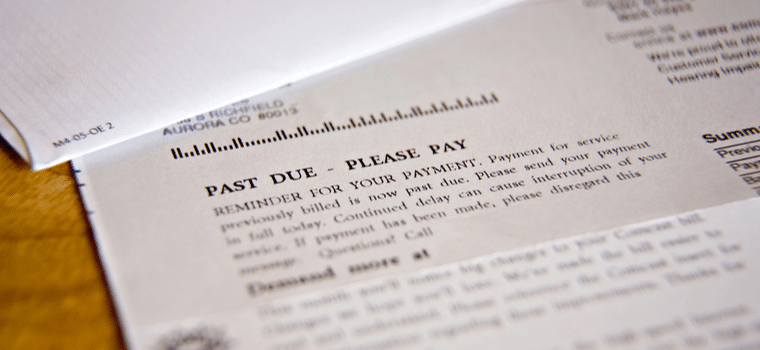

Sometimes it takes only a single situation — a medical expense, job loss or unforeseen event — to interrupt an otherwise timely payment history. Regardless of the circumstances, the reality is that any unpaid debt is fair game for collection. Once a delinquency hits your credit report, you can expect your credit score to drop.

How does debt go from being a late payment to a collection account? If you’re making payments, can the collection agency still report you to the credit bureaus?

Read on to find out the answers and discover how collection accounts impact your credit score.

What Does It Mean To Be Sent to Collections?

When you don’t pay your debt, your account will be considered past due. The most common types of collection accounts are unpaid credit card bills, medical bills, mortgage payments, auto payments and student loans.

While each lender or creditor has its own policies for when to send an account to collection, it typically happens only after you’ve missed several payments. Some creditors will send your account to collections after 180 days of nonpayment, which would typically be six missed payments.

What Is a Debt Collector?

If a lender or creditor sells your debt to a collection agency, it means that it has hired a third-party company, called a debt collector, to try to collect payment. Once a collection agency receives your debt from a creditor, it’s considered a new entry on your credit report.

The debt collector will call you, send you letters and report the collection amount to the three credit bureaus (Experian, TransUnion and Equifax). The debt collector’s communications all have one goal: to collect the money owed.

How Collections Impact Your Credit

An account in collection will cause your credit score to drop. Factors that impact the negative result are:

- Your existing credit scores. Higher scores tend to drop more than lower scores.

- The amount of debt. The larger the debt, the more damaging it can be.

- The type of debt. Different types of debt are treated differently. For example, medical debt tends to carry less weight than other types of debt. It’s worth noting that collection agencies must wait 180 days before reporting the debt to a credit agency. Once medical collections are paid off, they are excluded from the score calculation. Even if you’ve reached an agreement with a collection agency to make regular payments on your debt, the agency can still report the account to the credit bureaus, and it can still negatively impact your credit score.

Know Your Rights

If the debt is yours, you’re obligated to pay it. However, there are limits to how persistent a debt collector can be, and the Fair Debt Collection Practices Act (FDCPA) — which applies to debt that was incurred for personal, family or household purposes — protects consumers from unfair, overly aggressive or fraudulent debt collection practices.

Another agency working to protect you is the Consumer Financial Protection Bureau, which stresses the importance of understanding your rights when a debt collector contacts you. It recommends that you ask these six questions if you get a collection call:

- Who is the debt collector?

- What is the amount of the debt?

- What kind of debt is it?

- When was the debt incurred?

- Who is the original creditor?

- Who does the debt belong to (you or someone else)?

The Consumer Financial Protection Bureau also recommends that you insist a debt collector send you written notice of the debt so that you can verify that the collection agency is legitimate, and the debt is yours.

How Far Will Your Credit Score Drop?

A collection account stays on your credit report for seven years, but the amount your score will drop depends on how high it is to begin with. Over time, the impact of the collection account will lessen.