Study Shows: Consumer Usage of Mobile Payment Solutions is a Young Person’s Game, but Opportunity Exists for Providers

As technology continues to make our lives easier and more connected, certain technologies are still reserved, for the most part, for the younger generations. Mobile payment solutions, such as Apple Pay, Google Pay and newer entrants such as Zelle are a good example. These smartphone-based solutions are extremely convenient, but the technology comes with drawbacks, some they created themselves and others that are inherent to the payment industry. Along with these drawbacks come opportunities for providers to differentiate themselves and be the leader in this evolving category.

Mobile Payment Solutions Are for the Young

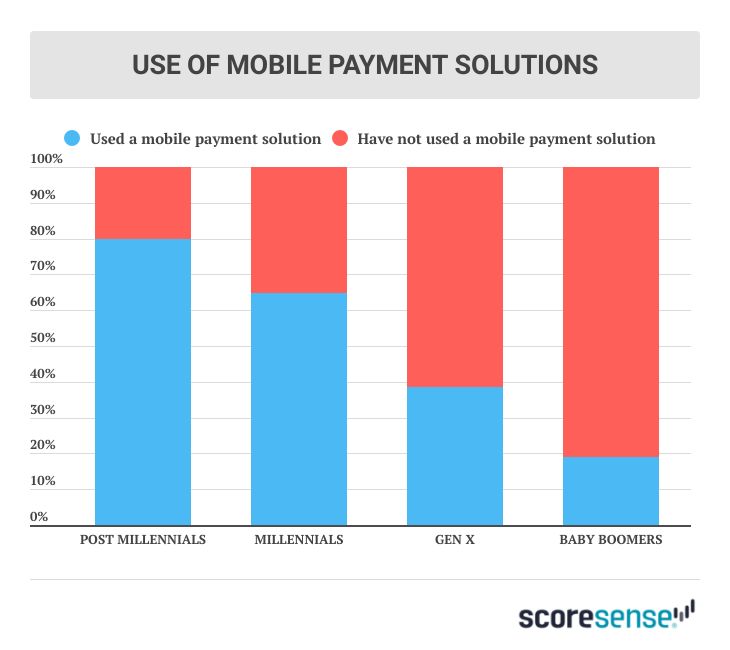

Our recent survey of 1,000 consumers in the United States on credit cards revealed a chasm in the mobile payment solution space. Millennials are more than 3 times as likely to use a mobile payment solution such as Apple Pay or Google Pay than Baby Boomers.

This should come as no shock considering the use of technology among each generation, but the gap is larger than expected. When the first commercially viable smartphones became available (2007 for the iPhone 2008 for the Android), the oldest Baby Boomers were already over 60 years old. Even the youngest Baby Boomers were well into their early 40’s. Being introduced to this ground-breaking technology as adults can be a daunting adventure. By contrast, Millennial consumers were between 26 and their pre-teen years. Most Millennials grew up with a smartphone in their hands or were at least used to the computer age and understanding of what they could for society. Placing a computer in their hand was a logical extension of an existing, familiar tool.

Reliance on Credit Cards is Universal

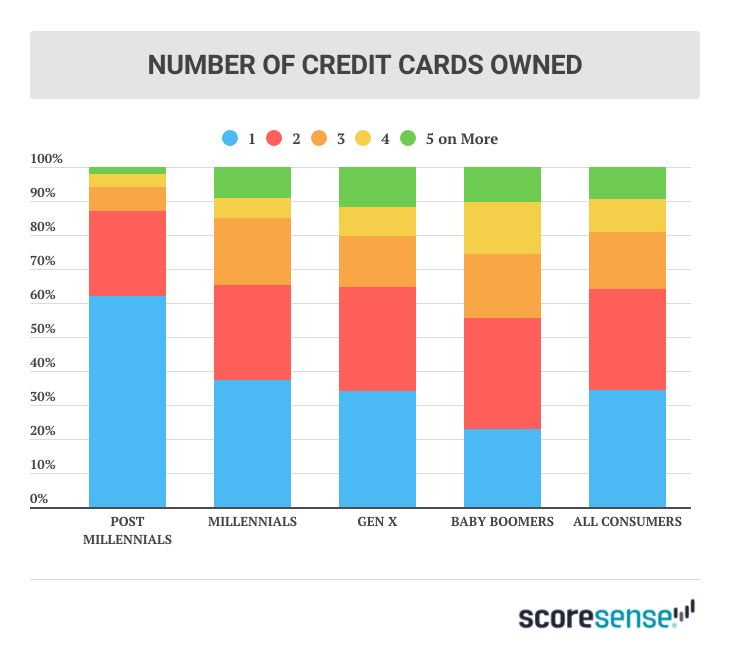

Usage of credit cards is expanding across the board. 2/3 of consumers own at least 2 credit cards, 35% own at least 3 cards, and 25% of Baby Boomers own 5 or more cards and use them regularly. 40% of Millennials and 56% of Baby Boomers use their card at least a few times per month. 35% of consumers use their cards as an alternative to carrying cash.

45% of consumers signed up for a new card within the past year, and 20% more plan to do so within the next 12 months. Credit cards are fast becoming the cash of our day.

Credit Card Rewards and Benefits Are Driving Usage

The convenience of using credit cards is not the only driving force behind use. 60% of consumers receive cash back on their credit cards and 31% rate cash back as the most important factor of a new credit card. Cash back has supplanted the interest rate as the primary reason for choosing a card, all this despite the 75% of consumers who carry a balance on at least 1 card. Credit limits have also skyrocketed, with 39% of Baby Boomers having a credit limit of at least $10,000. Of note, 33% of consumers pay their household bills with their credit cards, 33% want to increase their credit limit in the next 12 months. 25% have maxed out at least 1 card.

Mobile Payment Solutions Providers Have an Opportunity

Companies that provide mobile payment solutions have an opportunity to make their solution accessible, attainable, and synonymous with safety in a wide-open industry.

Companies that help Baby Boomers navigate the complexities of their payment solutions will make it easier to capture a percentage of the estimated 74 million Baby Boomers in the US, reaping significant revenue and profit.

Companies that market the opportunity to increase rewards or cash back benefits by using their payment solution will differentiate themselves from companies that only focus on the convenience rather than the additional incentives. 70% of Boomers currently have cards with cash back. This represents a tremendous market of individuals who use their cards often, have high credit limits, and chose their cards based on these rewards. Marketing messages that tout the convenience of the solution along with the opportunity to increase cash back will be well received.

Alternative Payment Solutions Are Not a Completely Foreign Idea

64% of Boomers have used PayPal before, compared with 19% of other payment solutions. Boomers are not unfamiliar with the concept of using a third-party technology for payments. They need additional clarity on how to use other payment solutions, and the proper incentive to do so. Using increases in cash back and rewards, and offering an easy, effective way to monitor credit will increase usage among this underserved population of consumers in the US.

Methodology

This study was conducted for ScoreSense by Panel Consulting Group. Surveys were collected during December 2019, among a sample of 1,002 respondents aged 18+. The margin of error for total respondents is +/-3.1% at the 95% confidence level.