May 2023

OVERVIEW

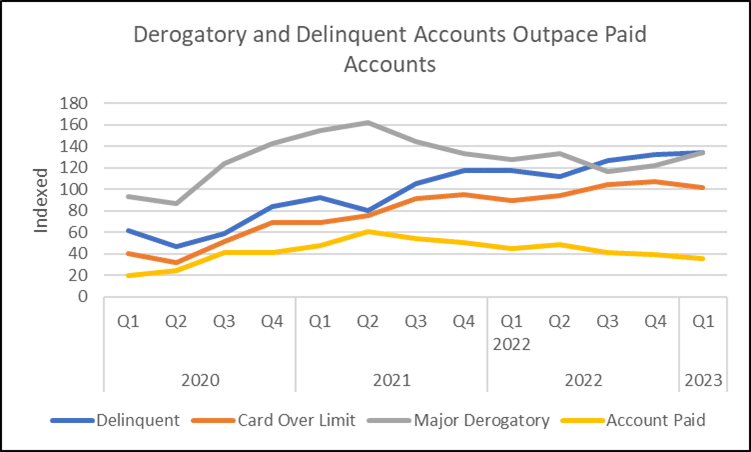

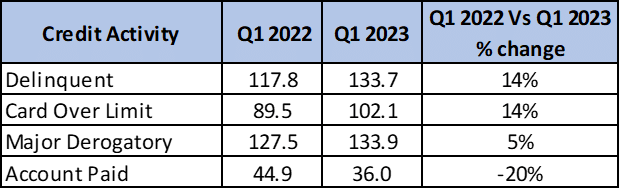

During the first quarter of the year, we typically see a higher number of delinquent and derogatory accounts, possibly due to consumers splurging on holiday spending and falling behind on payments. Current ScoreSense data shows that this trend continued into 2023.

- Delinquent and Card Over Limit both increased by 14% in Q1 2023 from Q1 2022.

- Major Derogatory increased by 5% in Q1 2023 compared to Q1 2022.

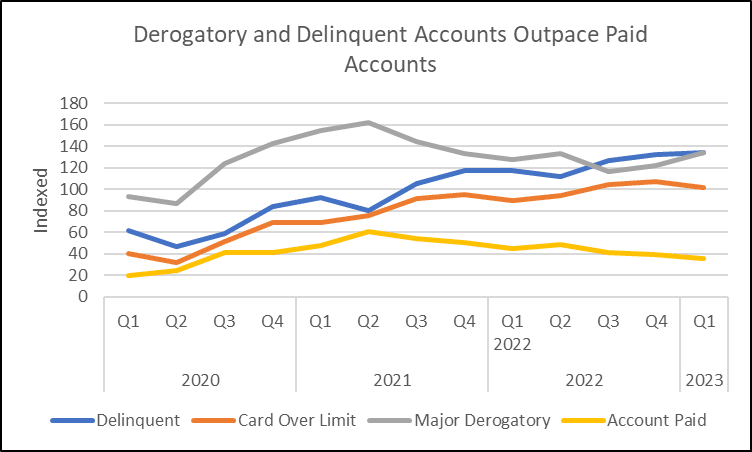

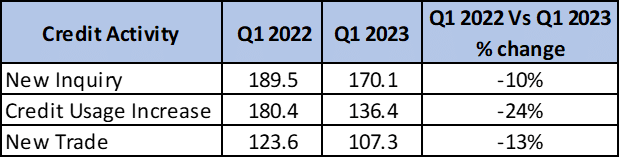

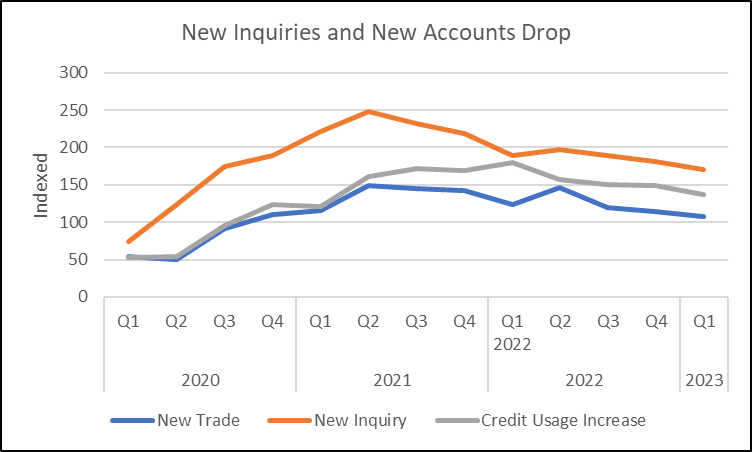

As the number of delinquent and derogatory accounts rise, consumers are applying less frequently and opening fewer new credit accounts. One probable reason for the decrease in credit inquiries and new accounts is the fact that so many consumers are already struggling with their current credit lines. For those who have a negative credit standing, it’s also less likely that a lender would give them a new account or give them attractive interest rates for an account.

- New inquiries (customers applying for credit and the bank pulling a credit report) went down 10% in Q1 2023 compared to Q1 2022.

- New trade lines (a new account on a consumer’s credit report) went down 13% in Q1 2023 compared to Q1 2022.

To better understand consumers’ sentiments and spending behavior as the threat of a recession looms, ScoreSense conducted a survey on credit activity and consumer sentiment. Key findings include 72% of respondents are either somewhat or very concerned about a possible recession this year, 48% of respondents feel financially stressed, and most respondents are cutting nonessential expenses, including large purchases such as vehicles, appliances, and vacations.

OPINION & OUTLOOK

As expected, the inflationary economy of 2022 spilled into 2023, bringing with it a continuation of high prices, increased credit spending and late payments, and increased fears of an economic recession.

Currently, more Americans are continuing to lean on credit cards to pay for goods and services that are more expensive due to inflation. Rising interest rates are making it more difficult to pay off credit card debit. At the end of Q1 2023, inflation cooled somewhat, but a myriad of factors prompted the Federal Reserve to increase its key interest rate by 0.25 percentage points – its 10th hike in 14 months – pushing its benchmark rate to between 5% and 5.25%, up from near zero in March 2022. For consumers, there are several implications including:

- For consumers with credit cards, every time the Fed raises rates, interest on variable-rate cards moves higher. The reason: the Fed’s rate is the basis for your bank’s prime rate. In combination with other factors, including your credit score, the prime rate helps determine the Annual Percentage Rate (APR) on your credit card. In simple terms, you pay more for the money you have borrowed, making it more difficult for some consumers to make even the minimum payments.

- Consumers seeking new lines of credit for credit cards, student loans, personal loans, vehicle loans, and other things will face increased scrutiny and pay a higher rate. In the case of a mortgage loan, higher rates can add hundreds of dollars a month to mortgage payments and, for some buyers, this factor alone removes their ability to buy a new home. Bankrate reported that the national average APR is higher than 20 percent as of May 3, 2023, up from 16.34 percent in March 2022.

- The cost of a home equity line of credit (HELOC) will be climbing higher since HELOCs adjust somewhat quickly to changes in the federal funds rate. Those with outstanding balances on their HELOC will see rates tick up.

- For savers, rising interest rates mean consumers can realize higher returns on savings and money market accounts.

The Federal Reserve’s latest report, released in February 2023, set credit card debt at $986 billion, higher than the pre-pandemic high of $927 billion. While growing balances are concerning, so too is the increase in delinquent accounts. The rate at which U.S. consumers miss payments on credit cards and personal loans is expected to surge to levels not seen since 2010, according to TransUnion’s credit forecast. TransUnion forecasted serious credit card delinquencies to rise to 2.6% at the end of 2023 compared to 2.1% at the close of 2022. Unsecured personal loan delinquency rates will increase to 4.3% from 4.1% in the same timeframe.

As if the current economy were not challenging enough, consumers with federal student loans are expected to be required to resume payments this summer. Federal student loan payments were put on pause by President Trump in March 2020 as the COVID-19 pandemic took hold. The exact date payments will resume is tied to events involving President Biden’s Student Loan Relief plan.

For the remainder of 2023, we expect a continuation of the same consumer behavior and credit trends we’re seeing today – credit spending, late payments, and delinquencies. Unfortunately, no one can predict what the economy will do; however, many economists are predicting a recession to occur later this year. In the ScoreSense consumer survey conducted in April (see above), 72% of respondents are either somewhat or very concerned about a possible recession this year, especially those ages 64 and older.

While we cannot control the economy or a possible recession, we can prepare. To stay ahead of the potentially negative economic news, consumers should focus on paying down or refinancing high-interest debt and cut spending to increase savings. Consumers also should monitor their credit scores to better understand their current credit positions, be more aware of what lenders may see, and help detect any inaccurate or incomplete information. Additionally, credit monitoring notifies you of important changes to your credit report, which can signal identity theft and fraud.