The lack of security with full-time jobs and the need to pay increasing living expenses has fueled this new segment of work society. As companies continue to offer the opportunity to supplement your income (such as Uber, DoorDash and Lyft), those making a higher salary are actually the ones with more side hustles, make more money, and have more options.

Side Hustles Do Not Benefit Every Segment Equally

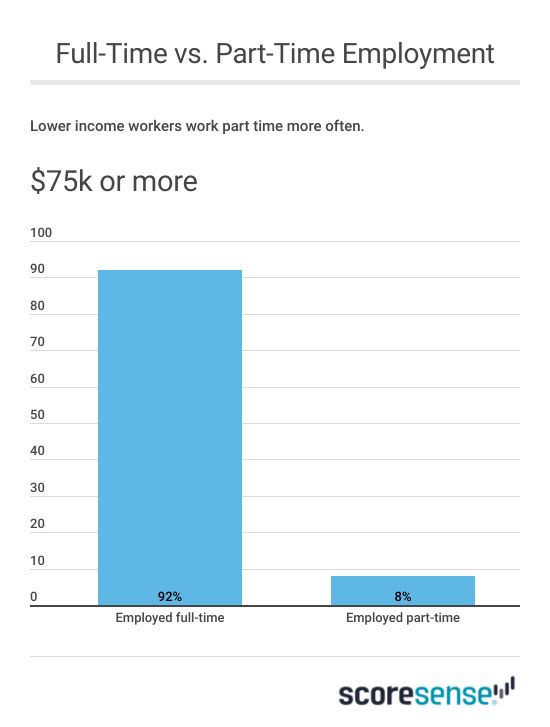

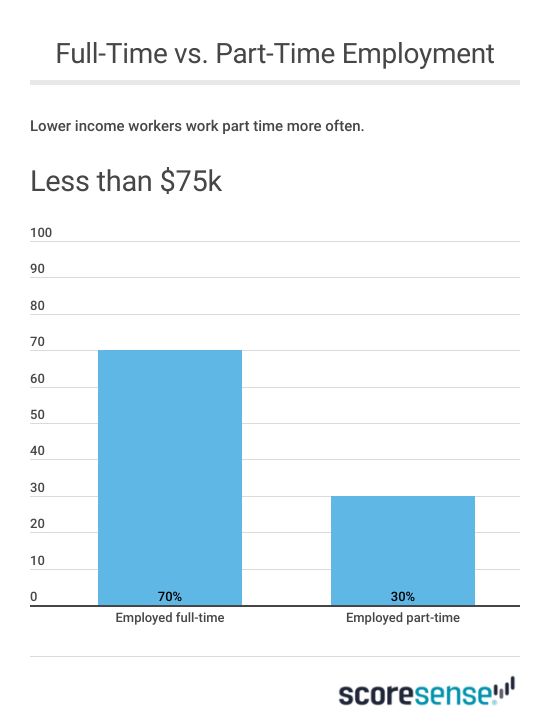

Our recent study of 1,000 workers with side hustles revealed an imbalance between those making under $75,000 from all sources and those making $75,000 or more. 49% of lower income workers use their side hustle to pay for everyday expenses compared with 45% for higher income workers. Part of this discrepancy is the pervasive nature of lower income side hustles that have become part of everyday conversation. These companies (such as Uber, Lyft, DoorDash, GrubHub and the like) that have been part of recent legal narrative concerning employee status and right to operate in certain locations, are being used as primary sources of income and are not allowing lower income workers to be make a true impact on their standard of living. Our survey found that 30% of those with lower income work part-time only along with their side hustle, compared with 92% working full-time among higher income individuals.

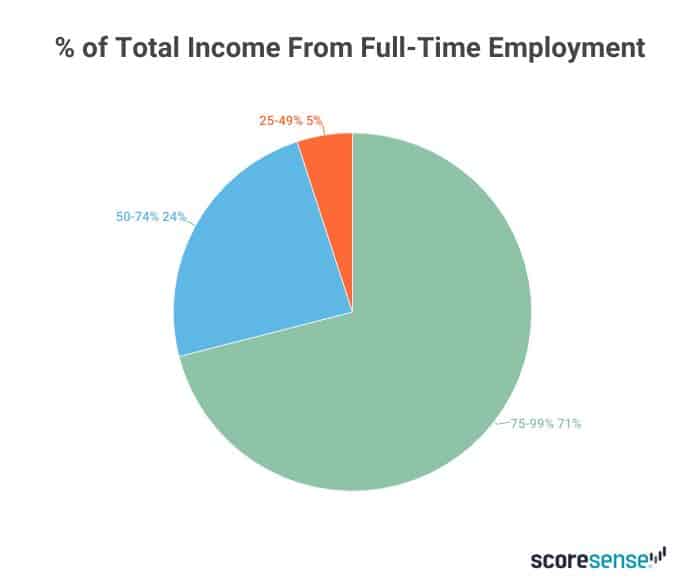

Workers Still Make a Substantial Amount of Income Through Their Full-Time Jobs

Despite the growth of side hustles, 70% of workers still make 75% – 99% of their income through their full-time jobs. The pervasiveness of the side hustle, and its purported benefits for those who take one on, are not being realized. The majority of side hustle workers are still making their income through traditional means.

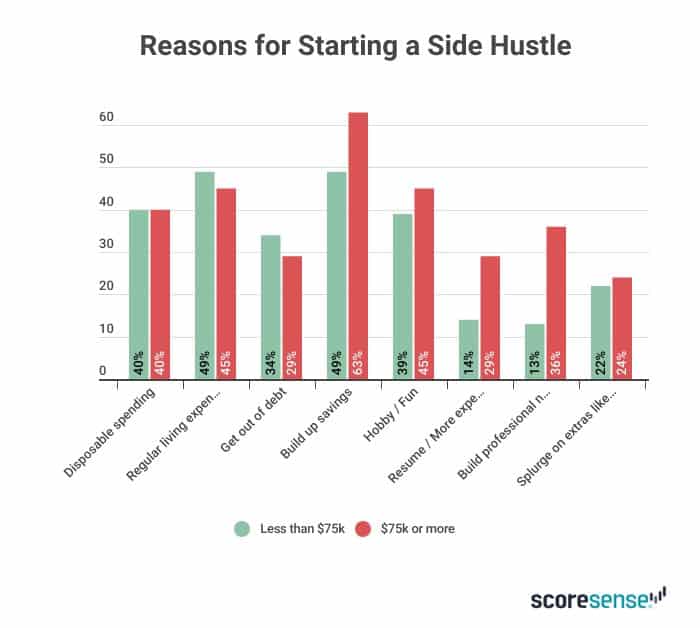

Side Hustles Are for Disposable Spending

40% of side hustle income is used for disposable spending rather than making financial life better. Only 31% use it to pay down debt and 23% is for luxury items or vacations. Almost 2/3 of higher income workers use it to build up savings and build their professional network. Compared with lower income workers, 45% of higher income workers treat their side hustle as a hobby compared with 39% of lower income workers.

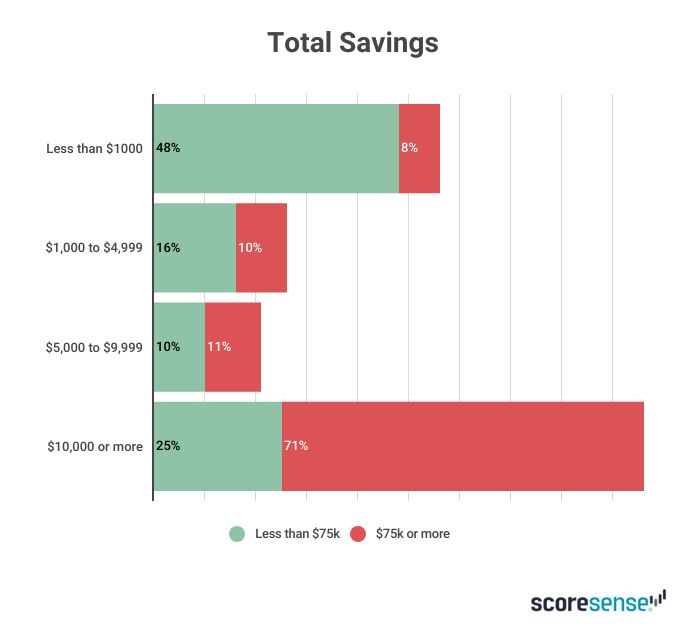

Higher income workers have an average of $10,000 in savings compared with less than $1,000 for lower income workers. Income does not remove the necessity or desire to have a side hustle.

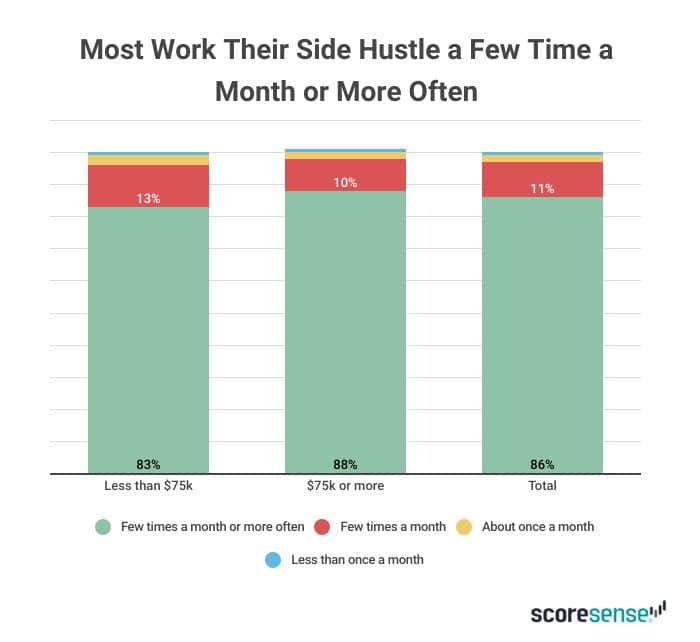

Time Spent Working Does Not Equate to Income

Income does not equal how hard you work. 85% of all workers, regardless of income, work their side hustle a few times a week or more often. 46% of higher income workers work more than 10 hours per month, compared with 36% of lower income. Higher income workers are also more likely to sell a custom service, leading to a higher earning potential.

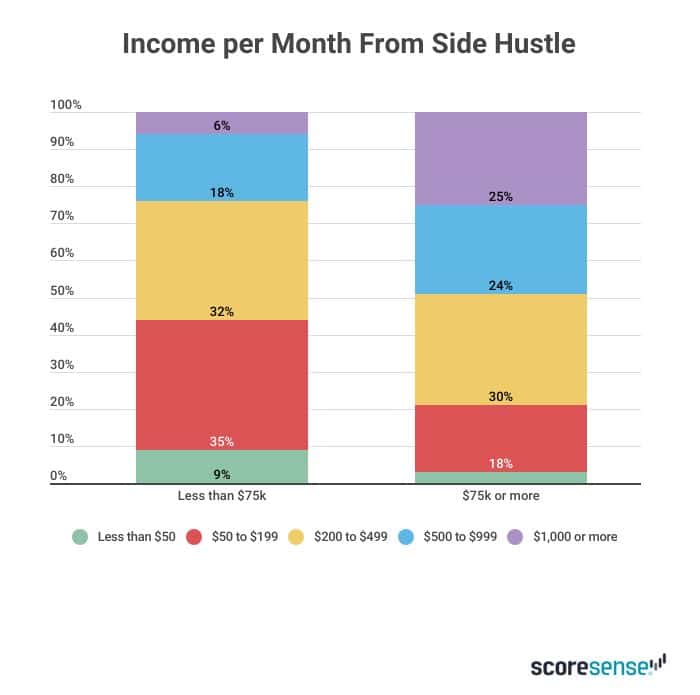

Half of higher income workers make $1,000 a month or more at their side hustle. 75% of lower income workers bring in less than $500 per month from their side hustle. Higher income workers are more likely to sell custom made products demonstrating their focus on hobbies. Lower income workers are likely to be teachers and coaches as their side hustle.

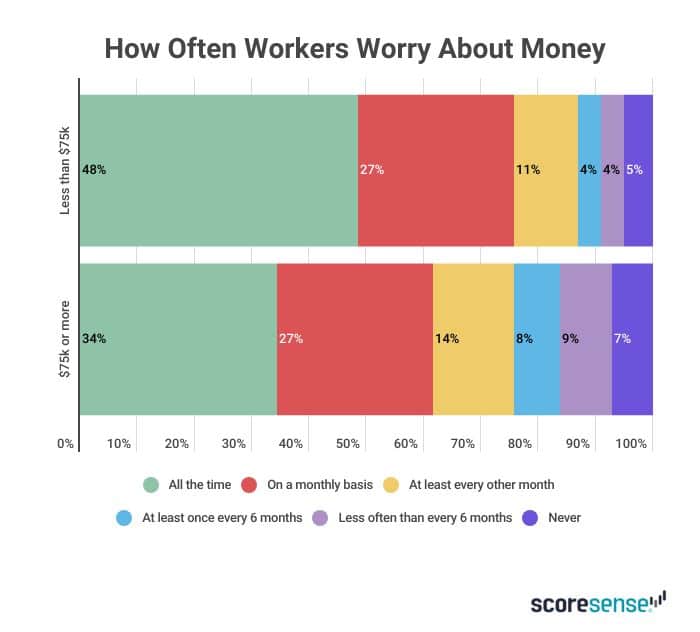

Despite the Difference in Income, Side Hustle Workers Deal With the Same Issues

40% of all workers and 48% of lower income workers worry about money all the time. 61% of lower income workers, and 51% of all workers worry about everyday expenses. Higher-income workers are more likely to worry about saving for retirement than lower income workers. 40% overall are worried about health care or insurance bills.

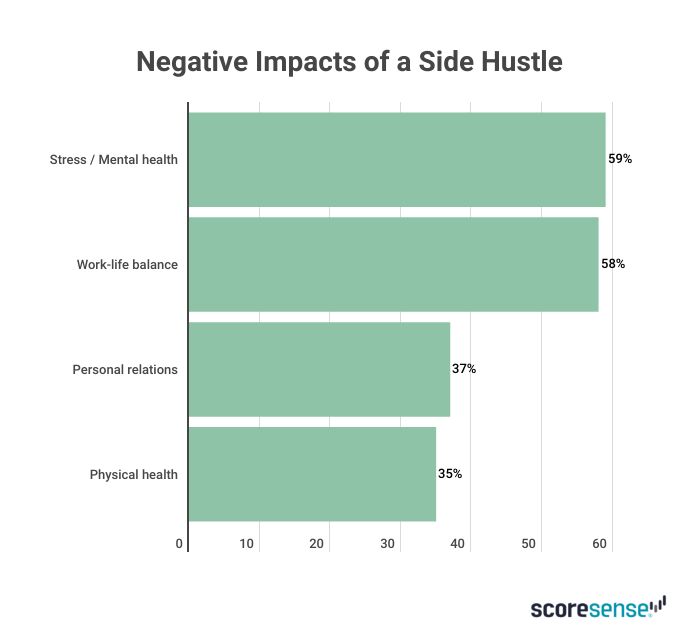

As workers add their side hustle to their lives, the additional time and stress have made an impact. 28% of workers say their side hustle has negatively impacted them. Key issues are their stress and mental health (59%), the impact on their work-life balance (58%) and 37% have issues with personal relations. A third report physical health challenges.

Issues Aside, Side Hustle Work Is Attractive as a Full-Time Option

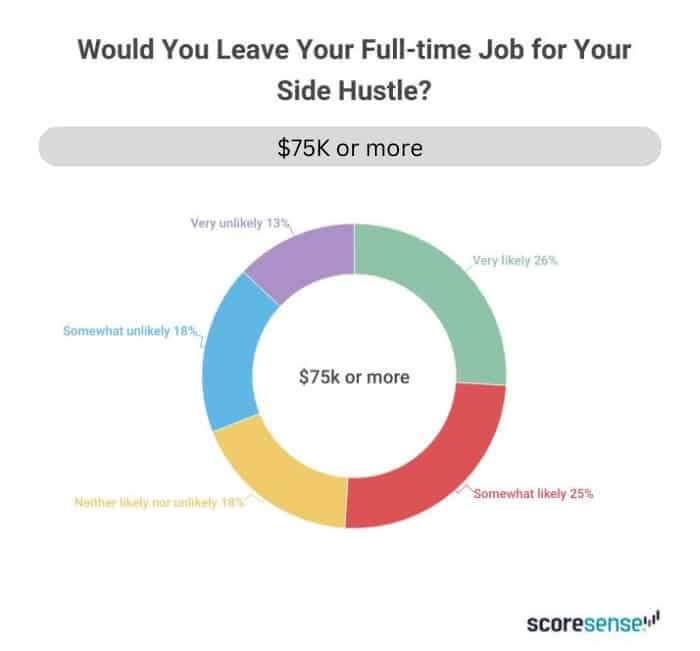

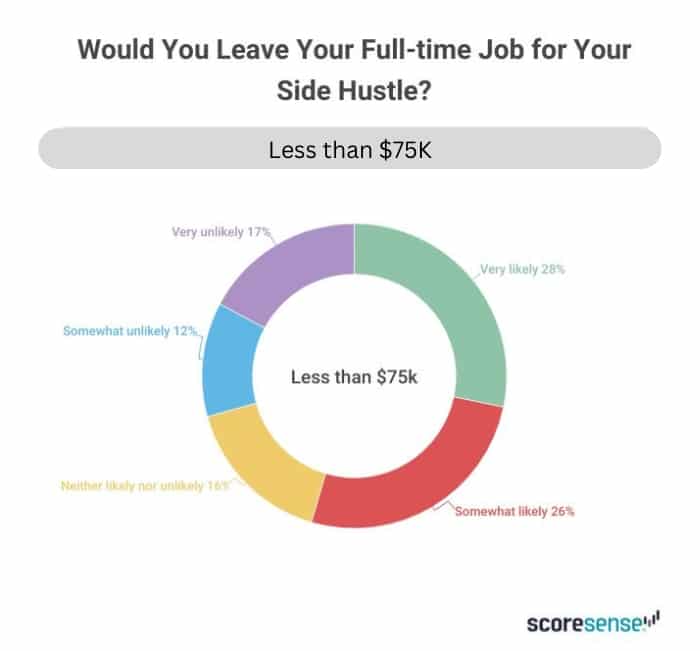

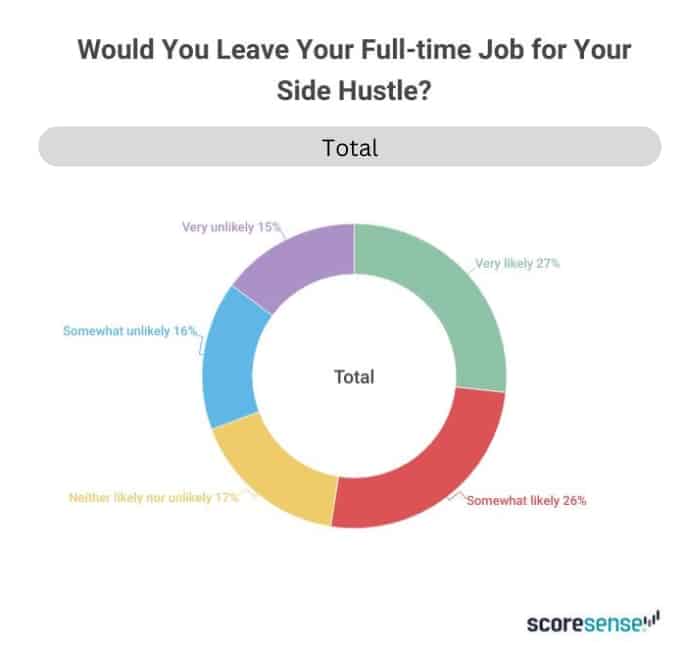

52% would leave their full-time job for their side hustle if available to them. A third like their side hustle better than their full-time job. Another 37% like their side hustle and full-time job equally.

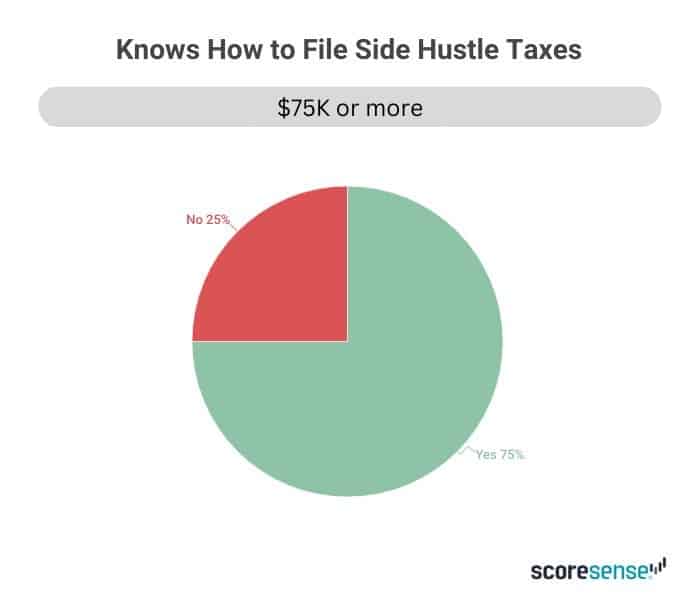

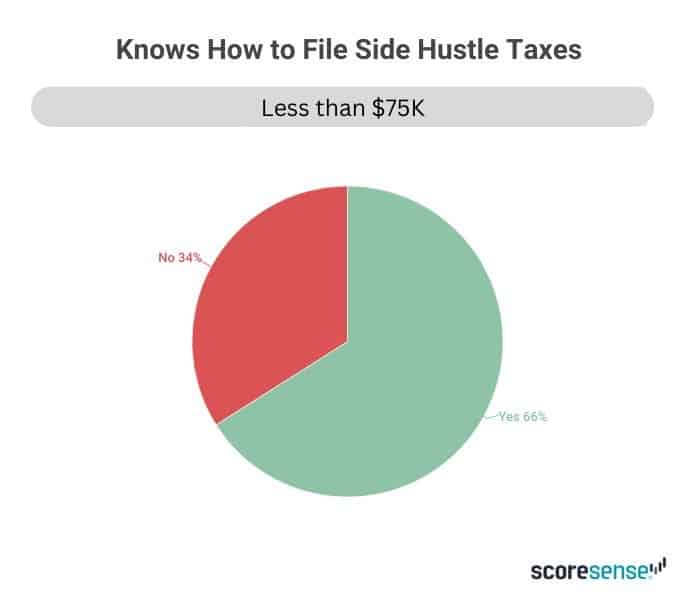

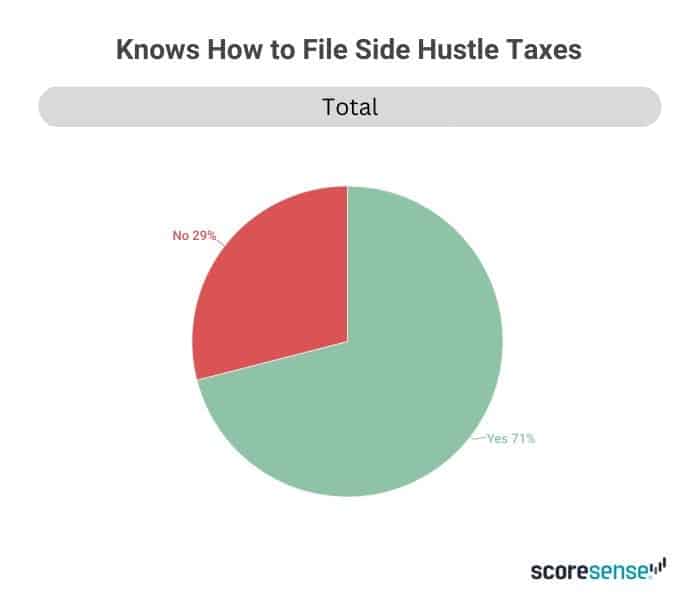

As side hustles become more attractive, the need to understand the tax implications increases. 71% report knowing how to file their taxes and about half have expenses associated with their side hustle.

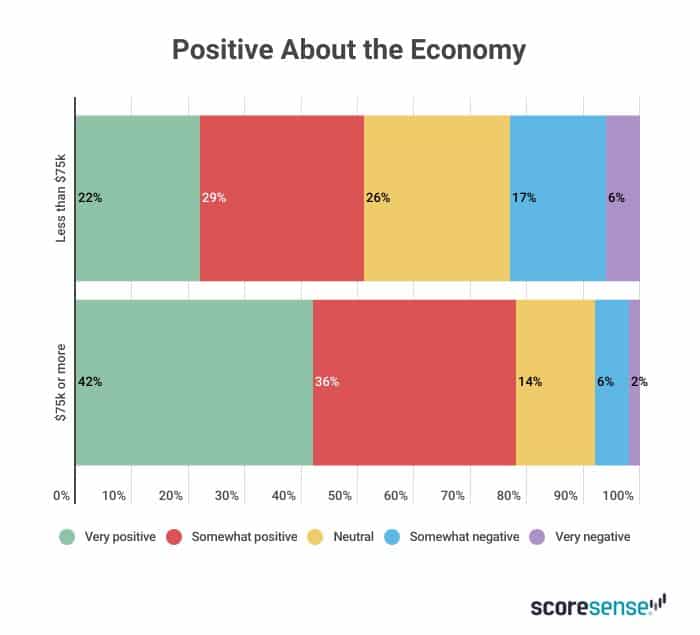

Overall, although side hustles are used for different purposes, both higher and lower income workers have had their side gigs the same amount of time and put in the same amount of work, but both groups have the same stresses. The main difference: higher income workers are much more positive about the economy (78%) compared with 51% of lower income workers. Higher Income workers have a better outlook on side hustles, which produce more income and help them do better financially. Higher income workers use side hustles to get ahead while lower income workers use side hustles just to keep their head above water.

Methodology

This study was conducted for ScoreSense using the online portal by PeopleFish. Surveys were collected in February 2020, among a sample of 1,006 side hustle workers aged 18+. The margin of error for total respondents is +/-3.1% at the 95% confidence level.