Consumer Debt has many effects on our lives, and changes how we view life and make decisions. The type of debt you own also changes how you make those decisions. In this article, we will unpack how debt affects those with high student loans, those with high credit cards balances, and those with expensive car loans to understand how that debt changes the decisions you make.

The Whole Country Has Various Modes of Consumer Debt

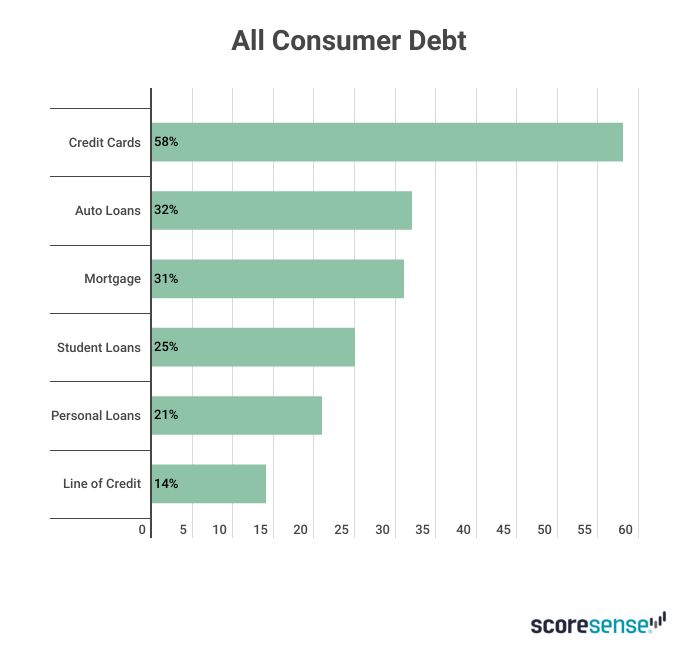

If you live in our modern society, you will likely be in debt somehow. The exception in today’s economy is the consumer who does not owe a creditor any money. According to our recent survey of more than 1,000 consumers in the US, almost 60% of consumers have credit card debt. Homeowners with mortgages account for nearly a third of consumers and 32% have car loans. The recent discussion in the media has been about student loans, which account for 25% of our study. Of note, 21% of consumers have unsecured personal loans and another 14% have a line of credit. In short, debt is pervasive in our economy, and takes several forms.

Consumers Are Encumbered by Student Loan Debt

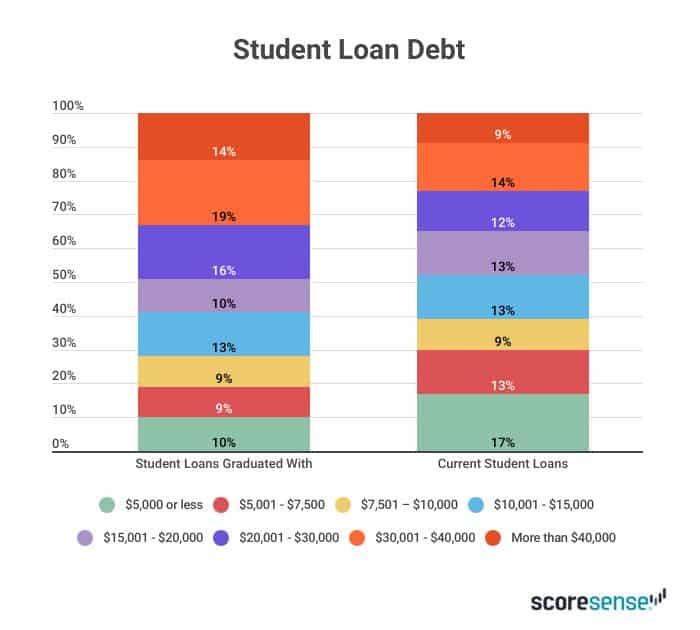

Student loan debt is the biggest debt payment that has no current redeeming value. In other words, student loans are just debt – you can’t use the debt to address things today like you can with credit cards or personal loans. They are a record of how you got where you are and have an impact on life for a significant time. Half of students graduated with $15,000 to $20,000 in loans and still owe $10,000 to $15,000. Using $10,000 in debt as the cutoff between “higher” and “lower” debt, higher student loan owners are more likely to also have personal loans than lower student loan owners. Having significant student loan debt makes having other debt more likely.

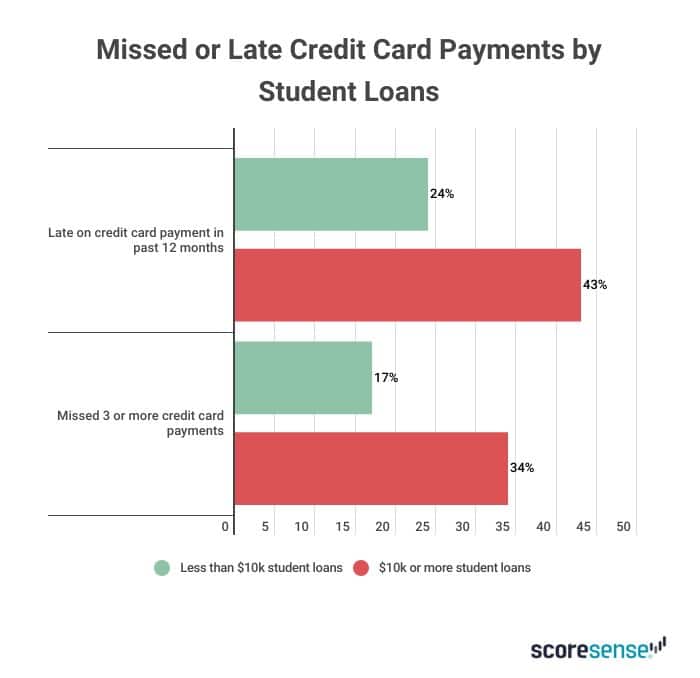

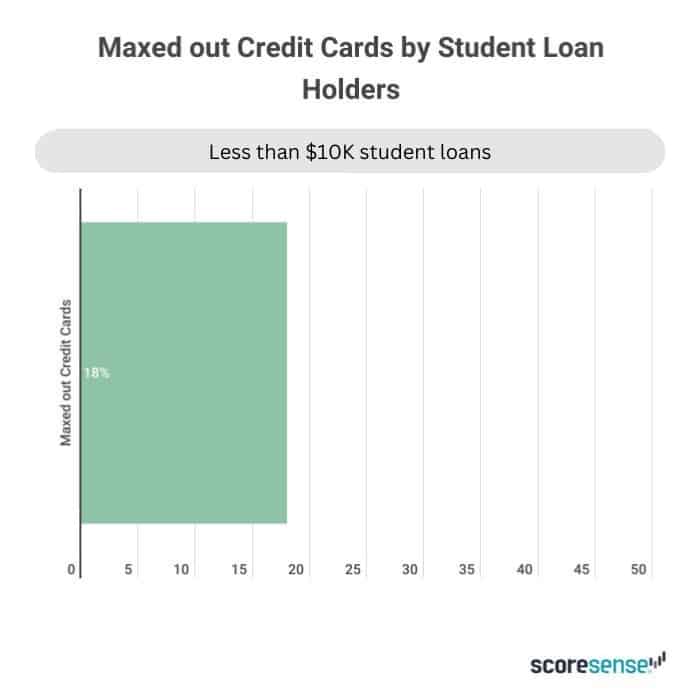

Two-thirds of those with higher student loan debt routinely use their credit cards for things like groceries. 43% with higher student loans have been late with a credit card payment at least once in the past year, and 34% have missed 3 or more credit card payments in the past year, double those with lower student debt. Higher student debt holders have also maxed out their credit cards more than 2.5 times as often as lower student debt holders.

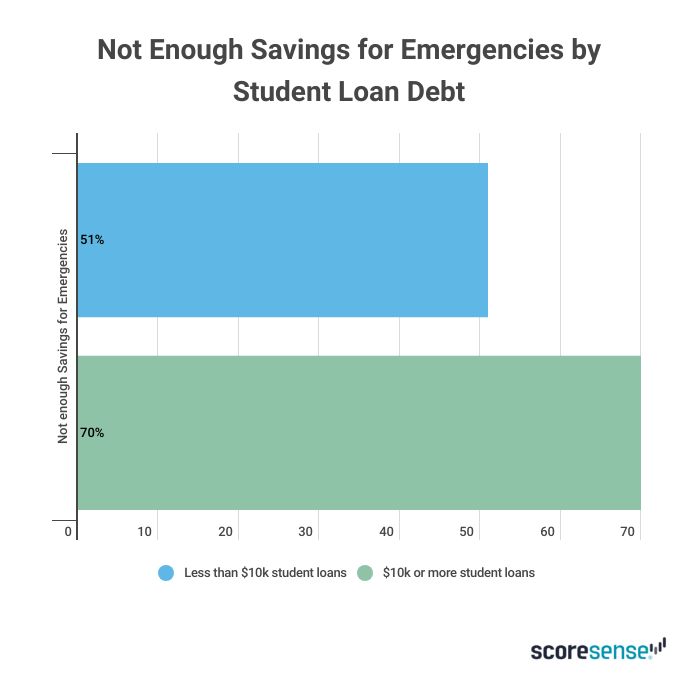

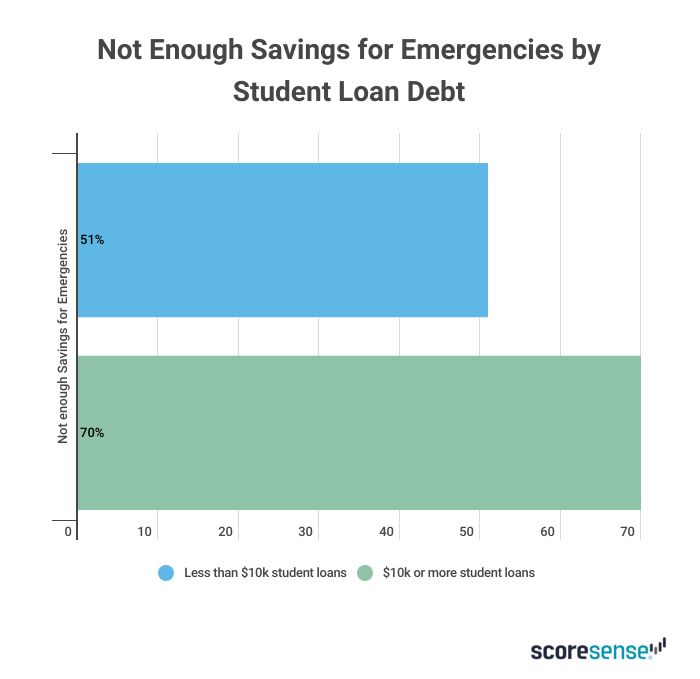

Student debt also impacts access to money. Higher student loan holders are twice as likely to have no savings compared with lower student loans. 70% with higher student loans do not have enough money saved for emergencies compared with 49% of lower student loan holders, and 63% of higher student loan holders ask friends and family for help when there is an emergency.

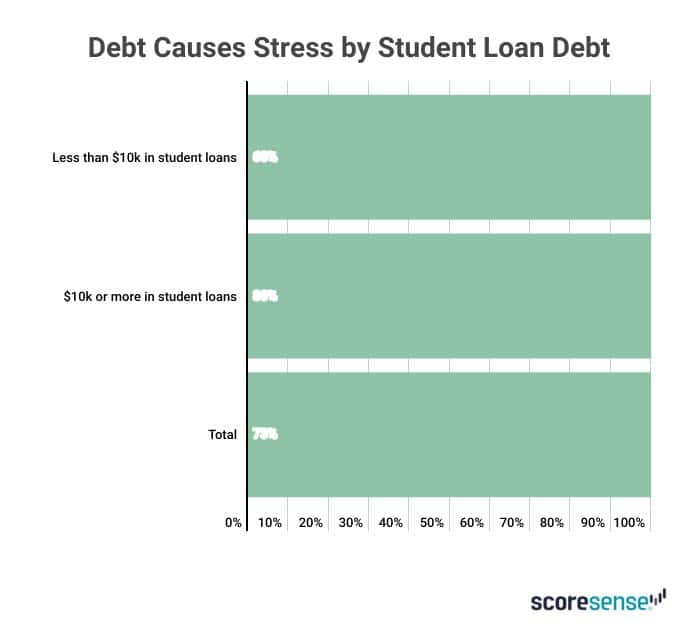

80% of higher student loan holders report that debt has caused a great deal of stress. 63% of lower student loan holders also report this stress, for a total of 74% with student loans reporting stress based on their consumer debt.

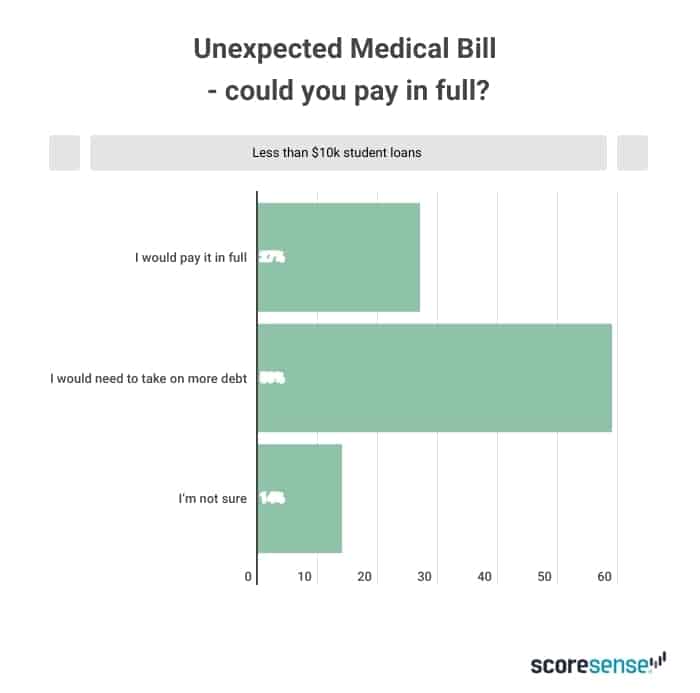

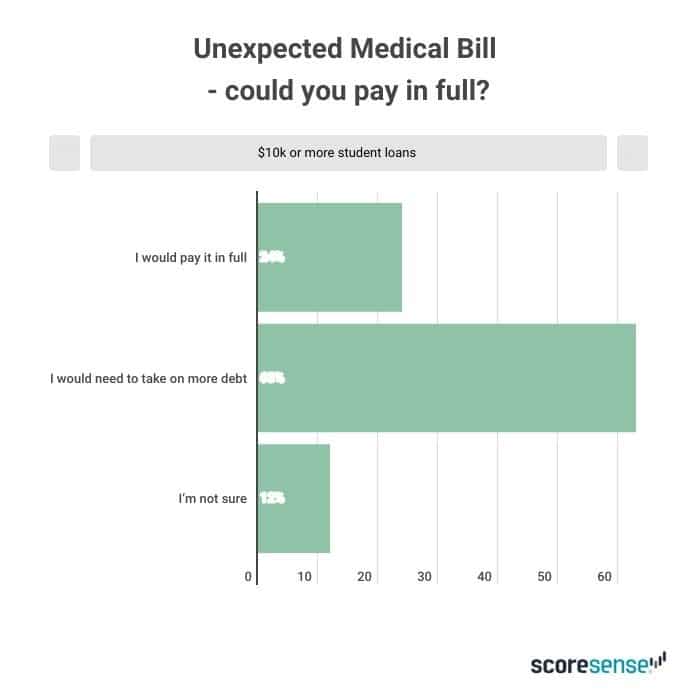

Higher student loan debt is associated with not being able to afford to purchase what they want and making monthly expenses difficult to pay. 22% have considered declaring bankruptcy in the past 24 months. Those with higher student loans are also more likely to take on more debt when faced with an emergency, such as an unexpected medical bill or car repair.

Credit Card Debt Continues to Drag Consumers Down

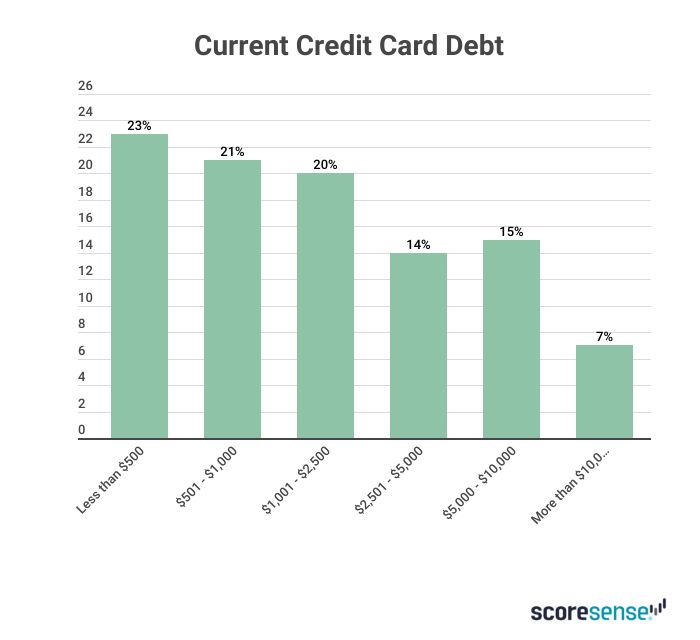

Overall, 77% of consumers owe at least $5,000 in credit card debt, our study cutoff for higher and lower credit card debt. 74% also owe at least $10,000 in student loan debt, making for a tough combination. Additionally, 22% with credit card debt have missed a credit card payment in the past 12 months. 36% of larger credit card debt holders have maxed out a credit card, and an additional 32% are close to maxing out their card.

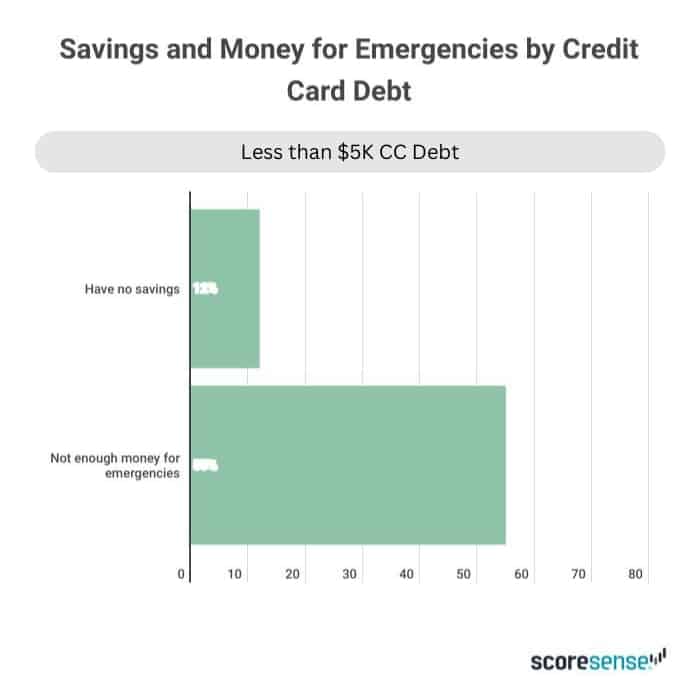

Larger credit card debt is associated with higher car payments and more expensive cars. Higher credit card debt holders are almost twice as likely to have no savings and 75% do not have enough money saved for emergencies.

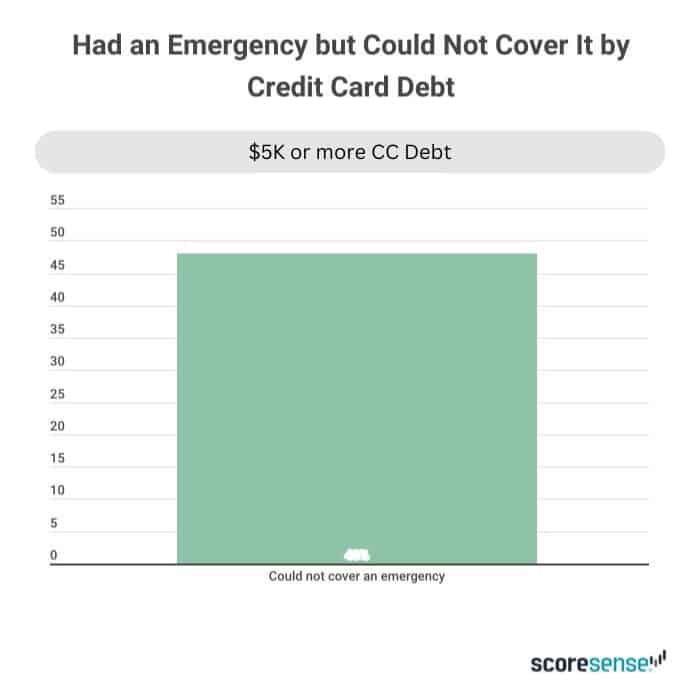

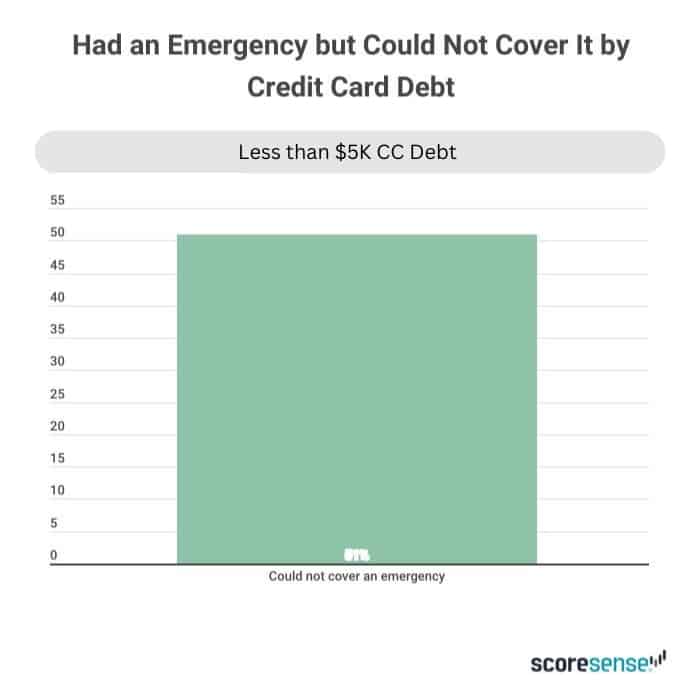

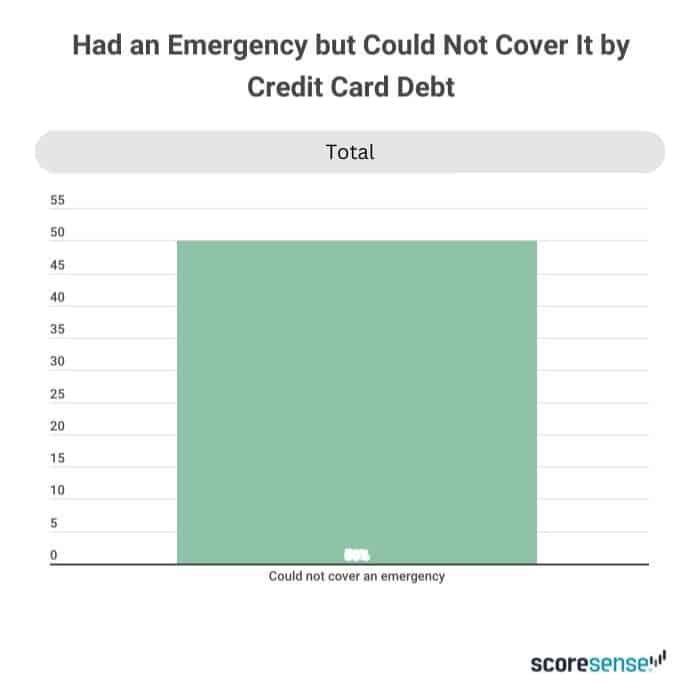

Half with larger credit card debt have had an emergency and could not afford it and 64% used their credit cards to cover the emergency. One-quarter of all credit card debt holders have taken out a personal loan to cover expenses.

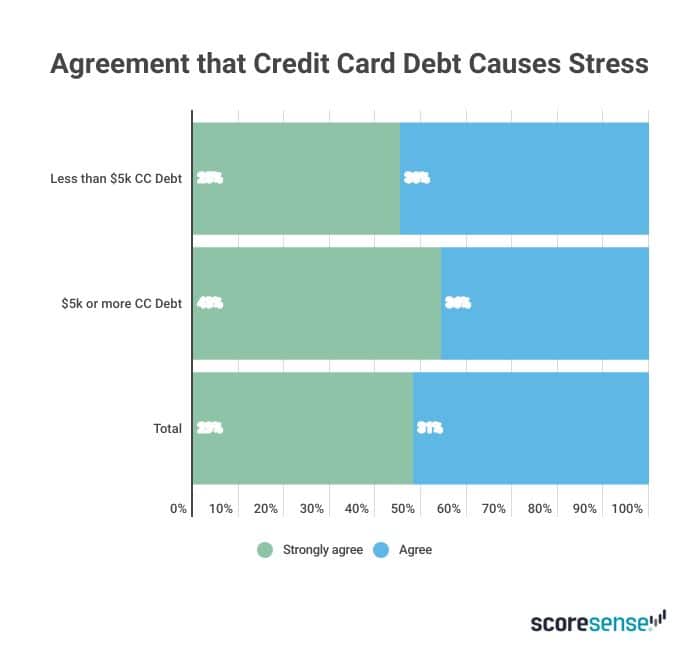

Credit card debt causes stress. 79% with higher credit card debt agree the debt has caused a great deal of stress compared with only 55% with less credit card debt.

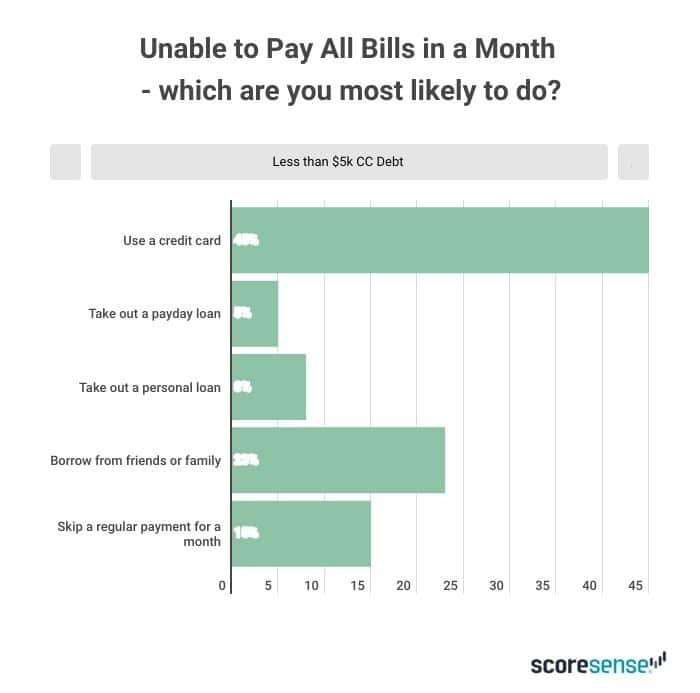

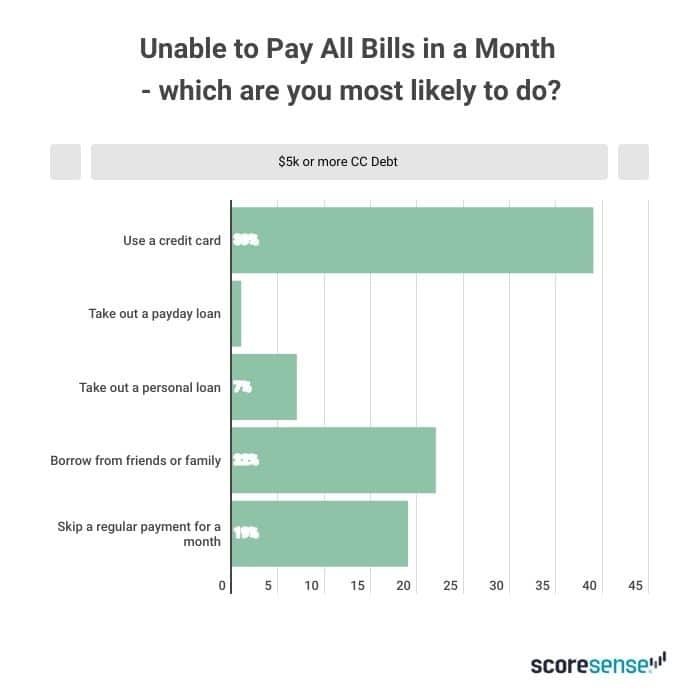

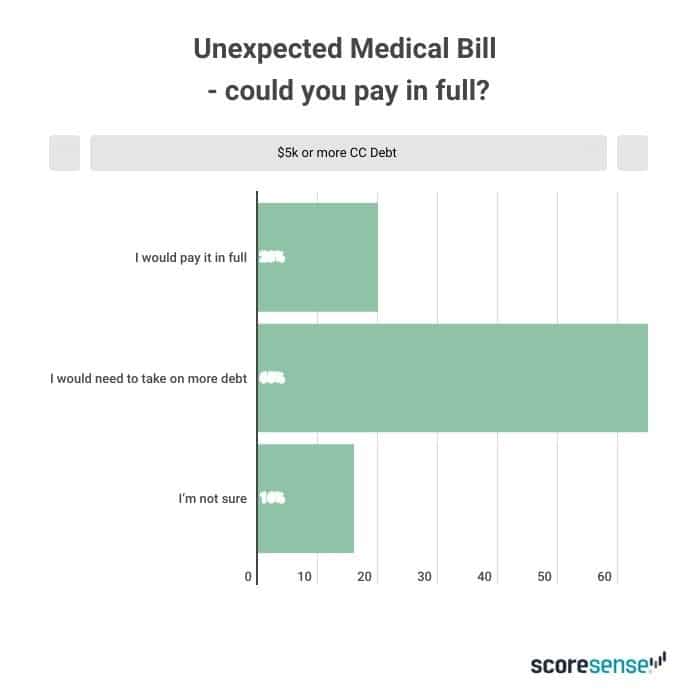

High credit card debt holders have a hard time being able to afford nice things, secure higher interest rates than those with lower credit card debt, and 62% have difficulty paying for monthly expenses. Higher credit card debt holders are more likely to skip a regular monthly payment if they are unable to pay their regular bills, and more likely to take on additional debt to cover unexpected medical bills and car repairs.

Large Car Loans Are Related to Credit Card Use

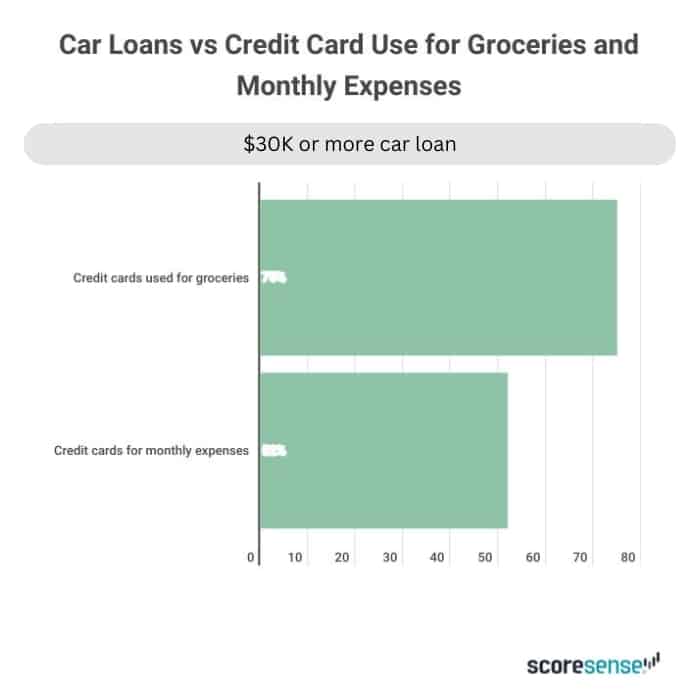

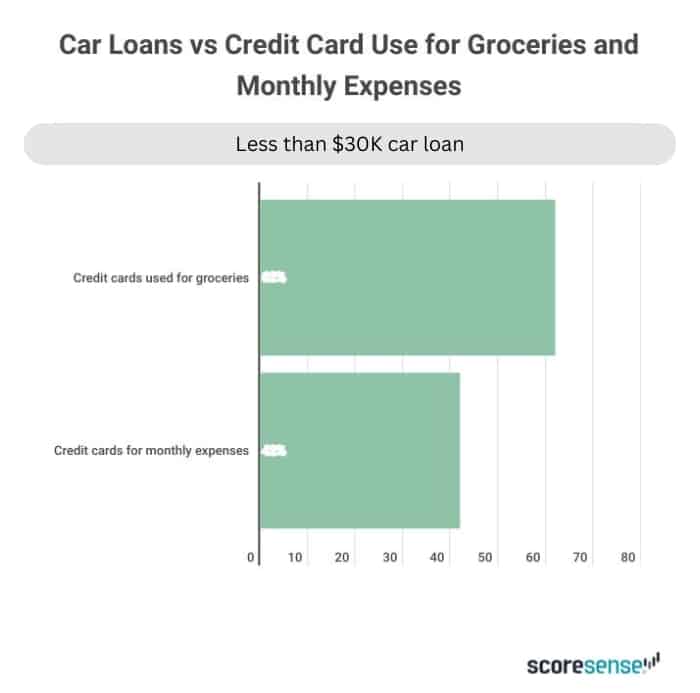

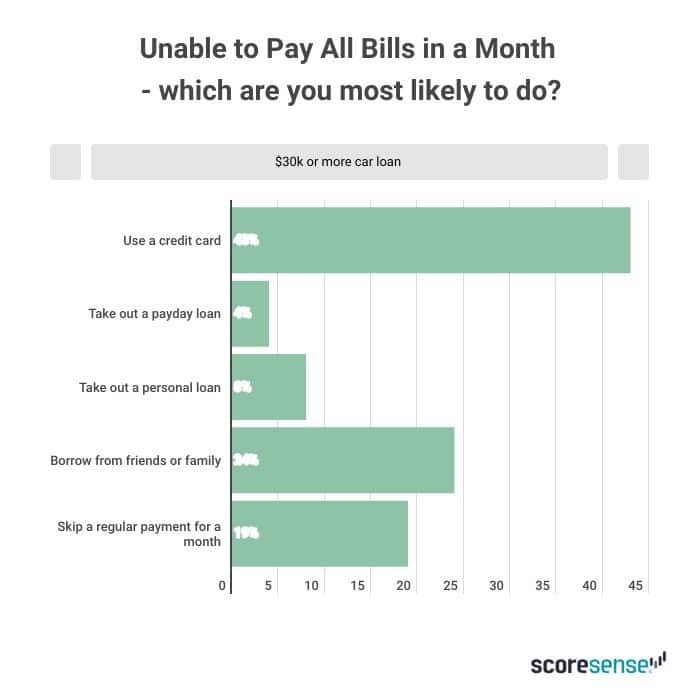

75% of those with large car loans, $30,000 or more, are more likely to use their credit cards to buy groceries and more likely to use their credit card for everyday monthly expenses. They are also more likely to be late on a credit card payment. Large car loans are not necessarily associated with having savings. Those with smaller car loans are more likely to have savings than those with larger car loans, but those with larger car loans are more likely to have $2,000 saved up and much more likely to have $10,000 or more saved. Those with larger car loans, however, are less likely to believe they have enough savings for emergencies.

Emergency Scenarios

Respondents were presented with three scenarios to understand how they would deal with it and the debt implications.

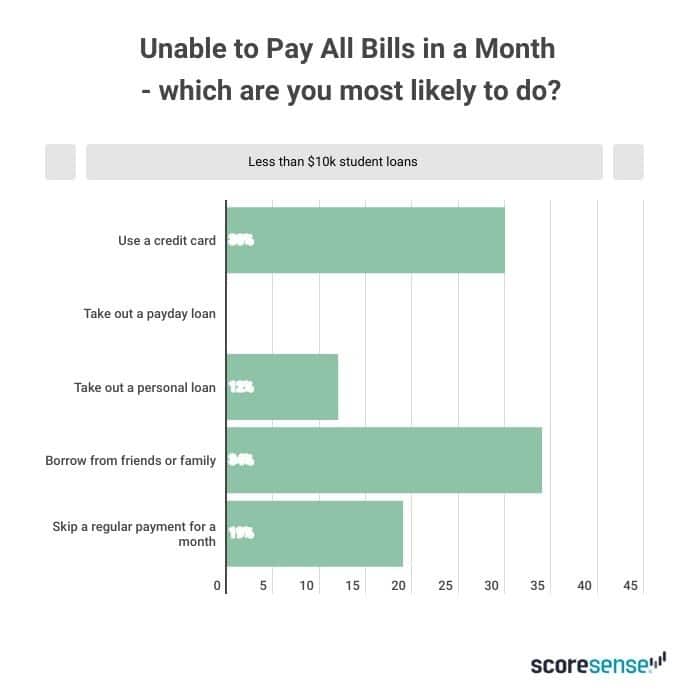

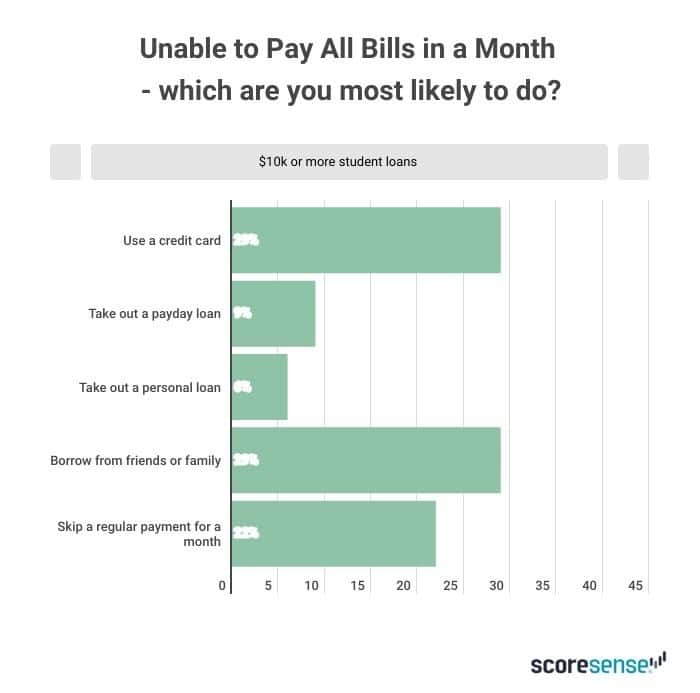

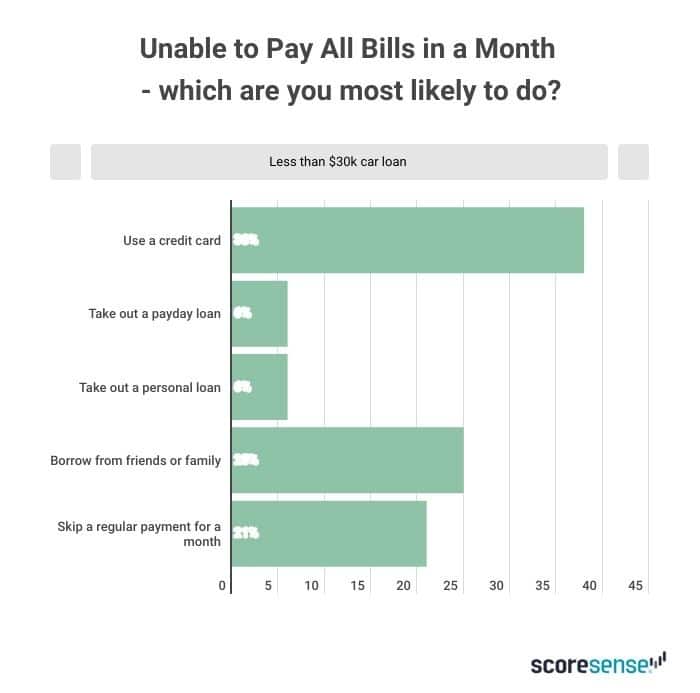

Scenario 1 is not being able to pay all your monthly bills. 31% with student loans would borrow from family and friends. 16% with credit card debt would skip a regular payment. Those with high car loans would use a credit card to pay bills. Overall, running low on money affects your independence by relying on friends and family, negatively impacts your credit by missing a payment, and increases your credit card debt to make up the difference.

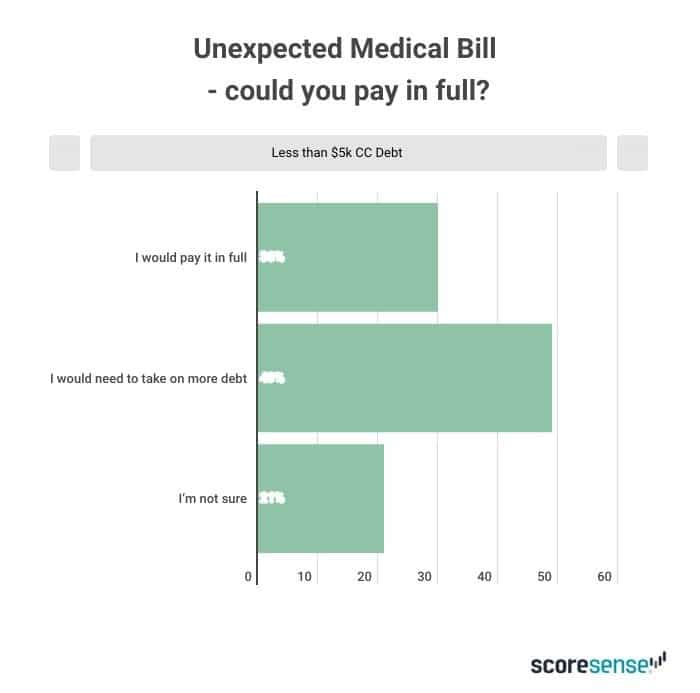

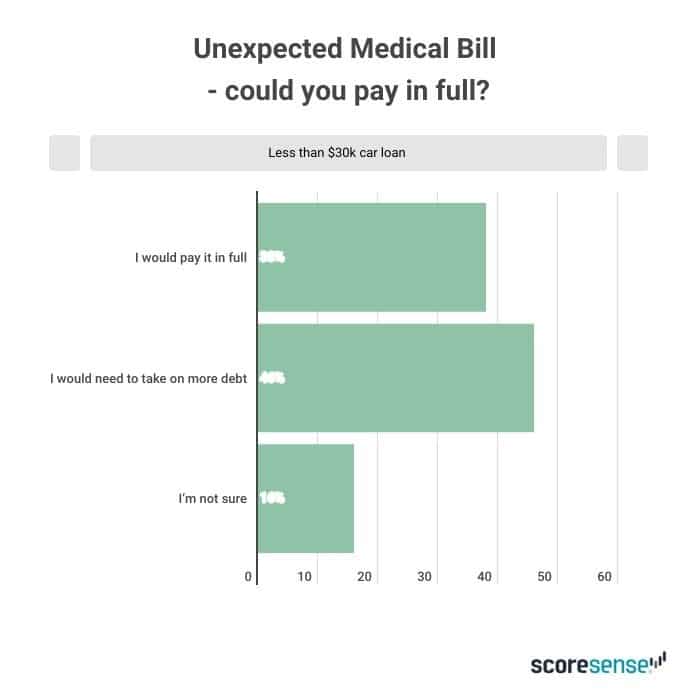

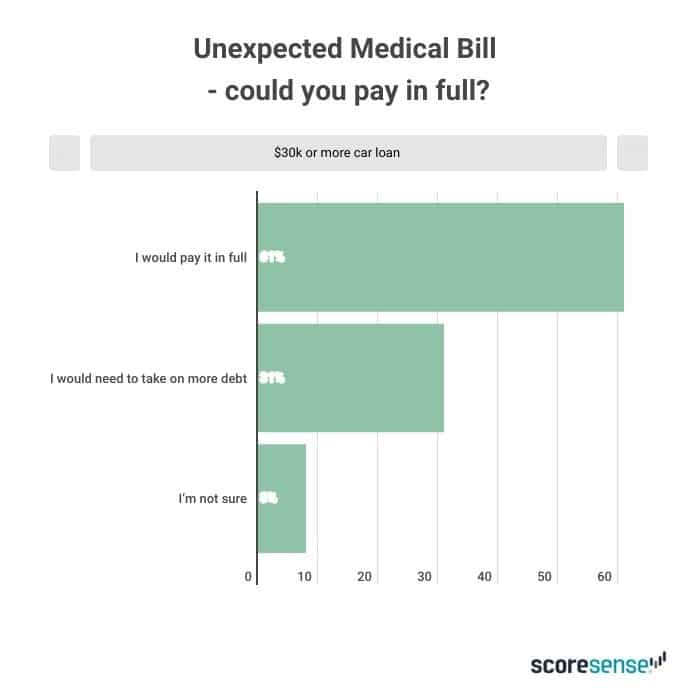

Scenario 2 is an unexpected hospital stay for a medical emergency. Paying the bill in full is the exception. Only 25% with student loans would pay it in full. Most, including those with high credit card debt, would take on more debt. Only 38% of those with high car loans would pay it in full.

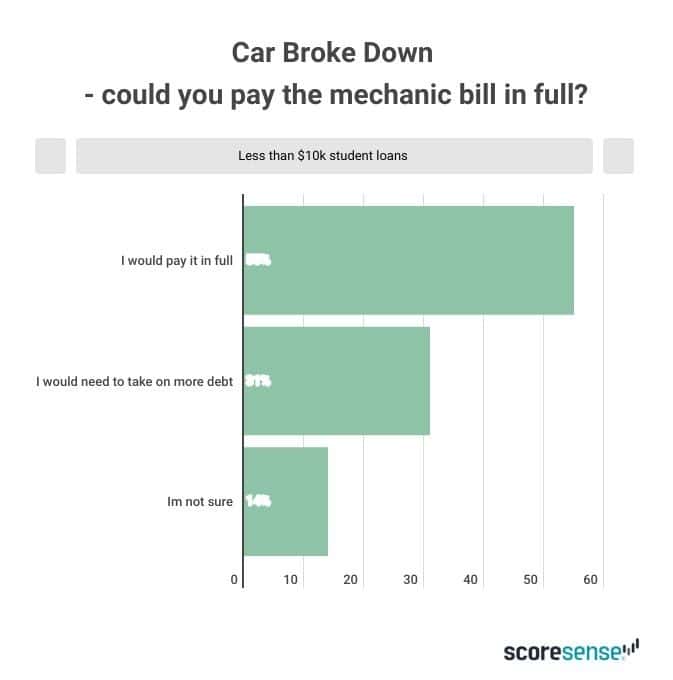

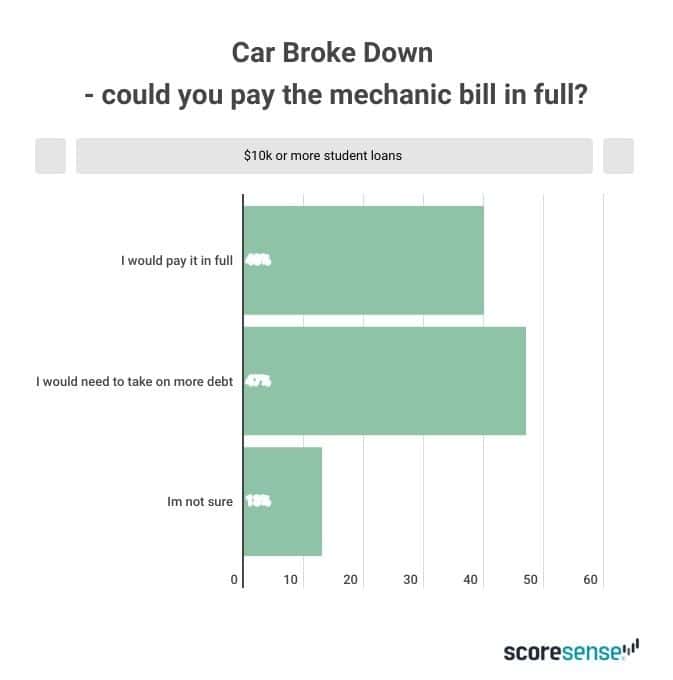

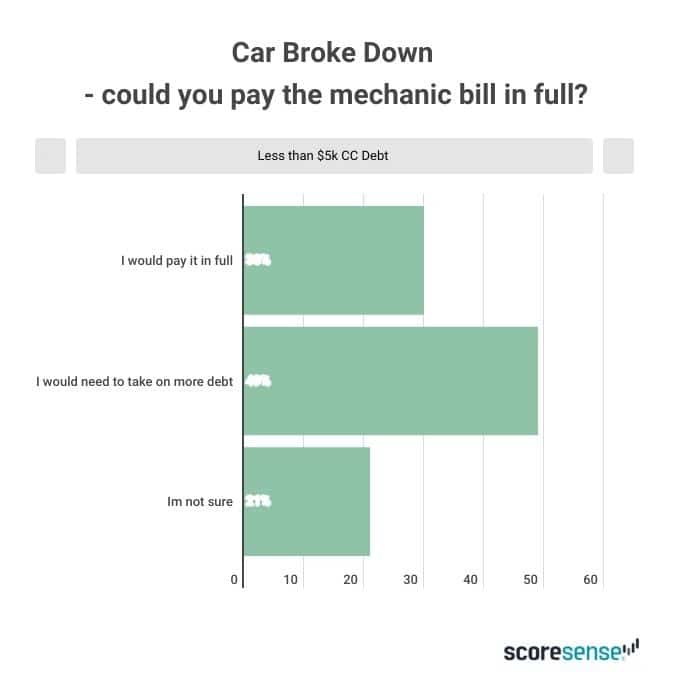

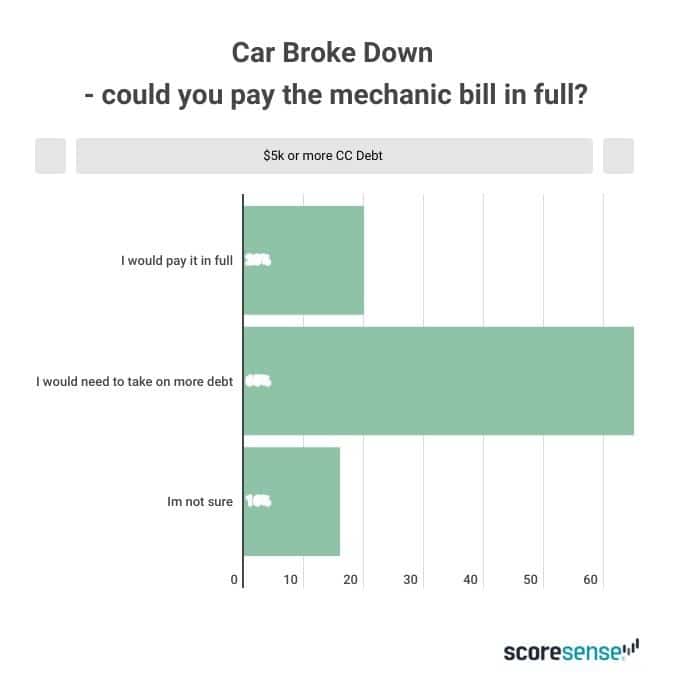

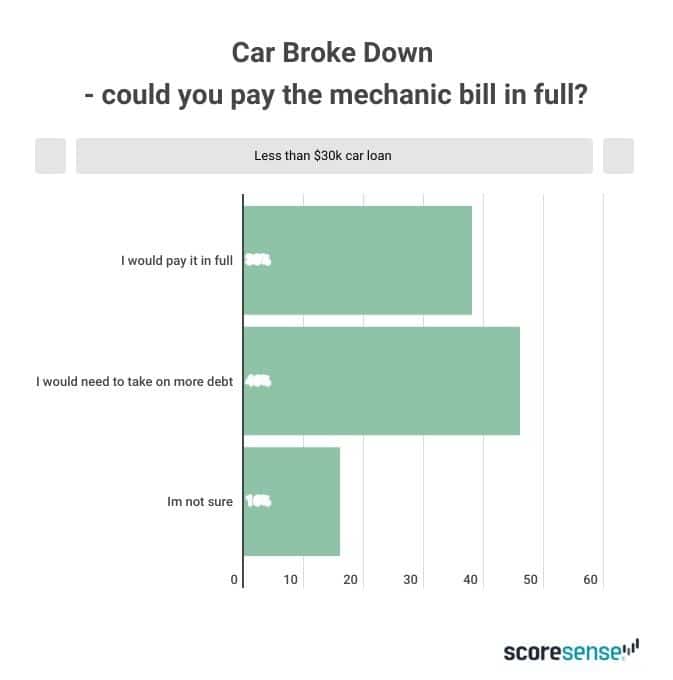

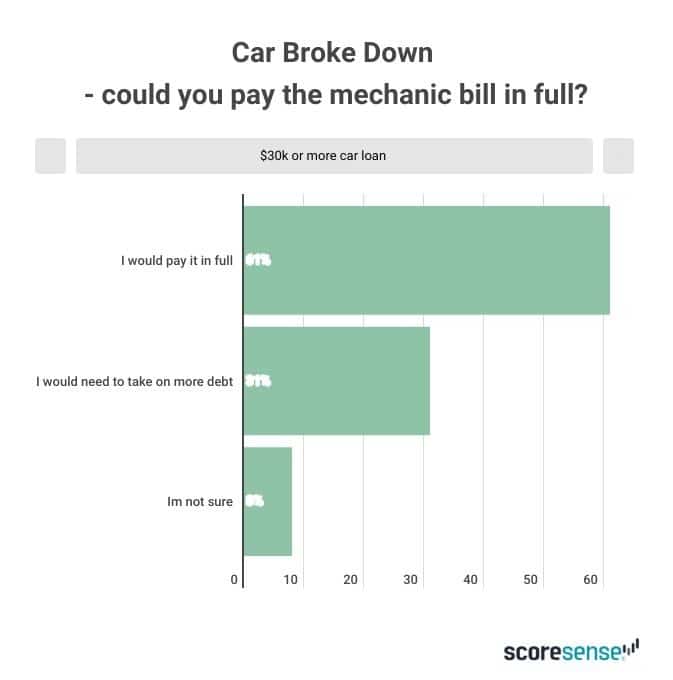

Scenario 3 is your car breaking down and requiring a substantial mechanic bill. Nearly 50% of those with high student loans and high credit card debt would take on more debt to pay the bill. Those with higher car loans are mostly likely to pay it in full.

Methodology

This study was conducted for ScoreSense using the online portal by PeopleFish. Surveys were collected in February 2020, among a sample of 1,063 consumers in the US aged 18+. The margin of error for total respondents is +/-3.1% at the 95% confidence level.