If your child has completed college, congratulations! If you or your child have borrowed funds to complete that degree, the financial work of college isn’t done yet. Continue to make the right financial moves to guide your new grad’s transition into the workforce and to move your own life forward on secure financial footing.

Offer support for your child’s next steps.

Most college graduates experience some stress as they seek employment and launch their careers. If your child is entering this new stage with student loan debt payments looming, try to be supportive by listening and connecting them with people you may know who work in their field. If it’s taking longer than expected for your child to find the job they want, gently encourage them to take a job that may not be their ideal position and continue their search. By starting to earn regular income, your child can begin repaying their student loans while they continue to look for their perfect job. Experts recommend that students do not take on a student loan payment that exceeds 20% of their projected discretionary income, or 8% to 10% of their projected total monthly income.

Continually communicate about your original loan repayment plans.

If you and your child made a repayment agreement before borrowing for college education, communicate with your child to make sure you are both still on the same page. For example, if you agreed to make payments on a student loan until six months after your child’s graduation, make sure they are planning to take over the loan payments on that date. With open communication, you can stick to your original plans without causing friction in your relationship with your child.

Create a budget based on your post-college commitments.

If you took out a parent loan, home equity loan, or other loan for your child’s education that you committed to repay, work to repay it as quickly as possible. Consider creating a new budget that will allow you to pay as much as possible toward the college loan each month. By paying off any debt associated with your child’s education, you’ll be better positioned to work toward your own future financial goals. If your child will be responsible for repaying some or all of their college debt, consider helping them develop their own budget to ensure the funds will be repaid.

Stay on top of your credit.

Review your credit reports regularly to check for errors and to make sure your credit is readily available when you need it. If you or your child took out student or parent loans for college, making regular, on-time payments on those loans can have a positive impact on your credit over time.

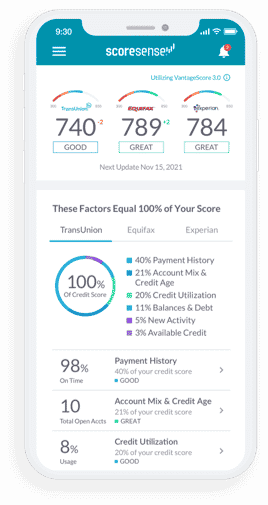

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores

and reports from all three bureaus show you where you stand. - Understand your scores. Credit Insights pinpoint what’s most affecting

your scores, so you can make informed decisions. - Know when things change. Daily Monitoring alerts you to suspicious

activity that may pose a threat. - Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.