Weigh the costs of paying cash or borrowing.

If you have cash available to pay for your child’s college expenses along the way, you may want to use it and avoid paying for college over time. However, take time to consider your other financial goals for the next four years and into the future. Will paying for college in cash limit your ability to meet other financial goals in the coming years? If so, consider paying some college expenses in cash and paying for the rest over time. That way, you can preserve more of your available cash and avoid getting into a cash flow crunch in the next several years.

Keep track of your credit.

Monitor your credit regularly to check for errors and stay aware of the factors impacting your score. Understanding and protecting your credit score will be important if you need to open or renew college loans, and for using credit to handle unexpected expenses while you’re paying for college.

Consider the options for borrowing.

If you plan to borrow some of the money needed to pay for college, there are several potential ways to do this. Take time to learn about all your options and choose those that will work best for your situation. Some of the most used options include:

- Direct PLUS loans for parents. Funded by the federal government, Direct PLUS loans for parents of dependent undergraduate students have fixed interest rates and minimal fees. The credit requirements are generally not as rigorous as those for private loans, but they do require a credit check. Borrowers who have an adverse credit history must meet additional requirements to qualify. The PLUS loan offers an income-based repayment option and extends death and disability discharges to the parent borrower.

- Private loans. Private loans are offered by banks and online lenders. They generally don’t include origination fees and may have lower interest rates than federal loans, depending on your credit history.

- Home equity loans. If you own a home, borrowing against your home equity can be one of the most affordable ways to borrow money. Because a home equity loan or home equity line of credit (HELOC) is secured by your home, it usually comes with a lower interest rate. While home equity loans and HELOCs often have lower interest rates than student loans or parent loans, they also carry more severe consequences if you’re unable to repay them. If you default on a student loan or a parent loan, the lender can’t repossess your child’s education. However, if you default on a home equity loan, the lender can repossess your home.

- Student loans. Many college lending experts do not recommend taking out parent loans for college until your child has maxed out their federal student loan options. That’s because federal student loans come with lower interest rates, and undergraduate students do not need a credit check to qualify for federal student loans. In addition, these loans may be subsidized by the federal government. So, consider requiring your child to take out student loans before you take out parent loans.

Work with your child to create a plan for repayment of any borrowed college funds.

Whether you take out parent loans or your child takes out student loans, it’s important that you both understand who will be responsible for repaying the loans. Maybe you plan to make payments on the loans until your child graduates or reaches a certain level of income. (Experts recommend that students do not take on a student loan payment that exceeds 20% of their projected discretionary income, or 8% to 10% of their projected total monthly income.)

Whatever your plan is, make sure both you and your child agree about whose responsibility it will be to repay the loans. Keep in mind that different loans have different timelines for repayment, so consider the timeline when deciding which loans to pursue.

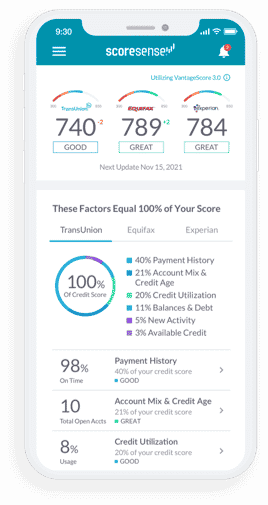

Get Started with ScoreSense®

ScoreSense® provides accurate, personalized credit information and the insights to help you understand it, backed by live customer care representatives and credit specialists available by phone. Millions of consumers have trusted ScoreSense® to track their credit score and help protect them from identity theft.

- See what lenders may see. Monthly updates to your three credit scores

and reports from all three bureaus show you where you stand. - Understand your scores. Credit Insights pinpoint what’s most affecting

your scores, so you can make informed decisions. - Know when things change. Daily Monitoring alerts you to suspicious

activity that may pose a threat. - Protect your money. Up to $1 million identity theft insurance* helps offset the high cost of repair should identity thieves strike.