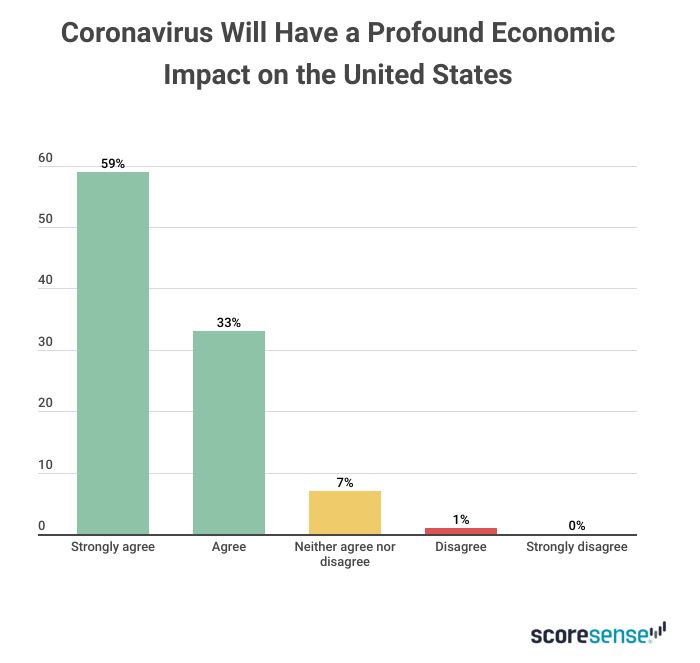

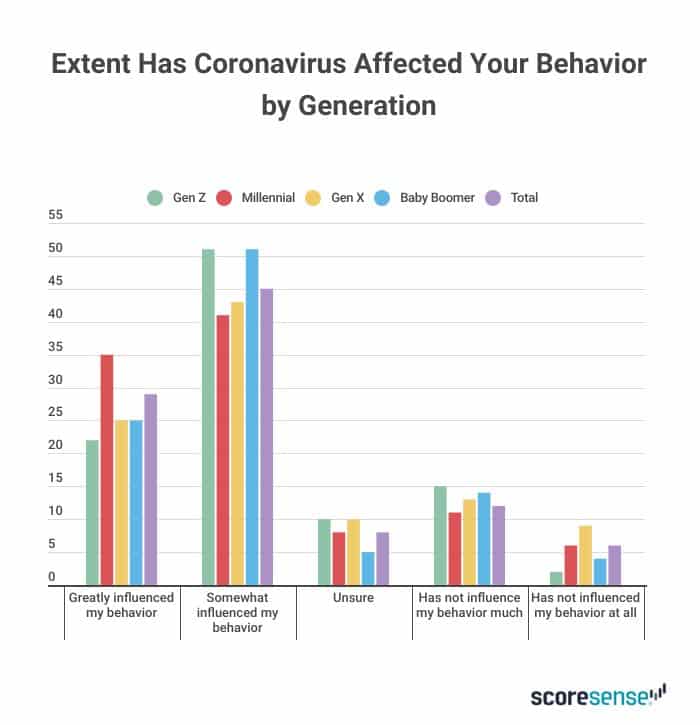

The Coronavirus (COVID-19) pandemic has already created an environment of panic and hysteria, unlike any seen since the days of HIV/AIDS in the late 90’s. With 80% of consumers “very aware” of Coronavirus, 45% “very concerned” about the virus and 29% stating the virus has “greatly influenced their behavior”, decisions and activities change depending on who you are. Age, income, whether you have children or not, gender, marital status, ethnicity, and employment status all have an impact on your decisions when it comes to the Coronavirus.

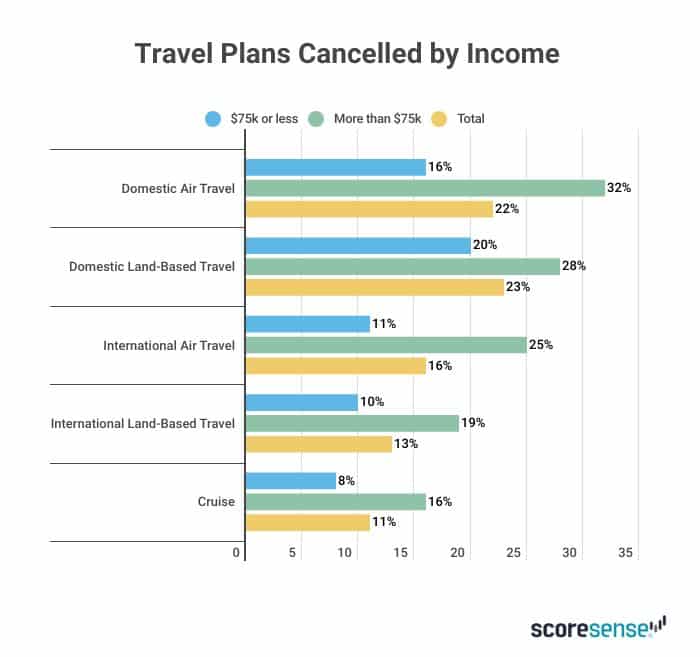

The Travel Industry Has Been Hit Hard

More than a third (37%) of all respondents have cancelled or postponed their cruise due to the coronavirus, led by Generation Z and Millennials. Those making $75,000 or more are more likely to have cancelled domestic land-based travel and almost twice as likely to have cancelled international land-based travel plans. Men, those who are married, and those who have children are more likely to have changed their travel plans during the pandemic.

Of note, those with full-time employment are least likely to have changed their travel plans.

Grocery Stores Are Feeling the Pinch as Consumers Stockpile Supplies

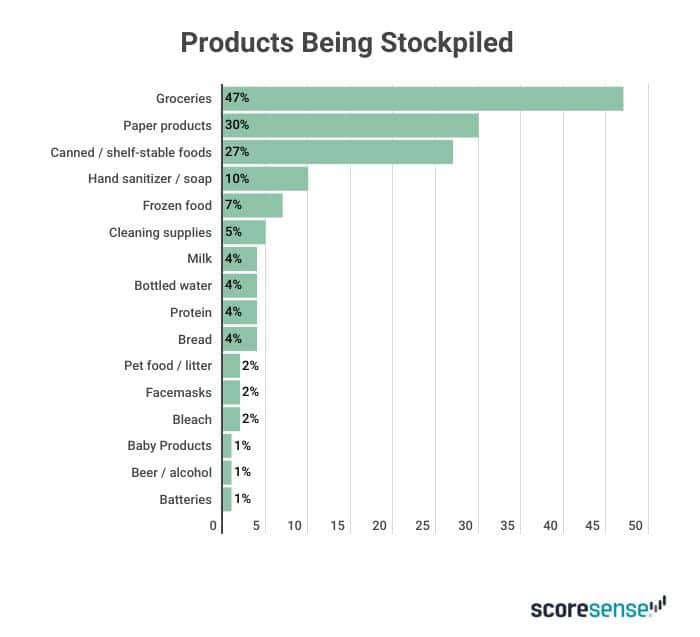

Baby Boomers are least likely to spend more than usual, and Millennials are most likely. 23% of all consumers will spend more, an average of 42% more. 45% of all consumers have stockpiled products because of the coronavirus. 47% are stockpiling groceries, 30% are stockpiling paper products (tissue, toilet paper, etc.), and 27% are stockpiling canned and shelf-stable products. Those with less than $75,000 in income are much less likely to stockpile supplies compared with income of $75,000 or more. Those without children are more likely to stockpile supplies, which is an interesting find. It is possible those with children understand better how much they will need to purchase to survive, while the concept of stockpiling is all new to those without children. Single women are more likely to stockpile supplies than men. Asian Americans are least likely to stockpile compared with African American and white Americans.

Grocery Stores, Social Events and Places With Lots of People Are Being Avoided by 1/3 of Consumers

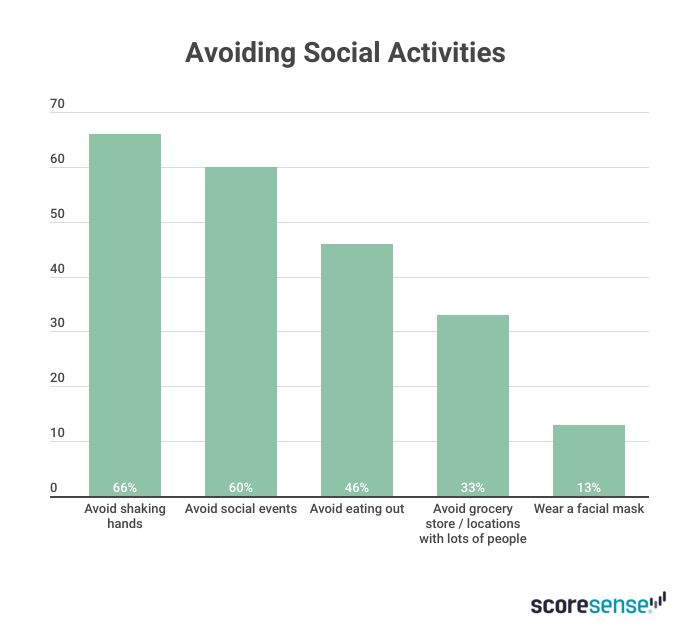

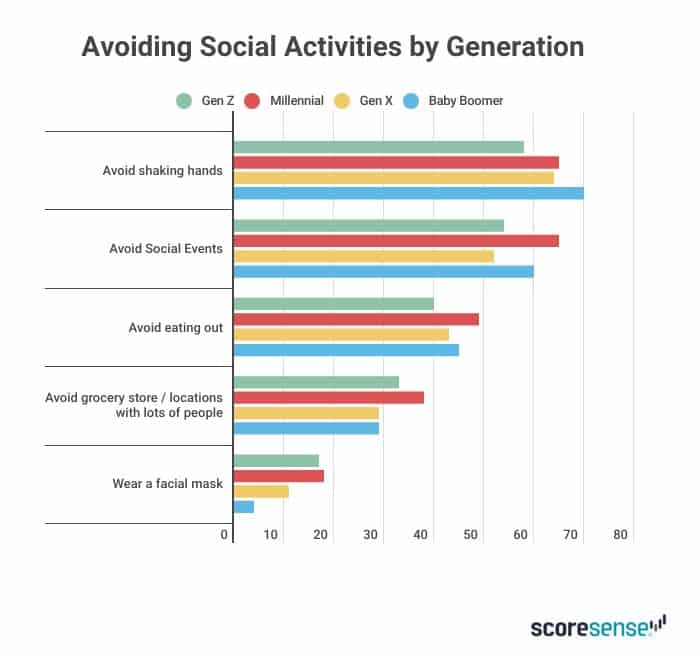

Millennials are least likely to avoid crowds, as are people with less than $75,000 in income. Parents appear to be more concerned with the virus and this has impacted behavior dramatically through social distancing. Women and married people exhibit the same social safeguards. All three groups of people (parents, women and married people) are more likely to avoid social events, grocery stores, eating out, shaking hands and more likely to wear a face mask. Asian Americans are also most likely to avoid social locations. Overall, 46% of consumers are avoiding eating out, 65% are avoiding shaking hands, and 60% are avoiding social gatherings. Generation Z and Millennials are most likely to avoid these gatherings.

Consumers making less than $75,000 are least likely to make these social changes, and most likely to report no change to their social activities.

International Commerce Has Been Affected Greatly

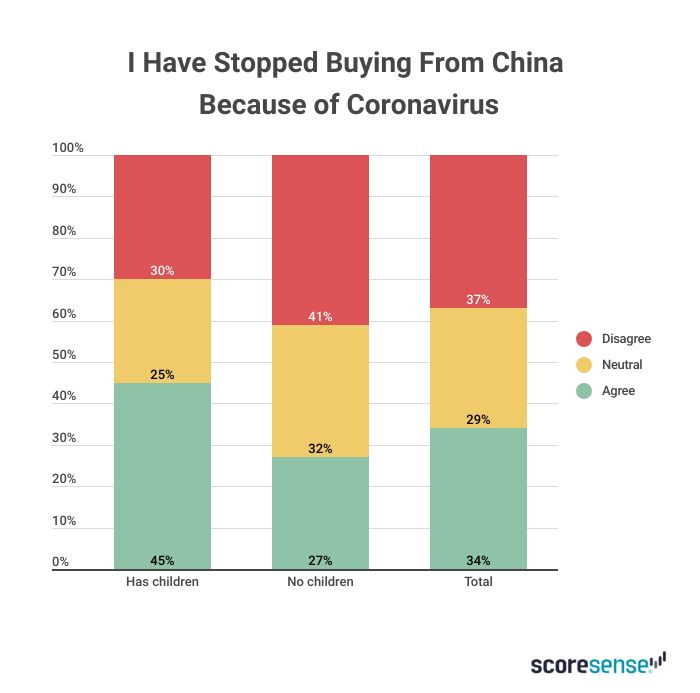

Despite current guidance that products produced in China should have no ill health effects, one-third of consumers have stopped purchasing products from China. Consumers with incomes of $75,000 or higher are more likely to continue purchasing products from China and are more likely their overall spending has increased compared with lower income individuals. Parents are most likely to discontinue buying from China and more likely to have increased their overall spending compared to those without children.

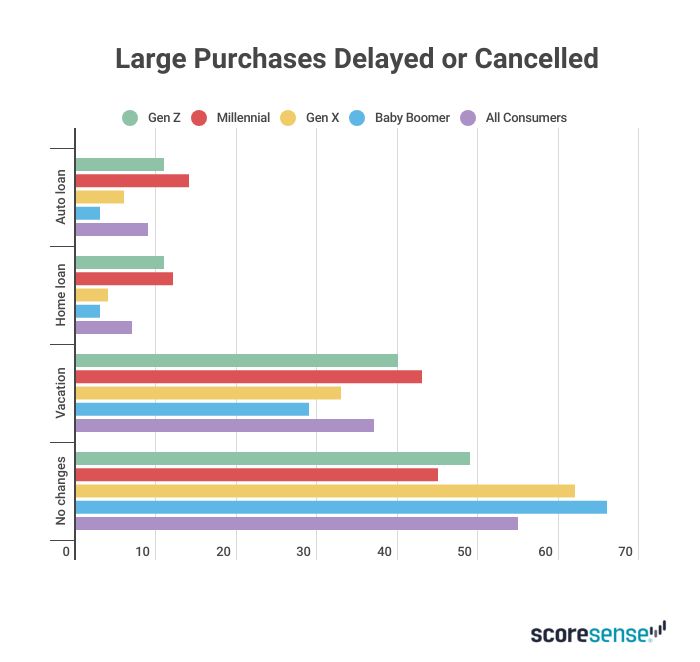

Large Purchases Are Unchanged Until the Economy Has Stabilized, a Hopeful Sign

37% of all consumers, and half of those making $75,000 or more, have delayed their vacations in response to the Coronavirus, compared with only 30% with incomes of $75,000 or less. Baby Boomers, for example, have not changed their large purchases compared with the younger generations.

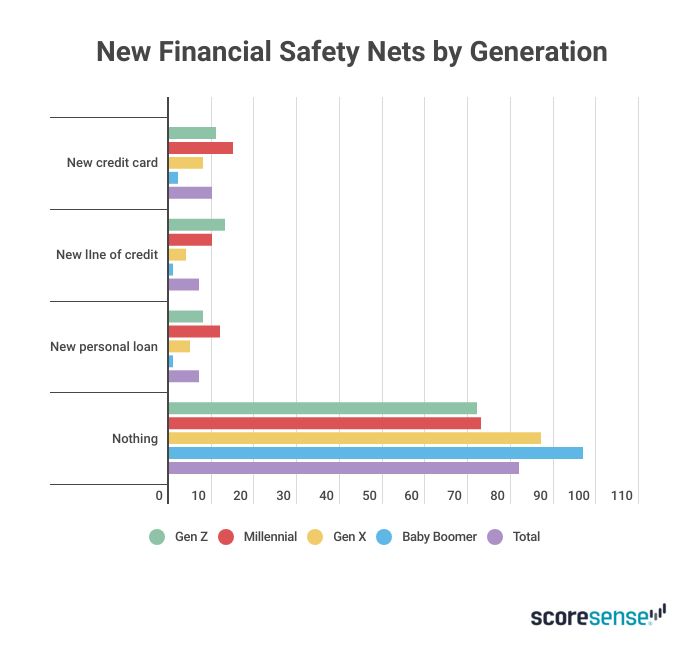

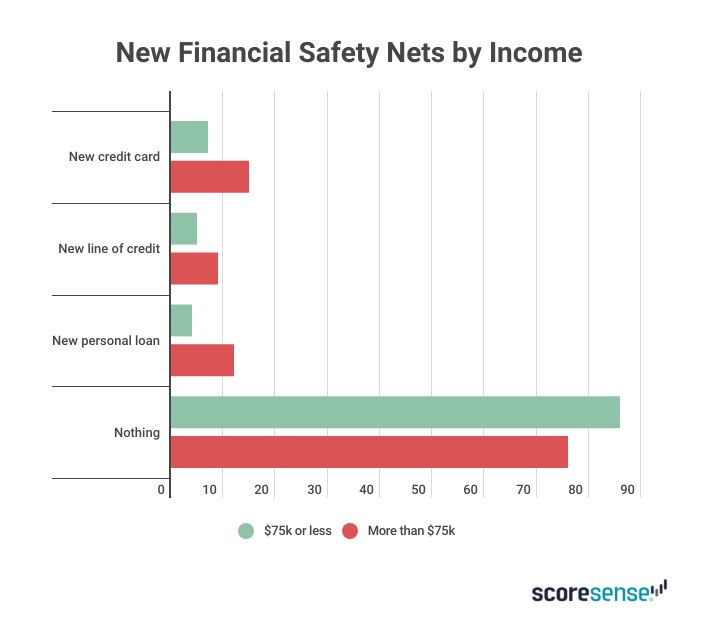

Younger Generations Are Looking for Financial Safety Nets During the Pandemic

Gen Z and Millennials are most likely to have applied for a new credit card. Those with incomes north of $75,000 have applied for both a new credit card and a personal loan as have people with children.

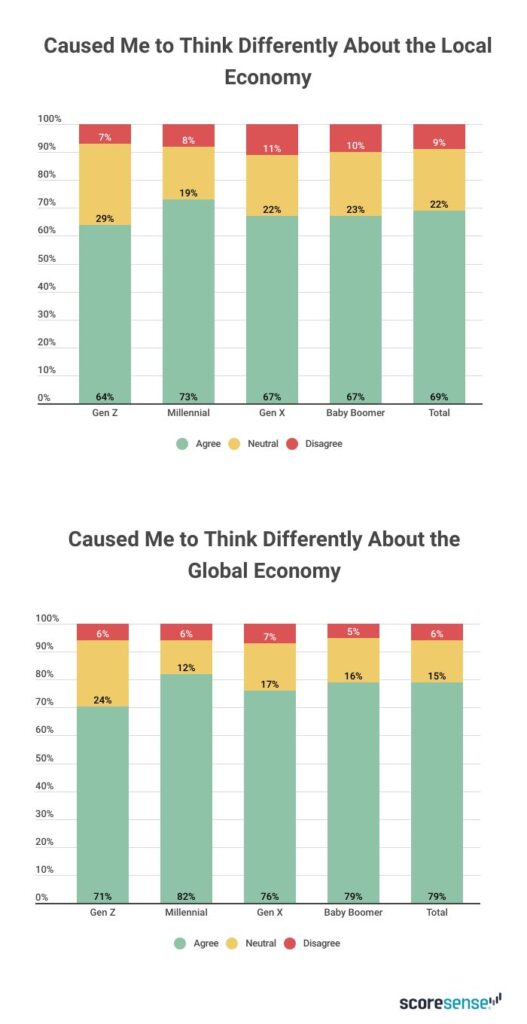

These safety nets have become top of mind as consumer confidence in the local economy has waned by 69%, and 79% for the global economy because of the Coronavirus, led by Millennials at 73% and 82%, respectively.

The Coronavirus has uprooted our society and made the public re-evaluate how the economy works locally and globally. While it is true that younger generations think about the repercussions differently from older generations, your income and being a parent are better indicators of the decisions you will make during this global health scare.

Methodology

This study was conducted for ScoreSense using the online portal by PeopleFish. Surveys were collected in March 2020, among a sample of 1,112 consumers in California, Hawaii, Illinois, New York, Texas, and Washington State aged 18+. The margin of error for total respondents is +/-2.9% at the 95% confidence level.