The latest ScoreSense survey aimed to gauge retirement readiness and to understand how today’s economy has affected retirement plans for consumers between the ages of 40 and 79 and who have yet to retire.

Top Insights:

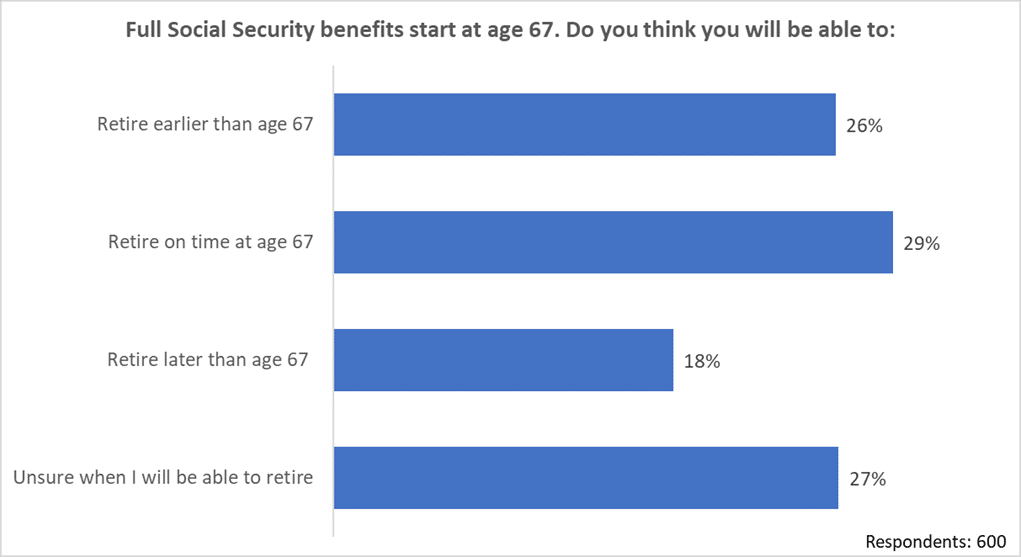

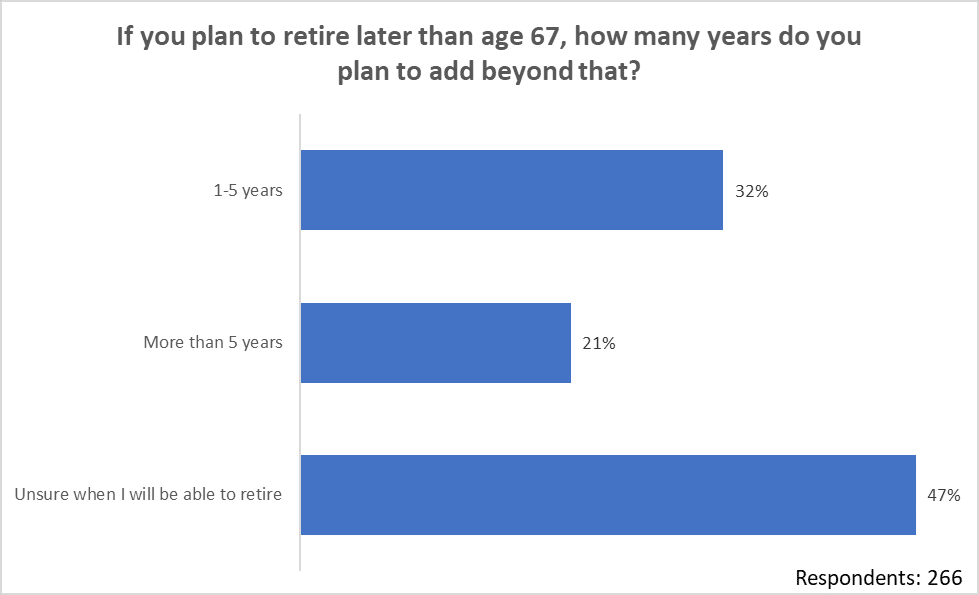

While full Social Security benefits start at 67, over a quarter of respondents are unsure when they will be able to retire. Only 30% think they will retire on time and 18% think they will retire later than age 67. Those of ages 40-49 were significantly less confident in being able to retire early as compared to other age groups. Surprisingly, to boost retirement savings, one out of three respondents took a Second job or side gig which was noticed across all age groups.

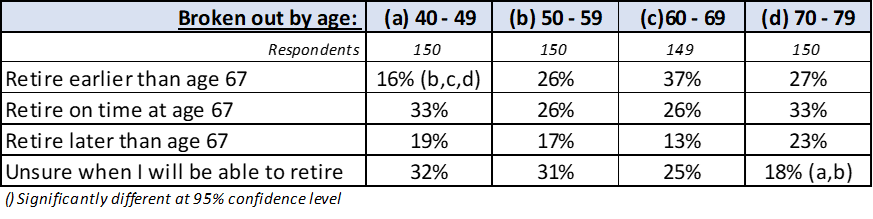

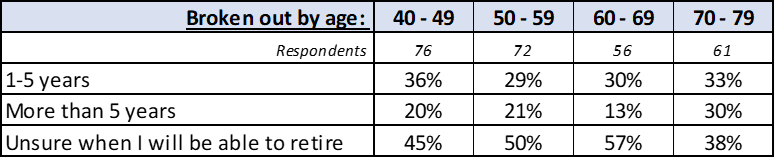

- One out of three respondents that were unsure when they would be able to retire or think they would retire after the age of 67, think it would be an additional 1-5 years after the age of 67 before they could retire.

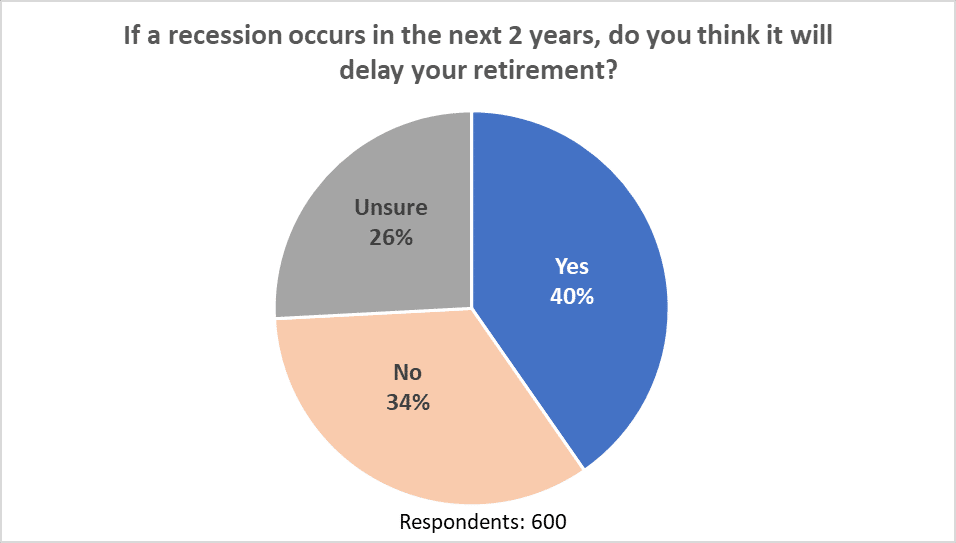

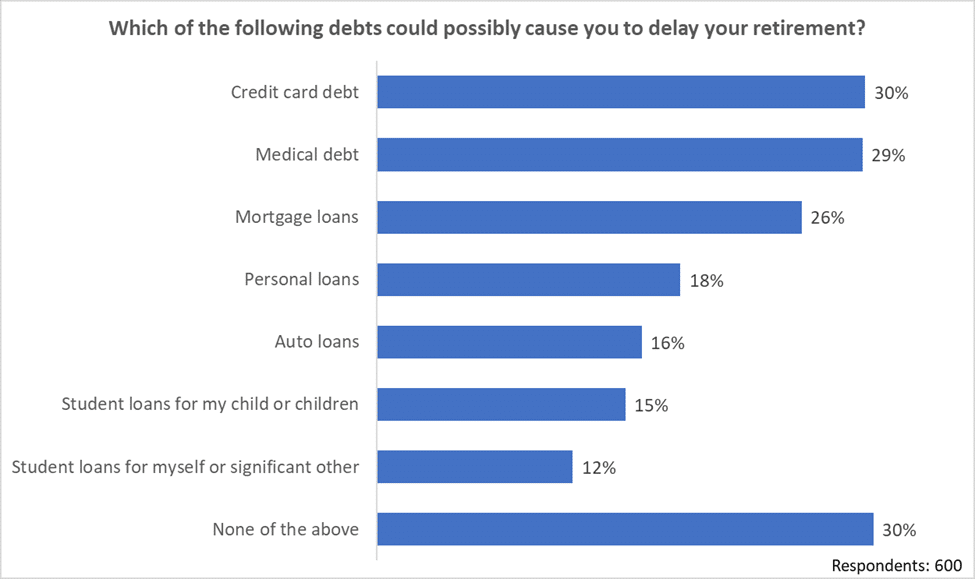

- If a recession occurs in the next two years, 40% of respondents think it would delay their retirement plans. Those between the ages of 40-59 were more likely to think the recession would delay retirement as compared to those of ages 60-79.

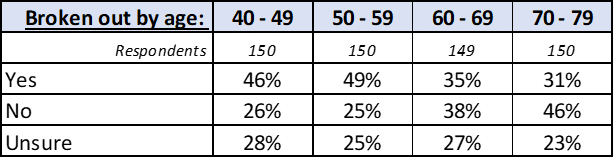

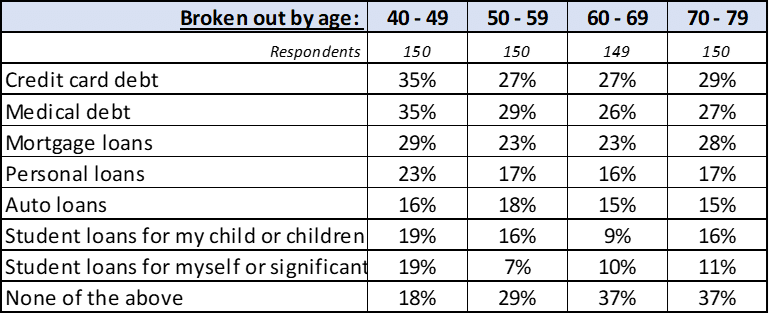

- Credit card debt (30%) was the leading type of debt respondents think could delay their retirement followed by Medical debt (29%). Those between the ages of 40-49 are anticipating these two types of debt to affect their retirement more as compared to other age groups. The delay in retirement for those of ages 70-79 could be due to still dealing with Credit card debt (29%), Mortgage loans (28%), and Medical debt (27%).

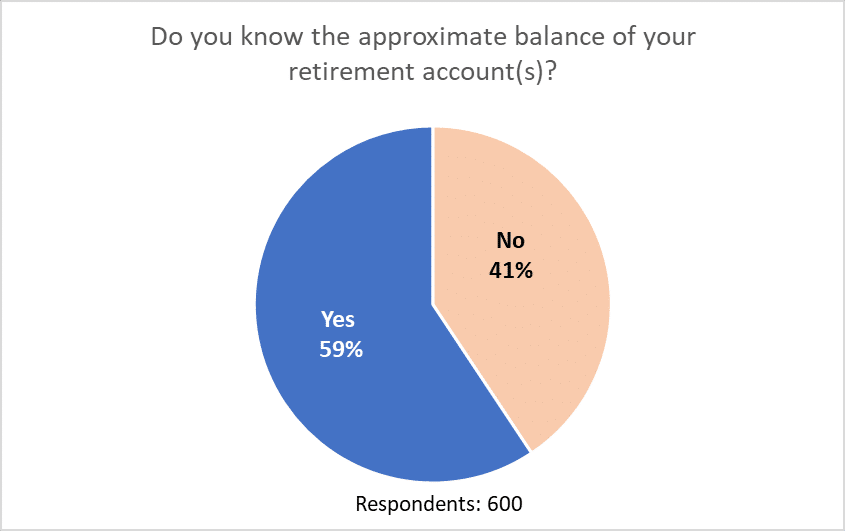

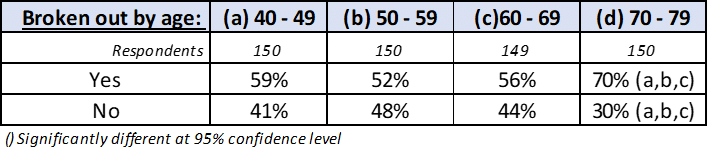

- About 40% of respondents do not know the approximate balance of their retirement account. About half only know how much they would need to comfortably retire. Those between the ages of 50-59 (37%) were significantly less likely to know how much they would need to retire as compared to other age groups.

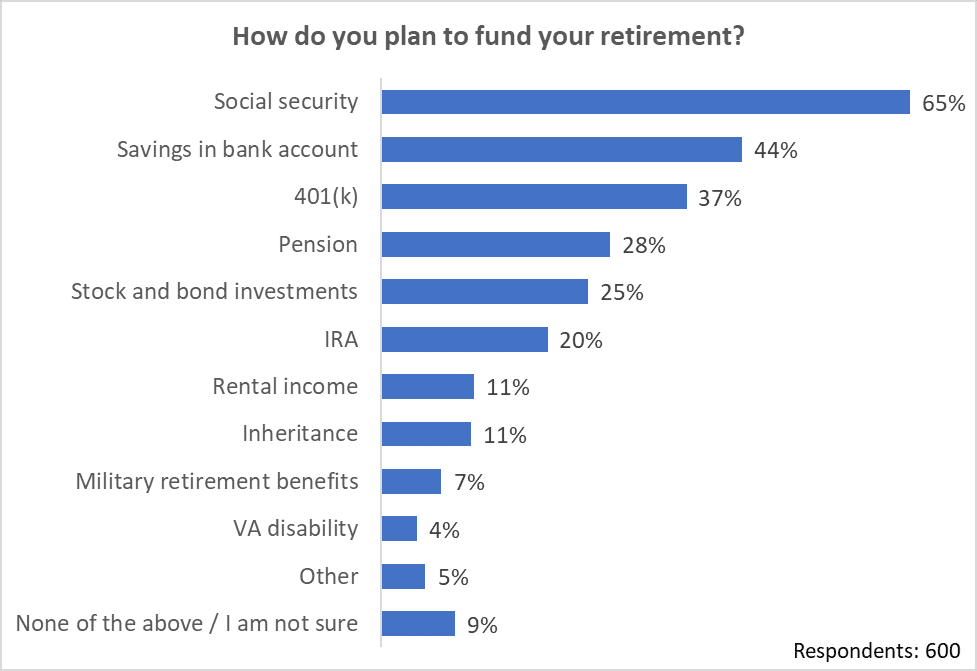

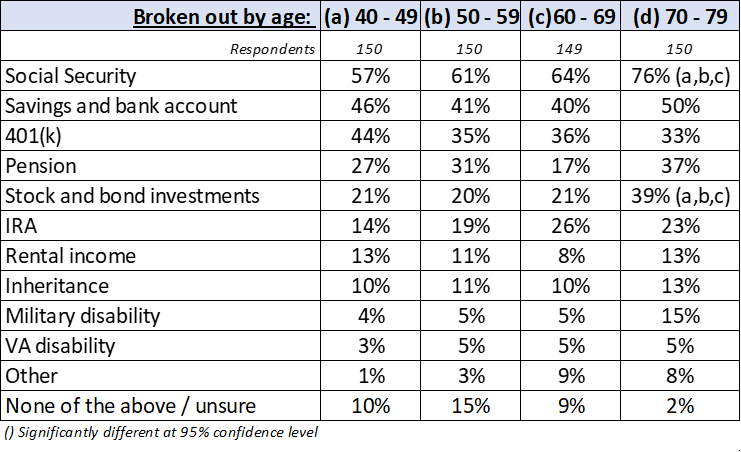

- To fund retirement, Social Security (65%) is the leading method followed by Savings in bank account (44%). Those of ages 70-79 are significantly more likely to also include Stock & bond investments as a method as compared to other groups. For those of ages 40-49, 401(k) is heavier relied on as compared to other groups, while ages 60-69 have more mention of IRA as compared to other groups.

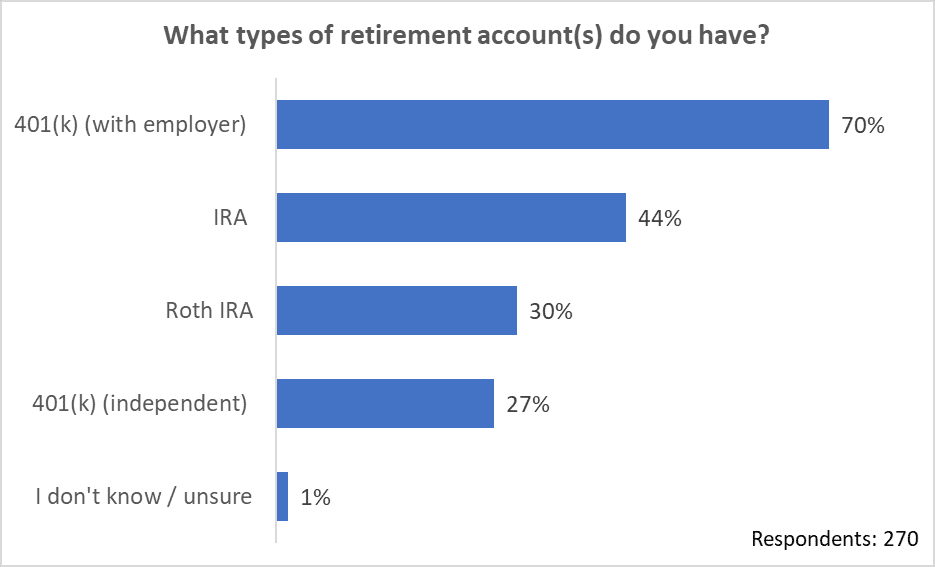

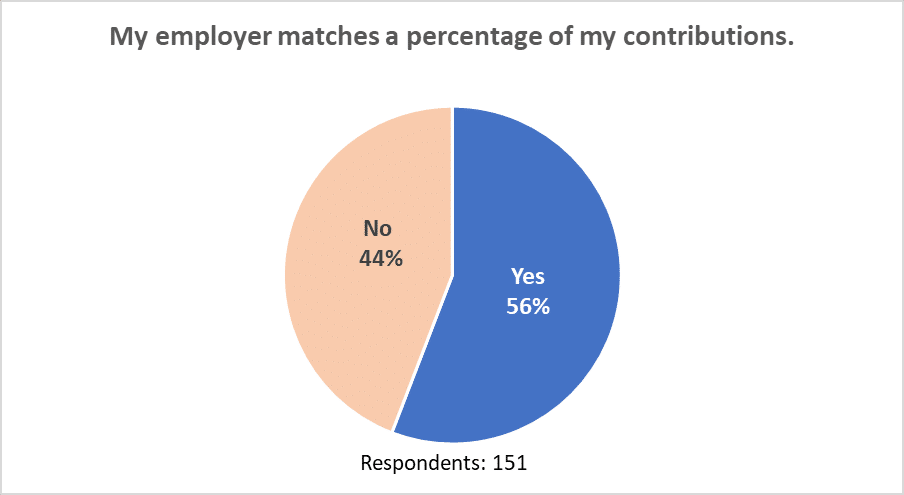

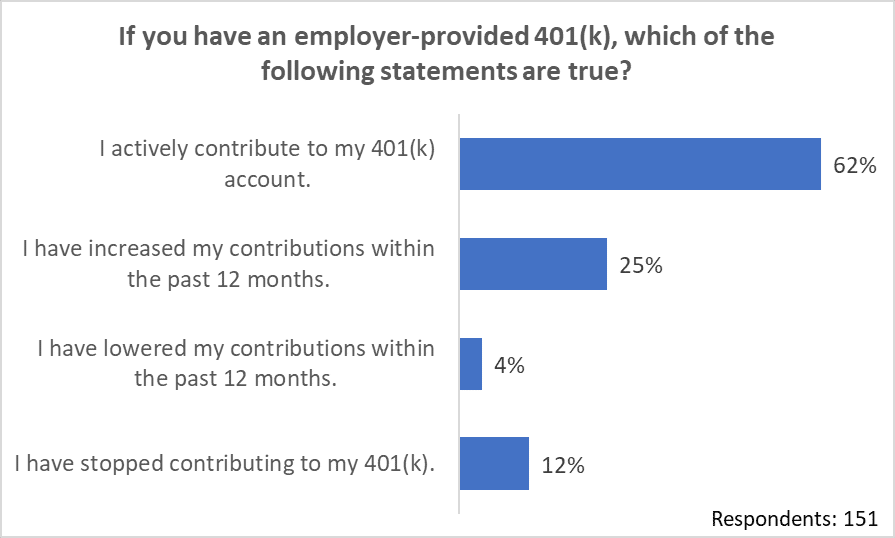

- 70% of respondents have a 401(k) with an employer, with 56% mentioning their employer matches a percentage of their contributions. Over 60% are still contributing to their account. One out of four respondents have increased their contributions within the past 12 months.

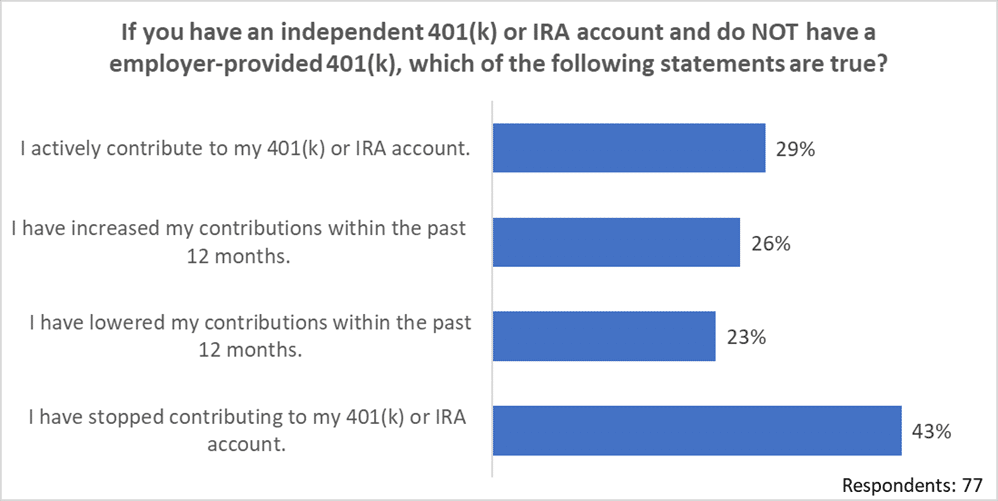

- For those with an IRA or an independent 401(k) account only (i.e., don’t have an employer-provided 401(k)), only 29% are contributing to their account. This group also has more respondents (43%) that claimed they stopped contributing to their account as compared to those with an employer-provided 401(k) (12%).

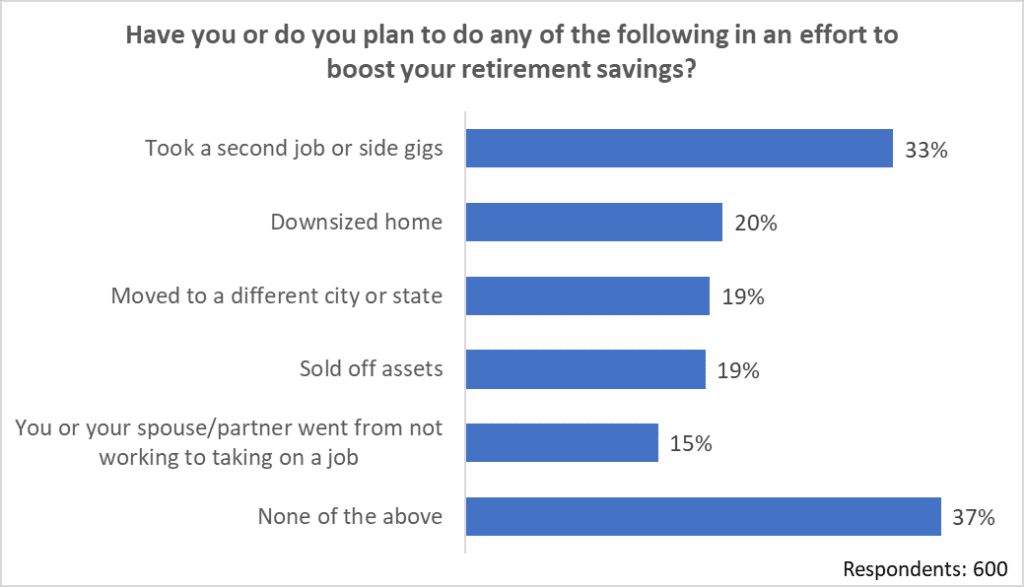

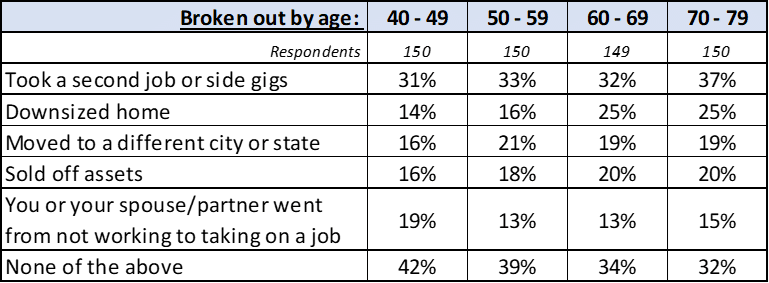

- To boost retirement savings, 30% took a Second job or side gig. Downsizing home (20%), Moved to a different city or state (19%), or Sold off assets (19%) were also other methods. Those ages 60-79 were more likely to Downsize home as compared to those between 40-59.

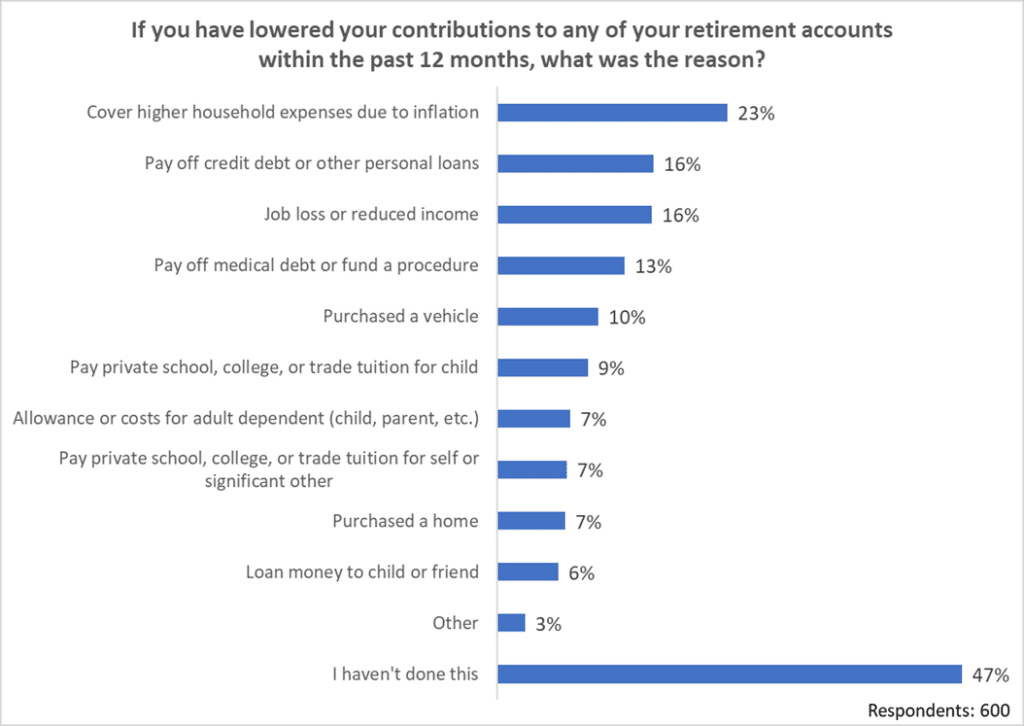

- 23% of respondents said they lowered their contributions in the last 12 months to Cover higher household expenses due to inflation.

- Nearly 1 in 4 plan to Retire earlier than age 67.

- Those ages 40-49 were significantly less likely to say they would retire earlier than 67 than other age groups.

- 18% think they will Retire later than 67.

- A quarter of the respondents are Unsure when they will be able to retire.

Of those planning to retire later than age 67 or were unsure when they would retire, nearly 1 out of 3 from this group of respondents think it would be another 1-5 years beyond 67 before they can retire.

- If a recession occurs in the next two years, 40% of the respondents think it would delay their retirement.

- Those between the ages of 40-59 were more likely to think retirement would be delayed due to recession as compared to those 60-79.

- Credit card debt (30%) was the leading type of debt that could delay retirement, followed by Medical debt (29%).

- Those of ages 40-49 were more likely to mention these two reasons as compared to other age groups.

- Those ages 70-79 are still dealing with debt that could delay their retirement – Credit card (29%), Mortgage loans (28%), and Medical debt (27%).

41% of respondents do not know what the approximate balance is for their retirement account.

- About half of respondents know how much they would need to retire somewhat comfortably.

- Those ages 50-59 were significantly less likely to not know how much they need to retire as compared to other age groups.

- Social security (65%) was the leading method to fund respondents’ retirement, followed by Savings in bank account (44%).

- Those ages 70-79 are significantly reliant on Social Security (76%) and Stock & bond investments (39%) to fund their retirement as compared to other age groups.

- 401 (k) with employer (70%) is the top retirement account respondents have.

- 56% of respondents reported their employer matches their contributions.

- 62% are actively contributing to their 401(k) (with employer) account.

- 1 out of 4 increased their contributions to their 401 (k) (with employer) within the past 12 months.

- Only 29% of respondents that have an independent 401(k) or IRA are actively contributing to their accounts.

- 26% of these respondents have increased their contributions to their independent 401(k) or IRA in the past 12 months.

- 43% of respondents stopped contributing to their accounts.

- 1 out of 3 respondents took a second job or side gigs to help boost their retirement savings.

- Other ways respondents are trying to boost retirement savings include Downsized home (20%), Moved to a different city or state (20%), or Sold off assets (20%).

- Those ages 60-79 were more likely to Downsize their home as compared to those between 40-59.

- 23% of respondents said they lowered their contributions in the last 12 months to Cover higher household expenses due to inflation.

Scope: Survey was conducted in September 2023 using Pollfish.com with 600 adults in the U.S. between the age of 40-79 who have not retired.