Any time you start a new job, your new employer will ask you to fill out a W-4 Employee’s Withholding Certificate, also known as the W-4. Your employer uses the information in the form to determine how much of your paycheck they should withhold and remit to the IRS in every pay period for taxes. That makes it less likely that you’ll find yourself owing money to the IRS when tax time comes around.

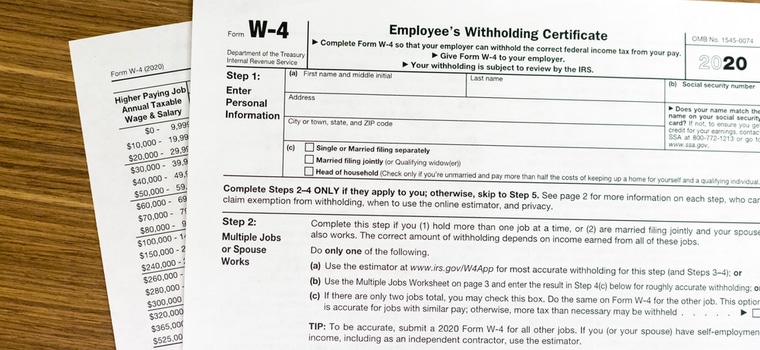

The 2020 W-4 form has been revised and it won’t be the same form you’ve filled out in the past. The good news is that it’s simpler. The seven sections in the old form have been reduced to five and many taxpayers won’t have to fill out all of them.

What Does the W-4 Form Do?

Your employer withholds money from your paycheck in every period for federal income tax. This money is sent to the IRS, along with your name and Social Security Number. The money that’s deducted from your paycheck goes to paying the annual income tax that you file on your tax return.

Based on what you deduct from your paycheck for taxes, you’ll face three possible scenarios at tax time:

- If the correct amount has been withheld, you will not owe any tax.

- If too much tax has been withheld, you’ll get a refund.

- If not enough has been withheld, you will owe money to the IRS.

The information in your W-4 form tells your employer how much they need to withhold to help ensure that you will not owe money to the IRS when you file your taxes.

Your W-4 form is not sent to the IRS. Your employer uses it to calculate your withholding and keeps it on file.

How Has the W-4 Form Changed?

The Tax Cuts and Jobs Act, signed in Dec 2017, changed the way deductions are claimed and the way taxes are withheld. The new W-4 form reflects these changes.

The main change in the new form is that you no longer have a personal allowances worksheet to help you figure out what allowances to claim. That’s because the Tax Cuts and Jobs Act replaced multiple deductions with a single standard deduction.

If you are single or if your spouse doesn’t work, all you have to do is fill in your information and sign and date the form. If your spouse works, if you have multiple income sources or if your tax situation has other complications you may have to provide additional information.

Filling Out the Form: Step by Step

There are several steps to filling out the new W-4 form:

Step 1: Provide your personal information.

Step 2: If you have multiple jobs or a working spouse (if you file jointly), provide information on them. The form gives you three options:

- Use the Tax Withholding Estimator.

- Use The Multiple Jobs Worksheet.

- If there are two jobs with similar incomes, check box C on both W-4 forms

Step 3: If you have dependents, fill in details on step 3. This will determine your eligibility for the child tax credit.

Step 4: The “other adjustments” section of the form allows you to adjust the amount withheld. If you had a large tax bill last year or you have additional income, you might want to have more money withheld. If you got a large refund last year and you’re not keen on making another interest-free loan to the government, you might want to have less money withheld.

Step 5: Sign and date the form.

That’s all there is to it. For most workers, it’s a very simple process.

Who Should Fill out the New W-4 Form?

If you start a new job in 2020 you will have to fill out the new W-4 form.

If you already have a W-4 form on file, you do not have to file a new one. You may wish to file a new W-4 if you had a large tax bill or refund last year or if your tax status has changed. You can file a new W-4 form at any time.

Consider filing a new W-4 form if any of the following apply:

- You’ve gotten married or divorced.

- You’ve had a child.

- You’ve bought a home.

- Your pay has been cut or increased.

- You work seasonally.

- You have dividend or investment income.

- You or your spouse have started freelancing on the side or have taken another job.

Any of these factors can change the amount that will be withheld from your paycheck. A new W-4 form may help make your withholding more accurate and keep you from facing a large tax bill.

Things to Consider

If your tax life is relatively simple – for example, if you’re single and you only have one source of income – you will not need to put much thought or effort into your W-4. In other circumstances, you might have to be more careful.

If you are exempt from withholding, you can just write “exempt” below step 4(c). You will have to file a new W-4 every year that you wish to claim exemption from withholding. In general, you’ll be exempt if you had no tax liability last year and you expect the same to happen this year.

If you plan to file as a Head of Household, select that filing status on the W-4. That wasn’t an option on the previous version of the form and if you are using that status you may wish to file a new form.

If you have more than one job or if you are married, filing jointly and you both work, you will need to file a W-4 for each job.

- Fill out steps 2 to 4(b) on the W-4 for the highest-paying job and leave them blank on your other W-4s.

- If you’re married, filing jointly and your earnings are similar, check the box indicating that on both W-4 forms.

If you expect to earn non-job income such as investment income, fill in the expected amount in section 4(a)

If you have an additional freelance job or if you don’t want your employer to know you have an additional job, you can instruct your employer to withhold extra tax on line 4(c). You can also send estimated quarterly tax payments on your freelance income.

In Closing

The W-4 is a relatively simple form and there’s no need to be intimidated by it. It is worth thinking about it before completing it. If your W-4 isn’t filled out correctly you could find yourself with larger deductions than you need or a large tax bill if the deductions were insufficient.

Remember that you can file a new W-4 at any time. If you think the amount being deducted from your paycheck is too large, or if you think it’s too small to cover your tax liability, consider updating your W-4.

If your tax status is complicated or if you’re still not sure how to complete the form, check the IRS W-4 FAQ page for more information.