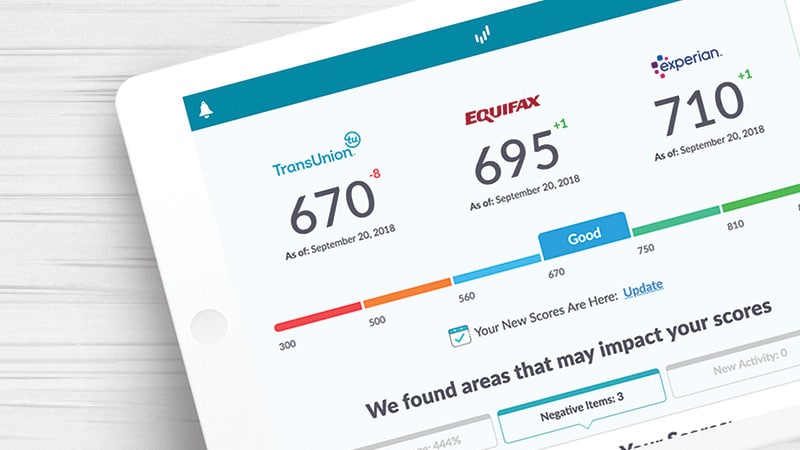

Credit Scores & Reports

We fill in the gaps that other credit score providers simply don’t.

3-Bureau Updates

Get your latest credit scores and credit reports from TransUnion®, Equifax® and Experian®.

Personal Credit Specialist

Speak one-on-one with a Credit Specialist, every time you call or online chat.

Dispute Center

Use our step-by-step guide to learn how to correct score-lowering errors on your credit report with all 3 bureaus.

Credit Insights

We analyze your latest credit data to identify changes that may affect your scores.

Score Factors

Find out how your credit scores are calculated and what’s having the biggest impact.

Credit Reports Analysis

See account discrepancies we identified when comparing your reports across all 3 bureaus.

Daily Monitoring & Protection

We can alert you to changes that may pose a threat to your credit, identity and family.

Credit Alerts

Get notified about changes or unauthorized activity on your credit report.

$1 Million Identity Theft Insurance

Safeguard your savings from the cost of restoring your good name and credit.*

Identity & Family Safety

Get alerted to suspicious use of your personal data and registered sex offenders in your area.

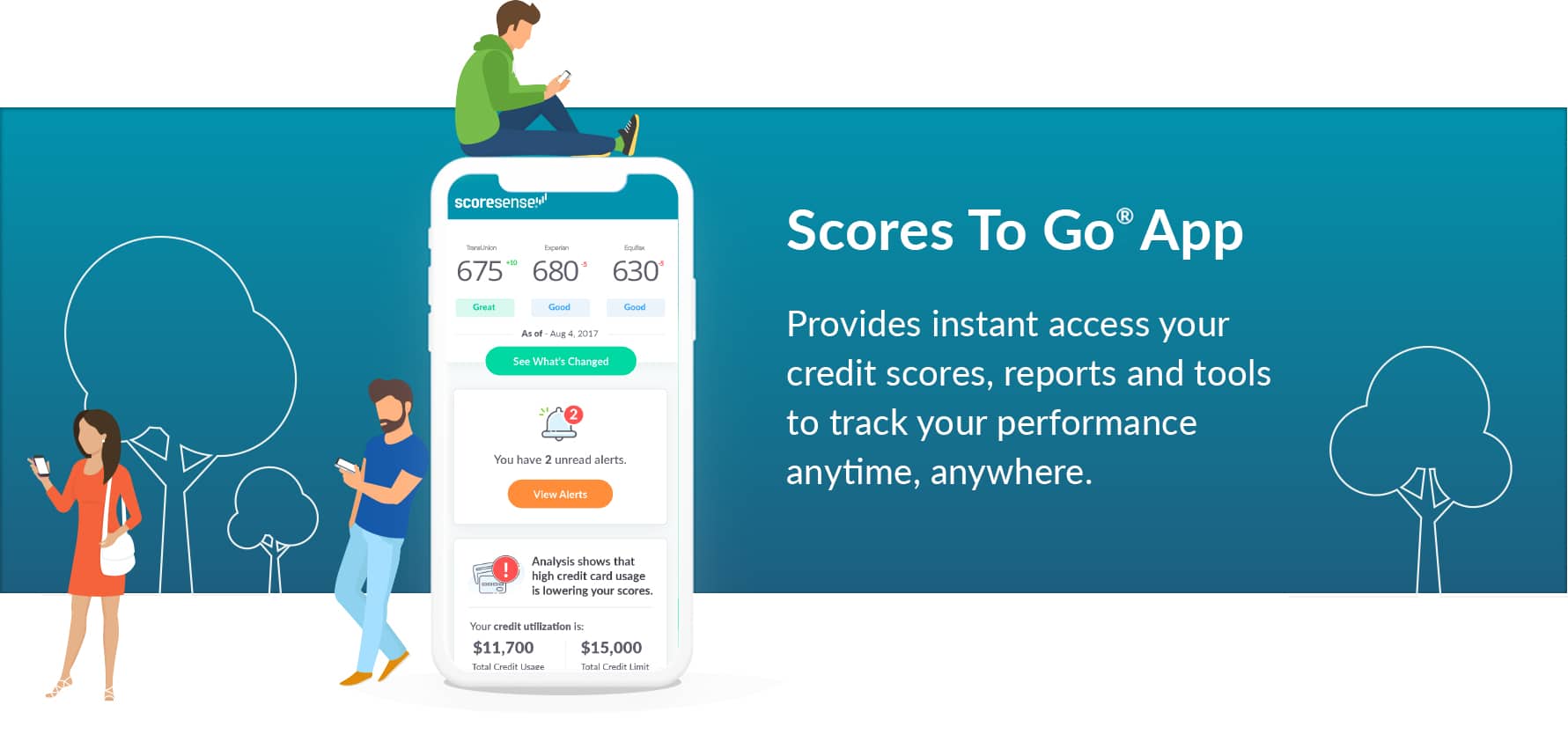

Scores To Go® App

Provides instant access to your credit scores, reports and tools to track your performance anytime, anywhere.

Credit Tools

We equip you with easy-to-use tools and resources designed to help you protect your credit.

ScoreCast™ & ScoreTracker™

Analyze how certain credit actions may change your scores and track results month to month.

Credit Freeze Center

Follow steps for initiating a Credit Freeze to restrict unauthorized access to your scores and reports.

Learning Center

Benefit from over 100 articles on credit basics, scores, reports, lender insights and identity theft.