OVERVIEW

Most Americans are feeling the weight of inflation and worry that a recession may be coming. Earlier this year, we reported that rising inflation and interest rates are making everyday living very difficult for many families, and that fact remains the same now. More Americans are using credit as a last resort to pay bills, and rising interest rates are making it more costly to borrow money and pay off balances. Thus, not surprisingly, the New York Federal Reserve reported U.S. household debt surpassed $16 trillion for the first time ever during the second quarter. Consumers also are overspending credits limits and getting behind in payments.

The following analysis of Q2 credit use, conducted by ScoreSense, sought to better understand consumers’ credit score activity and provide insight about what may occur in the coming months.

Additionally, the pause on federal student loan payments, which began in March 2020, continues to August 31 with payments scheduled to restart in September. We conducted a survey of 418 consumers with federal student loans on pause to better understand how the resumption of payments will impact their budgets.

CREDIT SPENDING ANALYSIS: Q2 2022 Compared to Last Year

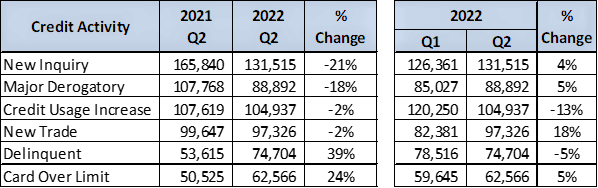

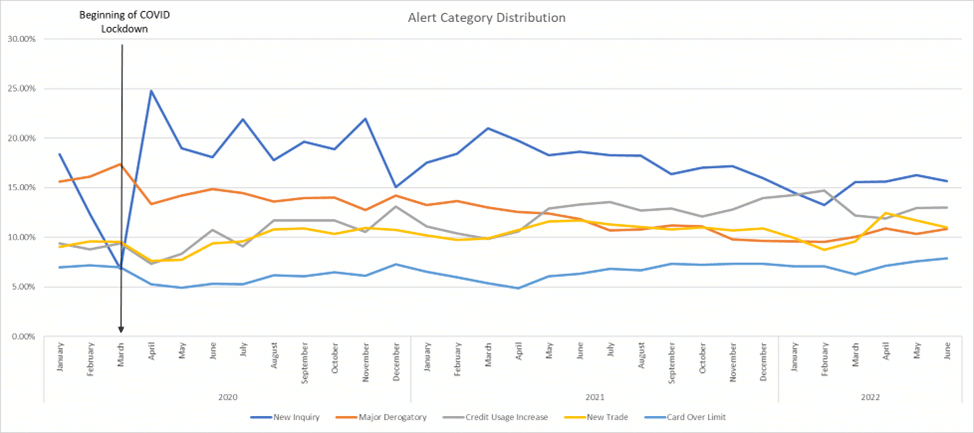

We analyzed credit activity for Q1 2022 compared to the same quarter last year. We also compared Q1 and Q2 2022 data to see recent shifts in activity. The results, illustrated on the graphics below, reveal the following:

- Delinquencies increased by 39% in Q2 2022, compared to Q1 2021. While the delinquencies remain somewhat flat from Q1 to Q2 this year, if you look at 2020 and 2021, there is normally a bigger drop in Q2 vs Q1 delinquencies, which makes sense. Customers normally run up credit cards in Q4, delinquencies show in Q1, and they start to catch back up with less spending in Q1 and a tax refund helps pay down debt. However, this year with higher cost in the daily budget due to inflation and lower tax refunds due to the child tax care credit being distributed early, consumers were unable to bring down delinquencies like they normally do.

- New Inquiries dropped by 21% in Q2 2022 compared to Q2 2021. From Q1 to Q2 this year, we see a 4% increase in new credit inquiries. While relatively consistent with Q1, the continued trend of lower inquiries shows lower credit activity this year versus the previous years. As consumers see interest rates and budgets shrink, they seem hesitant to borrow and less willing to commit to a longer-term loan.

- New trade, Q1 2022 to Q2 2022, increased by 18%. This increase is unusual, but when taken into the context of overall credit activity, we suspect this is likely a lagging indicator. This data most likely reflects people that were already locked into a loan rate and accounts coming on the report from previous months.

- Card Over Limit increased by 24% in Q2 2022 compared to Q1 2021. From Q1 to Q2 this year, we saw a 5% increase. We believe this indicates consumer inability to pay down credit cards as well as their reliance on them. Consumer budgets are getting stretched, and some consumers need to rely on credit cards more often.

- Major derogatory alerts – late payments of 180 days or more – including collections, repossessions, and foreclosures have trended down over the past five years as consumers have been doing better at paying down debt.

CONSUMER SURVEY: CONSUMERS WITH FEDERAL STUDENT LOANS

Key Findings

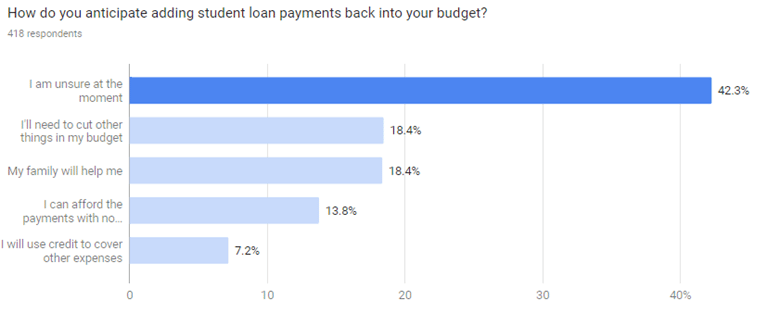

- 42% of respondents aren’t sure how they will add loan payments back into their budgets.

- Only 14% of respondents with federal student loans on pause say they can afford to restart payments.

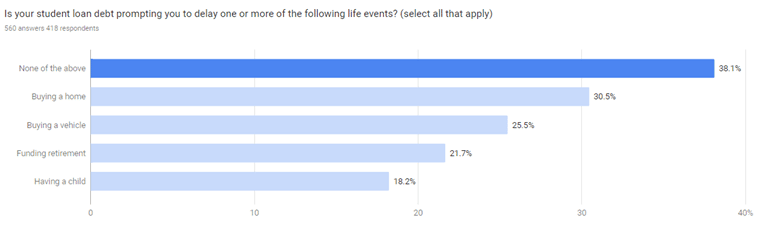

- 62% of survey respondents say they are delaying major life purchases and the resumption of payments will delay major life events for some loan holders, including purchase of a home (30% of respondents) or having a child (18% of respondents.)

- To resume payments, 18% of survey respondents say they will need to cut their budgets or rely on family to help. About one of four respondents between the ages of 18-34 will need help from family members to help with student loans.

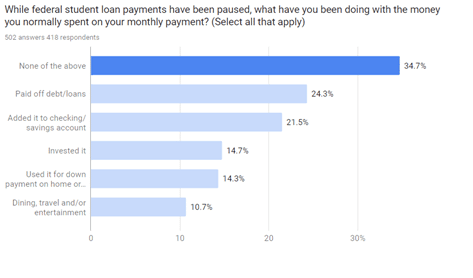

- During the pause, nearly 25% of respondents used their money to pay off debts/loans. Loan holders between 18-34 in age indicated they were more likely to invest the money compared to the older age groups.

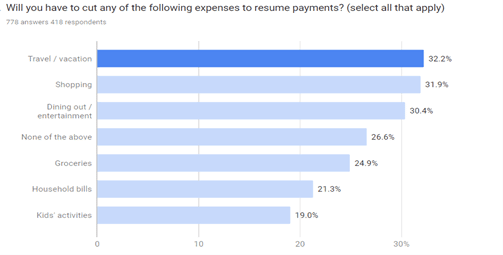

- Loan holders plan to cut expenses to make payments, including groceries (25% of respondents) and children’s activities (19% of respondents).

OPINION & OUTLOOK

Now halfway through 2022 in an inflation-plagued economy, we still see indicators of credit spending, overspending and late payments.

Since early 2020, ScoreSense has seen an increase in the number of delinquent payments reported, and while Q2 this year wasn’t as bad, we are up 39% over the same time last year.

As noted in the introduction to this report, the New York Federal Reserve reported U.S. household debt surpassed $16 trillion for the first time ever during the second quarter. Despite the surge in cost to borrow money, credit card balances increased by $46 billion last quarter. Over the past year, credit card debt has jumped by $100 billion, or 13%, the highest percentage increase in more than 20 years. In early May, The Federal Reserve Bank of New York’s Center for Microeconomic Data issued its Quarterly Report on Household Debt and Credit. The Report revealed an increase in total household debt during the first quarter of 2022, increasing by $266 billion (1.7%) to $15.84 trillion. Balances now stand $1.7 trillion higher than at the end of 2019, before the COVID-19 pandemic.

Not only are Americans racking up credit debt, but also, almost 40% of consumers cannot save, according to a recent analysis by the American Consumer Credit Counseling.

Higher interest rates will continue to set people back, with experts expecting balances to reach an all-time high this year, even before the holiday season.

Continued inflation and rising interest rates by the Federal Reserve will further impact many households.

On July 27, the Federal Reserve enacted its second consecutive 0.75 percentage point interest rate increase as it seeks to tamp down runaway inflation without creating a recession. The federal funds rate determines how much banks charge each other for short-term loans, but it also directly affects the interest rates on consumer products such as credit cards and mortgages. For consumers using credit cards to supplement their strained household budgets, this is especially concerning and could lead to more delinquencies. As of July 20, before the Fed’s rate hike on July 27, the average credit card interest rate reached 17.46%, according to CreditCards.com, which is a 1.3 percentage point-increase from a year ago. To date, the record high credit card rate is 17.87%, set in April 2019.

When inflation might start to reverse itself is anyone’s guess. A June survey of inflation expectations from the New York Federal Reserve indicates price increases aren’t over yet and predicts that by June 2023, prices will have risen approximately 6.8% from their current levels. As just one example, in April 2022, the U.S. Department of Agriculture released its food price outlook for 2022, which reported a range of foods will likely be getting more expensive. According to USDA, food prices in February 2022 were 7.9% higher than they were in February 2021.

Debt Consolidation

Many Americans are looking for ways to control debt better, including use of debt consolidation loans or transferring credit balances to lower-interest or zero-interest credit cards. For some, this may be a prudent move, but we advise to carefully read the terms and understand how interest will be charged and any fees involved. The goal should be to pay less interest than before.

Final Thoughts

Looking at our analysis of credit behavior in Q2 and over the past year, we’re concerned that many consumers under financial duress will continue to increasingly use credit to pay for “ordinary” things, such as groceries and fuel, and hold that debt instead of paying it off at the end of the month. Worse, we’re concerned that late payments and overdue payments that go to collections may increase as well. Our concerns continue to amplify as the Federal Reserve raises interest rates in an attempt to tamp down inflation, thus consumers with credit card debt pay more interest. That also means that consumers who are making minimum payments will see less of these payments applying to the principal, prompting balances to creep up and possibly reach or breach credit limits. Many households that were able to pay down debt and saw their credit utilization rate drop during the pandemic, due in part to government stimulus checks, will now see those gains lost.

At ScoreSense, we provide credit monitoring products to American consumers. Our website and credit specialists provide personalized education on how to better understand your credit and monitor for identity fraud.