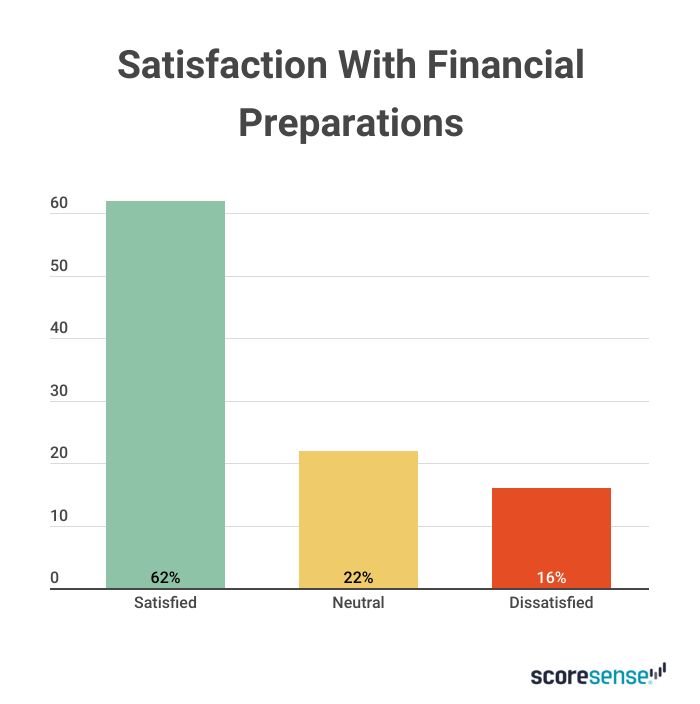

No one would disagree that the current climate has profoundly impacted life as we know it, both from a personal and financial perspective. ScoreSense’s study of over 1,000 consumers concerning preparing for emergencies revealed that, as people scramble to make ends meet, more than 6 in 10 consumers are happy with their emergency financial preparations, despite the results of those preparations.

Key Findings

- 26% of consumers do not have a financial plan in place for the next emergency.

- 63% of consumers are happy with their emergency financial preparations, but 59% will still increase their savings to prepare for the next emergency.

- 38% of consumers have at least $5,000 in savings, a primary source of revenue during the COVID pandemic emergency.

- The youngest consumers (Gen Z) are the most vulnerable when it comes to emergencies. This age group is least likely to have an emergency plan, most likely to open a credit card or secure a new loan as a response to emergencies, and most likely start a new side hustle as a response.

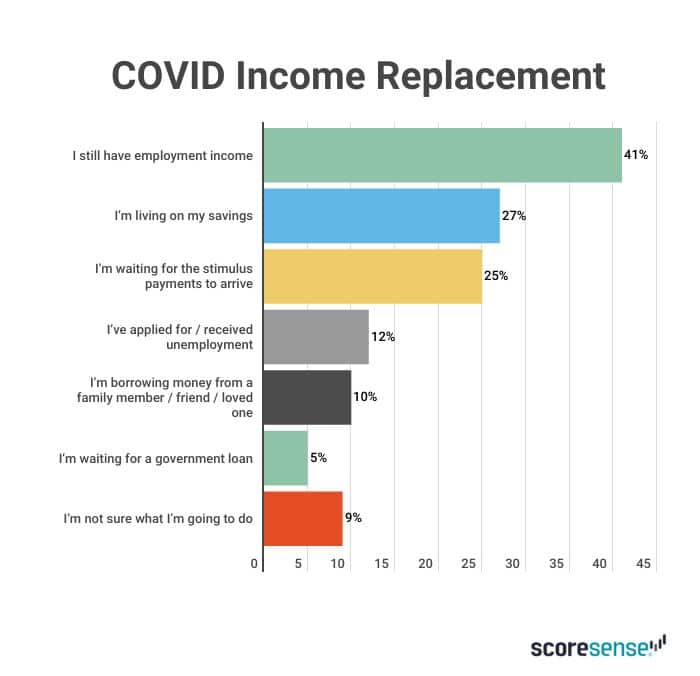

9% of Consumers Do Not Know How They Will Make Ends Meet

Most consumers who have lost their employment are living on their savings, with 38% of those who lost a job having more than $5,000 in savings. Of concern, 9% do not know how they will make ends meet without the stimulus payments.

Most Consumers Are Happy With Their Emergency Preparations, but a Quarter of Consumers Do Not Have a Plan

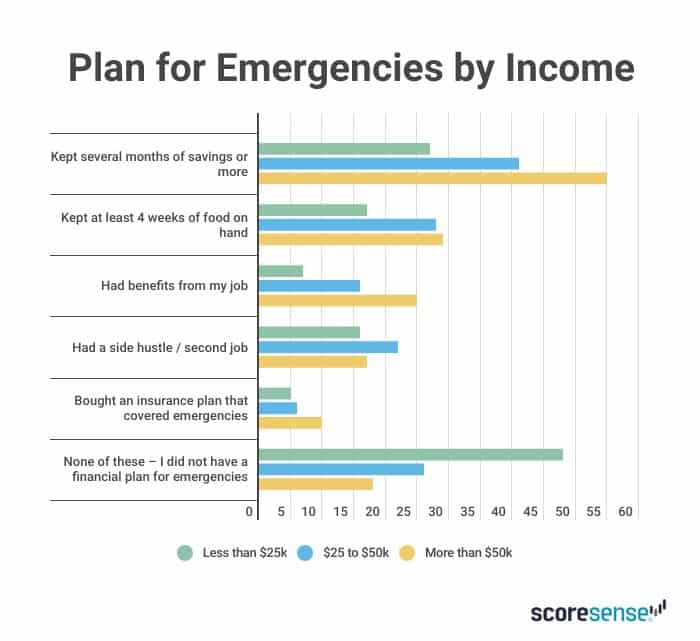

Overall, 63% of consumers are happy with their financial preparations despite their dire outlook on the economy. Emergency preparations included keeping several months of savings (46%) and keeping four weeks of food on hand (27%). 18% of consumers had a side hustle or second job to increase income. 26% of all consumers, and 48% of low-income consumers, did not have an emergency financial plan in place prior to the current COVID pandemic, leaving them in a challenging position.

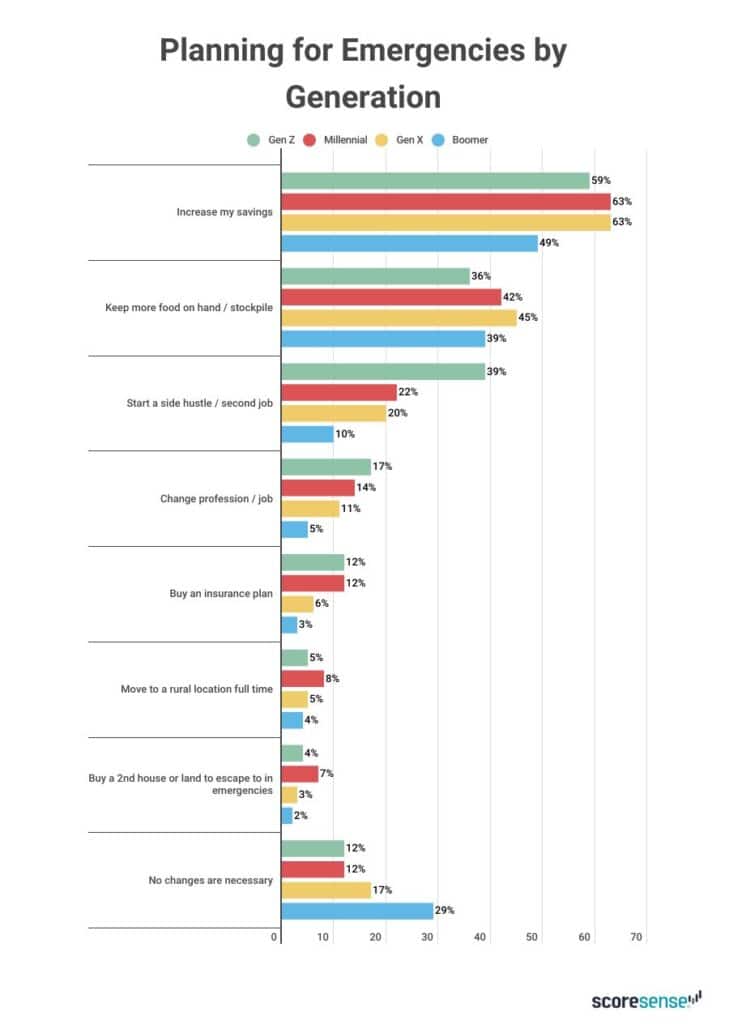

Increasing Savings Is the Primary Preparation Plan for Future Emergencies

Among all consumers, 59% plan to increase their savings for future emergencies, which is the primary preparation method. Currently, 12% do not have any savings, and 18% have $500 or less. Another 41% of consumers will keep more food on hand. 20% will start a side hustle or second job to increase their income. Only 11% will change their profession to increase their income, and 18% do not see any reason to change their future preparations.

Younger Consumers Are Most Likely To Suffer Personal and Financial Hardship in Emergencies

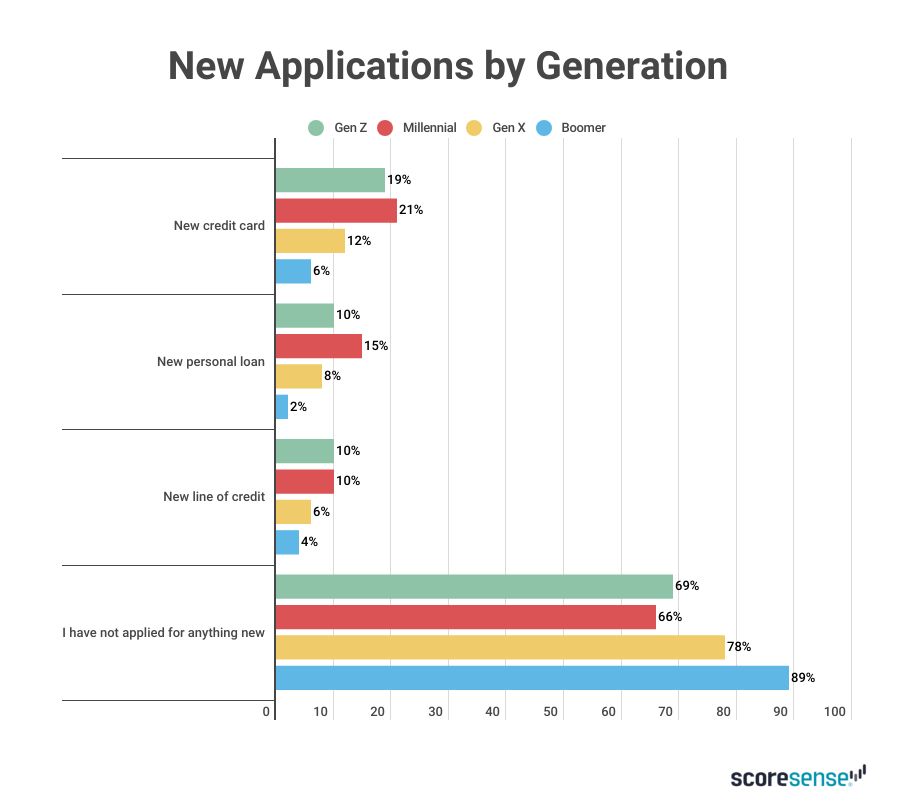

Gen Z consumers (25 years old or younger) are most likely to have part-time employment and, along with Baby Boomers, most likely to be furloughed in emergencies. Gen Z is also least likely to have a plan for dealing with emergencies. Both Gen Z and Millennials (26-40 years) are most likely to open a new credit card in response to emergencies, leading to increased future debt servicing. Older consumers (age 41 or older) are least likely to apply for something new. Younger consumers Gen Z and Millennials are most likely to have a side hustle currently, and Gen Z is most likely to start a side hustle to prepare for the future. Gen Z is most likely to prepare for emergencies, including buying insurance plans. Baby Boomers, in contrast, are most satisfied with their preparation plans and least likely to alter their life for the future.

Men Are More Comfortable Dealing With Emergencies, and Women Tend To Be More Pessimistic

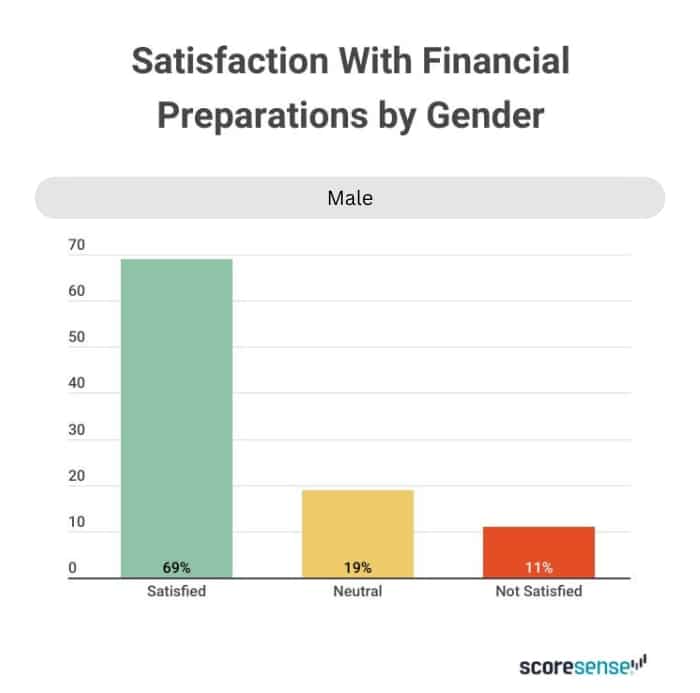

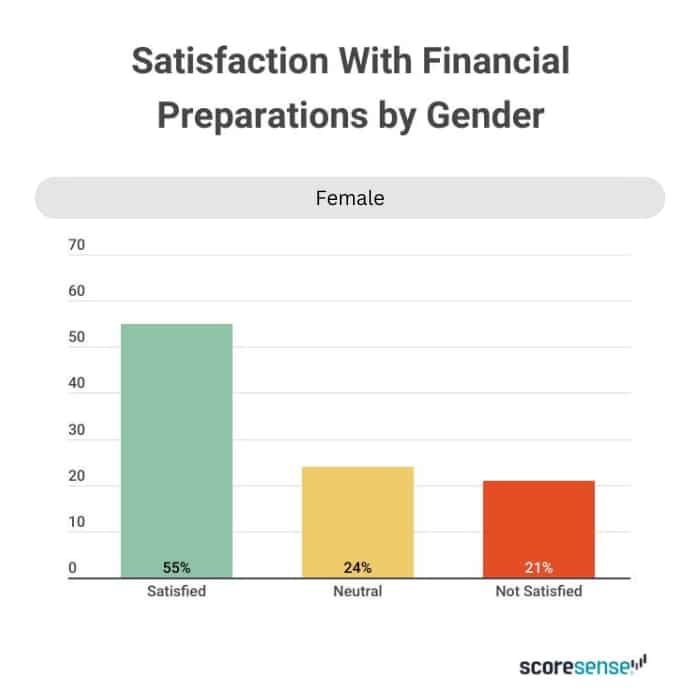

Among the genders, males are more likely to have full-time employment and least likely to experience a change to their employment in emergencies. Men are more likely to have lost some of their benefits, but 32% of them are living on their savings. On the other hand, women business owners are more likely to have pivoted their business to meet emergency needs but are more pessimistic about the economy overall (57% women v. 44% men). Women are also less positive about their emergency preparations (55% compared with 69% for men).

Men are more likely to increase savings for the future and more likely to start a side hustle for the future than women.

The Economics of Marital Status Has a Profound Effect on Planning for Emergencies

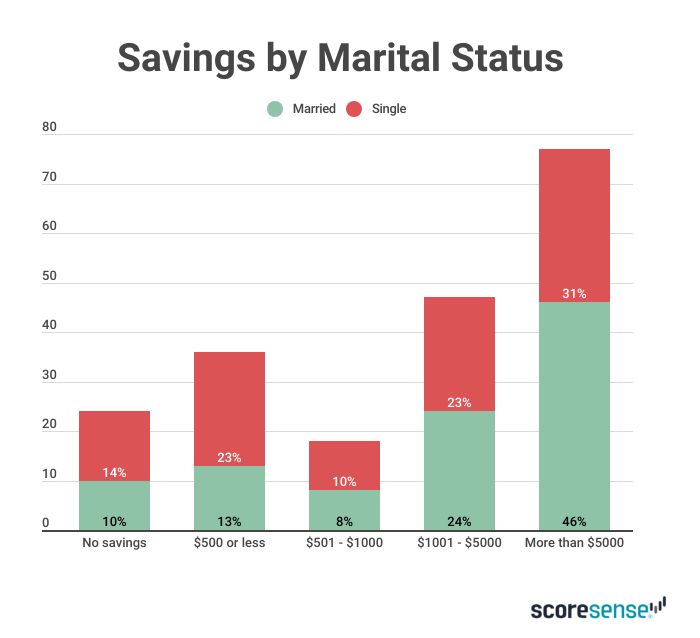

Married consumers are more likely to have a full-time job than single people. Single consumers are much more likely to have applied for unemployment insurance, either personally or as a business owner. 45% of married consumers have more than $5,000 in savings compared with only 31% of single people. Single people are more likely to have only $500 in savings, much less money than married people. Being married is correlated with a positive outlook on the economy, correlated with having benefits from their employer, having more food saved up for emergencies, and being happy with their emergency financial preparations. Married people are more likely to have a plan at all. Single people will rely on starting a side hustle to increase their income for the future.

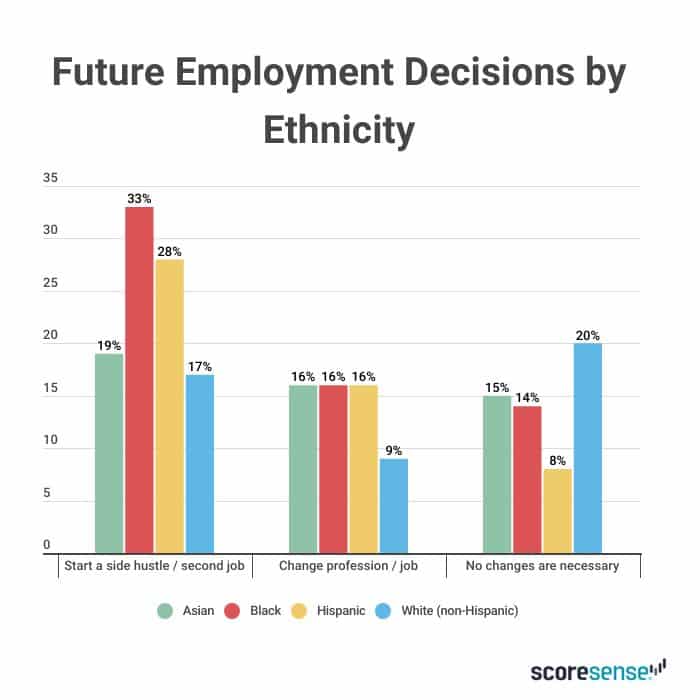

Ethnicity Has an Impact on Emergency Preparations for Non-White Americans

Hispanics are the least prepared ethnic group by self-report and most likely to open a new credit card in response. African Americans are most likely to have a previous side hustle, and most likely, along with Hispanics, to start a side hustle in preparation for the future. In contrast, Asian Americans are most likely to borrow money from family but are less likely to apply for a new financial vehicle (credit cards, loans, etc.) in emergencies.

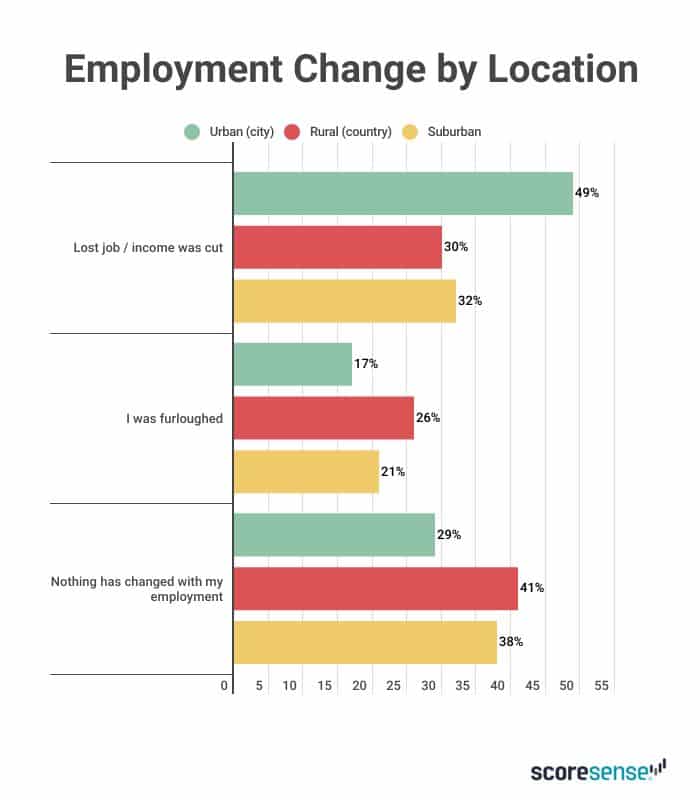

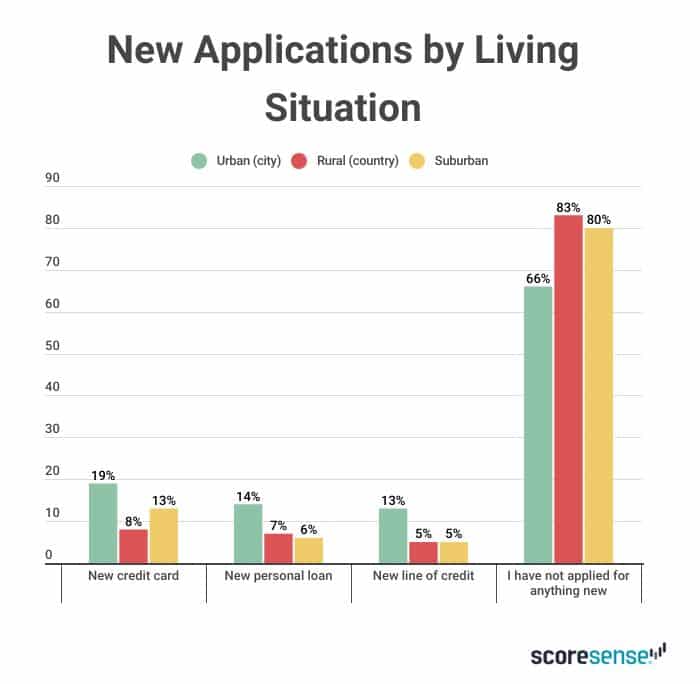

The Environment Consumers Live in Has an Impact on Financial Preparations

According to the US Census, 63% of consumers in the US live in urban areas, and this group is most likely to have lost their job or had their income cut due to the current emergency. They are also most likely to survive by borrowing from family or friends and are also most likely to have opened a new credit card or line of credit or personal loan, increasing their debt. Living in the city is also correlated with full-time employment. Employment opportunities in urban areas are related to lost or lower income compared with other environments.

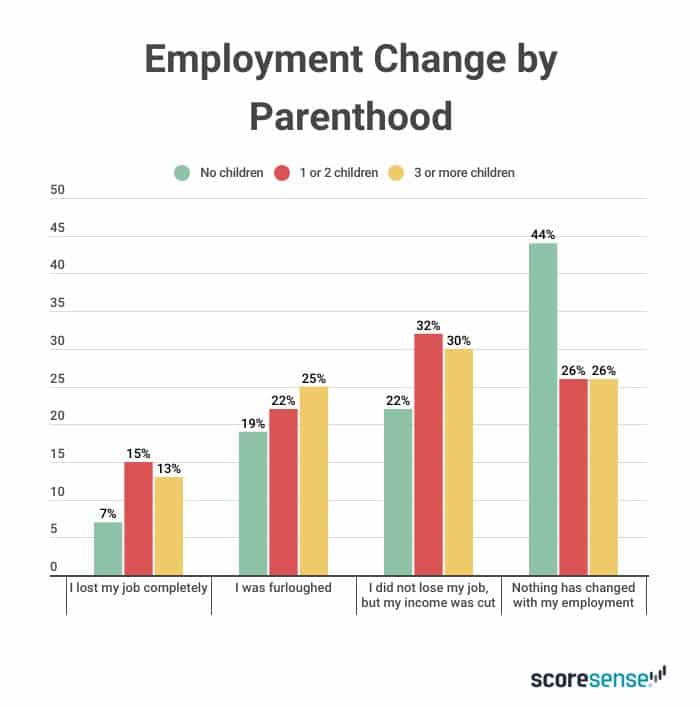

People With Children Experience a Bigger Hardship Than Those Without Children

Parents are more likely to have full-time employment, but they are more likely to have lost income during the COVID emergency. In contrast, 44% of those without children are more likely to keep their employment during emergencies. Parents are likely to borrow money from family, more likely to open a credit card, and more likely to open a personal loan. Parents are most likely to have a side hustle and to start one in the future for planning purposes. Parents are also more likely to increase their savings in preparation, and parents with three or more children are most unhappy with their financial preparation.

Summary

Overall, Americans believe they are mostly prepared for financial emergencies, and relatively few are adding debt that they will need to pay back to stay afloat during hard times. This is important considering the current the COVID pandemic. Responses to future planning vary widely by environment and demographics. Financial preparation outlooks are positive for most groups, despite their current individual situation. Plans such as increased savings and increased income opportunities are deemed more easily attainable and less expensive than opening credit cards or loans.

Methodology

This study was conducted for ScoreSense by the consumer research company, PeopleFish. Surveys were collected in June 2020, among a sample of 1,080 consumers in the United States aged 18+. The margin of error for total respondents is +/-3% at the 95% confidence level.