Despite efforts by the Federal Reserve to curb inflation, prices remain high or continue to climb, and many Americans continue to struggle. Inflation jumped by 8.2% in September versus a year earlier, worse than expected. Consumers have seen prices for food, energy, and housing rise sharply. For example, food prices jumped 11.2% in September from last year, according to the most recent consumer price index.

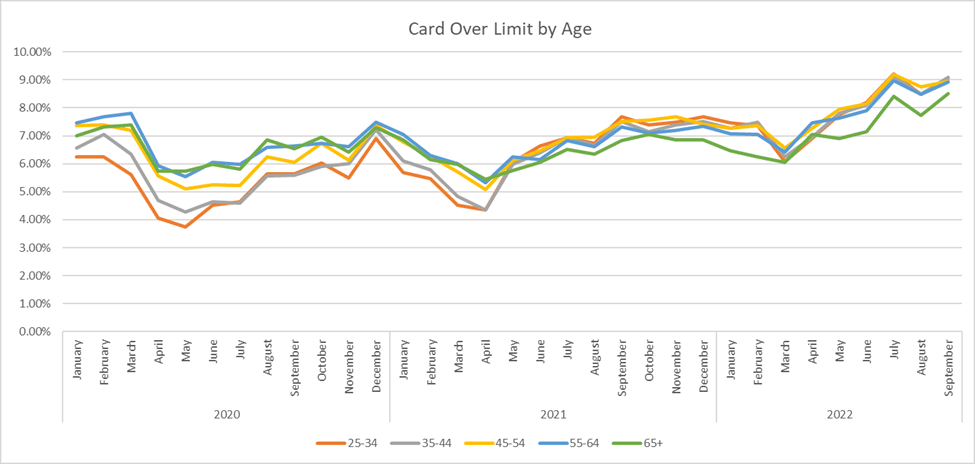

We continue to see that more Americans are using credit as a last resort to pay bills, and rising interest rates are making it more costly to borrow money and pay off balances. According to a survey by LendingTree, 32% of adults have paid a bill late in the past six months, and 61% of those people paid late because they didn’t have the money. Our analysis of credit data shows a continuing rise in delinquencies and consumers exceeding their credit limits (Card Over Limit).

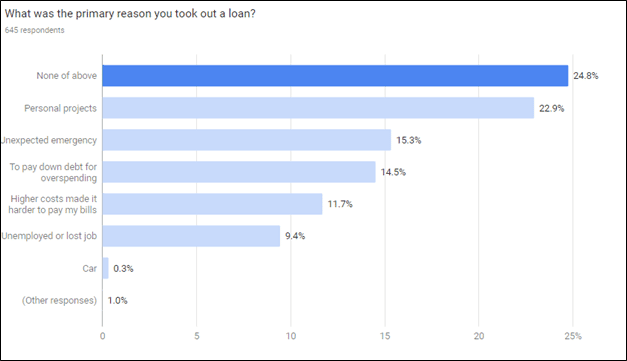

Many Americans are also taking out loans to pay bills, and we conducted a survey to gain insights. We learned that 30% of those who took out loans used them for emergencies or to pay bills.

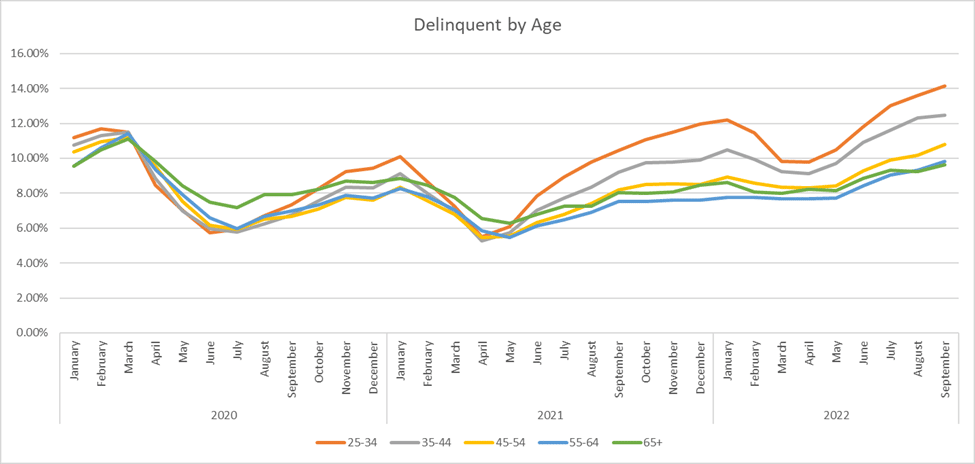

In our analysis of credit data, we see a continuation of credit spending, overspending, and late payments. Older Americans have not been spared; they also are experiencing the same increase in delinquencies (bills 30 days past due), and Card Over Limit, which shows the stress this economy can put on a fixed income. The ScoreSense loan survey revealed adults ages 65 or older were more likely to take a loan out for an emergency compared to younger adults surveyed.

CREDIT SPENDING ANALYSIS: Q3 2022 Compared to Last Year

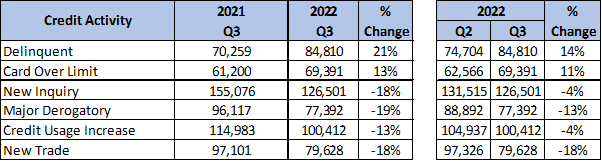

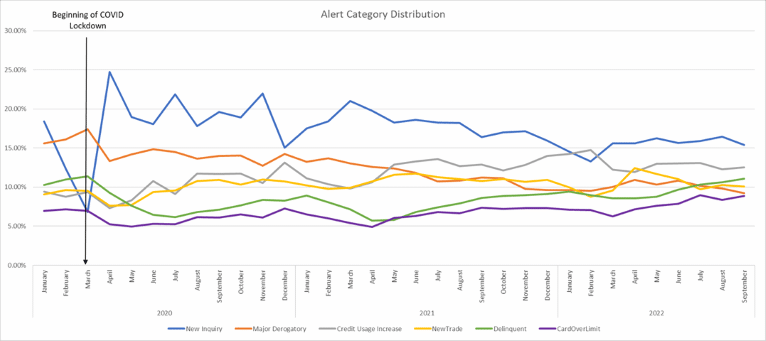

We analyzed credit activity for Q3 2022 compared to the same quarter last year. We also compared Q2 and Q3 2022 data to see recent shifts in activity. The results, illustrated in the graphics below, reveal the following:

Top Data Insights

- Delinquencies increased by 21% from 2021 Q3 to 2022 Q3. Looking within the year, it increased by 14% from Q2 to Q3.

- Card Over Limit increased by 11% in Q3 from Q2 of 2022.

- New Trade, when a consumer opens a new line of credit, is down by 18% in Q3 from Q2.

Overall Summary and Thoughts

- The overall trends continue the story that we have been discussing over the past quarter. For everyone, budgets are getting stressed due to inflationary pricing.

- The decrease in New Trade matches what we see in searches for credit and financial institutions’ website traffic – there is less consumer interest in securing a new loan due to the increase in interest rates.

- Adults 55-65 and 65+ are experiencing the same increase in delinquencies and Card Over Limit, which shows the stress this puts on a fixed income.

- The youngest age group, typically the lowest income and savings group, is getting hurt the most by inflationary pricing and the ability to afford it. Today’s economy and their spending could have a long-term impact on how this group manages their lives in the years to come. If they have such stress on their monthly budget, will they be able to afford to save for a house? Can they start to save for retirement? How will these difficult times impact them long term and their future life decisions?

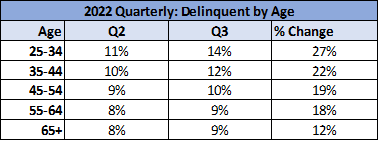

Credit Activity by Age

- There was very little distinction within most of the credit activity by age group.

- However, delinquent accounts increased by 27% for those who are 25-34 years old compared to adults who are 65 years old or older who only saw a 12% increase.

CONSUMER SURVEY: CONSUMERS WITH LOANS

Key Findings

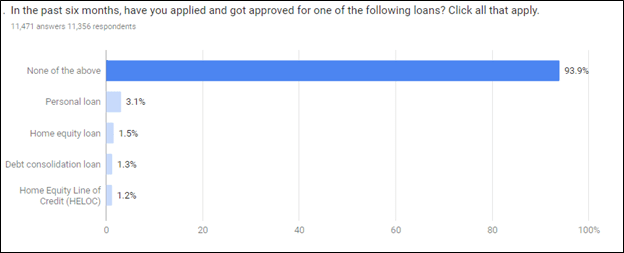

Only 7% of respondents said they applied and received approval for a loan within the last six months.

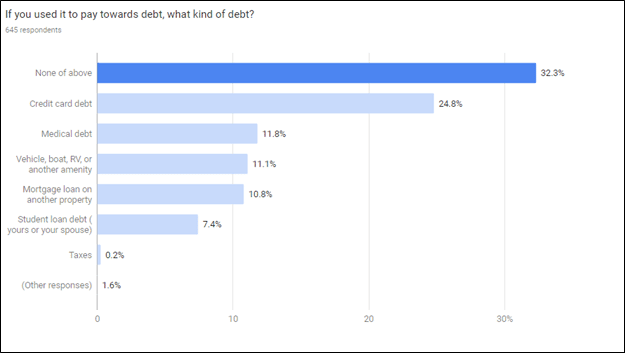

Loan used to pay certain debt: One in four adults used the loan to pay credit card debt.

Primary reasons for taking out loans:

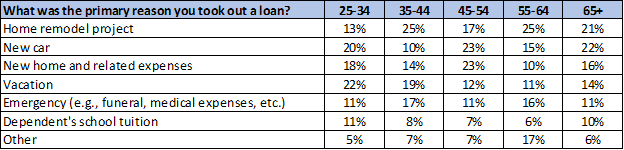

- 23% took out a loan for personal projects

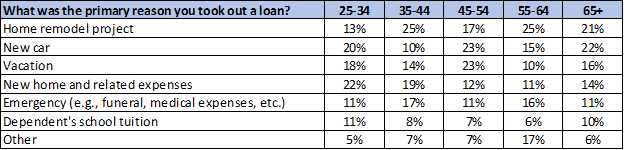

- Adults 65 or over were more likely to take out a loan for an emergency compared to younger adults surveyed.

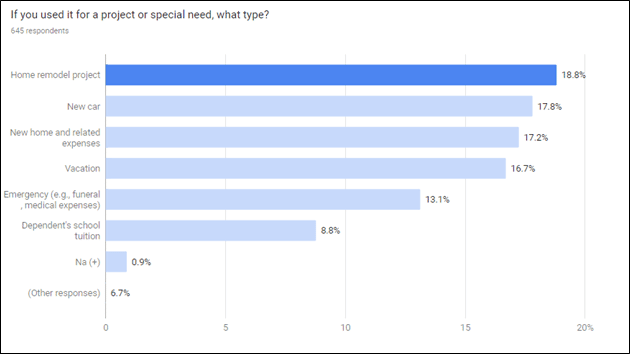

Loan for project or special need:

- Overall, 19% used the loan for home remodeling, and 18% of loans were needed for the purchase of a vehicle.

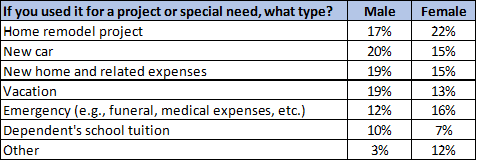

- Males were more likely to use the loan for either a new vehicle (19%) or a vacation (19%), whereas females were more likely to use the loan to fund a home remodeling project (21%).

- Adults 45-54 years old (23%) were more likely to use the loan for vacations compared to other groups.

- Adults 25-34 years old (23%) were more likely to use the loan for purchases of new homes and related expenses.

Survey specs: September 2022; sample size: 645 adults

Other reasons included moving, vacation, lower rates

Primary Reason to Take Out Loan – by Age

Primary Reason to Take Out Loan – by Gender

Respondents in the 25-34 age group (23%) were more likely to use the loan for the purchase of a home and related expenses.

Others used the loan to pay rent, utility bills, car insurance, and weddings.

OPINION & OUTLOOK

As we enter the fourth quarter, we see indicators that inflation is still with us, as well as a continuation of credit spending, overspending, and late payments. This is very concerning as we head into the holiday buying season.

Since early 2020, ScoreSense has seen an increase in the number of delinquent payments reported. Our analysis finds delinquencies increased by 21% from 2021 Q3 to 2022 Q3. Looking within the year, it increased by 14% from Q2 to Q3. Credit card debt continues to soar as consumers struggle with rising prices and depleted savings. In August, revolving credit increased by 18.1% as total consumer debt surged to a record $4.68 trillion, according to the Federal Reserve. With inflation still raging, we may see the Federal Reserve raise interest rates again, which will result in minimum payments on credit cards going up as well as balances on unpaid debt.

While some consumers may rely on tax refunds early next year to pay for holiday gifts and travel in Q4, others will likely use alternate forms of payment, such as credit and Buy Now, Pay Later options. In Q4, we anticipate seeing consumer spending, late payments, credit limit breaches, and delinquencies rise yet again.

At ScoreSense, we provide credit monitoring products to American consumers. Our website and credit specialists provide personalized education on how to better understand your credit and monitor for identity fraud.