A credit score is a three-digit number based on a statistical algorithm that calculates points based on how likely you are to repay debt when it’s due. Creditors use these scores to help them decide whether to grant you credit and, if so, at what terms and rate.

Who Looks at Credit Scores?

Aside from creditors and lenders, other people and companies may also have a need to see your scores. For example, insurance companies may look at your credit scores to determine the likelihood of you filing a claim and at what amount. Credit scores can be a deciding factor regarding whether to issue a policy and also to set the premium amount.

Utility companies and landlords— with your permission — can access your credit score to determine what type of credit risk you are.

Here’s some additional information on why your credit score matters so much:

How is a Credit Score is Calculated?

Credit-scoring models are created from a random sample of consumers with the purpose of identifying risk-related characteristics. Each characteristic is assigned a weight based on how likely it will be able to predict which consumers pose a good credit risk.

The Equal Credit Opportunity Act prohibits credit-scoring models from using characteristics, such as religion, sex, marital status, race, national origin or religion as factors. However, consideration of age is permitted.

Here are the factors that are considered in two of the most popular scoring models, VantageScore and FICO.

VantageScore

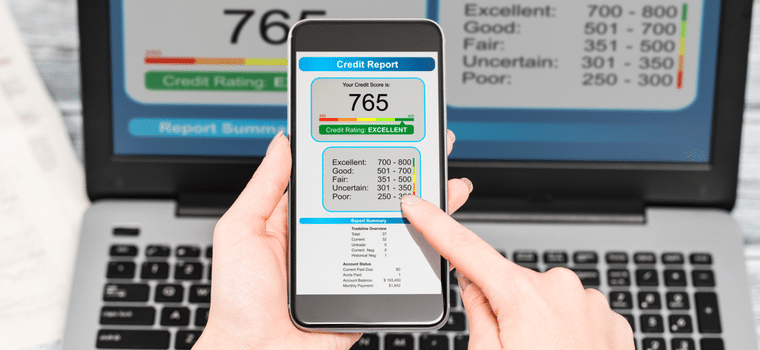

VantageScore has six credit-scoring tiers ranging from 300 to 850. Here’s the breakdown:

- 810 – 850 = Excellent

- 750 – 809 = Great

- 670 – 749 = Good

- 560 – 669 = Fair

- 500 – 559 = Poor

- 300 – 499 = Very Poor

Here’s how much each factor of the VantageScore model weighs and a description of each:

Payment history: 40%

Payment history weighs the heaviest in the overall makeup of your credit score. The factors included in this category are accounts paid on time, delinquent accounts, bankruptcies, collections and the dollar amounts of any past due accounts or collections.

Note: Reported late payments of 30 days are more remain on your credit reports for seven years.

Outstanding Debt: 35%

The amount of money you owe lenders indicates if you understand how to spend responsibly or if you’re likely to suffer financial trouble in the future. Lower credit balances are typically better for a credit score.

Credit utilization refers to how much of your available credit you use within a given month. Experts recommend keeping credit utilization under 30%. Utilization is considered in both individual accounts, and across all accounts you own.

Credit Mix: 10%

Lender and creditors like to see that you can handle a variety of installment loans and revolving accounts responsibly. Having a mix of credit cards, personal loans, mortgage, and auto loans is helpful in this area.

Credit Age: 10%

Credit age is the length of time you’ve been using credit. Scores are generally based on the age of your oldest active account or an average of the ages of your active accounts.

Consumers with a good score based on a long history of responsible credit use pose a much lower risk to creditors than consumers with a good score and a limited credit history.

Credit Inquiries: 5%

Recent credit behavior can be a good indicator to lenders of your future credit behavior. This area of the credit scoring model considers how long it’s been since you’ve applied for or opened an account, how many accounts you’ve opened in recent months and how many times you’ve applied for credit in the past year.

FICO

FICO has five credit-scoring tiers ranging from 300 to 850. Here are the score ranges within each tier:

- 800 – 850 = Excellent

- 740 – 799 = Very Good

- 670 – 739 = Good

- 580 – 669 = Fair

- 300 – 579 = Poor

Here are the weight and description for each one of the components that make up a FICO credit score:

Payment history: 35%

Payment history related to credit cards and loans weighs the most when it comes to FICO scores. How recent missed payments are, as well as how frequent and severe, all impact your score in this category. FICO uses a consumer’s past long-term credit behavior as a predictor of future behavior, so it’s vital to pay by the due date.

Credit utilization: 30%

Credit utilization – the amount of credit you’re using in relation to the total amount of credit you’ve been issued – is measured by each individual account and across all accounts carried.

If you make a habit of maxing out your credit cards or coming close to their limits, FICO may view you as a person who is irresponsible with debt. Although many experts recommend utilization of less than 30% of your credit, people with top scores tend to have an average credit utilization ratio of less than 6%.

Length of credit history: 15%

How long an account has been open, as well as how long it’s been since the most recent activity on the account, impacts credit history. The longer you’ve been using credit, the easier it usually is to predict your future behavior.

For those who don’t have a lengthy history, a positive and consistent payment history, as well as low credit utilization, can help equal a good score.

New credit: 10%

Opening too many new accounts at one time can negatively impact your credit score because it can indicate that you may be in financial trouble. Also, if you have limited credit information, opening new accounts can lower your average account age, which can affect the “length of credit history” portion of your credit score.

Credit mix: 10%

Responsible borrowers who have a good credit mix of revolving credit and installment loans often pose less risk for lenders. Positive payment history on different types of credit cards and loans can indicate that you can handle various types of credit responsibly.

Different Bureaus Have Different Scores

When you check your credit scores from each of the three national credit bureaus — Equifax, Experian, and TransUnion — you may see a difference in scores. This is because each of your creditors may not choose to report your credit history to all three bureaus, which can cause a score variance.

Additionally, credit bureaus may use different credit-scoring models to determine your credit scores. Different scores are not a reason for concern unless the information in your credit report is the result of a reporting error or fraud.

How to Check Your Credit Score on ScoreSense

ScoreSense offers credit scores and reports from all three credit bureaus. Once you sign up for an account on ScoreSense, you can visit your dashboard to access all of the features available to you, including your credit scores.

If you haven’t already signed up for ScoreSense, you may want to consider it. Not only can you keep tabs on your credit scores and review information in your credit reports to check for errors – ScoreSense daily monitoring will notify you about important changes on your credit report that could impact your scores and may signal identity theft or fraud.