OVERVIEW

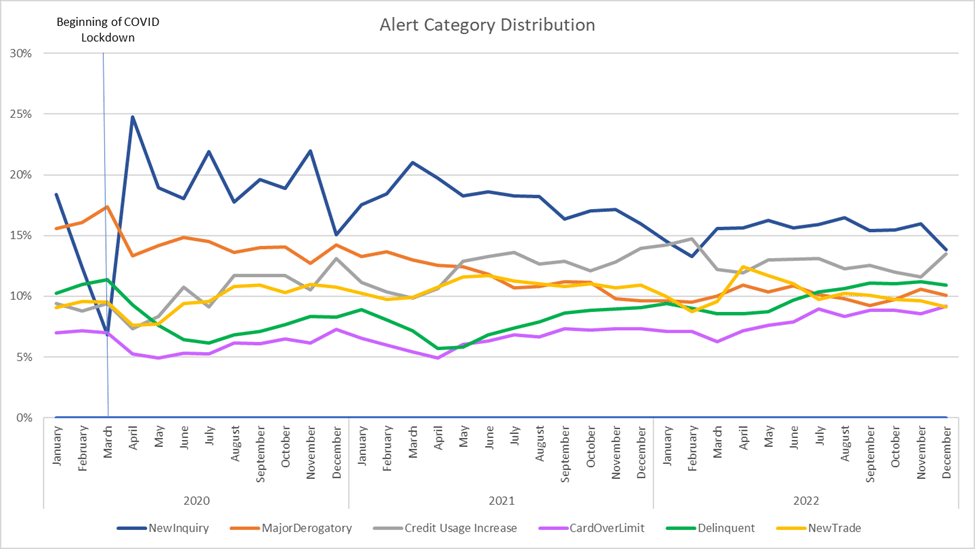

Despite consumer spending declining in December 2022, consumers are still struggling with delinquencies. December saw consumers change their spending behavior by eating at restaurants less and reducing their spending across most spending categories. These spending habits coincide with consumer credit data, which indicates an increase in delinquent credit accounts and an increase in maxed out credit cards. Normally, we would see increases in delinquencies and credit card usage after the holiday spending season. But this year, these indicators can also be attributed to many consumers who were already struggling with their normal day-to-day bills let alone what they spend during the holiday season.

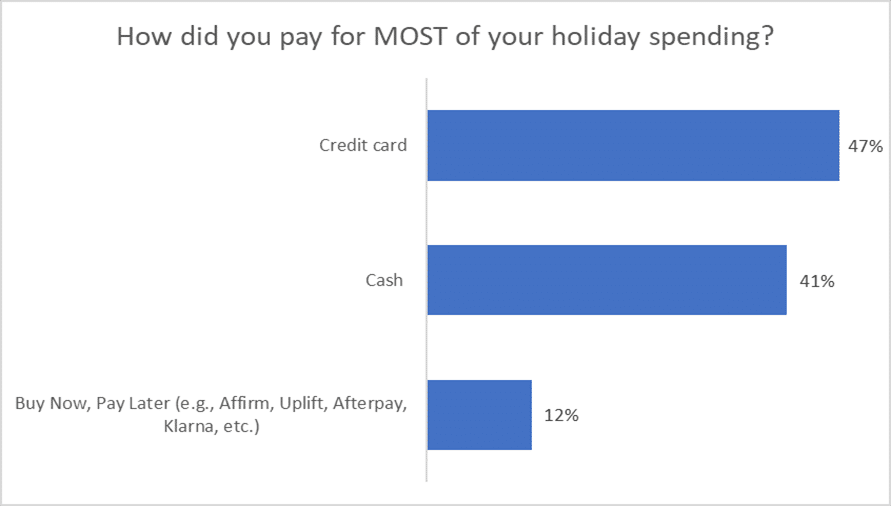

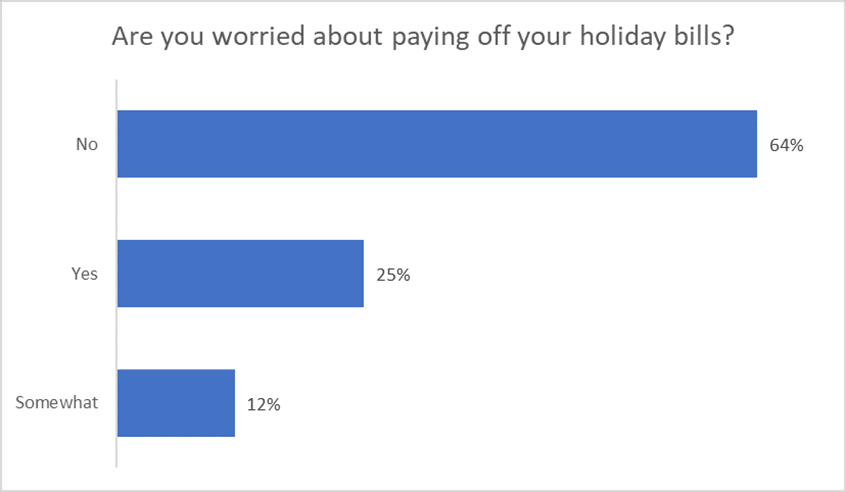

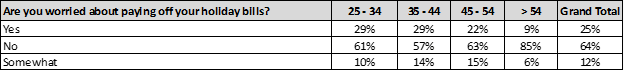

To better understand consumers’ holiday spending for 2022 and its effect on some consumers’ budgets, credit, and future spending, ScoreSense® conducted a survey. Key findings include 47% of respondents used credit cards to fund their holiday spending, and one in five respondents intend to pay off their bills with federal tax refunds. More concerning, 37% of survey respondents said they are worried or somewhat worried about paying off their holiday bills.

Food prices remain high, consumer savings are lower, and many economists are predicting a recession beginning in the first quarter of 2023. Based on this data, we predict a continuation of increasing credit card balances and delinquencies in the coming months.

To stay ahead of the potentially negative economic news, we recommend consumers work to pay down or refinance high-interest debt and cut spending to increase savings.

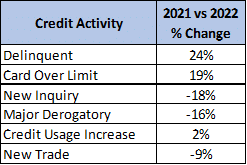

2022 Credit Activity Analysis – Top Insights

- Delinquencies increased by 24% from 2021 to 2022.

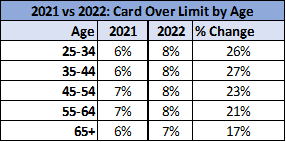

- Card Over Limit increased by 19% in 2022 compared to 2021.

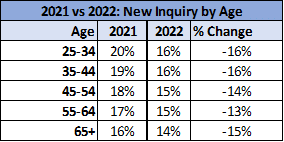

- New Inquiries dropped by 18% in 2022 compared to 2021.

2022 Credit Activity – Top Insights by Age Groups

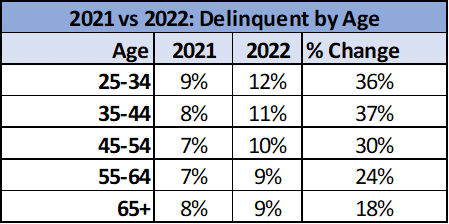

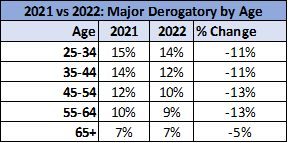

- While delinquencies increased across all age groups, those between ages 25-44 saw the most increase with about 37% in 2022 compared to 2021.

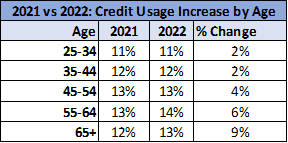

- Those 65+ years in age saw a 9% increase in Credit Usage and also experienced a 17% increase in Card Over Limit in 2022.

CONSUMER SURVEY: CONSUMERS’ HOLIDAY SPENDING

In January 2023, ScoreSense conducted a survey to better understand consumers’ holiday spending for the 2022 holidays and its effect on some consumers’ budgets, credit, and future spending. We surveyed 500 American consumers aged 25 and older with a household income of $25,000 or higher.

Top Insights

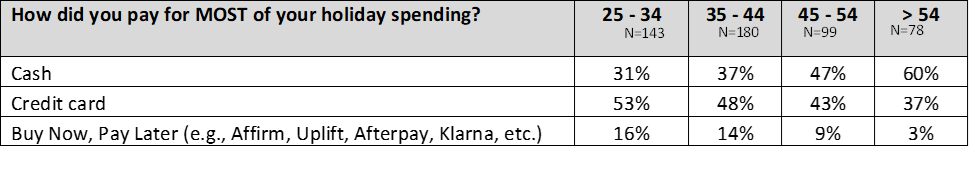

- 47% used credit cards to fund their holiday spending. Respondents between the ages of 25-34 were more likely to use a credit card or Buy Now Pay Later financing to fund their holiday spending. On the other hand, 41% used cash, the majority of whom are over the age of 54.

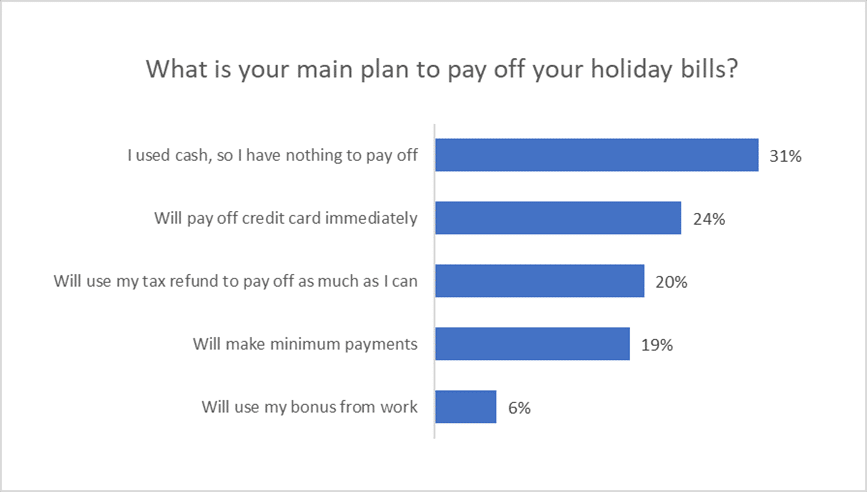

- 1 in 4 consumers will pay off their credit card immediately while 1 in 5 consumers are planning to use their tax refund to help pay their holiday bills.

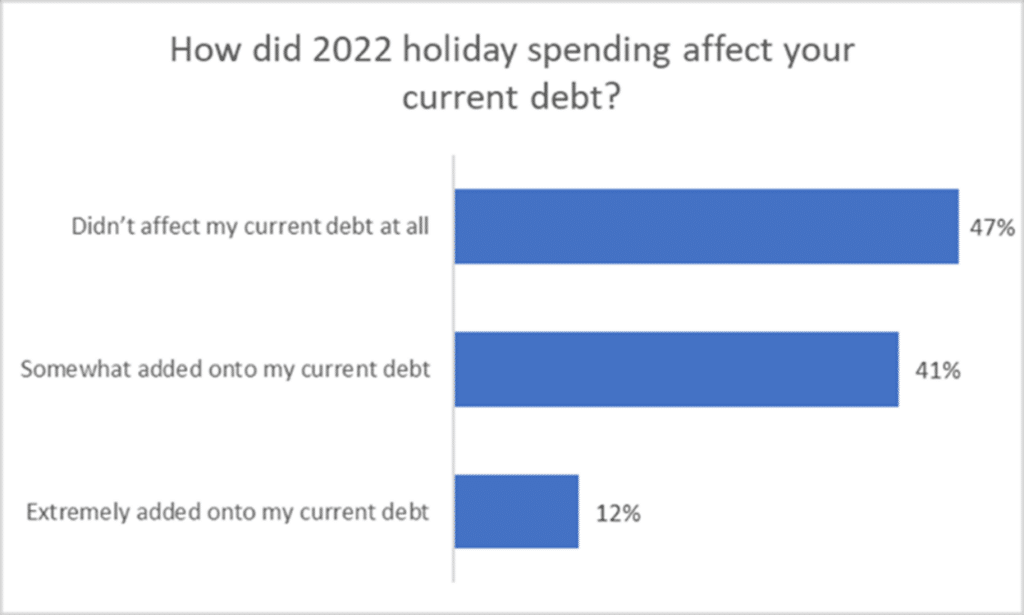

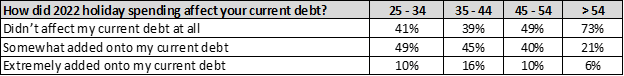

- Overall, 53% of participants mentioned that 2022 holiday spending somewhat or extremely added to current debt. This was very noticeable for those between the ages of 25-44 (60%).

- With an increase in debt, 37% of participants are worried or somewhat worried about paying off their holiday bills.

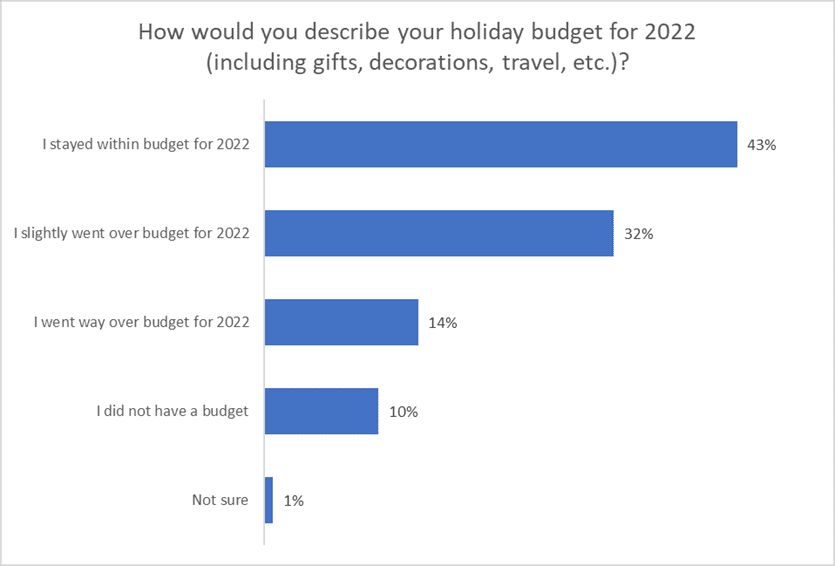

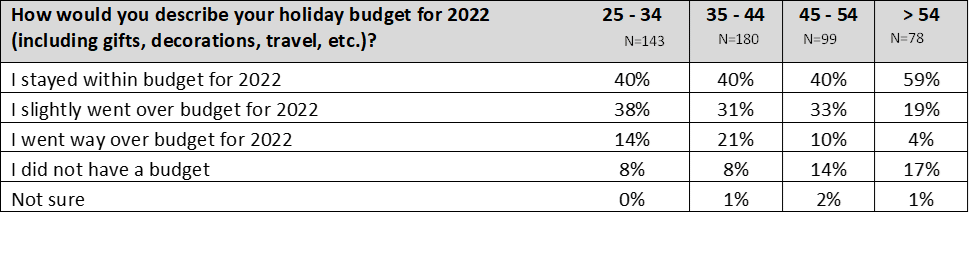

- Nearly 56% of participants went slightly or way over budget for their holiday spending in 2022. Those over the age of 54 were more likely to stay within budget compared to other age groups.

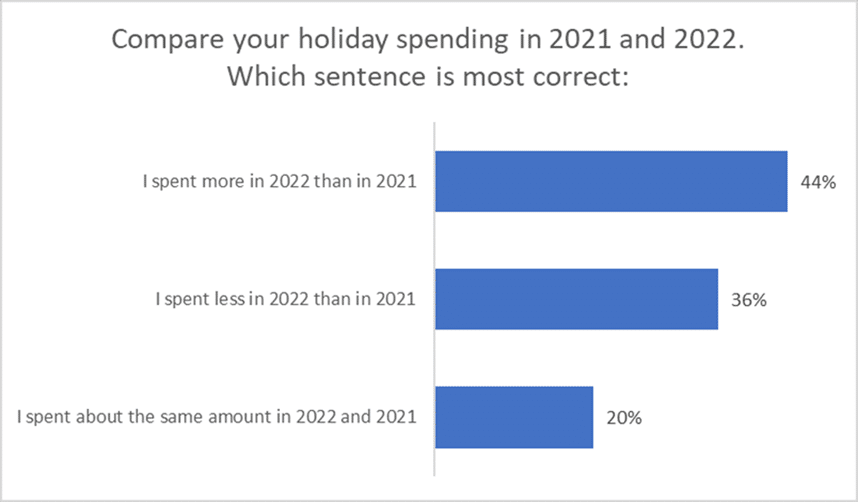

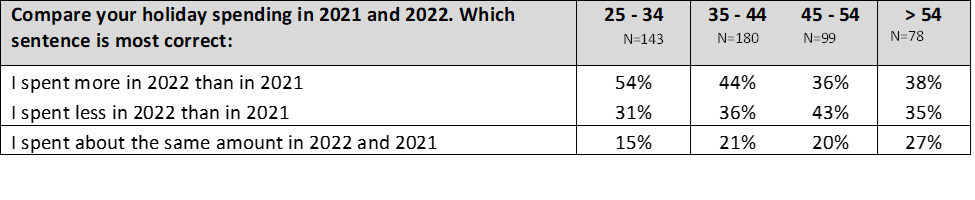

- 44% of participants said they spent more in 2022 than in 2021. Those aged 25-34 (54%) claimed they spent more in 2022 than in 2021 compared to other age groups.

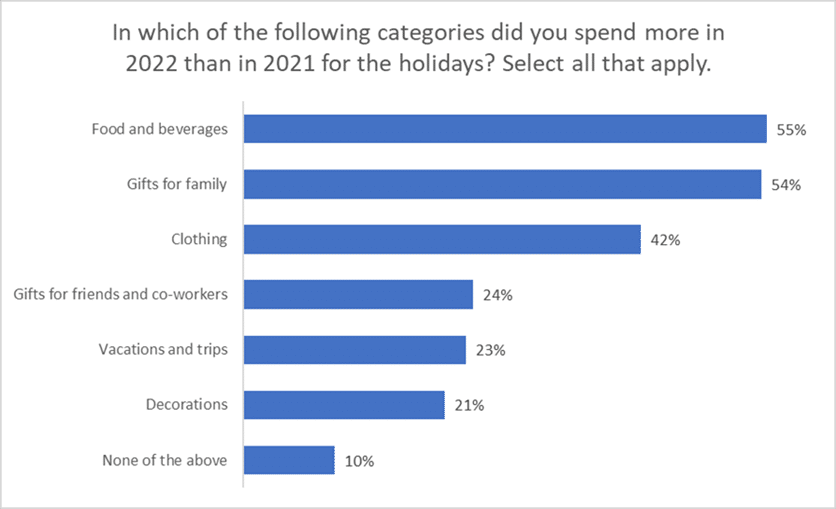

- 50% of participants mentioned they spent more on food and beverages as well as gifts for family in 2022 than in 2021.

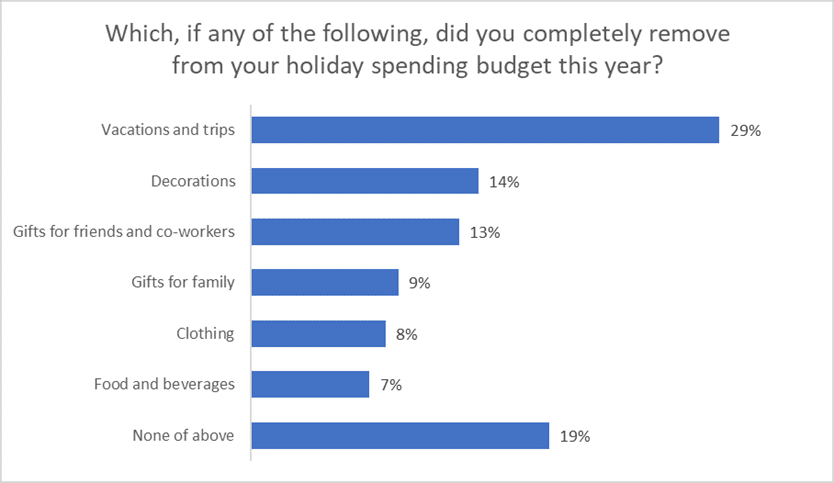

- Nearly 30% said they removed vacations and trips from their budget in 2022.

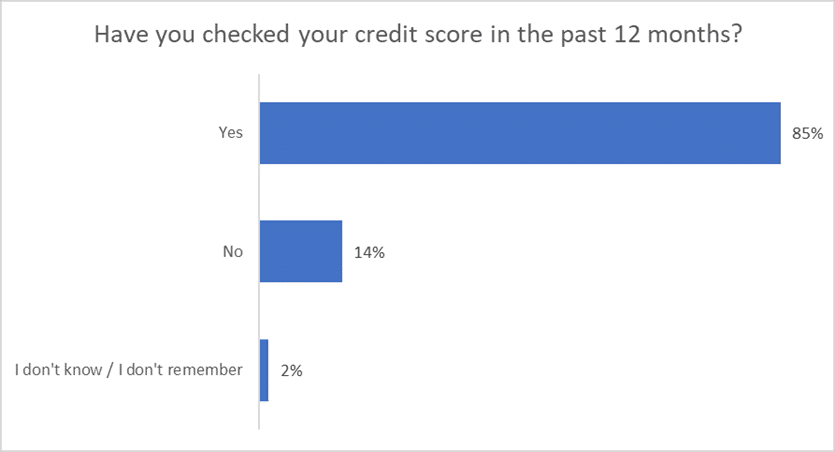

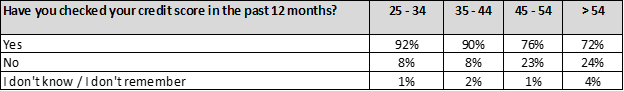

- Overall, 85% of participants say they have checked their credit score in the last 12 months. It was much higher at 90% for those between the ages of 25-44. Only about 75% of those age 45 and up checked their credit score in the last 12 months.

Those between 25-44 were more likely to check their credit score in the last 12 months compared to those over age 45.

- Nearly 56% of participants went slightly or way over budget for their holiday spending in 2022.

- This is much higher than what we saw in 2021—21% of participants claimed they went slightly/way over budget in 2021.

Those over the age of 54 were more likely to stay within budget compared to those 54 or younger. This is likely due to older adults being on fixed incomes.

44% of participants said they spent more in 2022 than in 2021.

Those aged 25-34 (54%) claimed they spent more in 2022 than in 2021 compared to other age groups.

Participants spent more on food and beverages as well as gifts for family in 2022 than in 2021.

Nearly 30% of participants removed vacations and trips from their holiday budget in 2022.

47% used credit cards to fund their holiday spending, while 41% used cash.

- Those between ages 25-34 were more likely to use a credit card or Buy Now Pay Later financing compared to other age groups.

- Those older than 54 were more likely to use cash and least likely to use Buy Now Pay Later financing.

- 1 in 4 consumers will pay off their credit cards immediately.

- 1 in 5 consumers are planning to use their tax refund to help pay their holiday bills.

37% of participants are worried or somewhat worried about paying off their holiday bills.

Approximately 30% of those between ages 25-44 were worried about paying off their holiday bills.

- 53% of participants mentioned that holiday spending somewhat or extremely added to current debt.

- Compare that to last year’s survey, in which 23% said it somewhat or extremely added onto their debt.

- About 60% of those between ages 25-44 said their holiday spending somewhat or extremely added onto their debt.

OPINION & OUTLOOK

In an inflation-plagued economy, 2022 was the year we saw increased credit spending, overspending and late payments. For many Americans, personal finance gains made during the pandemic were wiped out.

Many economists are predicting a recession in 2023. In a recent poll of economists, the World Economic Forum found that nearly two-thirds of the respondents believe there will be a recession this year. How bad it will be is a matter of speculation.

Currently, more Americans are depending on credit cards to pay for goods and services that are more expensive in an inflationary economy. As interest rates continue to climb, that debt is getting a lot more expensive. The Federal Reserve is increasing interest rates in the most aggressive way since the early 1980s as it tries to bring down inflation. The average credit card user was carrying a balance of $5,474 last fall, according to TransUnion, up 13% from 2021. As the personal savings rate lowered to a near all-time low, credit card balances jumped 15% year over year, according to the latest quarterly report from the Federal Reserve Bank of New York, which is the largest increase in more than 20 years. More than one-third (35%) of credit cardholders carry debt from month to month on at least one card, which is up from 29% compared to last year, according to a new report by Bankrate.com.

The average Interest rate on bank-issued credit cards reached 19.1% late in 2022, according to a Federal Reserve consumer credit report released on Jan. 9, 2023, marking the highest rate since the government began tracking this data in the 1970s. It surpassed the previous high of 18.9% in 1985, and could soon shoot even higher, with some experts predicting a 20% average rate this year as the Federal Reserve continues to raise interest rates to bring down inflation.

These dramatic jumps in credit card usage, as well as late payments and delinquencies, are largely reflective of many Americans who are leaning on credit cards to pay for necessities, such as food, gasoline, rent or mortgage, and utilities. Despite the Fed’s efforts to curb inflation through multiple rate hikes in 2022, prices are still higher than a year ago. The headline consumer price index, which measures the cost of a wide variety of goods and services, is up 6.5% as of December 2022, according to Labor Department data. That’s down from 7.1% in November 2022, and a 9.1% peak in June 2022. But it’s important to note that a decline in the annual inflation rate means that prices rose at a slower pace than earlier in the year; it does not mean overall prices went down although some did, such as gasoline.

In 2023, we expect a continuation of the same consumer behavior and credit trends we’re seeing today – credit spending, late payments, and delinquencies. The rate at which U.S. consumers miss payments on credit cards and personal loans is expected to surge to levels not seen since 2010, according to TransUnion’s credit forecast. TransUnion forecasted serious credit card delinquencies to rise to 2.6% at the end of 2023, compared to 2.1% at the close of 2022. Unsecured personal loan delinquency rates are expected to increase to 4.3% from 4.1% in the same timeframe.

Regarding tax refunds, the IRS advises consumers that they should temper expectations for a large tax refund. Many of the pandemic tax benefits from the past few years, such as the expanded child tax credit, temporary expansions to the child and dependent care credit and federal stimulus payments, ended at the end of 2021. Depending on a tax refund to pay off debt, including winter holiday spending, is not a wise financial strategy.

To stay ahead of the potentially negative economic news, consumers should focus on paying down or refinancing high-interest debt and cut spending to increase savings. Consumers should also monitor their credit scores and reports to better understand their current credit positions, be more aware of what lenders may see, and help detect any inaccurate or incomplete information. Additionally, credit monitoring notifies you of important changes to your credit report, which can signal identity theft and fraud.

METHODOLOGY

This study was conducted for ScoreSense© using the online portal by Pollfish. Survey was collected in January 2023 among a sample of 500 consumers in the United States aged 25+.