ScoreSense® worked with the team at Military Makeover with Montel to transform the home and life of the Stupar family.

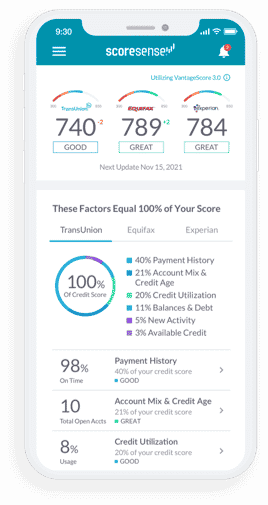

We've become attached to the ScoreSense® app; we check it all the time. We love how easy it is to read and to see our credit reports from all three bureaus side by side. I've never understood my credit so well and what affects it.

– Michael Stupar

Your Military Journey

Make the most of your service: Stay on top of your finances at every step of the way. Life in the military is full of sacrifice and rewards, but it also can present unique financial challenges. Many military families deal with financial struggles due to:

- Overseas deployments

- Frequent relocations

- Regular upheaval of spouse’s career

- Lack of military-specific financial advice

Despite the challenges, a military career can offer a reliable paycheck and opportunities to build a financially secure life while serving your country. To build a comfortable life in the military, it’s important to take the right financial steps at every stage: before you join, while you’re active, and as you transition back to civilian life.

At ScoreSense, we’d like to thank you for your service and help you learn more about the right financial steps to take at every stage of your military journey.

Joining the military is an important commitment. You need to be prepared physically, emotionally, and financially. Make sure you’re ready financially by completing the following steps.

- Check your credit. The U.S. Department of Defense will review your credit report before you join. Review it yourself first to understand what’s in it and to detect any errors.

- Understand military pay. Before starting any job, you need to understand what you’ll be earning so you can plan for expenses. Military members receive basic pay, housing allowance, subsistence (food) allowance, medical and dental benefits, bonuses and special pay, and a uniform allowance for non-officers.

- Build a budget. Create a plan for how you will spend your money each month. If you’ve never used a budget before, try to commit 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Understand the SCRA. The Servicemember’s Civil Relief Act offers protection and benefits to help reduce financial burdens for active military members. Through the SCRA, any debt you incurred before joining the military must be reduced to an interest rate of 6% or lower. In some cases you may terminate an apartment or car lease and you may be protected from foreclosure.

Life is busy as an active servicemember and keeping up with finances may not be at the top of your priority list. But if you make smart financial choices now, you’ll be better prepared for a solid financial future, regardless of where the journey takes you.

- Stick to a budget. Use a budget to make sure you’re living within your means and to avoid getting in unsustainable debt.

- Manage finances during deployment. Avoid letting a deployment ruin your finances. Ask someone trustworthy to keep track of your finances while you’re away if needed, and set up automatic bill pay to stay on track with bills. Also, consider putting an “active duty alert” on your credit, which will freeze your credit while you’re deployed.

- Keep good records during your frequent moves. Moving costs can add up, but the military may reimburse you for those costs if you keep receipts and submit complete records.

- Keep track of your credit. Monitor your credit regularly to check for errors and stay aware of the factors impacting your score. Your credit score will be important for setting up utilities each time you relocate, and for using credit to purchase a car or open a credit card.

- Prioritize savings. Even if you plan to stay in the military for 20 years to become eligible for a retirement pension, it’s important to save money on your own too. You may need savings for emergencies and for various financial goals, and for additional retirement savings, commit to the Thrift Savings Plan, the government’s version of a 401k.

If you’re preparing to make your final move and return to civilian life, congratulations! Continue to make the right financial moves as you prepare for this transition so you can start your new chapter on secure financial footing.

- Save strategically. As you near the end of your military service, try to commit additional funds to savings monthly. This will give you a cushion to pay for your last move and to get settled into civilian life.

- Get the right job. Your military service provides you with a wide range of skills and experiences that can smoothly transition into a new career. Take time to find the position that will allow you to use your hard-earned skills and reward your experience.

- Buy a home. If you’ve been renting throughout your military career, now may be the time to consider purchasing a home. Check your credit before contacting mortgage lenders, and consider using your VA loan benefit to get an affordable interest rate.

- Stay on top of your credit. Review your credit reports regularly to check for errors and to make sure your credit is readily available when you need it.

Put Your Credit

to Work for You

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores

and reports from all three bureaus show you where you stand. - Understand your scores. Credit Insights pinpoint what’s most affecting

your scores, so you can make informed decisions. - Know when things change. Daily Monitoring alerts you to suspicious

activity that may pose a threat. - Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.