If you want your kids to get a college education, they may need your financial help. And helping to pay for your kids’ college education is a long-term commitment and a financial journey.

Set a savings goal.

If you plan to help pay for your child’s college education, you need to have an idea of how much college will cost. The exact figure will depend on which college your child ultimately chooses to attend, but you can get a ballpark cost by using a college savings calculator like the one available from the U.S. government’s Office of Financial Readiness. It can help you build a plan for college savings, including consideration of the potential increase in college costs and your expected rate of return.Save as much as possible.

Start saving for college as early as you can. By starting to save when your child is young, your investments will have more time to grow. As a result, you can end up with a bigger pot of savings without personally contributing as much.If you haven’t been saving for your child’s college education, start now. Consider speaking to a tax consultant about opening a 529 plan, which is a tax-advantaged college savings account. The money you invest in a 529 education savings plan grows tax-deferred, and withdrawals are tax-free if you use them to pay for qualified educational costs.

Use the FAFSA forecaster.

Federal student aid is available for many families to help send their children to college. The Free Application for Federal Student Aid (FAFSA) is the form that the government and many colleges use to determine the amount of financial aid for which your child will qualify. You can’t complete the FAFSA until your child’s senior year of high school, but you can use the FAFSA forecasting tool to get an idea of how much aid you can expect to receive. Forecast your aid while your child still has a year or more of high school so you can start planning for the correct amount of college costs.Set financial goals.

Helping to pay for your child’s college education may be an important financial goal, but it shouldn’t prevent you from reaching other important financial goals, such as retirement. Take time to write down your long-term financial goals, such as buying a home or second home, retiring at a certain age, or buying a new car. Determine how much you’ll have available to invest in your child’s college education without sacrificing other goals that are important to you.Complete the FAFSA during your child’s senior year.

The FAFSA is usually available in October of your child’s senior year in high school. It will usually be available until the following June, but some colleges have earlier deadlines for receiving financial aid. Complete the form as soon as possible after it becomes available. The information you provide on this form will be used to determine whether your child is eligible for federal grants, work-study programs, or other financial aid. Many colleges use the FAFSA to award their own aid.Encourage your child to apply for scholarships.

There are scholarships available from a wide variety of sources, including local governments, community organizations, corporations, and colleges. Consider using sites like Scholarships.com, FastWeb, and Scholly to find scholarships that may fit your child and encourage them to apply for as many as possible. Scholarship dollars can add up and help pay for a significant portion of your student’s college costs.Help your child choose the college that meets your family’s needs.

When your child has been accepted to one or more colleges and you have completed the FAFSA, your child will receive a financial aid award letter from each college that has accepted their application. The award letter will include your child’s total Cost of Attendance at that school, the amount of funding your family will be expected to contribute (Expected Family Contribution), and the amount of any scholarships, grants, or loans the institution is willing to offer your child. Encourage your child to consider the financial aid awards in deciding which college to attend, and make sure you or your child have a plan for paying for any expenses that are not covered by grants or scholarships.Check your credit and monitor it regularly.

Keep track of your credit on a regular basis. If you eventually need to borrow any funds to help pay for your child’s college education, lenders will review your credit report to determine whether you qualify for a loan and at what interest rate. Review your credit report on your own first to understand what’s in it and to correct any errors with the bureaus.Understand any potential college benefits available through your employer.

Some employers provide college tuition benefits to their employees, which can be used for employees’ children. For example, if you’re a member of the military, you may have GI benefits available that can help pay for your child’s tuition. If you’re an employee of a college or state government, your child may qualify for discounted tuition at your institution, state institutions, or partner institutions. Find out the details of any potential employer discounts to help you and your child make educated decisions about college plans.Get Started with ScoreSense®

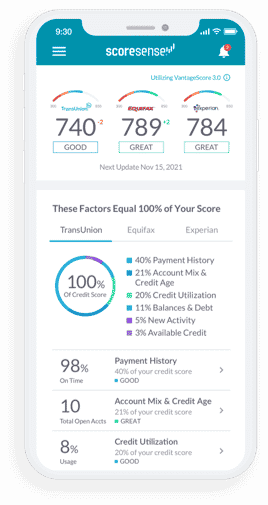

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores

and reports from all three bureaus show you where you stand. - Understand your scores. Credit Insights pinpoint what’s most affecting

your scores, so you can make informed decisions. - Know when things change. Daily Monitoring alerts you to suspicious

activity that may pose a threat. - Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.