Credit bureaus were created to be the objective authority for informing lenders, creditors and other relevant parties about issues related to your personal creditworthiness. There are three major credit bureaus, each one working independently to assess and score your financial history and payment behaviors.

Knowledge is power, and understanding the differences between the three credit bureaus can be important to your financial well-being.

3 Major Credit Bureaus

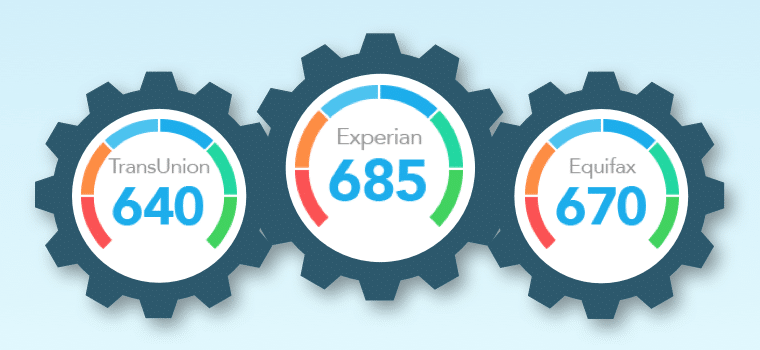

The three consumer credit bureaus are TransUnion, Equifax and Experian. Each one stores information related to your financial accounts and credit history to create your credit reports and credit scores.

Each bureau operates independently as its own entity but can choose to share some or all consumer credit information. There are some instances, such as in the case of a fraud alert, where bureaus are required to share information.

The Differences Between TransUnion, Equifax and Experian

All three credit bureaus collect basic consumer information, including name, address, social security number and date of birth. They also compile information related to your payment history, credit application activity and debts.

But here’s how things start to differ.

The three credit bureaus get their data from several different sources, including account information from your lenders and credit card issuers. However, your creditors are not required to report your information to all three credit bureaus and may only report to one or two. This means you may see differences when you compare your credit reports and credit scores from each bureau.

The bureaus may also buy information about government tax liens or bankruptcyjudgements from another bureau or a third-party source.

Variances on Your Credit Reports

Each credit bureau can also decide the level of detail they provide on certain types of information, such as your employment history.

In addition, credit bureaus each have their own timeline for compiling data, so scores may change from month to month depending on what day the information was calculated.

Why Your Credit Score Differs Among Bureaus

When you compare your credit scores from all three bureaus, you may see different numbers. Credit score differences are also attributed to these factors:

- Hard inquiries: If a lender checks your credit with just one bureau, let’s say TransUnion, then you could have more hard inquiries on your TransUnion report than on your Equifax or Experian report, which could cause your TransUnion score to be different.

- Errors or fraud: Your scores change as information is reported by your creditors and mistakes do happen. In fact, 1 in 5 people have credit report error that can impact their score. If you have an error on one report, but not the other two, your scores may differ.

What Are Credit Scoring Models?

There are two main credit scoring models, FICO and VantageScore. While the majority of consumers are familiar with FICO, most consumers have both.

And all three major credit bureaus use both models.

FICO and VantageScore use a rating scale of 300 to 850. For VantageScore, an excellent credit score is between 810 and 850, a great credit score is 750 to 809, and good is 670 to 749.

FICO is slightly different with 800 to 850 as excellent, 740 to 799 as very good, and 670 to 739 as good.

There are several nuances between the scoring methods, but VantageScore is considered by many to be more consumer-friendly. One of the reasons is because VantageScore, unlike FICO, accepts utility, rent and smartphone payment history as scoring data. VantageScore can also score people after a one month payment history while FICO requires six months of established history.

VantageScore and FICO also differ when it comes to rate shopping and the impact that various late payments have on your score.

The three credit bureaus aggregate a lot of information from various data points to create your credit scores. Monitor your credit reports every month so you can ensure the information reported is accurate and that your credit score is a true reflection of your creditworthiness.