Your credit utilization ratio is the ratio of your total debts against your total credit. This ratio, when used to measure your credit usage on all accounts on your credit report, is called your total credit utilization ratio.

Credit utilization only factors revolving credit, such as credit cards and other lines-of-credit, and is used by many reporting and scoring institutions as a factor in determining your overall credit health. Understanding your own credit utilization can help you better plan your financial future in terms of securing loans or other lines of credit when you need them.

How Do I Calculate My Credit Utilization Percentage?

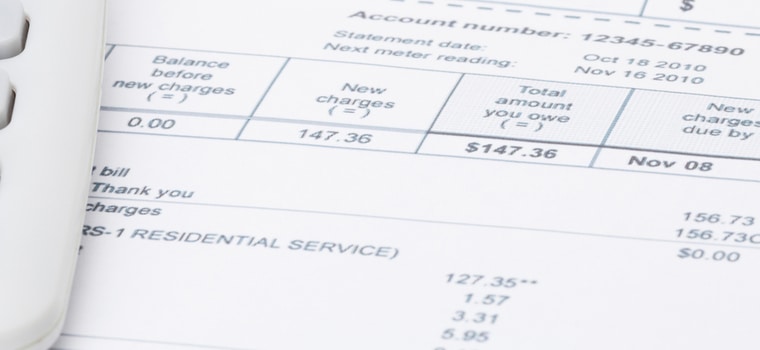

Your credit utilization percentage is a simple calculation that only requires you to know your credit card balances and limits. If you’re unsure of these numbers, check your account statements or call your creditors’ customer service.

To determine your utilization ratio for a single card, start by dividing the credit card balance by its credit limit. For example, taking a $6,512 balance on a card with a limit of $10,000 gives you 0.6512 (or 6,512/10,000) . This number, represented as a percentage of credit usage, tells you that you use about 65% of the total credit available on that card.

You can follow this same formula for all of your revolving credit to get the total credit you are utilizing on all your credit accounts, or your total credit utilization ratio.

Most experts recommend a total credit utilization ratio below 30%. That means if you have $10,000 in available revolving credit, your balances should probably be less than $3,000.

How Credit Utilization Percentage Impacts Lending Decisions and Your Credit Score

Most lenders use credit utilization ratios to assess the credit risk of potential borrowers.

Generally, a higher credit utilization ratio suggests that a person who uses most or all of their credit limit may have a harder time repaying additional loans and may represent a credit risk to the lender. On the other hand, the lender may see less risk with someone possessing a low utilization rate, as they may have more available money to make timely loan payments along with a positive history of paying down their debts.

Although results vary for every individual, generally speaking, consumers who maintain a low utilization percentage typically have higher scores than consumers with maximum balances on their credit cards, all other factors being equal.

How Can I Lower My Credit Utilization Ratio?

Pay Your Balances

Pay what you can to lower credit card balances and, consequently, your credit utilization ratio. Just remember, credit card companies may not report your new balance until the end of the billing cycle, so keep balances low until then.

An easy way to keep your utilization low is to spread your bill into two payments each month.

If you’re using cards throughout the month, a payment two weeks into the monthly billing cycle may help pay your card balance to below the 30% mark. This way your accounts are continually showing as paid.

Also, spreading purchases across different credit cards may result in lower balances on a number of cards rather than a high balance and possibly more than 30% of the limit on one card. Not all scoring models factor the total utilization of all credit accounts, however.

Ask Your Creditors to Increase Credit Limit

Asking your creditors to raise your credit limit is another way of lowering your credit utilization ratio. Securing a credit increase can be difficult, however, as creditors may factor your income, credit history and the duration of time since your last increase. If your income is improving and credit history is solid, asking for a credit increase may make sense.

Before you request a higher credit limit, consider that your credit issuer may perform a hard inquiry, which could impact your credit scores in the short term.

Consolidate Credit Card Balances With a Personal Loan

If you can find a personal loan with a lower interest rate than your credit cards, it may make sense to consolidate multiple credit cards with one personal loan. After your credit card balances are transferred to a personal loan, keep their accounts open to lower your credit utilization rate.

What’s more, a lower rate personal loan may reduce the amount of interest you’ll pay in the long run for the debt. Paying less interest means you can pay more on the principal and pay off the account in less time.

Does Closing a Credit Account Impact Credit Utilization?

Closing a credit card account directly lowers the total amount of credit available to you at any given time, which may raise your credit utilization percentage. Compare this to maintaining open credit cards with zero balance on them: you still have the available credit, you aren’t being penalized with fees, and your credit utilization remains low and healthy.

However, if one or more of your accounts have a balance and you close a zero-balance account, you’ll be reducing your total available credit and potentially impacting your utilization rate.

For instance, imagine that you have two credit cards, each with a $3,000 limit. One of the accounts has zero balance and one has a balance of $3,000. In this case, the total credit utilization is 50%. If you were to close the account with zero balance, your total available credit would fall to $3,000, leaving you with a new credit utilization rate of 100%.

Credit card companies tend to look for borrowers who have a credit history and can demonstrate continued healthy credit practices like paying down debt and maintaining lines of credit over long periods of time.

The Bottom Line

Credit scoring models consider a number of factors and your credit utilization ratio is just one of them. Ideally, you should aim to keep your credit utilization ratio below 30%. Knowing how credit utilization works can help you use it to your advantage.

Learn how to keep your credit card balances low, which can help you lower your credit utilization rate.