If you discover incorrect information on your TransUnion credit report, it’s not necessarily set in stone. Instead, you can file a TransUnion dispute to have your claims investigated and possibly corrected if the credit reporting agency is able to verify the error.

Ways to Dispute Your TransUnion Credit Report

TransUnion offers consumers several ways to dispute information on their credit reports: online, by phone and by mail. No matter how you file your dispute, include creditor names, specific account numbers and why you believe the information is in error.

How to File a Dispute With TransUnion Online

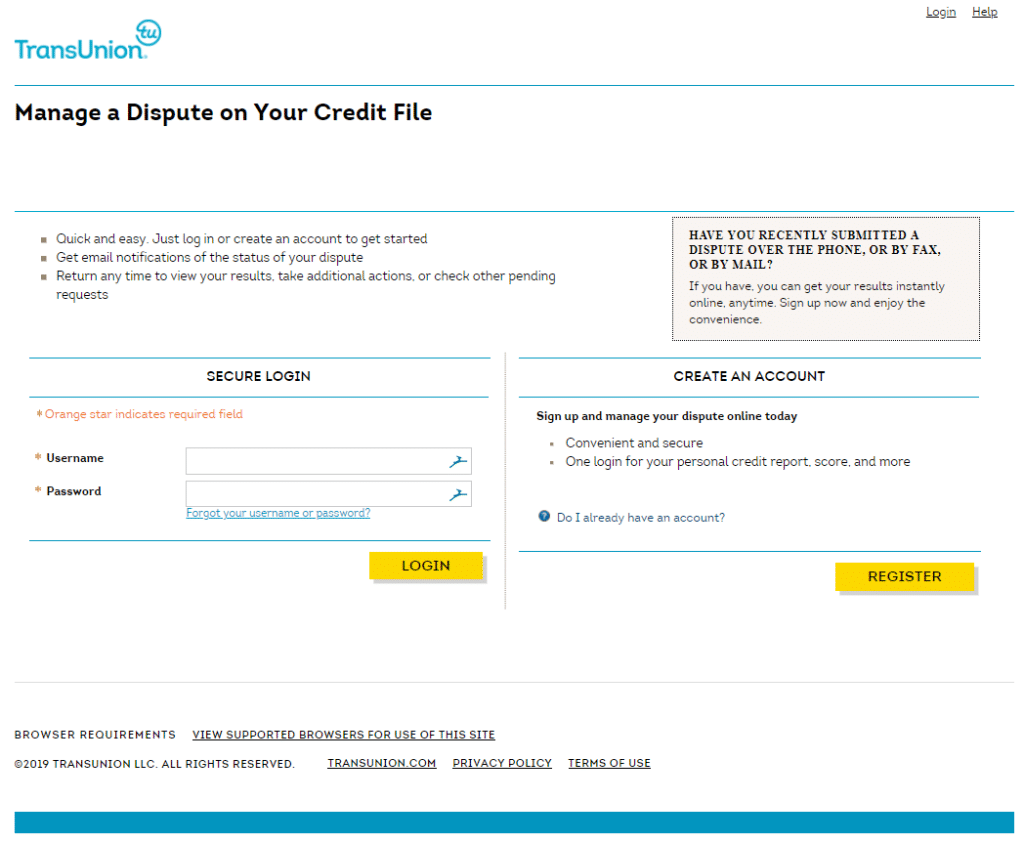

According to TransUnion, the online method is the quickest and easiest way to file a dispute.

- Go to the TransUnion dispute website and click on Start a New Dispute. You will then be prompted to create an account or log in to your account.

- Follow the prompts to fill out the required information.

- Wait for the results – This generally takes around 30 days.

TransUnion will send you email notifications regarding the status of your dispute. You can also log in to your account anytime to check the results.

How to File a Dispute With TransUnion by Phone

If you choose to file your TransUnion dispute via phone, you’ll need a current copy of your TransUnion credit report in hand before calling. If you pulled your report from the TransUnion website, it will contain an important File Identification Number — aka FIN — which will help expedite the identity verification process.

Here’s what to do next:

- Once you have your TransUnion credit report, call 1-800-916-8800 — 8 a.m. to 11 p.m. EST, Monday-Friday.

- Have the following information available:

- Birthdate

- Current address

- Social Security number

- Company name related to disputed item

- Account number related to disputed item

- Reason for dispute

- TransUnion credit report FIN – if available

- Other items that may be helpful to have on hand include:

- A police report or Federal Trade Commission identity theft report if disputed item resulted from identity theft

- Bankruptcy schedules

- Student loan discharge letters

- Letters from creditors

- Canceled checks to show payment on disputed account

- Deferment or forbearance documentation

How to File a Dispute With TransUnion by Mail

- Print out a TransUnion “Request for Investigation” form you can find online.

- Fill out the form completely.

- Information you’ll need includes:

- Name, address, birthdate, phone number and Social Security number

- TransUnion credit report FIN – if available

- Driver’s license number

- Employer name

- Account names and numbers for disputed items

- Reasons for disputing each item

- You may also want to add a copy of a utility bill, bank statement or phone bill to prove your identity

- Mail the completed form to:

TransUnion Consumer Solutions

P.O. Box 2000

Chester, PA 19016-2000

Why Should I Dispute Inaccurate Information On My TransUnion Credit Report?

When you apply for a loan or credit card, lenders and creditors pull your credit reports. If your credit report contains inaccurate information, your application could end up being denied, or you could have to pay a higher rate of interest. You might also lose out on a job offer or be rejected for insurance coverage.

What Errors Could Be On My TransUnion Credit Report?

According to the Consumer Financial Protection Bureau, credit reports can have identity errors,

account status errors, data management errors or account balance errors. Here is an explanation of each:

- Identity errors – errors in your personal information; accounts belonging to someone with the same or similar name as yours; accounts resulting from identity theft

- Account status errors – closed accounts reported open; owner status instead of authorized user status; incorrect late or delinquent statuses; incorrect date of account opening, date of last payment or date of first delinquency; debts that are listed more than once

- Data management errors – reposting of incorrect information; accounts appearing multiple times with different creditors listed

- Balance errors – accounts with incorrect current balance or credit limits

What Happens During the TransUnion Dispute Process?

After TransUnion receives your request, it will investigate and update any information it deems incorrect that does not need additional verification. If disputed information does need additional verification, TransUnion will contact the relevant creditor. Investigations usually take up to 30 days.

After the creditor verifies the information, TransUnion will make the necessary corrections, if any. If the creditor deems the information correct, TransUnion will not alter it. Either way, you will receive a summary of the dispute process results and an updated copy of your credit report if applicable.

Notifying Others About Corrections

If an investigation by a credit reporting agency — such as TransUnion — results in corrections to your credit report, you can ask that it send notices of corrections to anyone who ordered your report within the previous six months, according to the Federal Trade Commission.

The time limit extends to two years for people who viewed your credit report for employment purposes.

Verifying Information On Other Credit Reports

You will want to ensure all three of your national credit reports are accurate, so you should also obtain and review your Equifax and Experian credit reports.

When you apply for a loan or credit, a lender may pull your credit report from any or all of the credit reporting agencies, so ensuring all of your credit reports are accurate can benefit you.

What if I Don’t Agree with My TransUnion Dispute Results?

Sometimes a credit reporting agency’s investigation may not yield the results you were expecting. In that case, you can take these additional steps:

- Contact the lender or creditor who is reporting the information you believe to be in error directly

- File a complaint with the Consumer Financial Protection Bureau

- Contact your state’s attorney general

- Add a consumer statement of up to 100 words to your report detailing why you believe the information to be incorrect; anyone who views your report will see the statement

- File another dispute with additional documentation to support your claim

According to TransUnion, you can add the consumer statement online by logging in to your TransUnion account, clicking the “New Investigation” tab and entering your statement in the “Consumer Statement” section.

Does Disputing TransUnion Credit Report Information Hurt Your Score?

Your credit score won’t suffer if you start a dispute. However, if the credit reporting agency’s investigation corrects or removes information from your credit report as a result of its investigation, your credit score could change.

Staying On Top of Your Credit

Regularly monitoring your credit can help you learn about any changes to your credit, including items that are incorrectly entered that you may want to dispute. If you’re not already using a product that can help you monitor your credit, you may want to consider using ScoreSense.

ScoreSense offers credit reports and scores from all three credit reporting agencies, as well as daily monitoring, monthly updates, credit alerts – and a Dispute Center that outlines the steps for filing a dispute with each of the credit bureaus.

What do you think? Are you ready to start keeping tabs on your credit?