If you find inaccurate information on your Equifax report, you have the option of filing an Equifax dispute. During the dispute process, the credit reporting agency will investigate the data in question and determine if it needs to be updated.

File Your Dispute With Equifax

Several steps are involved when filing a dispute with Equifax, but the effort may be well worth it if your credit report contains inaccurate information.

1. Check Your Equifax Credit Report

When reviewing your credit report, look at the following pieces of information for errors. Note that payments to creditors can take around 30 days to appear on your credit report.

- All personal data, including name, address, phone numbers, birthdate and Social Security number

- Account data, including account numbers, payments, credit limits, balances and collections

- Hard and soft credit inquiries

- Public records data, including property or bankruptcies

2. Gather Information and Supporting Documents

When filing a dispute, you may be asked for some, if not all, of the following information including:

- Your full name

- Past and current addresses

- Birthdate

- Social Security number

- Copy of government-issued identification (e.g., driver’s license)

- Copy of utility bill or bank statement

To support your dispute, you may want to submit relevant documentation. If you initiate the dispute by mail, only send copies of documents — not the originals — because Equifax will not return documentation to you following the investigation.

Here are some examples of supporting documentation that you may want to submit:

- Police reports

- Federal Trade Commission identity theft report

- Court documents related to public records

- Canceled checks to show an account has been paid

- Student loan discharge letter

- Bankruptcy schedules

3. File a Dispute

Equifax offers consumers three ways to file a dispute: online, by phone or by mail. Before filing, compile a list of each item on your credit report you want to dispute, including the creditor’s name, the account number and the reason you believe the information is inaccurate.

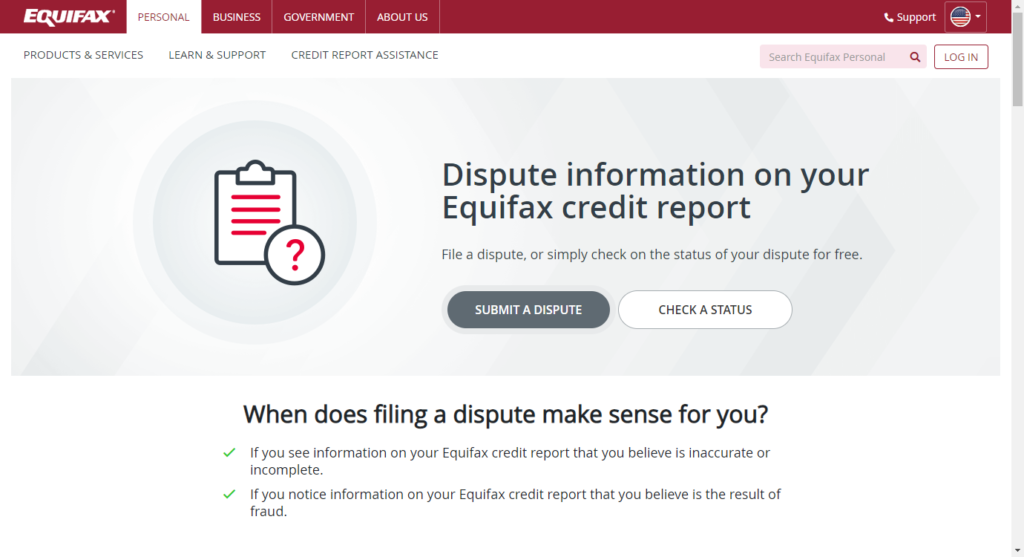

Filing Online

To file your Equifax dispute online, visit the Equifax website. If you provide an email address, a link will be emailed to you so that you can review the results of the investigation online.

Filing by Phone

To file an Equifax dispute by phone, call 866-349-5191 — 8 a.m. to Midnight EST, seven days a week — for assistance. Investigation results can be mailed to you, or if you provide an email address, you can receive a link to view them online.

Filing by Mail

To file your Equifax dispute by mail, download and complete the Equifax Research Request form. Mail the completed form and supporting documentation via certified mail to:

Equifax Information Services, LLC

P.O. Box 740256

Atlanta, GA 30374

Avoid using a generic template letter, or Equifax may deem your claim frivolous and refuse to investigate. Instead, write a letter specific to your situation that includes all relevant data, including account names, numbers and why you believe the information is inaccurate.

4. Wait for Results

Allow 30 to 45 days for Equifax to investigate your dispute. Once the investigation concludes, Equifax should report the results to you in writing and include the name, address and phone number of any information providers who were involved in the judgment.

Equifax should also provide you with a free copy of your credit report if the dispute resulted in a change to your information.

5. Request Updates to Be Sent

According to the Federal Trade Commission, if you ask, credit reporting companies, including Equifax, must send notices of corrections to your credit report to anyone who ordered your credit report within the past six months.

For those who viewed your credit report in connection with employment, the time limit extends up to two years.

6. Check Other Credit Reports

Equifax is required to report any corrections made to your credit report to the other national credit reporting companies — TransUnion and Experian — according to the Federal Trade Commission. You may want to verify, however, by checking your other reports.

Lenders pull credit reports from different credit reporting agencies, so following up to make sure that all of the information reported by TransUnion and Experian is accurate.

Why Should I Dispute Information on My Equifax Report?

The accuracy of your credit report is vital to your financial well-being. For example, when you apply for a home or auto loan, lenders use the information on your report to help determine whether or not to give you a loan and at what rate.

Inaccurate information on your report may result in lenders charging you a much higher interest rate to obtain the loan or denying the loan altogether.

What Information Can I Dispute?

Credit reports can contain various types of errors, according to the Consumer Financial Protection Bureau. Here is an explanation of each type:

- Identity errors – personal data errors, such other consumer’s accounts with a similar name listed on your report; accounts opened via identity theft

- Account status errors – incorrect opening or closing dates; incorrect late payment, date of last payment or date of delinquency statuses; duplicated debts

- Data management errors – reposting of inaccurate data; duplicate accounts under different creditors

- Balance errors – accounts listing balance or credit limit errors

If you find errors in your personal information, such as your name or address, Equifax recommends that you contact each of your creditors first to confirm that the information they have is correct. Updating your information can ensure that your creditors report accurate information to Equifax.

For other incomplete and inaccurate information related to your credit history, including public record items, notify Equifax directly via its dispute process. Equifax will investigate the item for free. If the investigation finds that the information in question was reported incorrectly, Equifax will update the information if needed or delete it from your credit file.

What if My Credit Dispute Wasn’t Resolved?

If the Equifax investigation didn’t resolve the dispute, you can take the following steps:

- Contact the lender or creditor directly about the error in question

- Initiate a complaint with the Consumer Financial Protection Bureau

- Contact your state’s attorney general

- Add a consumer statement of 100 words or less to your report explaining why you believe the information to be in error; the statement will be visible to anyone viewing your report

- Request that Equifax forward a copy of your statement to anyone who viewed your credit report recently; you may have to pay a fee for this service

- File another dispute with additional documentation to support your claim

Does Disputing Your Equifax Credit Hurt Your Score?

Initiating a dispute has no effect on your credit score. If the credit reporting agency makes corrections to your report, however, your credit score could change as a result.

For example, if your credit report incorrectly noted that an account wasn’t paid in full, but the credit reporting agency found through its investigation that it was, that information could have a positive impact on your credit score.

Make a Habit of Staying on Top of Your Credit History

Filing an Equifax dispute requires you to gather documentation and follow several steps. When your credit history is at stake, however, the time and effort you invest can be worth the outcome. When was the last time you checked your credit report for inaccuracies?

If you’re not regularly monitoring your credit, you may want to consider ScoreSense. With this product, you’ll receive all three credit reports and scores, as well as daily monitoring, monthly updates, credit alerts – and a Dispute Center that outlines the steps for filing a dispute with each credit bureaus.