OVERVIEW

Even before the new year began, credit applications, spending and deficiencies were already increasing in the wake of economic factors including inflation and rising interest rates, unemployment, federal income tax issues and more. One of the major spending events of any year is the winter holiday season, and market analysts projected a robust 2021 spending rebound from the previous year when many shoppers bought and traveled less than normal years. The following analysis and consumer survey, conducted by ScoreSense after the last day of January 2022, sought to better understand consumers’ holiday spending in late 2021 and its effect on some consumers’ budgets, credit, and spending in the months to follow.

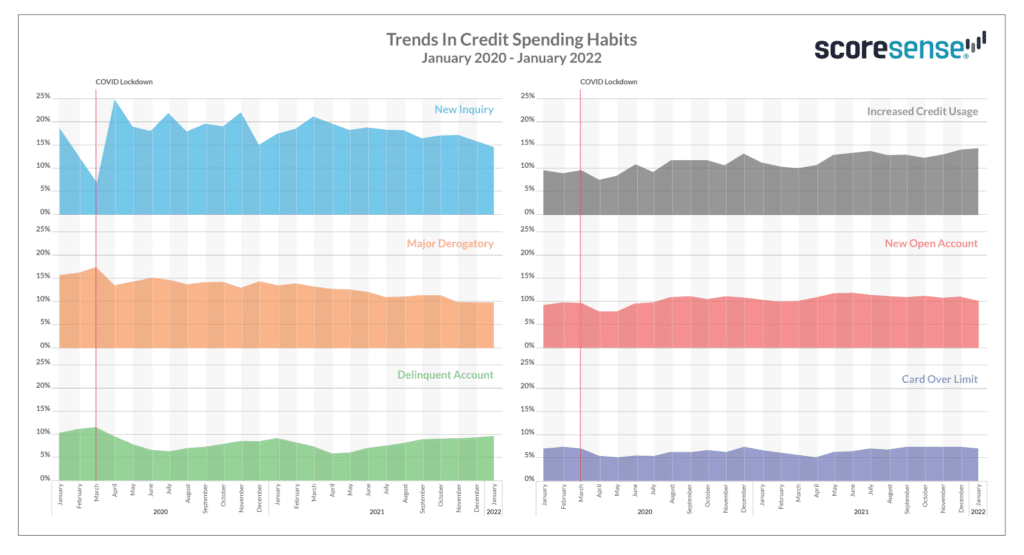

To do this from a market perspective, we analyzed credit spending over a two-year period to see the pre-pandemic activity of January 2020 versus what we see today. This approach was essential because 2020 was an anomaly during the heat of the pandemic, including factors such as lower spending for gifts and travel, government stimulus payments that many consumers used to pay down debt, and rising credit scores due to government-mandated forbearances for mortgages, student loans and rents. Thus, we performed a two-year analysis of consumer spending and credit, which compared this year’s post-holiday fallout to January 2020 and 2021.

Additionally, we also conducted a consumer survey to get a pulse on what consumers would tell us about their recent holiday spending – their budgets vs. actual spend, level of purchasing compared to last year, how they financed purchases and, importantly, how they felt about their finances today.

Lastly, this report provides our insights on what we expect in the months to come regarding credit activity. There are several economic influences in play, including a tax filing season that will be very different for some taxpayers, resulting in lower refunds or taxes owed.

CREDIT SPENDING ANALYSIS: January 2021-January 2022

A two-year analysis of consumer spending and credit, which compared this year’s post-holiday fallout to January 2020 and 2021, reveals:

- Credit card usage, surpassing limits, and delinquencies (late payments under 180 days) have increased over the past five months, influenced by economic factors such as inflation, the “Great Resignation,” and increased holiday spending.

- Major derogatory alerts – late payments of 180 days or more – including collections, repossessions, and foreclosures trended down over the past two years as consumers have been doing better at paying down debt. As delinquencies rise, derogatory alerts may begin to increase.

CONSUMER SURVEY: HOLIDAY SPENDING

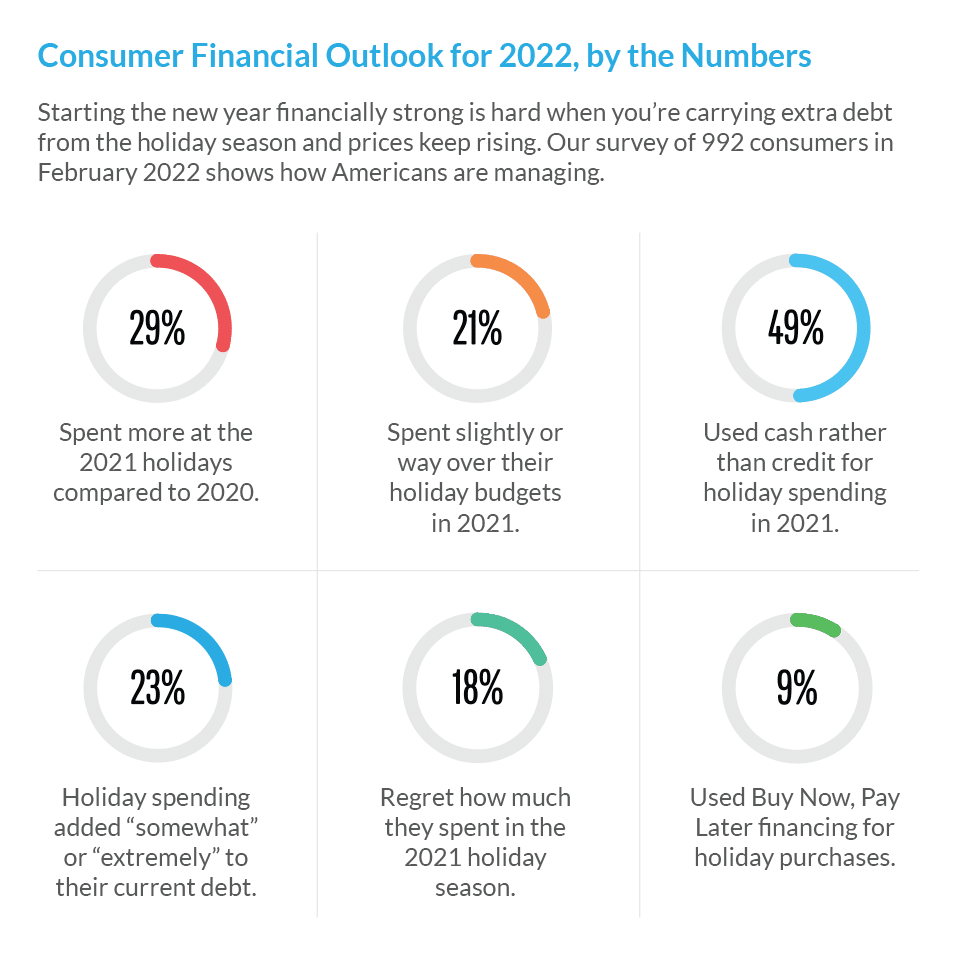

Key Findings

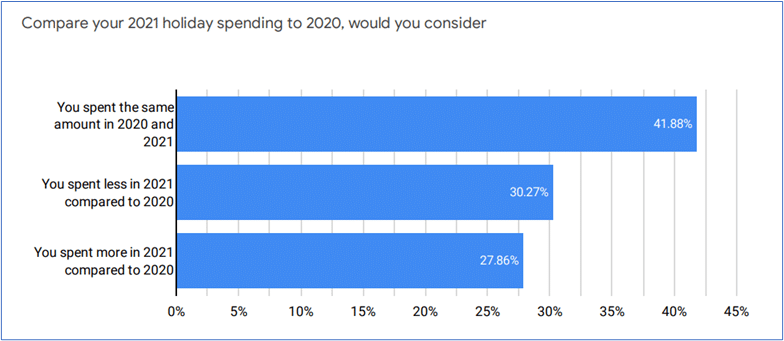

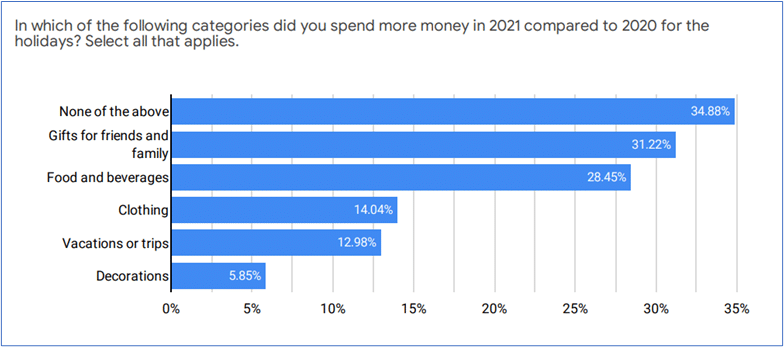

- During the holidays, almost 30 percent of respondents spent more in 2021 compared to 2020.

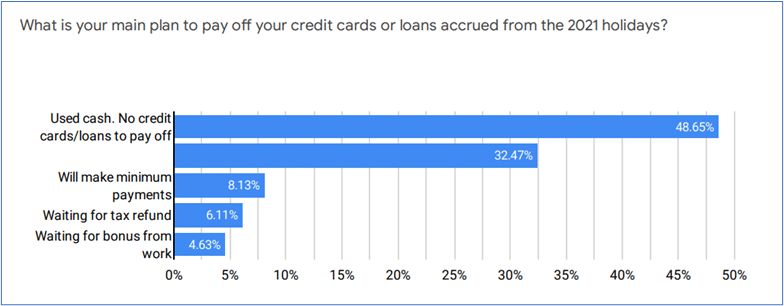

- Nearly 50 percent of respondents said holiday spending was paid with cash – not financed.

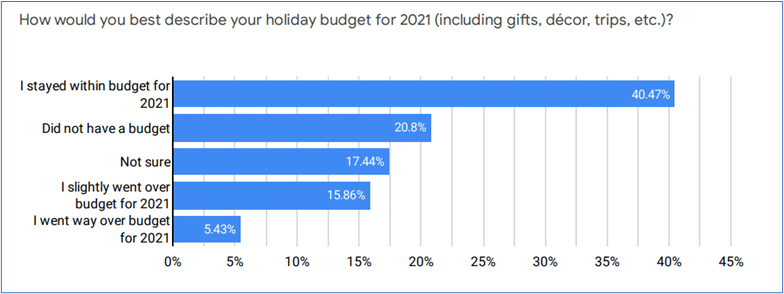

- One in five people overspent their 2021 holiday budgets slightly or went well above.

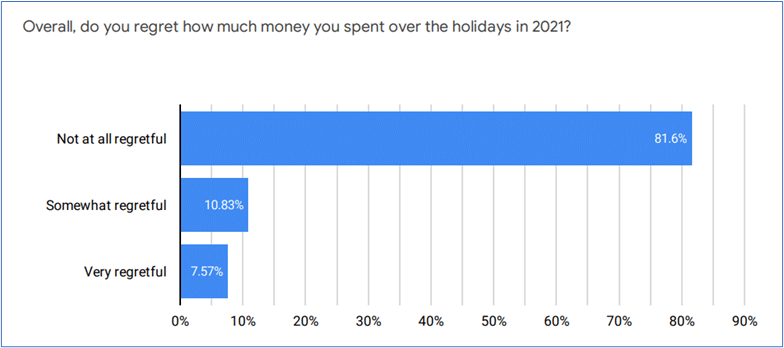

- Nearly one of five respondents (18 percent) regret how much they spent.

- Twenty-eight percent of respondents spent more money during the 2021 shopping season compared to 2020.

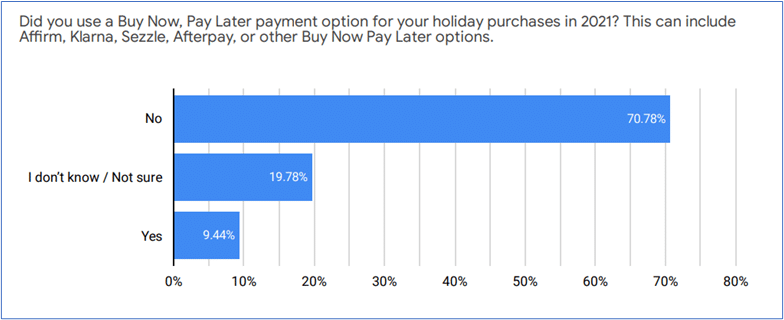

- Buy Now, Pay Later financing for holiday purchases was used by 9 percent of respondents.

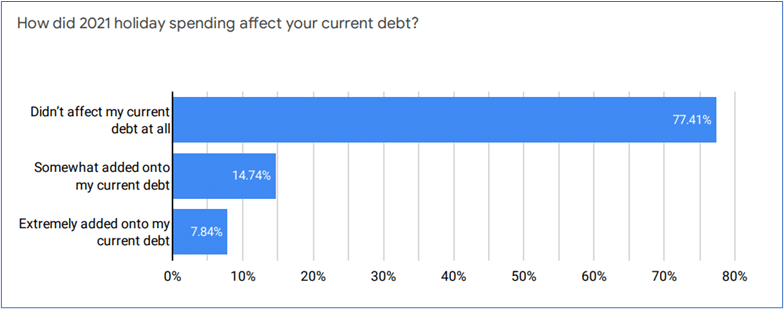

- Twenty-three percent of respondents said their 2021 holiday spending added to their current debt.

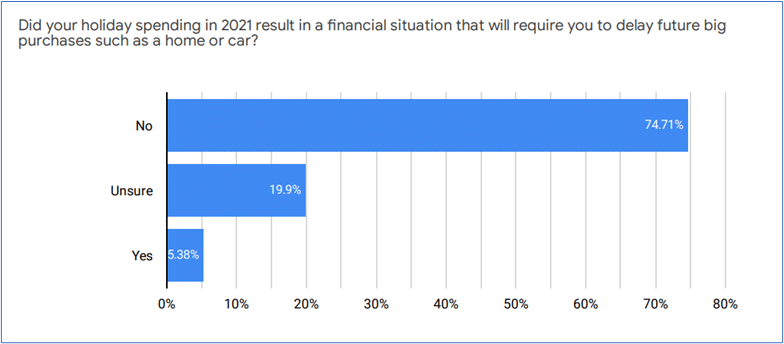

- About one in four respondents are unsure they will be able to make a major purchase, such as a home or car, this year.

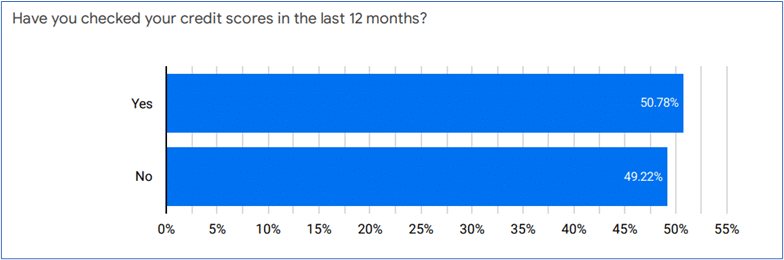

- Fifty percent of respondents said they had checked their credit scores in the last 12 months, an increase of 52 percent over 2020 when only 33 percent of Americans checked their credit in a year.

OPINION & OUTLOOK

During the holidays, consumers opened more lines of credit, spent more, and racked up debt. Before the gifts were unwrapped, ScoreSense had already seen an uptick in delinquent payments being reported, and our post-holiday data confirmed it. These trends are continuing and not expected to abate anytime soon. Recent Federal Reserve data showed that consumers’ revolving credit levels in November 2021 were a projected $1.02 trillion, the highest since March 2020. Moody’s Analytics reported $717.2 billion in consumer bankcard debt outstanding in December 2021, also the highest level since March 2020.

Buy Now, Pay Later was heavily promoted before the holidays, and almost 10 percent of our survey respondents said they used that type of financing for purchases. It remains to be seen if consumers will adhere to the payment requirements, and if this financing trend continues to grow and take away share from credit card companies.

The post-holiday spending survey revealed one major surprise: about half of respondents said they used cash to finance their purchases. Not surprisingly, about one-fifth of respondents blew their budgets and may find themselves in trouble in the coming months. We expect to see most consumers continue to try to adhere to smart spending behaviors, such as paying with cash, but some may not be able to keep it up considering inflation and other factors.

Many consumers typically reduce or pay off debt with their tax refunds in April – but this year will be different. Particularly parents and people with student loan deferments may be shocked to find out their refunds will be much smaller, or worse, they will owe money to the IRS. Most parents will not get the “big” child tax credit write-off this year, as those credits were paid out in advance during 2021, and there’s no write-off of student loan interest for people who took deferments

For those with federal college loans, payments scheduled to resume in May 2022which will add another line item to household budgets. For many, this is a substantial expense, especially after more than a year of forbearance. Also, those who took forbearance will not have the same tax write-offs on their 2021 returns as they may typically have.

People already having trouble paying their bills – and now facing reduced orzero refunds, or owed taxes – may open more lines of credit to pay for must-have goods and services. Then, the aftermath: Credit scores will go down for having too many lines of credit, too much debt, and late or defaulted payments. For many, purchases of big-ticket items, like an appliance or vehicle, will be delayed.

The Great Resignation, a trend in which we’re seeing millions of workers quit their jobs, is also factoring into some household budgets. While some people leaving jobs have accepted new positions, others are between employers or planning to launch their own businesses and may be supplementing their income by dipping into savings or using credit.

METHODOLOGY

This study was conducted for ScoreSense© using the online portal by Google Survey. Surveys were collected in January 2022 – February 2022 among a sample of 992 consumers in the United States aged 24+. The margin of error for total respondents is +/-3.1% at the 95% confidence level.