To better understand consumers’ sentiments and spending behavior as the threat of a recession looms, ScoreSense conducted a survey on credit activity and consumer sentiment in April 2023.

Overview of Findings:

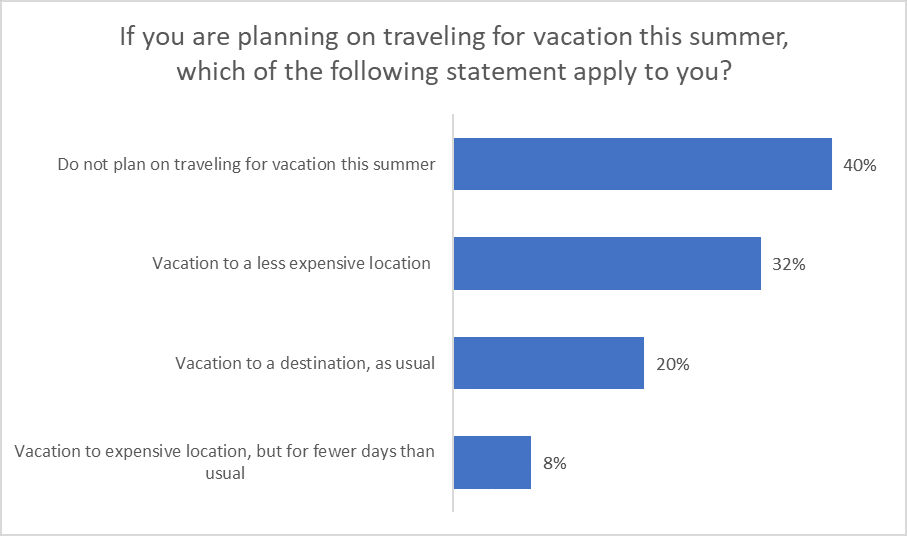

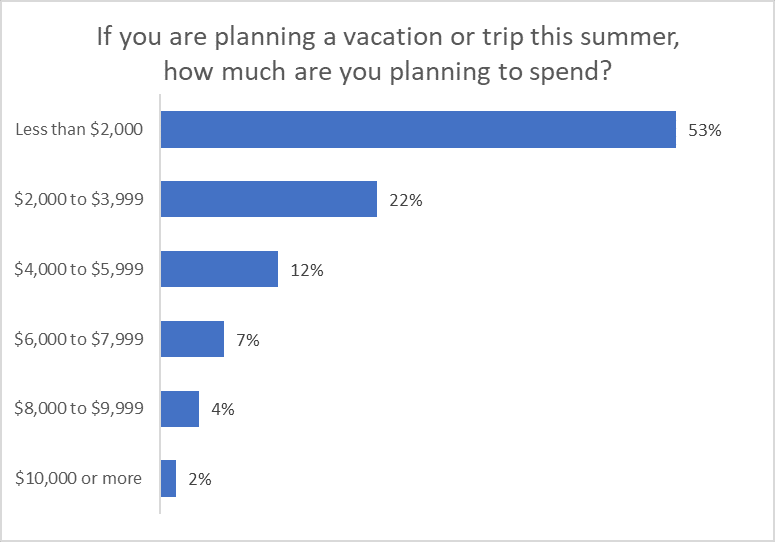

Consumers are concerned about a possible recession this year and are stressed financially due to inflation. They are using personal loans to help pay for typical monthly purchases like groceries, utility bills, and mortgage payments. People are looking for money-saving strategies such as couponing, buying things on sale, and switching to store brands over name brand items. Many are spending less this year on dining out. While summer is usually a time for fun in the sun, many consumers are canceling their trips or going to a less expensive destination. For those who will go on a vacation, many plan to spend less than $2,000 on their summer trips.

Top Insights:

- 48% of respondents feel financially stressed, primarily due to inflation and higher prices.

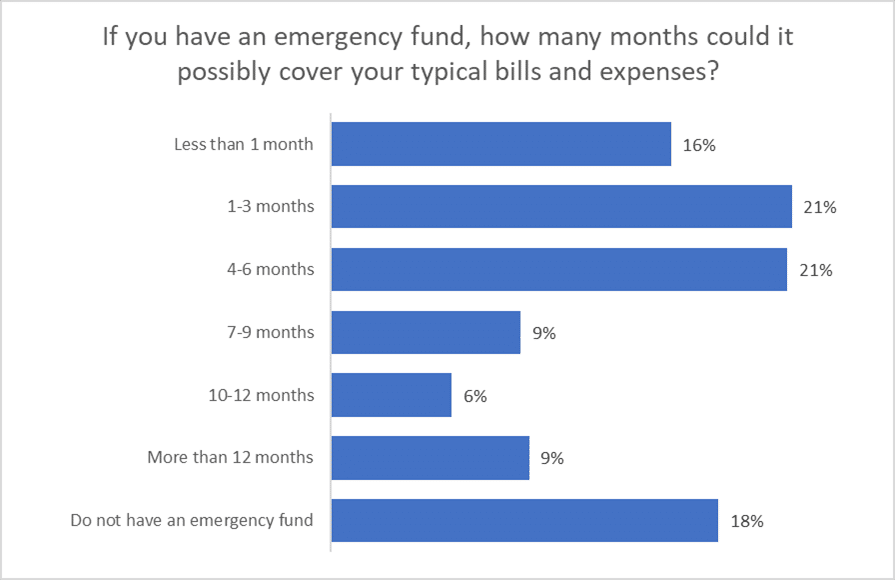

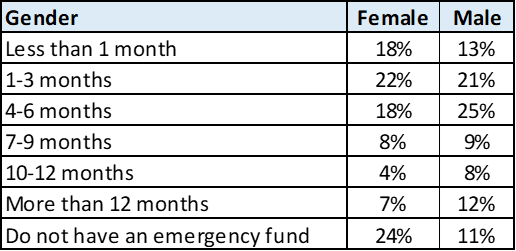

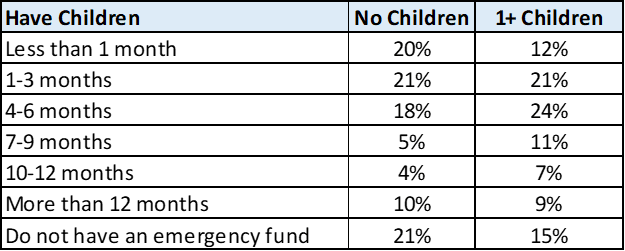

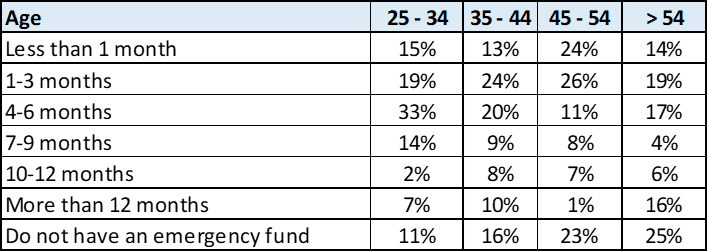

- Nearly 1 in 5 respondents do not have an emergency fund, while 58% of respondents have enough to cover 6 months or less.

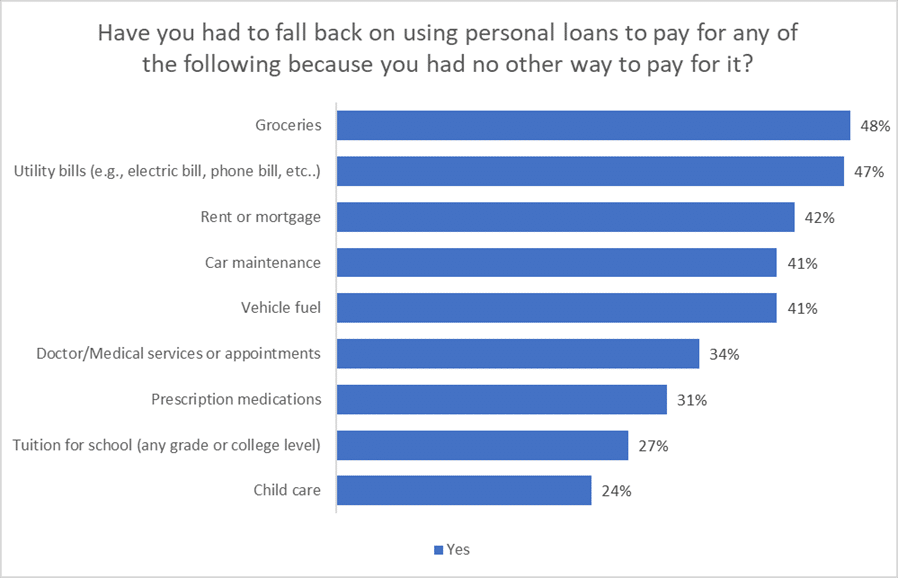

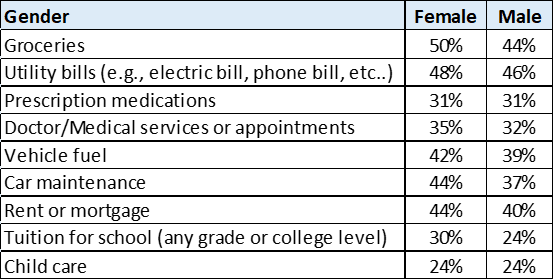

- Overall, respondents said they had used personal loans to help pay for groceries (48%), utility bills (47%), rent and mortgage (42%), and car maintenance and vehicle fuel (both 41%). Females are more likely to use loans for groceries compared to males.

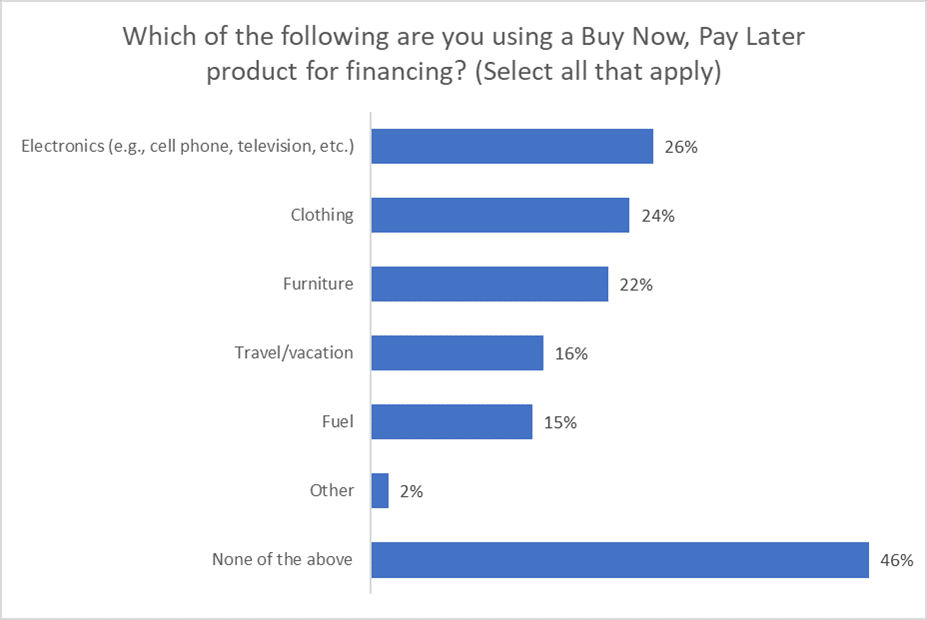

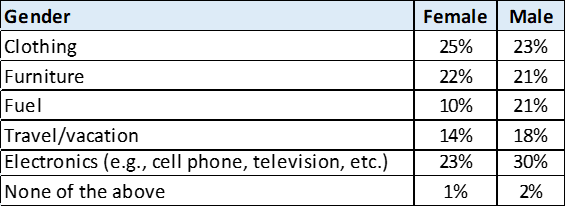

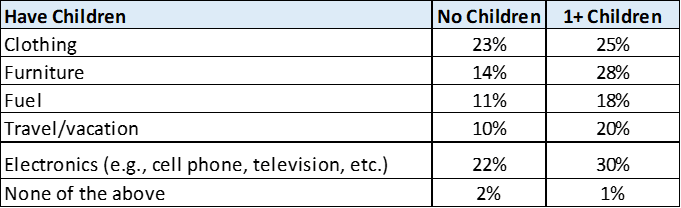

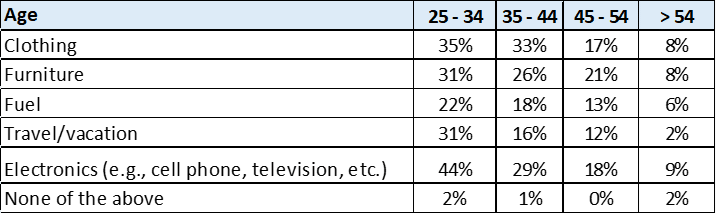

- About 1 in 5 respondents are using Buy Now, Pay Later (BNPL) for electronics or clothing. Males were more likely than females to use BNPL for electronics. Those in younger age brackets also were more likely to use BNPL for purchases compared to older respondents.

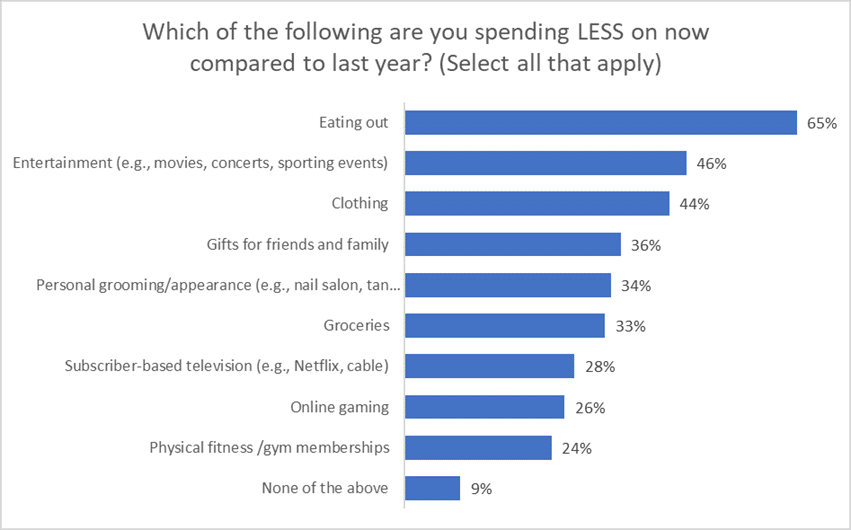

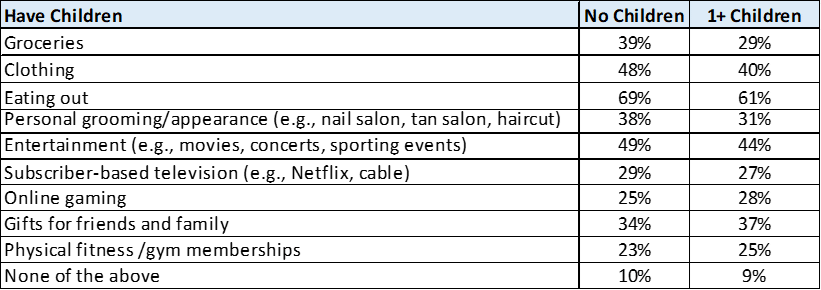

- 65% of respondents say they are eating out less than last year. Those older than 45 are spending less on eating out compared to those in younger age groups.

- In addition to dining out less often, people are also spending less on entertainment (46%) and clothing (44%).

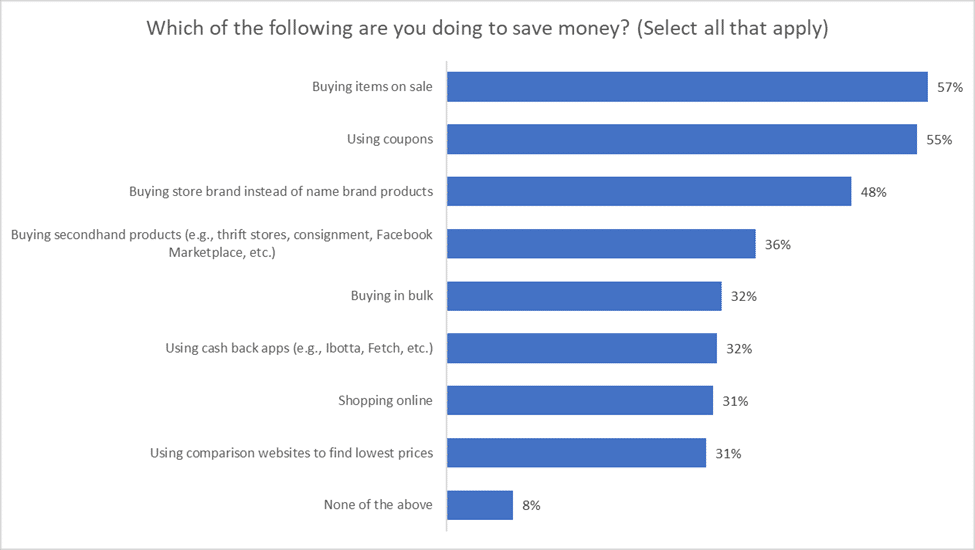

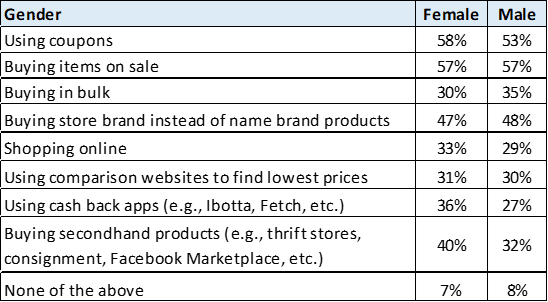

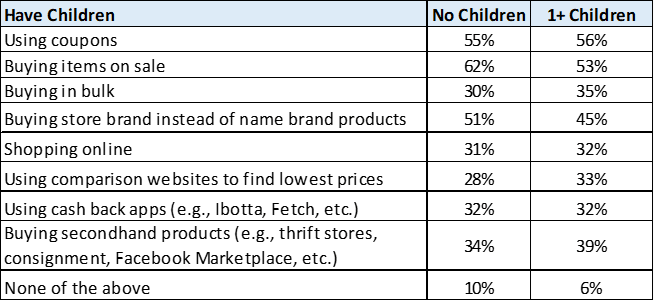

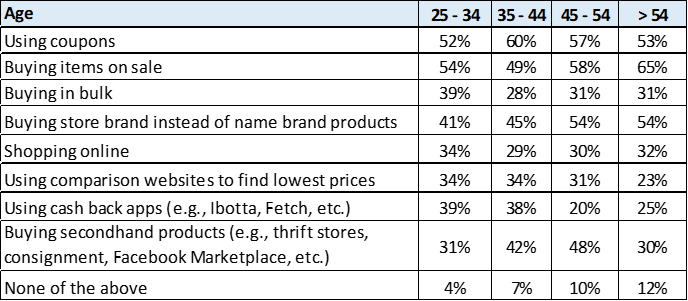

- 55% of respondents are using coupons, and 57% are buying on sale as a money-saving strategy. 48% are buying store brand instead of name brand products. This strategy is more apparent in those ages 45 and older compared to those under 45. Females are more likely to buy secondhand products compared to males.

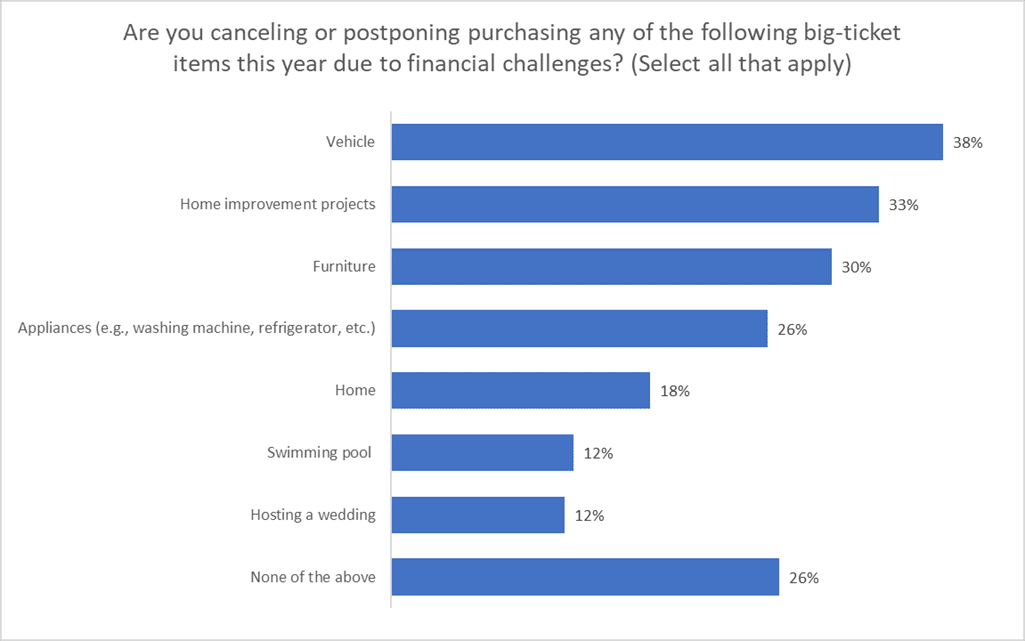

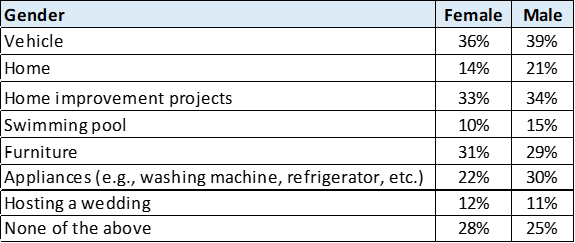

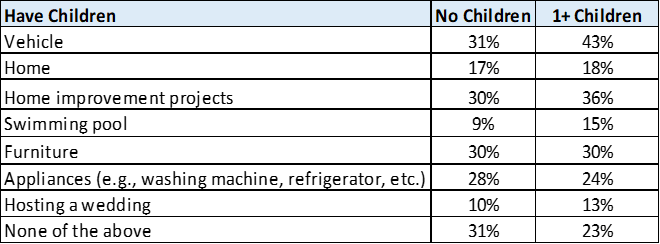

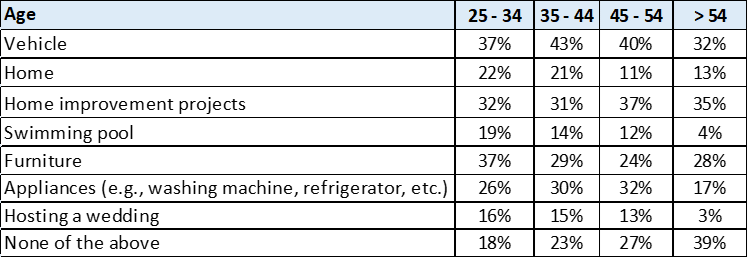

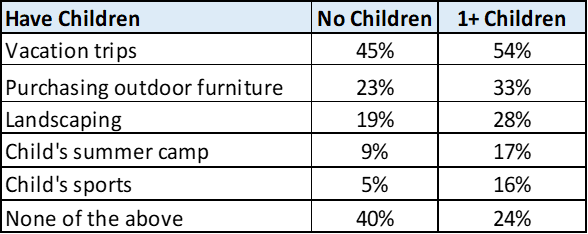

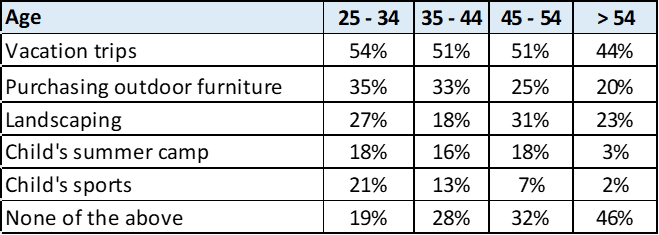

- Overall, 38% of respondents are canceling or postponing purchasing a vehicle this year due to financial challenges; among those with children, 43% say they will postpone a vehicle purchase. Those between the ages of 25-34 were more likely to postpone purchasing furniture than consumers in older age brackets.

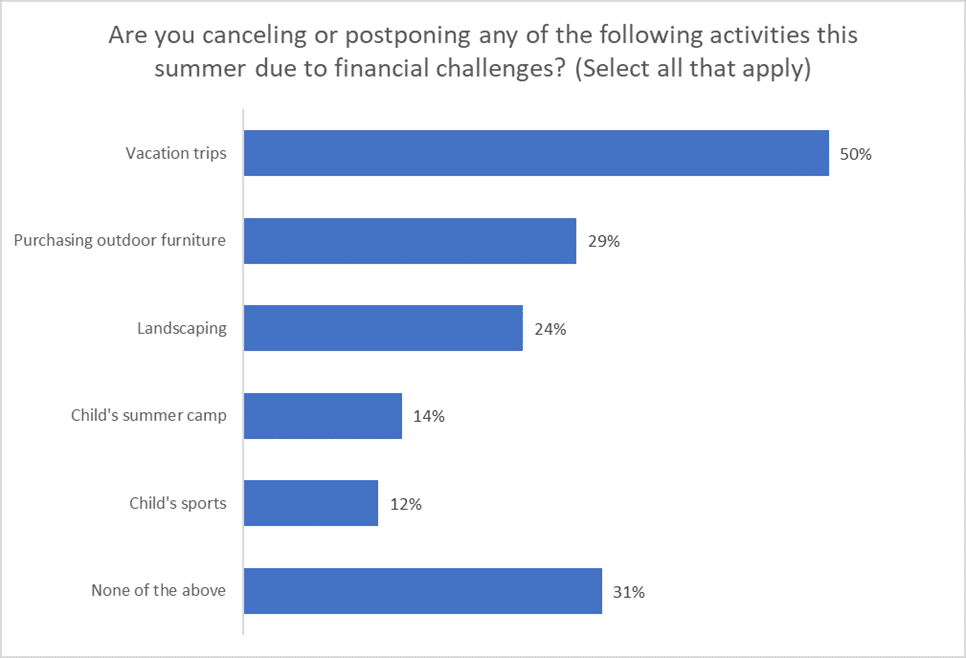

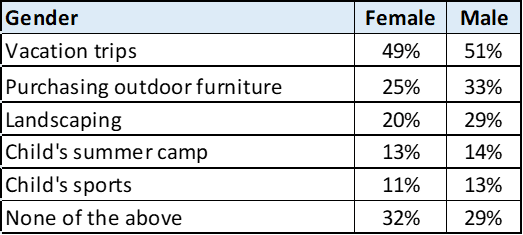

- 50% of respondents are canceling or postponing vacation trips due to financial challenges, while 1 in 3 respondents plan to spend less on expensive vacation locations.

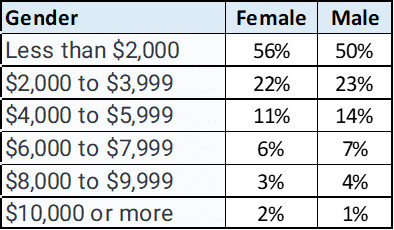

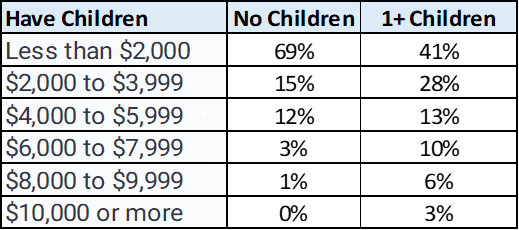

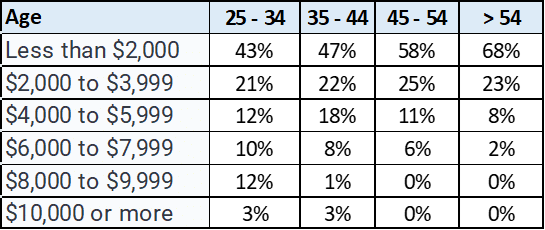

- 53% of respondents planning a vacation this summer intend to spend less than $2,000. This is especially apparent among respondents who do not have children (69%) compared to those with children (31%). Older respondents were more likely to spend less than $2,000 on summer trips compared to younger respondents.

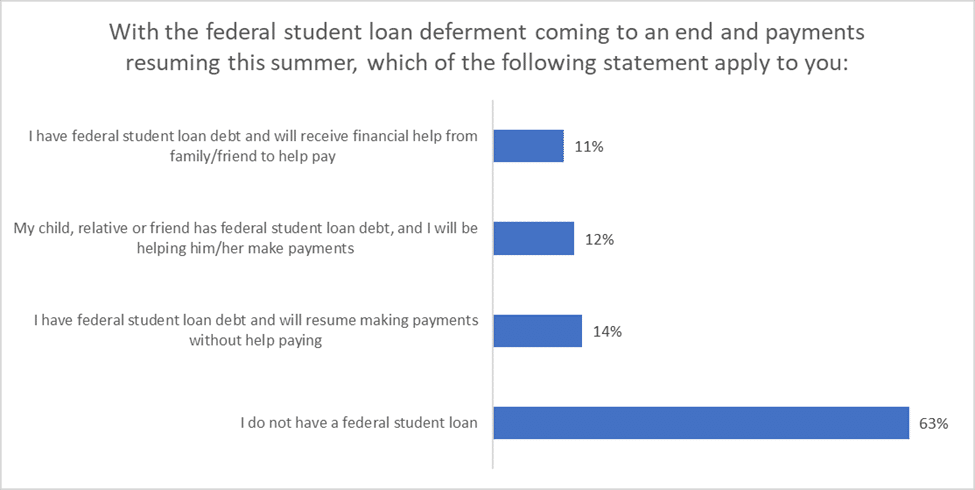

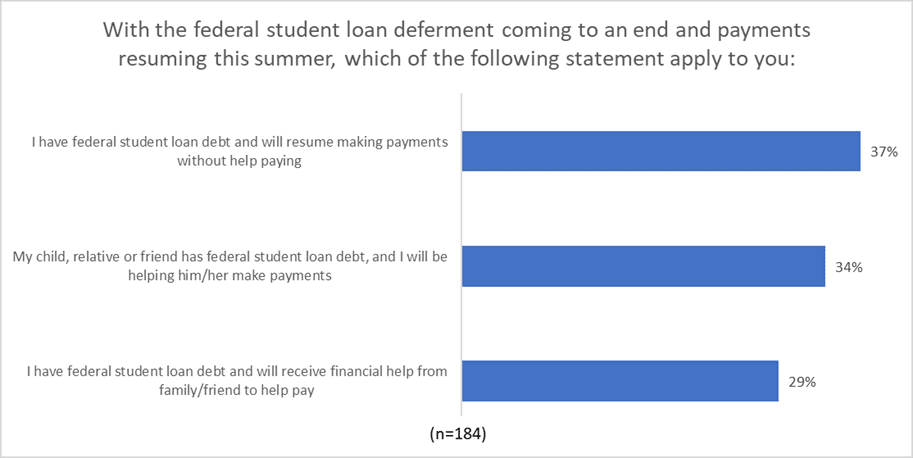

- Within our sample, 36% of respondents will be dealing with federal student loans. Of those dealing with the loans, 37% will resume payments without any help from others, 29% will need help from others to pay, and 34% will be helping their child/relatives/friends make loan payments.

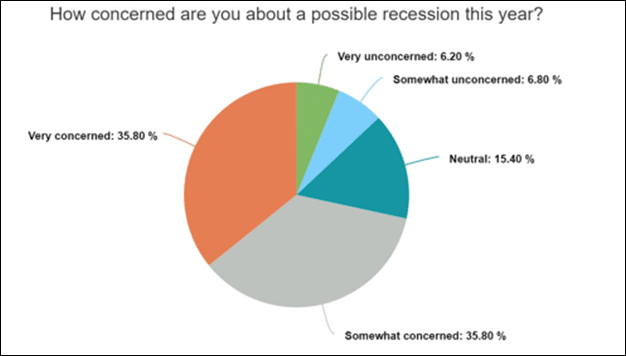

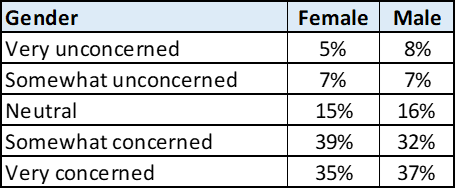

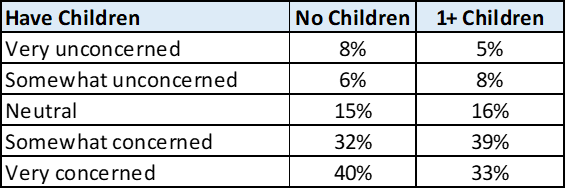

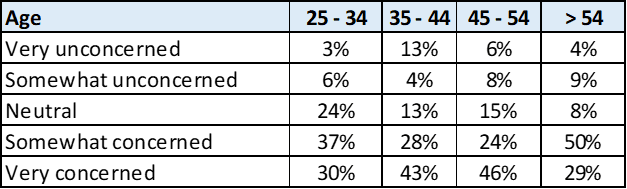

- Overall, 72% of respondents are either somewhat or very concerned about a possible recession this year.

- The older the respondents were, the more concerned they were.

- 79% of those aged 54 or older were somewhat or very concerned while only 67% of those ages 25-34 were somewhat or very concerned.

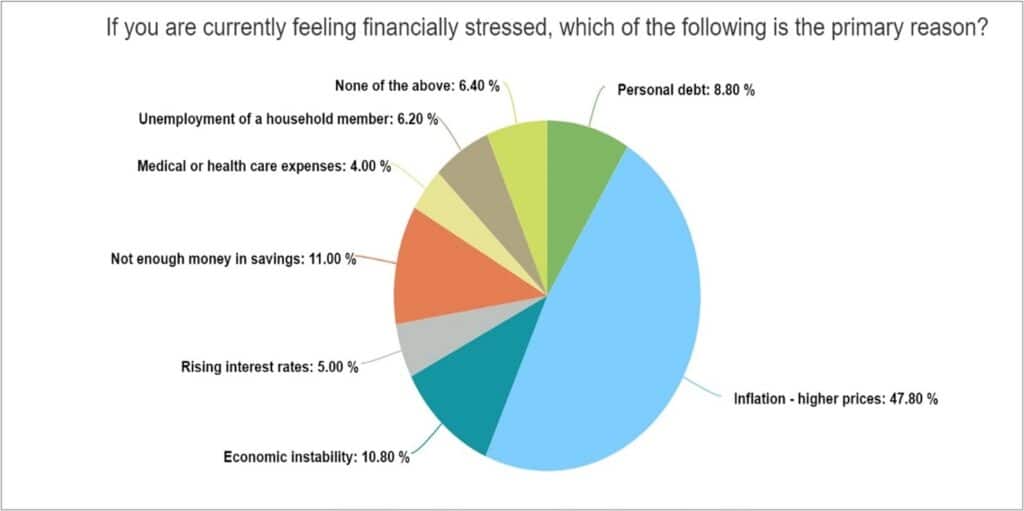

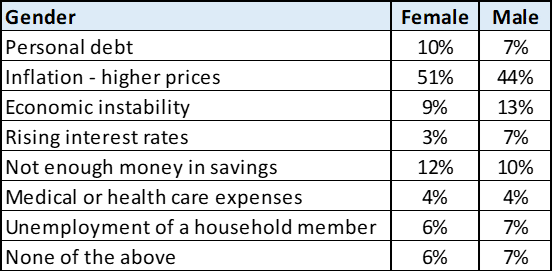

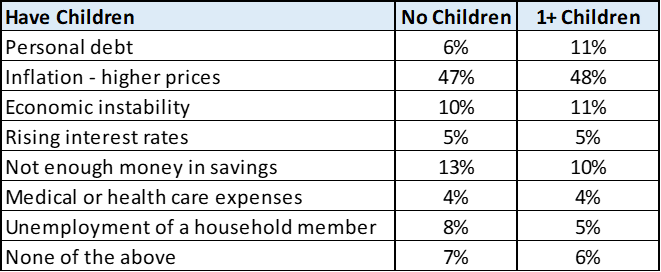

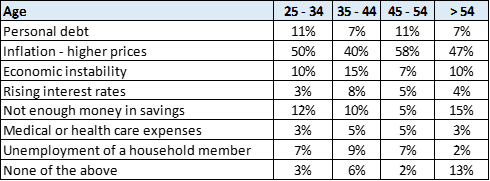

Overall, 48% of respondents claim that inflation is the primary reason why they are currently feeling financially stressed.

- Nearly 1 out of 5 respondents do not have an emergency fund.

- 58% of respondents have 6 months or less in emergency funds to cover typical bills and expenses.

- Females (50%) were more likely to use personal loans for groceries than males (44%).

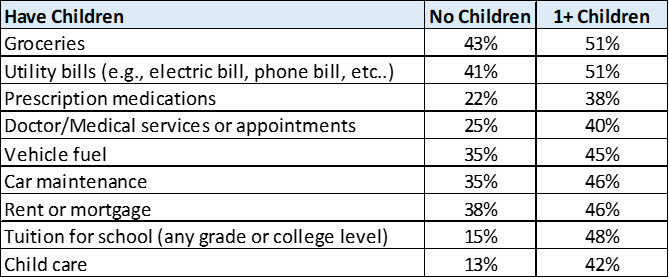

- Respondents with children were more likely to use personal loans for all the listed items compared to those with no children.

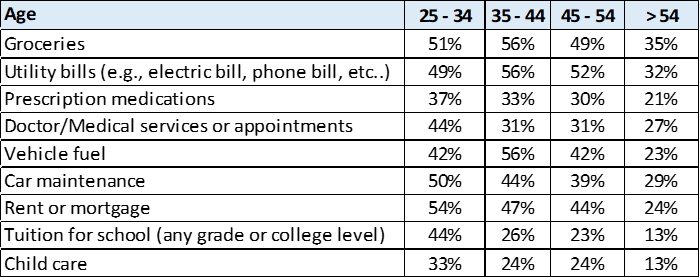

- Respondents between the ages of 25-34 were more likely to use personal loans to pay for groceries (51%), doctors/medical services or appointments (44%), car maintenance (50%), and rent/mortgage (54%). Those age older than 54 were least likely to use personal loans for the listed items.

- Males (30%) were more likely to use BNPL for electronics compared to females (23%)

- Those with children were more likely to use BNPL compared to those with no children.

- Respondents between the ages of 25-34 were more likely to use BNPL compared to the older age brackets. 44% of those between 25-34 mentioned they use BNPL for electronics compared to only 9% of those older than 54.

- Among respondents with no children, 39% claim they are spending less on groceries, compared to 29% who have children.

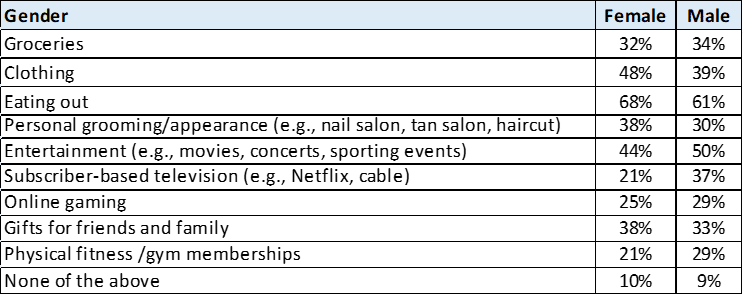

- 48% of Females are spending less on clothing compared to 39% of males making that claim. On the other hand, 50% of males said they are spending less on entertainment compared to 44% of females.

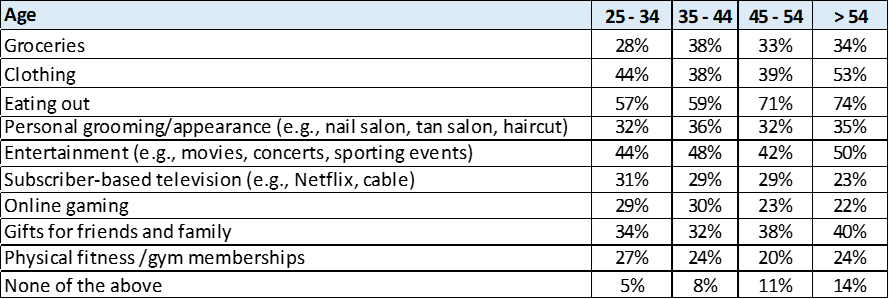

- About 70% of respondents aged 45 and older claim they are spending less on eating out while only about 58% of those between the ages of 25-44 said they are spending less on eating out.

- Consumers are saving money by either buying on sale (57%) or using coupons (55%). 48% of consumers are buying store brand instead of name brand products.

- 40% of females say they buy secondhand products while only 32% of males make that claim.

- Respondents with no children (62%) were more likely to buy items on sale compared to those with children (53%).

- Respondents ages 45 and older were more likely to buy store brand instead of name brand compared to those between the ages of 25-44.

- 38% of respondents said they are canceling or postponing purchasing a vehicle this year due to financial challenges. Among respondents with children, 43% said they would postpone or cancel compared to 31% of those with no children.

- 37% of those between the ages of 25-34 would cancel or postpone purchasing furniture.

50% of respondents said they were canceling vacation trips this summer due to financial challenges.

- 40% of respondents don’t plan on traveling for vacation this summer, while 1 in 3 respondents said they would go to a less expensive location.

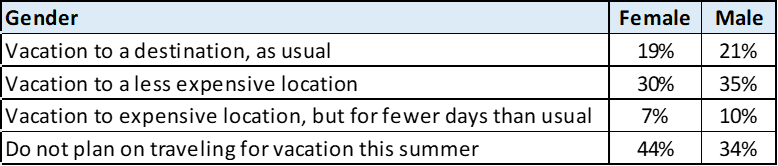

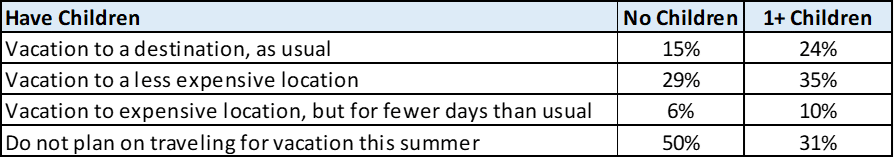

- 50% of respondents who do not have children do not plan to travel for vacation this summer, compared to only 31% of respondents who have children.

- 53% of respondents plan on spending less than $2,000 on a vacation or trip this summer.

- 69% of those with no children plan to spend less than $2,000 compared to 41% of those with children.

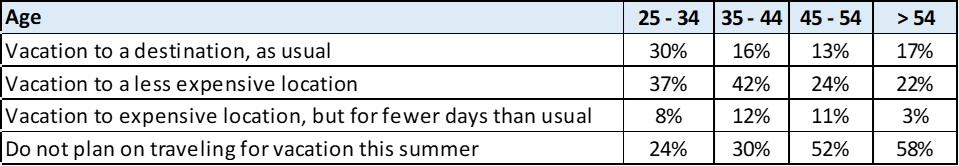

- The older the respondents, the more likely they plan to spend less than $2,000 for trips this summer. 68% of respondents over the age of 54 were planning to spend less than $2,000 compared to 43% of those between ages 25-34.

- About 36% of respondents are dealing with federal student loans.

- Of the respondents who are dealing with federal student loans, 37% will resume payments without any help while 29% will need help from family/friends to help pay, and 34% will be helping their child/relative/friend with student loan payments.

ScoreSense’s survey was conducted in April 2023 using Pollfish.com. Sample size 500 people, ages 24 and older.