October 2023

OVERVIEW

Delinquencies on auto loans, credit cards, and consumer loans are at their highest levels in a decade across America, according to data from Equifax and Moody’s Analytics analyzed by The Washington Post. Research reports by The Federal Reserve reveal the rate of credit card delinquencies in the U.S. jumped from 1.84% a year ago to 2.77% in the most recent quarter as consumers navigate the perils of rising prices and interest rates. There are 70 million more credit card accounts than in 2019; and Americans’ total credit card debt surpassed $1 trillion for the first time.

The average credit card interest rate is at a record high 20.6% (according to Bankrate data) and will likely go higher given that the Federal Reserve has indicated it might continue raising rates to control inflation. Additionally, millions of Americans have resumed making student loan payments. According to the New York Fed’s August 2023 Survey of Consumer Expectations, lending criteria have tightened, making it more challenging and more costly to secure loans for vehicles, homes, and credit cards.

After the pandemic struck, savings soared due to the combined effects of checks from the government and fewer opportunities to spend money, but times have changed. Americans’ personal savings rates remain below their historical average, according to U.S. Bureau of Economic Analysis data. Many Americans are unable to save because they took on debt before interest rates soared, and now they are struggling to make minimum payments on debts, leaving no money to save.

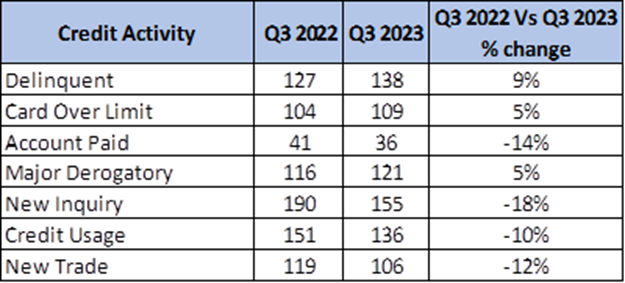

ScoreSense’s year-over-year (Q3 2022 vs. Q3 2023) consumer spending habit data concurs:

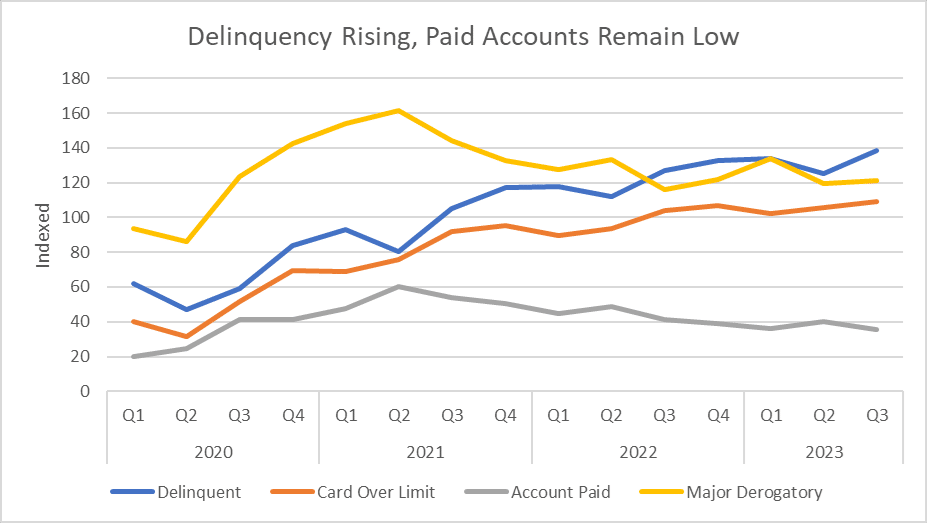

- Delinquent credit accounts reached a three-year high in Q3 2023.

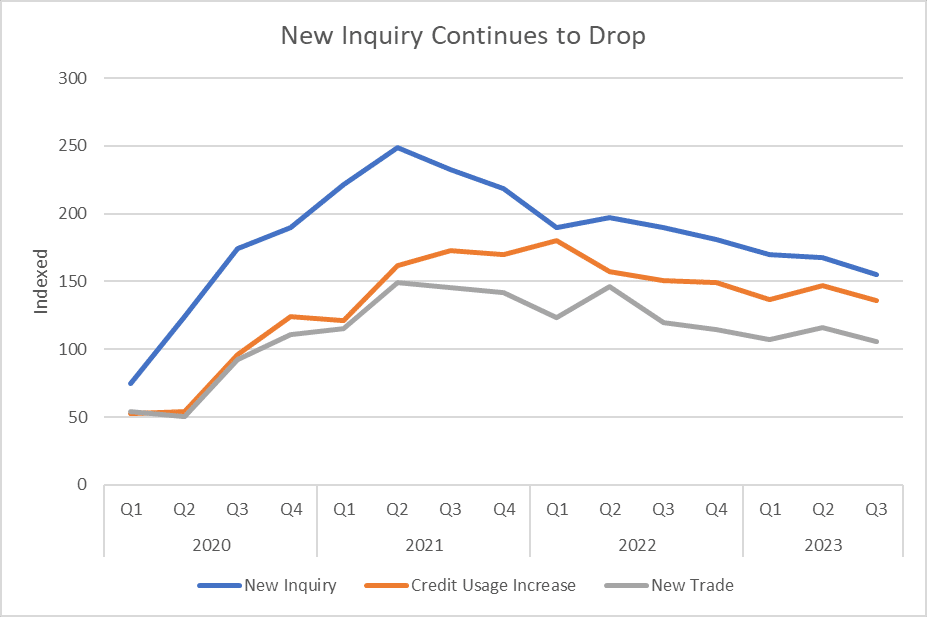

- Consumers are increasingly applying for and opening less credit in response to The Fed raising its key short-term interest rate 11 times since March 2022 by a total of 5.25 percentage points to fight inflation.

- While credit balances remain high as consumers struggle to pay off their credit cards, we are continuing to see less credit usage compared to last year as consumers are tightening their spending habits.

SURVEY: RETIREMENT READINESS

The latest ScoreSense survey aimed to gauge retirement readiness and to understand how today’s economy has affected retirement plans for consumers between the ages of 40 and 79 and who have yet to retire. While full Social Security benefits start at 67, over a quarter of respondents are unsure when they will be able to retire. Only 30% think they will retire on time, and 18% think they will retire later than age 67. Those of ages 40-49 were significantly less confident in being able to retire early as compared to other age groups. Surprisingly, to boost retirement savings, one out of three respondents took a second job or side gig, which was noticed across all age groups.

DATA ANALYSIS

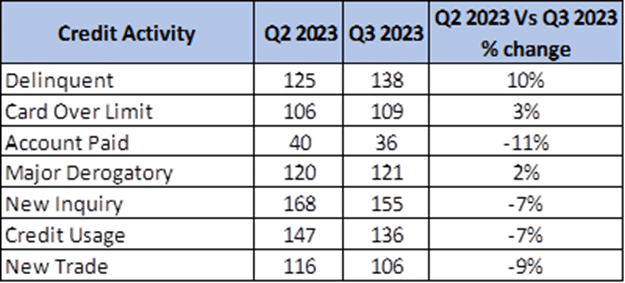

- The number of delinquent accounts jumped up by 10% in Q3 2023 from Q2 2023. It’s currently at the highest level in the past three years.

- Accounts being paid off dropped by 11% in Q3 2023 from Q2 2023. Compared to last year, Q3 2022, paid off accounts dropped 14% in Q3 2023.

- New Inquiry (when a creditor checks a consumer’s credit report) declined by 7% in Q3 2023 from Q2. It also dropped by 18% compared to Q3 2022.

- New Trade (a new account on a consumer’s credit report) also declined by 9% in 2023 from Q2. Compared to the same time in 2022, new trade dropped by 12%.

- Credit Usage dropped by 7% in Q3 2023 from Q2 as well as dropping by 10% compared to Q3 2022.

YEAR-TO-YEAR COMPARISON

QUARTERLY COMPARISON

OPINION & OUTLOOK

The Federal Reserve has raised its key borrowing rate 11 times since March 2022 by a total of 5.25 percentage points, and the central bank recently voted to keep rates higher for longer to fight stubbornly persistent inflation. Further, the yield on the benchmark 10-year Treasury crossed 5% for the first time in 16 years on Oct. 19, which could affect the economy by raising rates on mortgages, credit cards, auto loans, and more. As we cautioned in our Q2 report, waiting for interest rates to drop significantly to the historic lows of recent years may not be a good financial plan.

As indicated by the Q3 data for credit spending, we can clearly see that consumers are suffocating from credit debt. Delinquencies – late payments 30 days or more past due on debts – reached a three-year high. New Inquiries and New Trade are both down, illustrating consumers are less likely to apply for credit or use credit for more purchases.

The New York Fed has not released its Q3 Household Debt and Credit Report, but the Q2 report sheds light on why many households are struggling. The report summarizes: “Total household debt rose by $16 billion to reach $17.06 trillion in the second quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit. Credit card balances saw brisk growth, rising by $45 billion to a series high of $1.03 trillion. Other balances, which include retail credit cards and other consumer loans, and auto loans increased by $15 billion and $20 billion, respectively. Student loan balances fell by $35 billion to reach $1.57 trillion, while mortgage balances were largely unchanged at $12.01 trillion.”

- Many Americans are woefully behind in retirement readiness, and the current economy threatens many Americans’ plans on when they think they can retire. Read the latest ScoreSense survey aimed to gauge retirement readiness for more insights.

- For consumers with credit cards, every time the Fed raises rates, interest on variable-rate cards moves higher. Those seeking new lines of credit for credit cards, student loans, personal loans, vehicle loans, and other things will face increased scrutiny and will pay higher rates.

- The average 30-year fixed mortgage rate hit 8% for the first time since 2000, according to Mortgage News Daily. Homebuyers must earn $114,627 to afford a median-priced house in the U.S., according to a recent report by Redfin, a real estate firm, which also reported that mortgage applications have dropped to their lowest levels since 1995.

- The resumption of Federal student loan interest began on Sept. 1, 2023, and payments started in October. The White House announced that it will not report missed student loan payments to credit agencies for the first year following repayment resumption. Nevertheless, loan holders now have this additional household expense.

- For savers, high interest rates mean consumers can realize higher returns on savings and money market accounts.

At ScoreSense, we continue to urge consumers to focus on paying down or refinancing high-interest debt and cut spending to increase savings. Consumers also should monitor their credit scores to better understand their current credit positions, be more aware of what lenders may see, and help detect any inaccurate or incomplete information. Additionally, credit monitoring notifies you of significant reported changes to your credit report, which can signal identity theft and fraud.