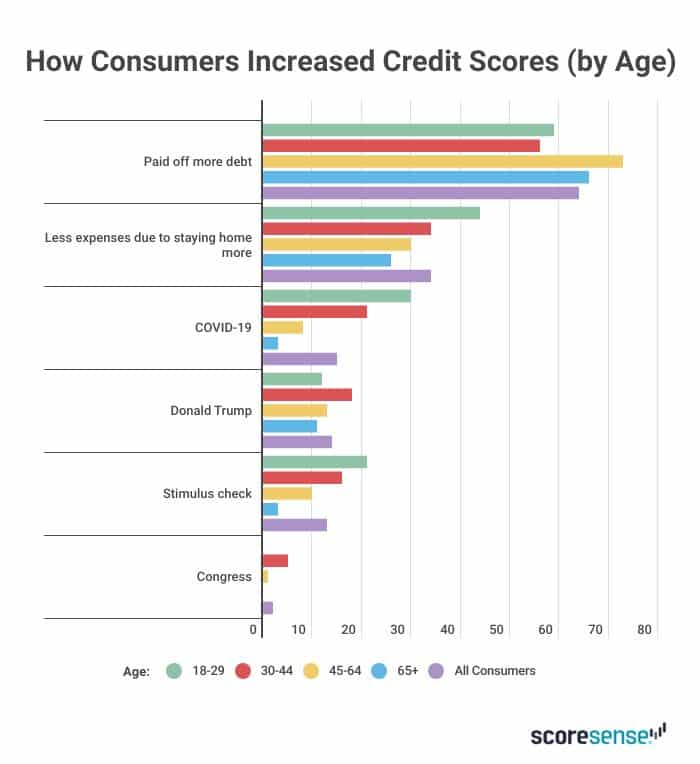

During the Pandemic, most consumers reported an increase in their credit scores, driven by spending less money, spending more time at home and paying off more debt.

Key Findings

- Among those 45 to 64 years old who indicated a credit score increase, 73% attributed it to paying off more debt during the pandemic.

- Among those Americans aged 18 to 29 who saw their credit improve, 21% report the stimulus check as a factor in improving their credit score.

- 33% of men have seen their credit scores increase over the last six months, compared to 29% of women.

- Among those Americans who experienced pay cuts during the pandemic 62% say they are considered essential workers.

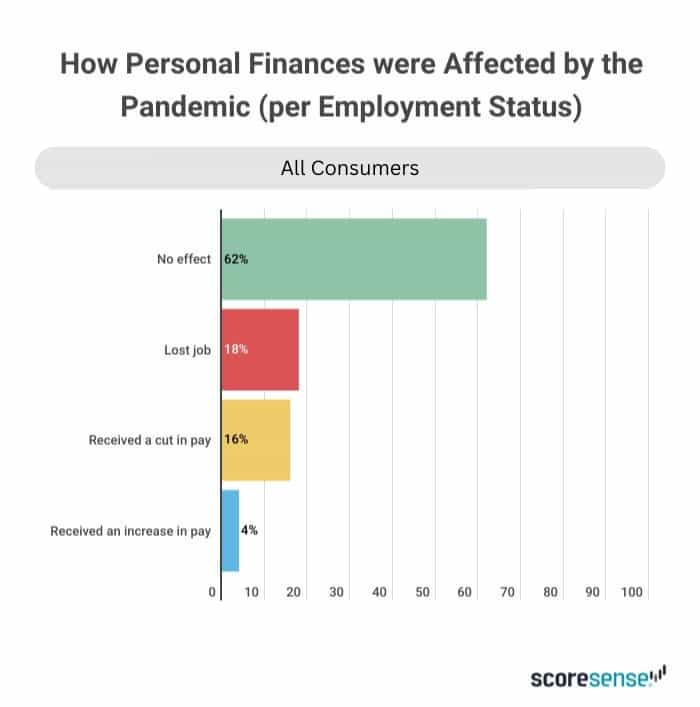

- 70% of Americans aged 45 to 64 have experienced no financial impact from COVID-19, compared to 41% of those between 18 and 29 years old.

- Americans between 18 and 29 years old were significantly more likely than those in other age groups to have lost their jobs or receive pay cuts due to the pandemic.

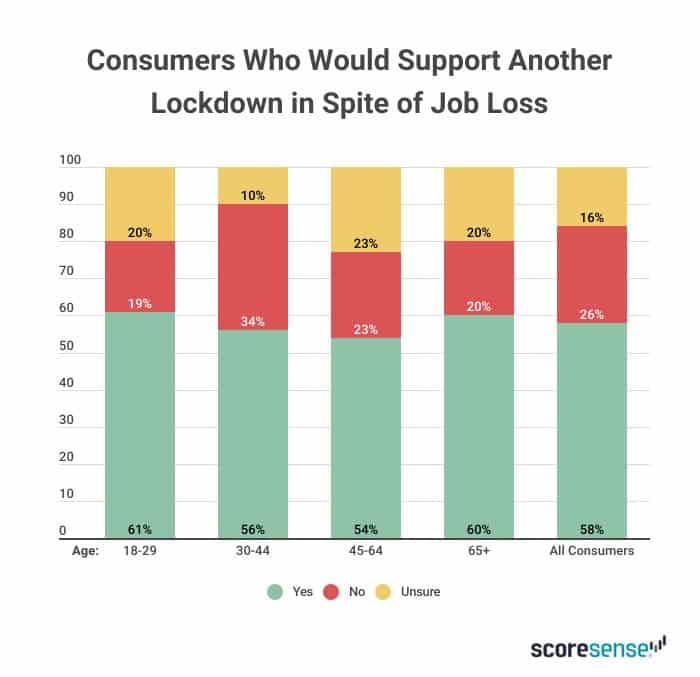

- Among those Americans who have lost jobs due to COVID-19, 58% support another lockdown, compared to 48% of Americans who have experienced no financial impact during the pandemic.

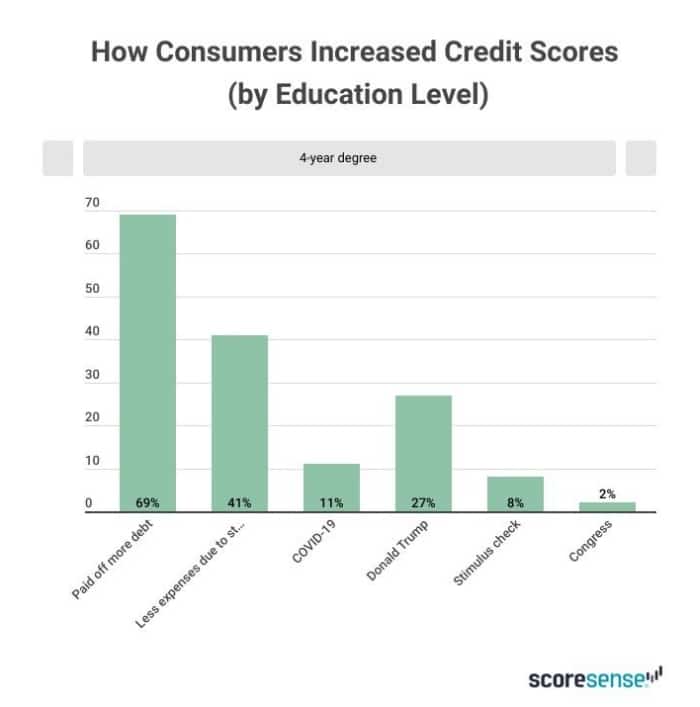

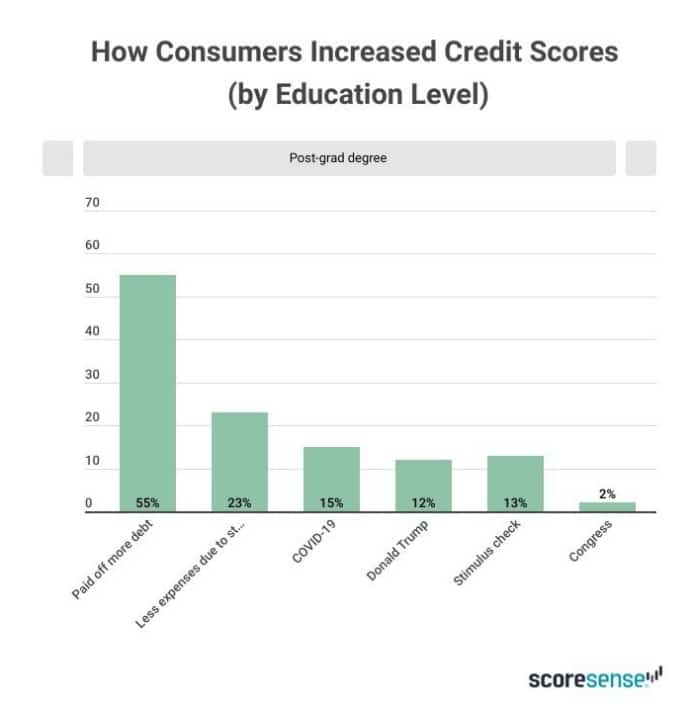

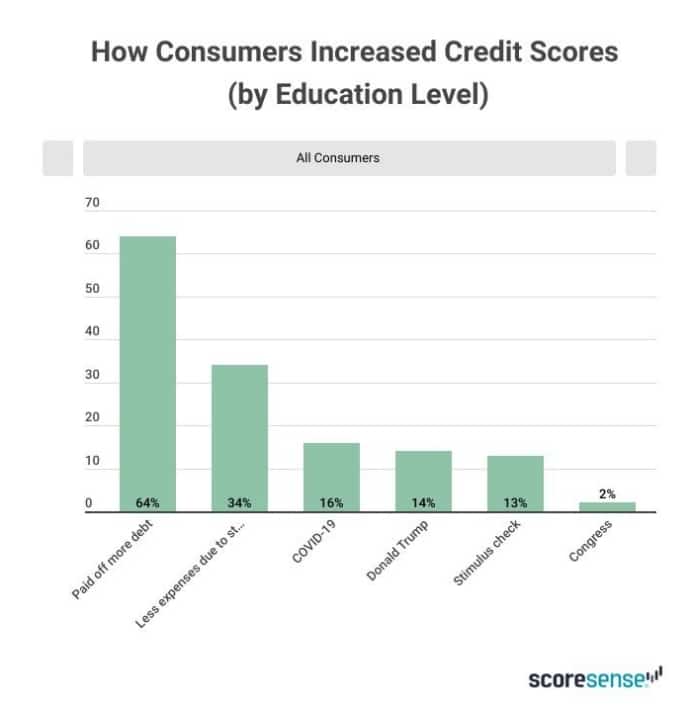

Lowered expenses from staying at home more often resulted in increased credit scores for 34% of consumers

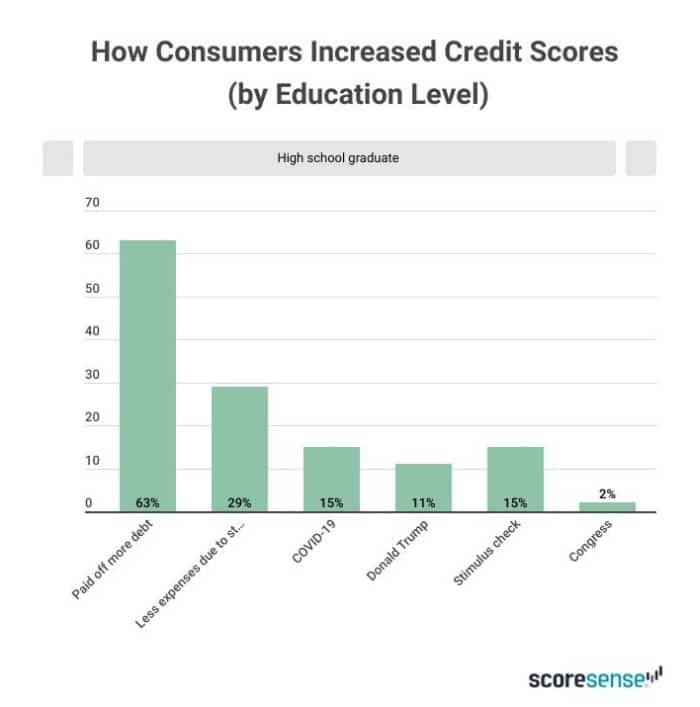

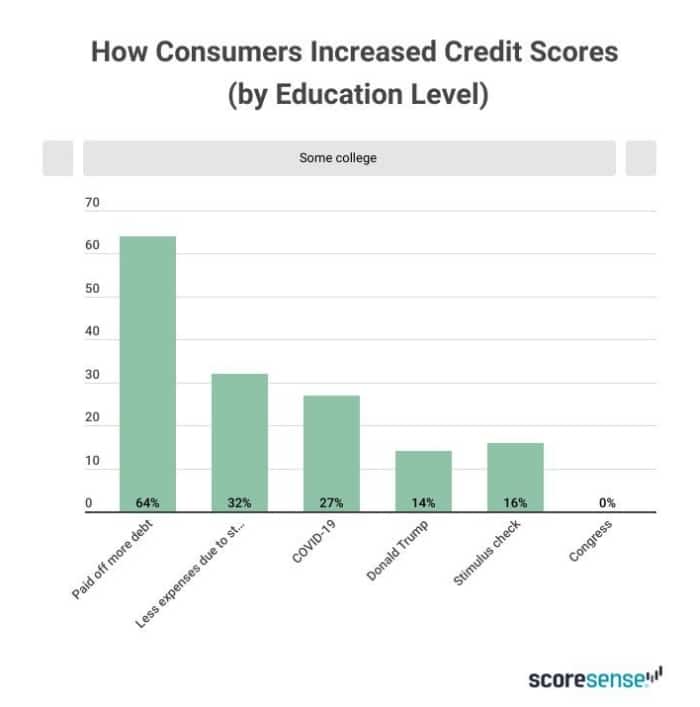

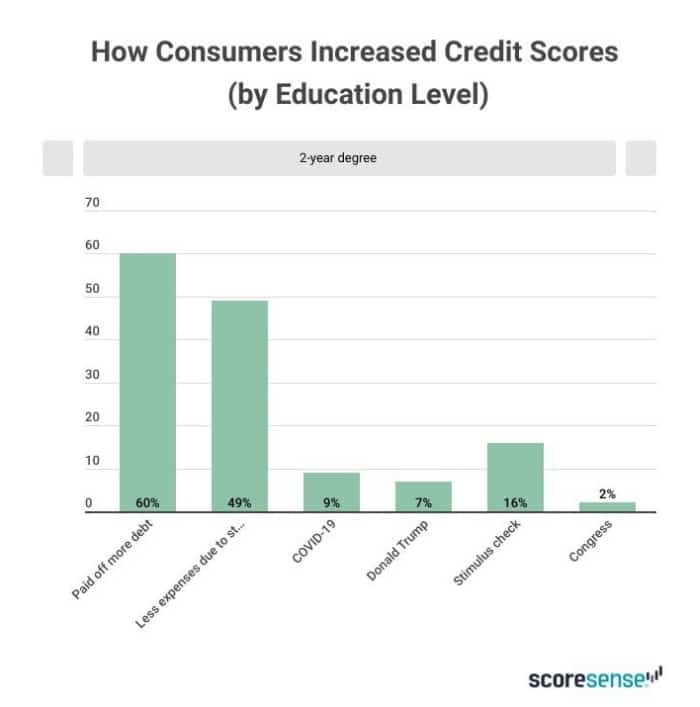

Sixty-nine percent with a 4-year degree cited paying off more debt, and 41% cited paying less expenses staying at home. About one-tenth of consumers, including 21% aged 18-29, report the effectiveness of the stimulus check as a factor in improving their credit score. Of note, 30% of those 18-29 give credit to COVID-19 for the increase in their credit score.

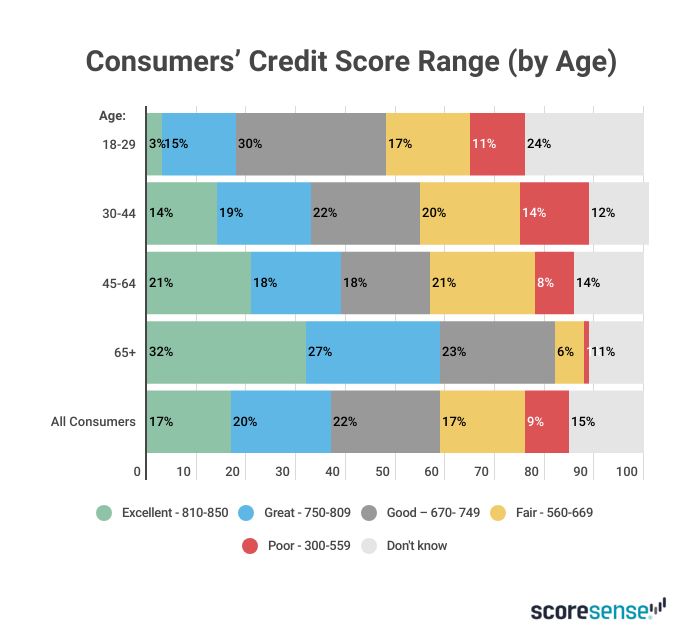

Consumers aged 65+ have the highest credit scores

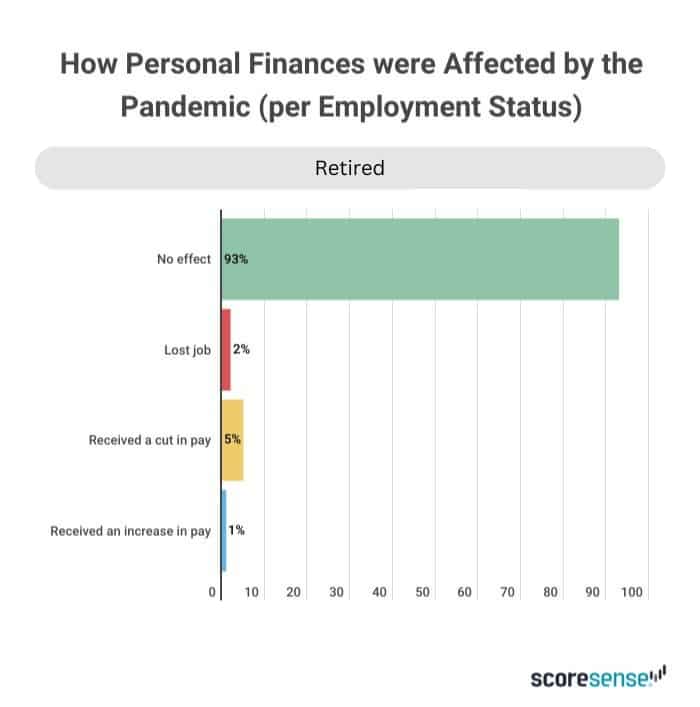

Nearly one-tenth of consumers have “poor” credit scores, with consumers aged 30-44 having the lowest scores. On the other end, 17% of consumers have “excellent” scores, driven by consumers aged 65+ at 32%. In general, the higher the education, the higher the credit score. Divorced consumers have the lowest scores, and those who are married have the highest. Retired consumers are most likely to have the highest score by employment type.

Men are more likely to have seen their credit scores increase

33% of men have seen their credit scores increase over the last six months, compared to 29% of woman.

Older consumers are least likely to see a change resulting from the pandemic

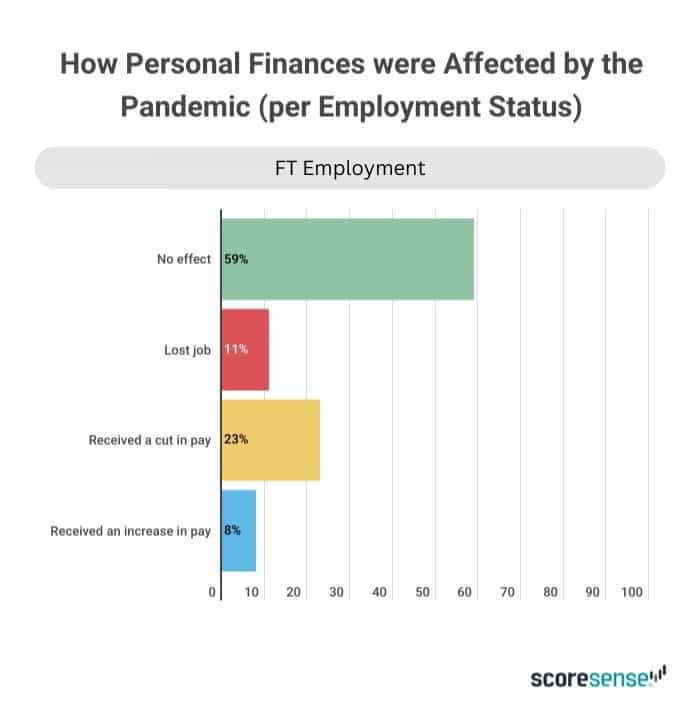

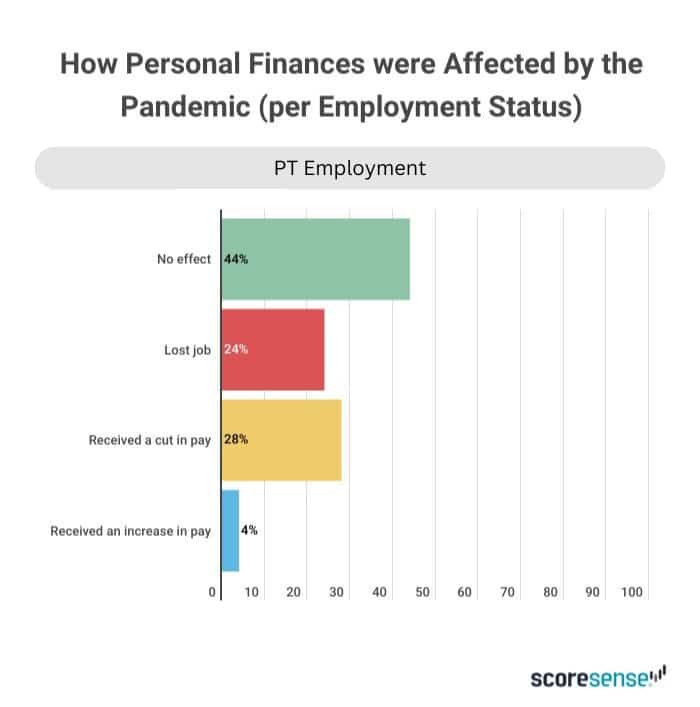

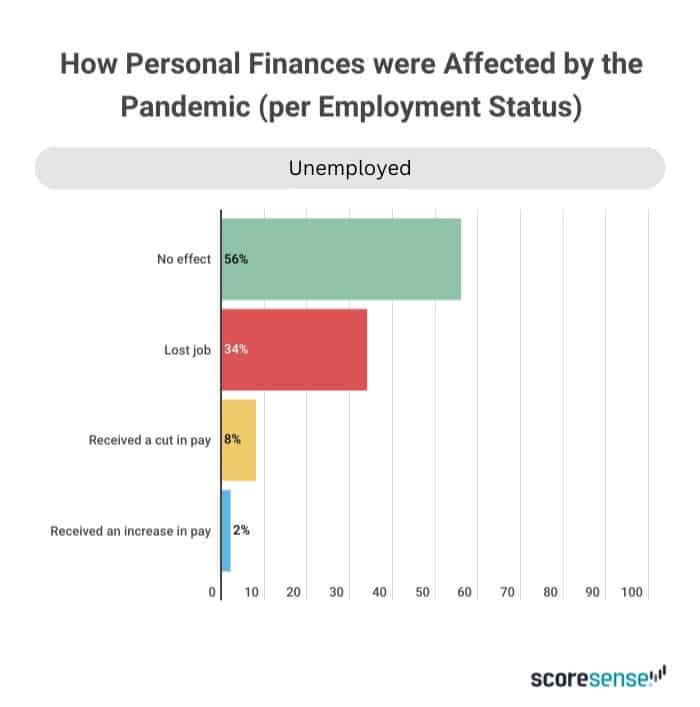

Sixty-two percent of all consumers, including 90% aged 65+ and 70% aged 45-64, were not affected personally by the pandemic. Of the rest, 23% of full-time and 28% of part-time workers experienced a cut in pay, while only 11% of full-time workers lost their jobs.

Younger consumers most likely to support future lockdowns

Despite their hardship, 58% of consumers who lost their job due to COVID-19 still support another lockdown if cases spike. Compare that with 49% whose jobs were not affected by the pandemic.

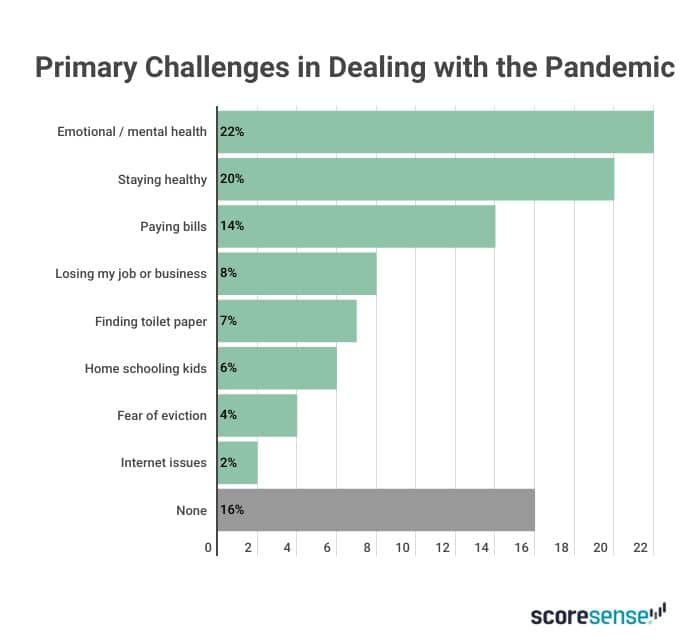

Staying healthy, both physically and mentally, are the primary challenges of the pandemic

Nearly all consumer groups consider their health (physically and mentally) the pandemic’s primary challenge, especially the widowed, retired and higher educated.

Summary

In general, consumers’ credit scores increased during the pandemic by spending less and paying down debt. Older consumers, who tend to be more insulated from financial issues, are least likely to be affected by the pandemic and most likely to have higher credit scores. Younger consumers are more likely to support another lockdown.

Methodology

This study was conducted for ScoreSense by the research company YouGov. Surveys were collected online from October 22, 2020 to October 23, 2020, among a sample of 1,000 consumers in the United States aged 18+. The margin of error for total respondents is +/-3.77% at the 95% confidence level.