Your Medicare card contains important information. If it’s lost or damaged you should replace it as soon as possible. You should also take steps to assure that the information on the card can’t be used by identity thieves.

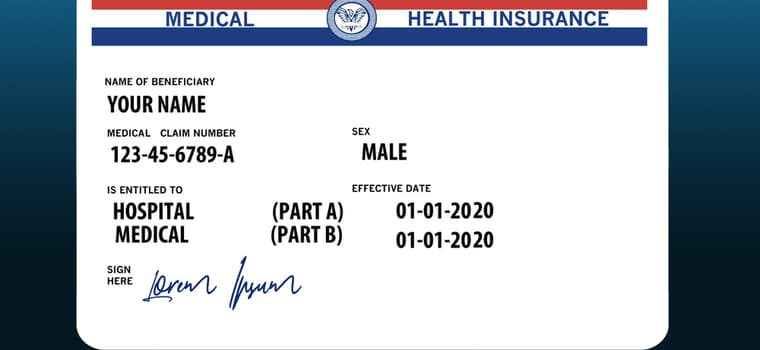

Medicare recently replaced all old-style Medicare cards with a new card design. If you are still using an old Medicare card you should request a replacement at once. This is because the old cards integrated your Social Security Number into your claim number, which exposed users to a high risk of identity theft.

If you already have a new Medicare card or when you receive one, consider opening an online account which will make it easy to replace your card and track activity on your account.

Medicare Cards: The Old and the New

For many years Medicare users were plagued by a serious security flaw: Medicare cards used Social Security Numbers as a part of their claim numbers. Medicare cards often had to be presented at clinics, hospitals and pharmacies and carrying Social Security Numbers openly created a high risk of identity theft.

Medicare has issued new cards that use a Medicare-specific claim number called a Medicare Beneficiary Identifier, which no longer contains a Social Security Number. The issuance of new Medicare cards began in April 2018 and all Medicare users should now have their new cards. If you are still using an old Medicare card, you should request a new one and destroy the old card as soon as the new one arrives.

New Medicare cards also come with an online account option. If you haven’t signed up for your online account yet, go to the Medicare website and do it as soon as you can.

If You Lose Your Medicare Card

If you are sure that your Medicare card was lost or destroyed and cannot be recovered by you or anyone else, all you need is a new card.

If you are using a new Medicare card, getting a replacement is easy. All you have to do is go to your online account and download a new printable card. If you have not signed up for an online account, you can request a new card over the phone.

If you are on a Medicare Advantage Plan and you receive benefits from an Health Maintenance Organization (HMO), Preferred Provider Organization (PPO) or Prescription Drug Plan (PDP), request a new card from your plan.

If you were using an old Medicare card and it is lost or destroyed, you can request a new card through Medicare.gov. You should be absolutely sure that the old card was destroyed and cannot be recovered.

If Your Card May Have Been Stolen

If there is any possibility that your card may have been stolen or could be recovered by another person, you’ll need to protect yourself against identity theft.

If a new Medicare card was stolen the threat of identity theft will be less severe than it was with the old cards. Your Social Security Number will not be compromised. A new Medicare card can still be used to get medical treatment in your name, especially if it was stolen along with another ID. Follow these steps to protect yourself.

- Replace your card, following the instructions above.

- Check for unauthorized activity on your account. Your online Medicare account will show every use of your account. If your card may have been stolen, check your account regularly to see if there has been any activity on your account that was not yours. If you don’t have an online account, review your quarterly summaries carefully or sign up for monthly email notices.

- Report any unauthorized activity. If you see potentially fraudulent entries, report them at once.

If an old Medicare card may have been stolen, your Social Security Number has been compromised and your entire identity is at risk. Thieves can use that information to open credit accounts in your name, claim your tax return, or engage in other fraudulent activities.

If an old Medicare card is stolen you will have to take full precautions against identity theft, just as you would if your Social Security card was stolen.

- Report the theft to your local police. The police may advise you to report the theft to other offices that monitor financial crimes. Keep copies of all reports you file.

- Have a security freeze placed on your credit files. A security freeze will require your permission for any access to your credit file. You will need to place a security freeze with each of the major credit reporting companies: Equifax, Experian and TransUnion.

- Consider credit monitoring or identity theft protection services. A credit monitoring service will alert you immediately to any activity on your credit report. Identity theft protection will monitor your credit report and add additional protection, including dark web searches to see if your information is being sold.

- Report identity theft. If you find evidence of identity theft, file a report with the FTC. You will receive a personalized recovery plan.

Following these steps will help you detect any identity theft quickly, which can make recovery faster and easier.

Prevent Loss and Theft

The best way to avoid loss or theft of your Medicare card is to keep it at home in a safe place. Only carry it if you expect to need it:

- You will not need your Medicare card to get emergency care. You can present it after your discharge.

- If you are going to a new health care provider, you may need to present your card. If you have used the provider before they will probably have your card on file. You won’t need to carry it.

- If you are using a Medicare Advantage Plan or Prescription Drug Plan, your plan may have its own ID. You can use that and leave your Medicare card at home.

Avoid giving out your Medicare claim number over the phone or email. Make a note of who is requesting the number, look for the institution’s phone number and call them back to verify. Medicare will never ask for your claim number or threaten to cut off services if you don’t supply personal information.

Conclusion

Your Medicare card is an important piece of information that you should try to keep secure. Old Medicare cards included your Social Security Number and presented a serious risk of identity theft. If you are still using one, you should request a new Medicare card as soon as possible.

A new Medicare card presents less risk of identity theft than old ones, but it can still be used to claim benefits in your name. Keep your card as secure as you can and only carry it when you expect to need it.