A credit score simulator is an interactive online tool designed to show you the ways in which different scenarios could theoretically impact your credit score.

For example, what might happen to your score if you pay down $1,000 in credit card debt? What if you obtain a $25,000 car loan? Can your score get dinged if you miss a debt payment?

By using a credit score simulator, you can identify what actions have the potential to positively or negatively impact your score and help you make better-informed decisions about your credit.

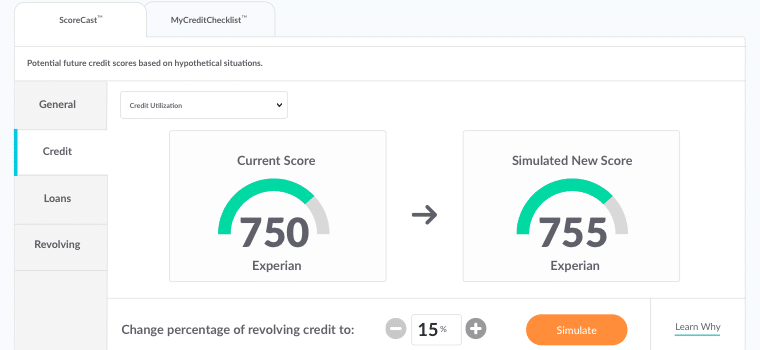

ScoreSense Credit Score Simulator

A 650 credit score is good, but a 750 score is even better. ScoreSense members have access to ScoreCast™, a credit score simulator.

ScoreCast analyzes possible credit actions across four categories:

- General: How will your score change if you make all debt payments on time for six months? Twelve months?

- Home: Plug in a mortgage amount, and see how your score can change.

- Auto: How does an auto loan impact your score? Select an amount and see the results.

- Revolving Credit: What happens if you increase your credit balance? Pay off credit cards? Apply for new credit?

How to Make Smarter Financial Decisions

Because your credit score is based on five general factors — payment history, amount of debt, credit age, credit mix, and number of inquiries — any new action can impact your number. By using the ScoreSense credit score simulator, you can try out different variables to help you make smarter financial decisions.

For example:

- Changing Your Credit Mix: What might happen if you open a new retail credit card with a $3,000 limit? If the simulator shows that your score may decrease, this may not be an action you’d want to take.

- Paying Off Your Credit Card Balance: If the simulator predicts a rise in your score, you may want to make a lower debt balance your priority.

- Obtaining a Car Loan: The greater the loan, the greater the impact to your credit score. See the ways in which a $15,000, $20,000 or $30,000 car loan will potentially impact your number.

- Closing Your Oldest Credit Card: Credit history is one of the five factors impacting your score, and the longer you have a good credit history the better. In many cases, closing a credit card will lower your score. See what the ScoreCast credit simulator reveals.

Understanding Your Results

Your credit score is unique to you and represents your financial habits. The ScoreCast credit score simulator shows how your score can change based on various scenarios, but the impact may be different for someone else.

Remember, the results from the credit simulator aren’t guaranteed; they’re estimates based on your credit report as it stands today. However, this analysis is precisely why ScoreCast is so valuable. The information reflects what’s possible for you based on your credit profile.