OVERVIEW

Going into the new year, many consumers felt optimistic that the worst of the pandemic had passed and that 2022 would be focused on promising plans to return to normalcy as much as possible. Many hoped the crazy home market would normalize, and they could purchase a new home. But it’s been anything but normal, with gloomy economic news – rising inflation, continuing supply chain problems, and other factors influencing higher costs for everything. Sadly, many households are suffering difficult economic strains while others are nervous as news headlines hint a recession may be on the horizon. The following analysis and consumer survey, conducted by ScoreSense in March and April 2022, sought to better understand consumers’ credit score activity and their plans – on track or changed – for buying a home this year.

CREDIT SPENDING ANALYSIS: Q1 2022 Compared to Q1 2021

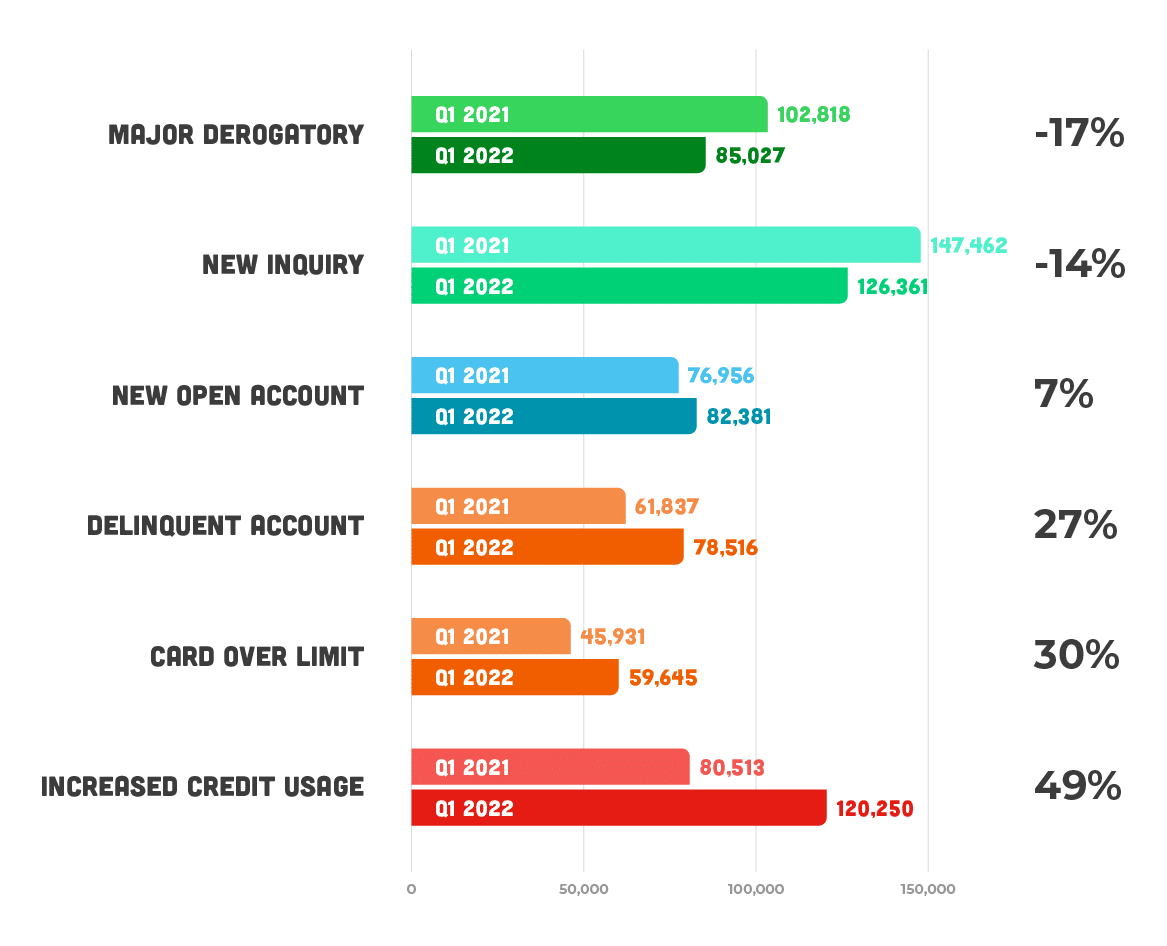

For perspective on the market, we analyzed credit activity for Q1 2022 compared to the same quarter last year. The results, illustrated on the graphic below, revealed the following:

- Credit card usage has skyrocketed, up 49% this year. Consumers also are overspending credit limits; the number of consumers who have spent over their credit limits is up 30% over last year. This can largely be attributed to inflation: many households with budget stress are resorting to pay for food, doctor visits, gas, and other things with credit. The over usage of credit cards shows that consumers are still buying at the higher prices versus saving. This is also evident in recent consumer spending data.

- Major derogatory alerts – late payments of 180 days or more – including collections, repossessions, and foreclosures have trended down over the past five years as consumers have been doing better at paying down debt. From January 2021 to 2022, derogatory alerts dropped 17%. What remains to be seen is whether we will see an increase due to delinquent accounts going past 180 days.

- Inquiries and new trade accounts (Open New Account) have been decreasing since September 2021. January 2022 saw inquiries down 14% from the previous year. Consumers opening new lines of credit over the same period was down 7%. Since last fall, people have continued to shift spending and make fewer big purchases as uncertainty rises in the economy, but it’s also due to shortages of big-ticket items such as vehicles and homes.

CONSUMER SURVEY: HOME BUYING PLANS FOR 2022

Key Findings

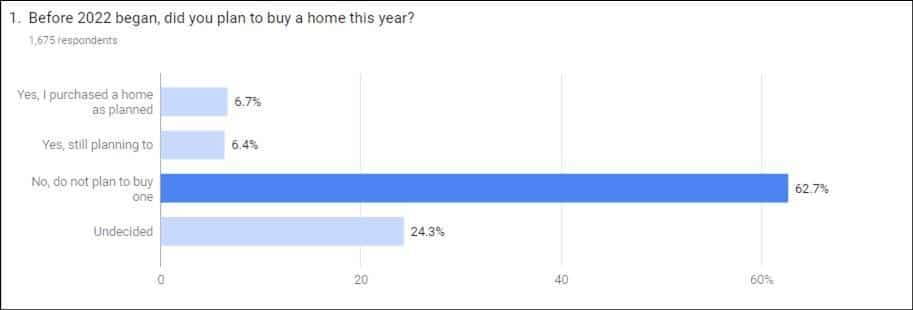

- Nearly one out four people were undecided if they were planning to buy a house this year.

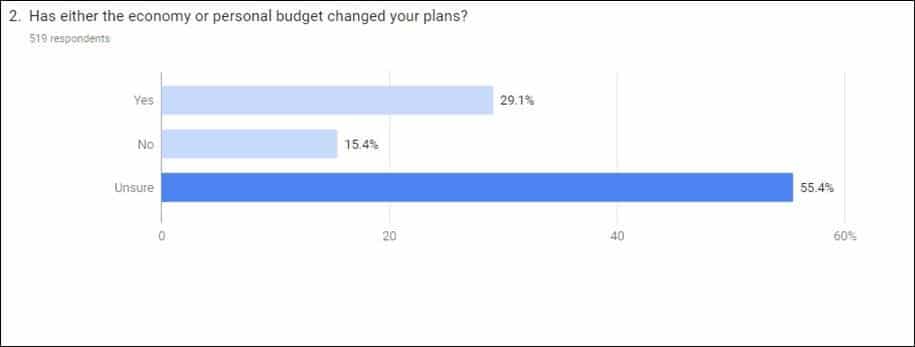

- 30% of the respondents said the economy or personal budget changed their plans.

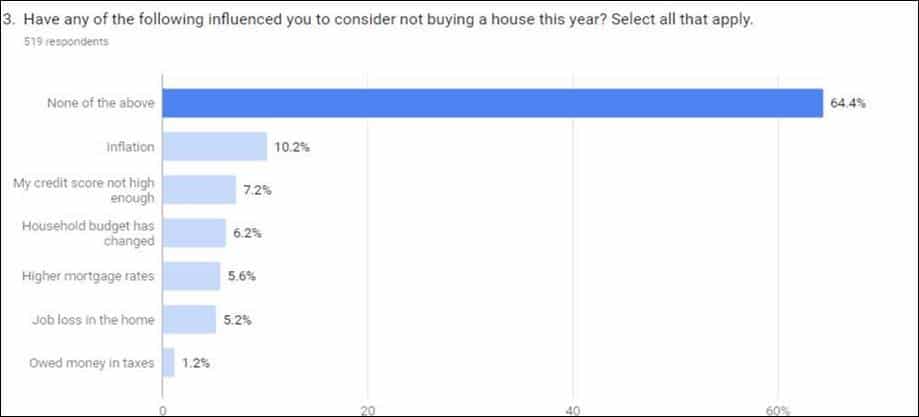

- Inflation was the top reason that could influence consumers not to buy a house this year, but 7% of respondents said it was their credit score.

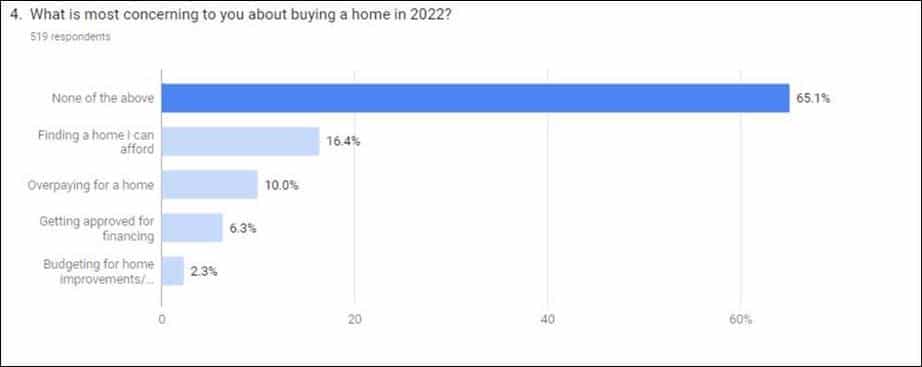

- Finding a home I can afford is the most concerning thing when buying a home this year.

OUTLOOK

As we entered 2020 during an inflation-plagued economy, credit spending, overspending and late payments all increased. Earlier this year, ScoreSense had already seen an uptick in delinquent payments being reported on the heels of increased holiday spending. In February, Federal Reserve data showed that Americans incurred more debt, as rampant inflation – which shows no signs of abatement anytime soon – kept up the pressure. The Fed reported that debt levels jumped by nearly $42 billion to a total of almost $4.5 trillion. That’s an annual increase of 11.3%, seasonally adjusted, setting a new high. Revolving credit, which includes credit cards, jumped by 20.7% to about $1.1 trillion. We believe this will only get worse and expect that our Q2 analysis will reflect the impacts on household budgets from smaller IRS refunds, increased mortgage payments due to property tax increases, and costs for goods and services that have shown no signs of falling.

Worries are increasing over inflation and the Fed aims to raise interest rates. Consumers now see inflation hitting 6.6% over the next year, according to the New York Fed’s survey of consumer expectations in March. By the end of April, it happened: the Commerce Department reported prices had surged 6.6% during the 12 months ending in March. That’s the highest increase in prices since 1982. All signs point to the Federal Reserve moving forward on a series of interest rate hikes to help slow the economy and fight inflation this year; the latest rate increase of half a percentage point occurring May 4. Consumer fears could translate more strongly to what we’re seeing now – a decrease in big-ticket purchases like homes and vehicles but deeper to include reduced purchases of durable goods such as home appliances. Interest rate hikes by the Fed means it will cost consumers more to borrow money.

Many consumers typically reduce or pay off debt with their tax refunds in April – but this year was different. Particularly parents and people with student loan deferments were shocked to find smaller refunds, or worse, they wrote checks to the IRS. Most parents did not receive the “big” child tax credit write-off this year, as those credits were paid out in advance during 2021, and there’s no write-off of student loan interest for people who took deferments. These dynamics only added to the strain of inflationary budgets.

Financing requirements to buy a home and costs to own it have gone up, knocking many prospective buyers out of the market and adding budget stress for some owners. Several dynamics include:

- Dramatically higher property tax assessments in many areas of the country, reflecting soaring home prices in a low inventory market, will result in higher taxes. For prospective buyers, the added cost may be too much to overcome. For current owners, the increase will be reflected on the higher escrow amounts on mortgage payments, yet another strain on the household budget.

- Some of the nation’s biggest mortgage lenders are raising financing requirements for borrowers. Some banks have raised credit score requirements above 700 and are requiring higher down payments, as much as 20%.

- According to a Mortgage Bankers Association report, mortgage credit availability declined sharply in March. A benchmark index for mortgage credit availability dropped by 16%, with availability for all types of loans declining.

- Data from LendingTree revealed that new mortgage offers to prospective borrowers with credit scores below 720 dropped by five percentage points between January and March. In the same period, mortgage refinance offers dropped by 10 percentage points for prospective borrowers with credit scores below 720. For both groups of customers, the drop accelerated between February and March.

- New Gallup poll results released in early May found that 30% of Americans believe now is a good time to buy a house. This is the lowest level on record since Gallup began surveying consumers this question beginning in 1978. This also is the first time less than half of consumers thought it was a good time to buy. The poll also found that seven in 10 Americans expect home prices to rise in their area.

For those who cannot buy a home, high rental costs are squeezing budgets. In the 12 months through March 2022, average rent rose 17% according to research by ApartmentList.com. The average rent for a two-bedroom home in the U.S. is about $2,000, according to a recent research report from Rent.com — up by 22% year over year basis.

For those with federal college loans, payments have been postponed through August 2022. But when payments resume, some households will feel budget stress. For many, this is a substantial expense, especially after more than a year of forbearance.

Final Thoughts

Looking at our analysis of credit behavior in Q1 and over the past year, we’re concerned many consumers under financial duress will continue to increasingly use credit to pay for “ordinary” things, such as groceries and fuel, and hold that debt instead of paying it off at the end of the month. Worse, we’re concerned that late payments and overdue payments that go to collections may increase as well. Lastly, credit scores always matter, but especially now with lenders tightening restrictions for whom they will loan money.

At ScoreSense, we provide credit monitoring to thousands of Americans. Our website and credit specialists provide personalized recommendations on how to better understand your credit and monitor for identity fraud.

METHODOLOGY

This study was conducted for ScoreSense© using the online portal by Google Survey. Surveys were collected in March 2022 among a sample of 519 consumers in the United States aged 24+ who might consider to buying a home in 2022. The margin of error for total respondents is +/-4.3% at the 95% confidence level.