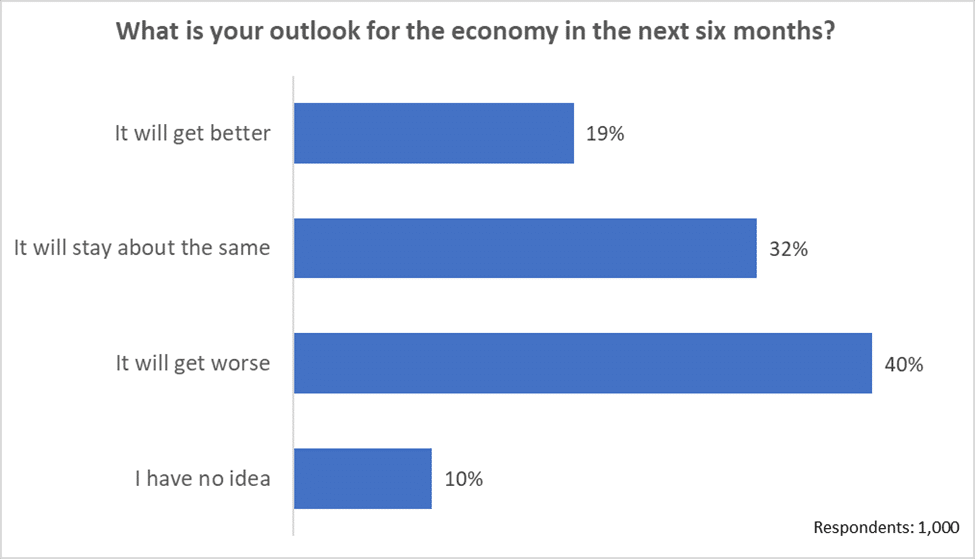

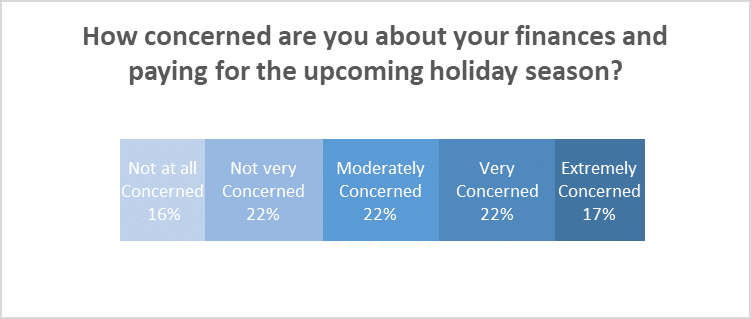

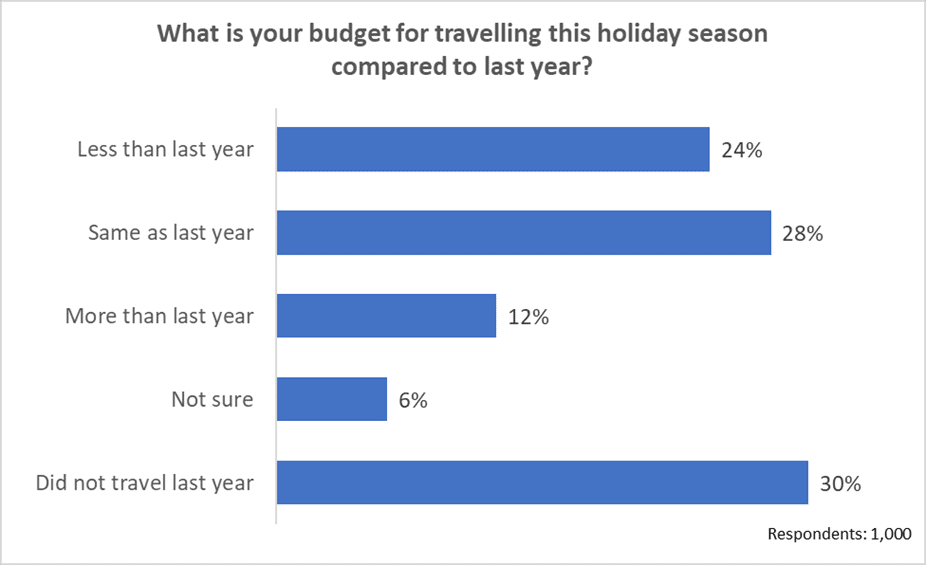

As the 2023 holiday season approaches, consumers don’t see a jolly outlook, with 40% of polled respondents believing the economy will continue to get worse in the next six months. With 40% concerned about their finances to pay for the upcoming holidays, consumers are trying to save money this season. Compared to last year, 43% are expecting to spend less on holiday shopping this year. More than half (55%) plan on just staying home for the season and 24% plan to spend less on traveling compared to last year. Times are tough, as 25% plan to give less to charity this year and one out of four people will be seeking help from charities due to their current finances.

Top Insights

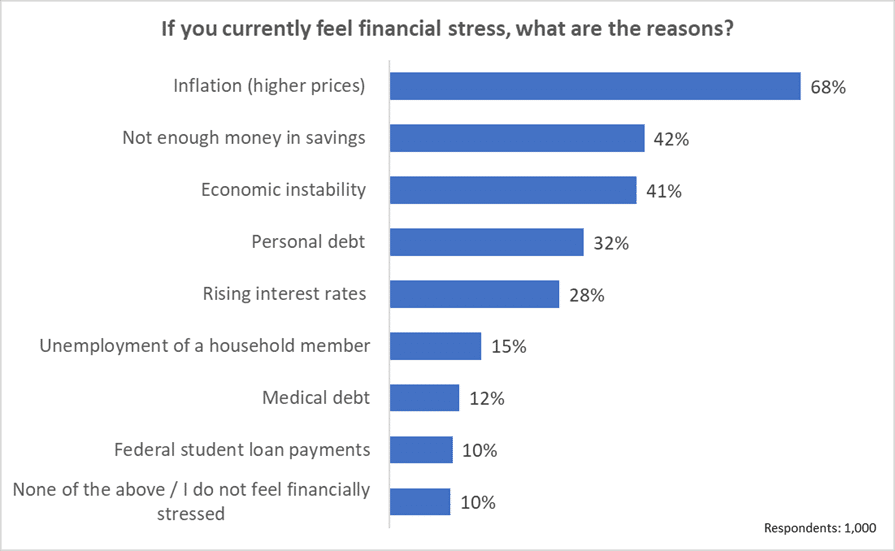

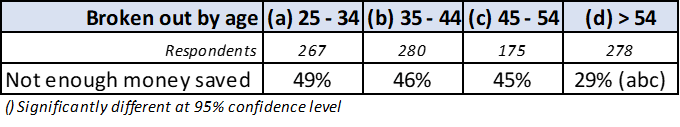

- Nearly 40% of respondents are Very or Extremely Concerned about their finances and paying for the upcoming holiday season. Sixty-eight percent of respondents ranked inflation as the top reason consumers are feeling financially stressed. Not having enough money saved, was the 2nd top response, which was more often mentioned by those under the age of 55 vs. those older.

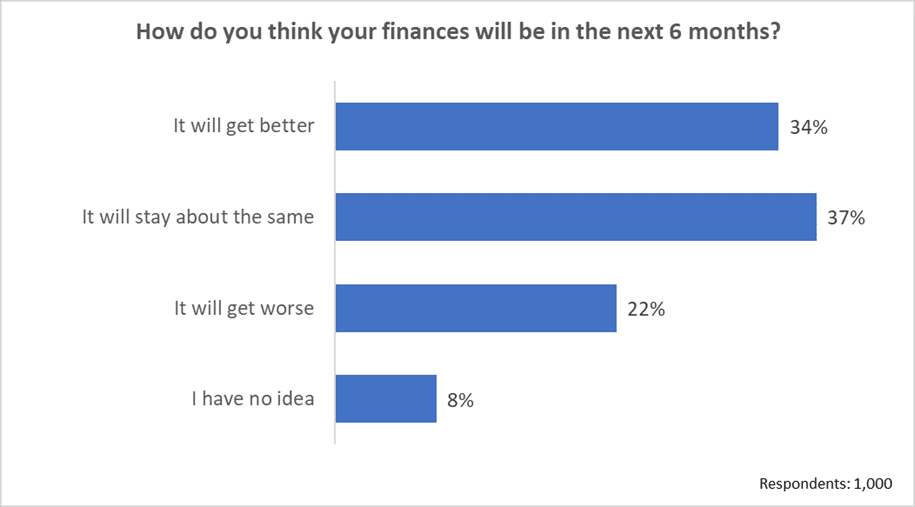

- About one-third of respondents are hopeful and think their finances will get better in the next six months. Those between the ages of 25-44 were significantly more likely to say they think their finances will get better compared to those older.

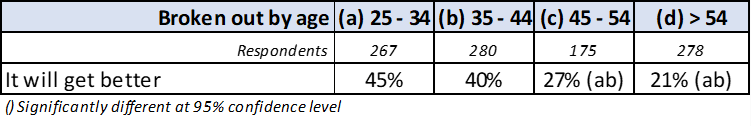

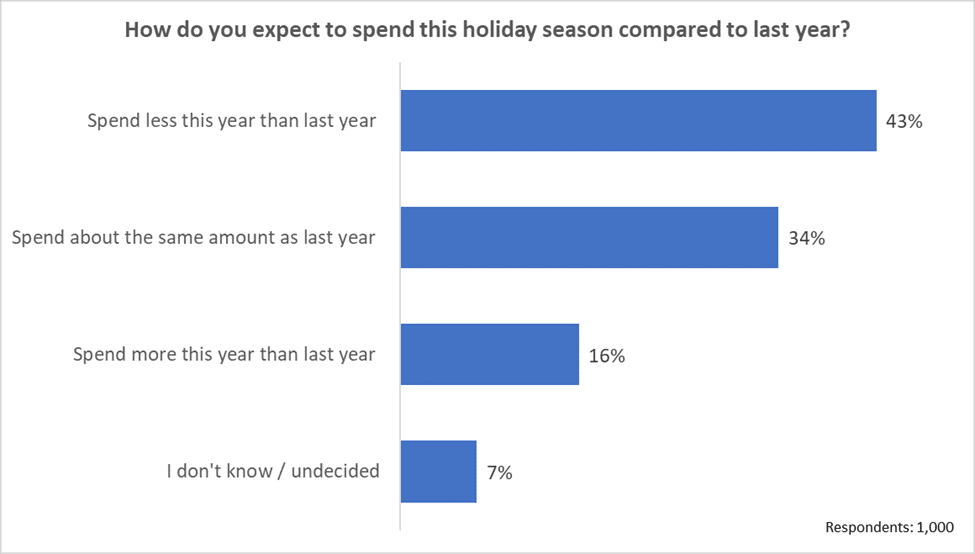

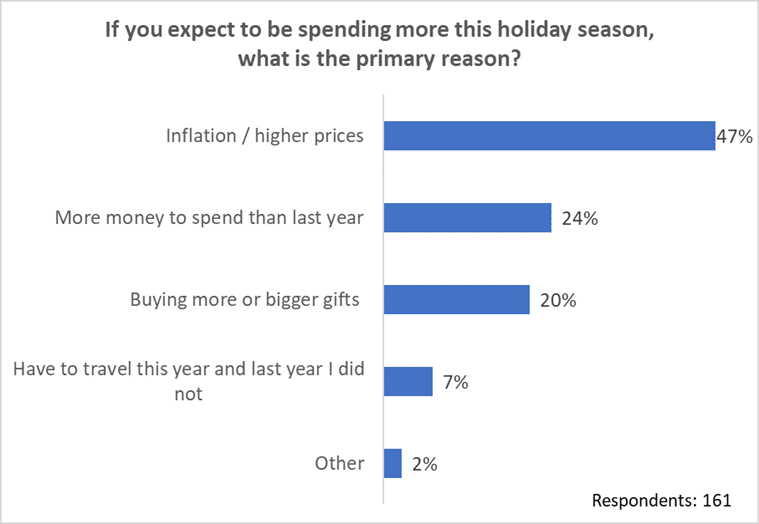

- With holiday shopping season approaching, 43% expect to spend less this year compared to last year. The top reason for spending less this year is that they need to save more money. For those who plan to spend more this year for the holidays, inflation and higher prices is the main reason.

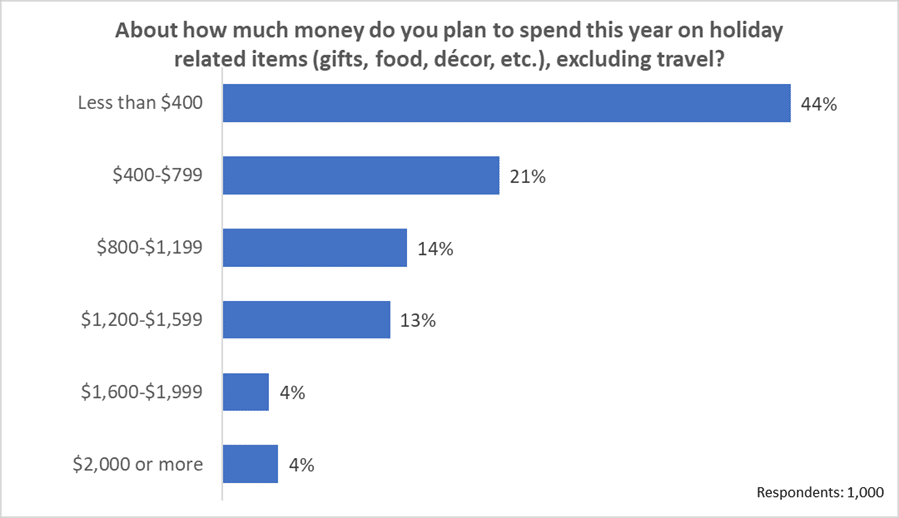

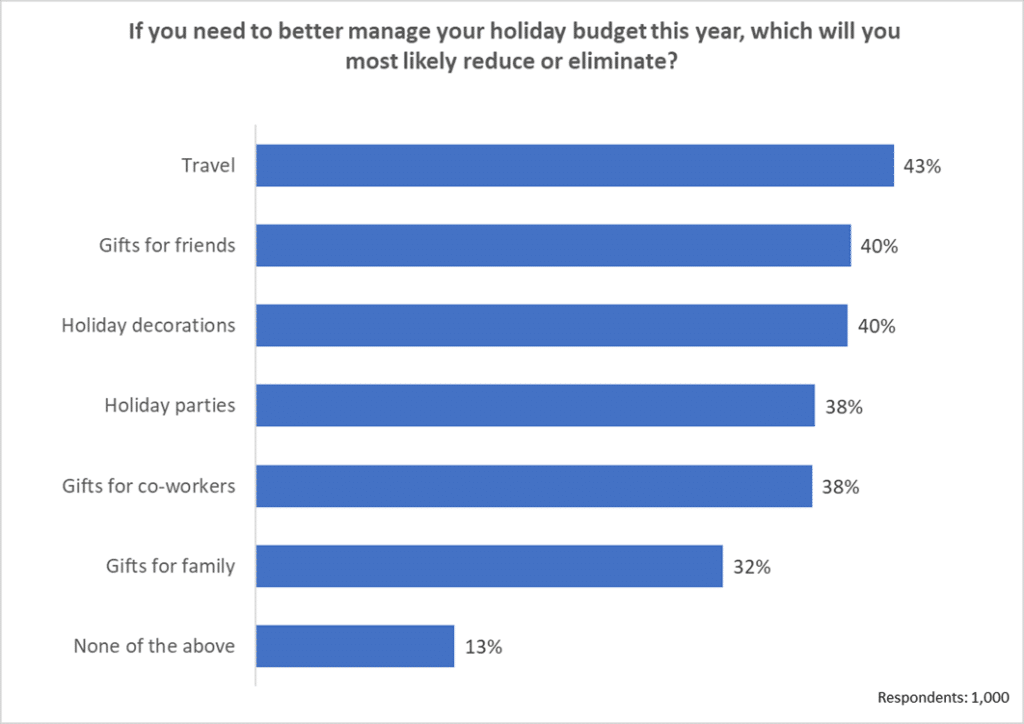

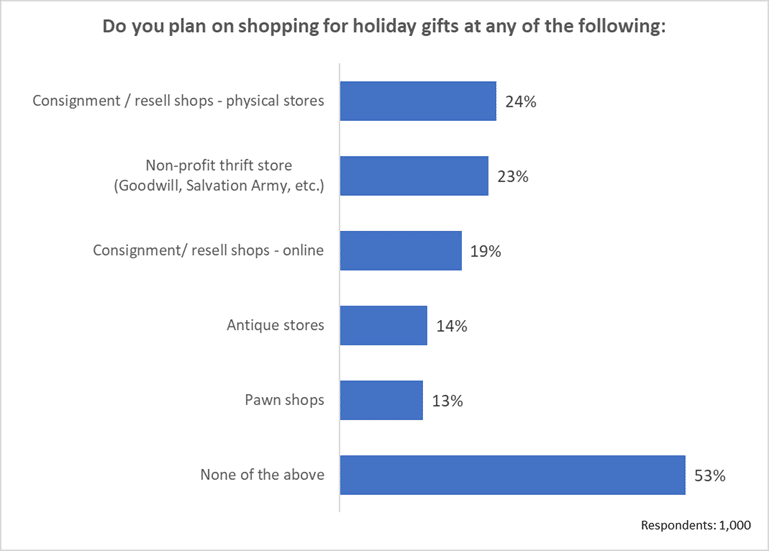

- Consumers’ budgets for holiday spending on gifts, food, and décor for this year are low, with 44% planning to spend less than $400. Reducing or eliminating travel was mentioned by 43% to better manage their budget. Those between the ages of 45-54 were more likely than all other age groups to say they’re reducing or eliminating travel to reduce their holiday budgets.

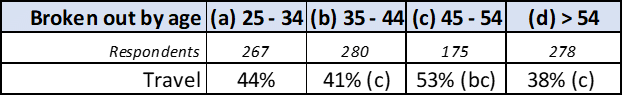

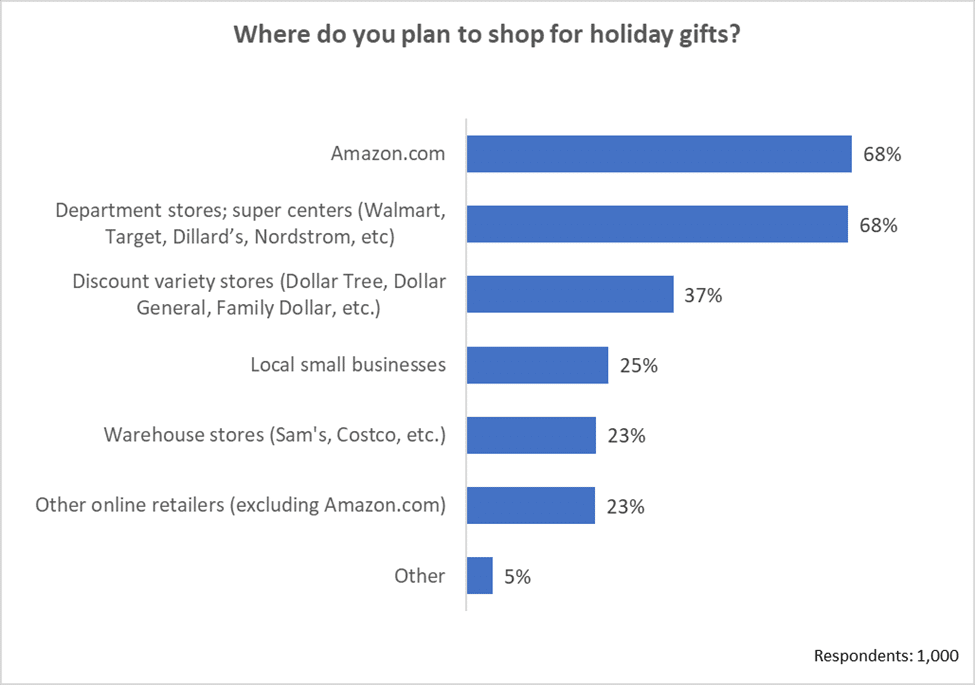

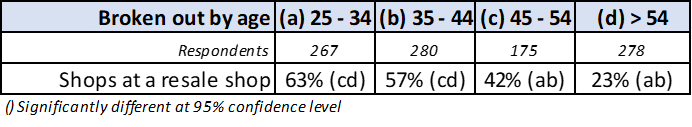

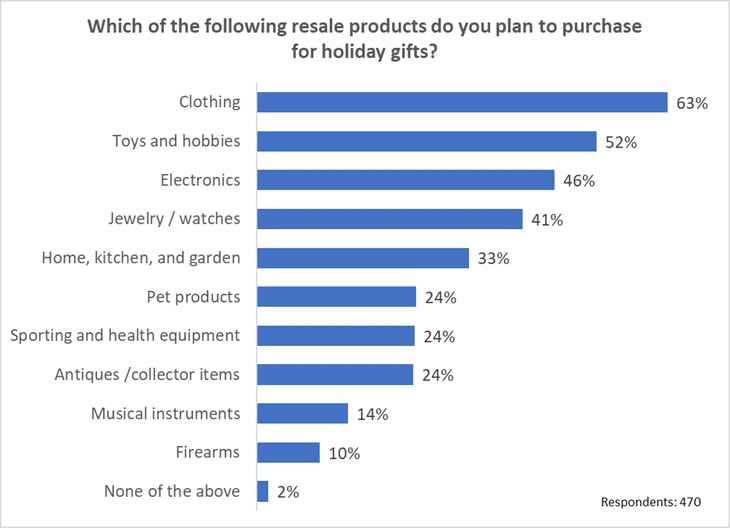

- To shop for holiday gifts this year, 68% mentioned they plan to buy on Amazon.com as well as department stores or super centers. Another 37% said they plan to buy gifts at discount stores. Resell stores such as thrift stores, antique shops, consignment stores, and pawn shops are also a popular option, mentioned by 47% of respondents. Those between the ages of 25-44 were more likely to shop at a resell outlet. Sixty-three percent of respondents plan to purchase clothing and over half mentioned they would purchase toys or hobby items from resell shops.

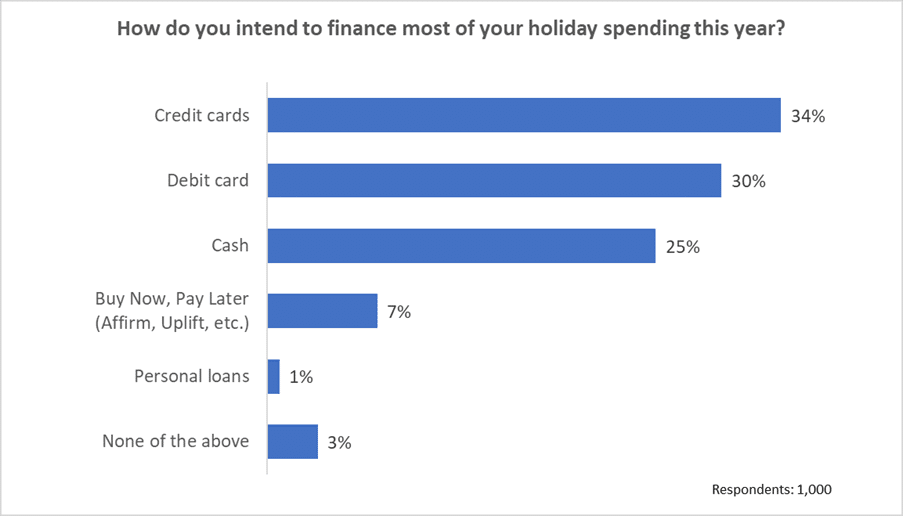

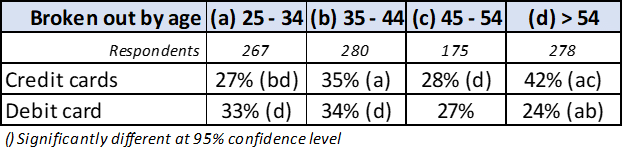

- For 34% of respondents, credit cards will be the main method of financing their holiday shopping. Those over the age of 54 were more likely than younger age groups to say they will use credit cards. Debit cards were mentioned by 30%, more frequently by those between the ages of 25-44.

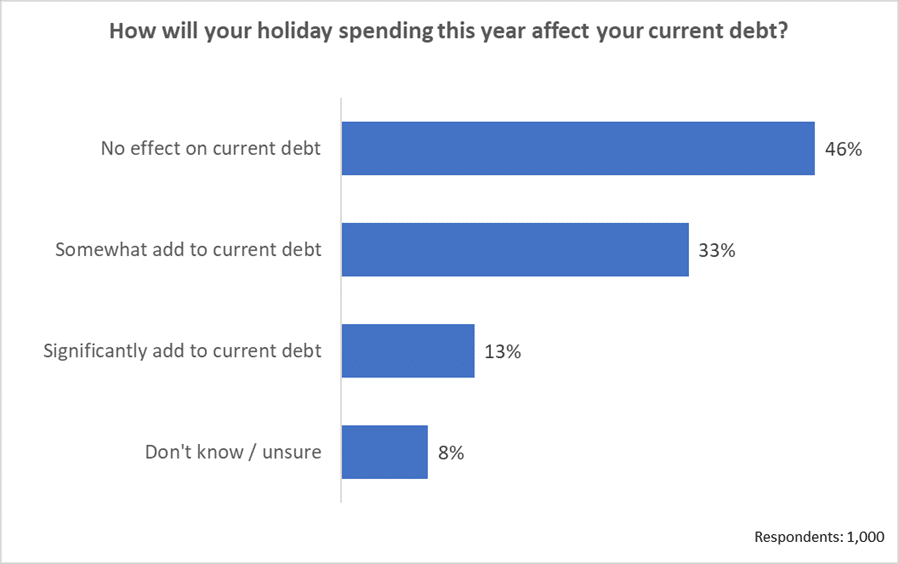

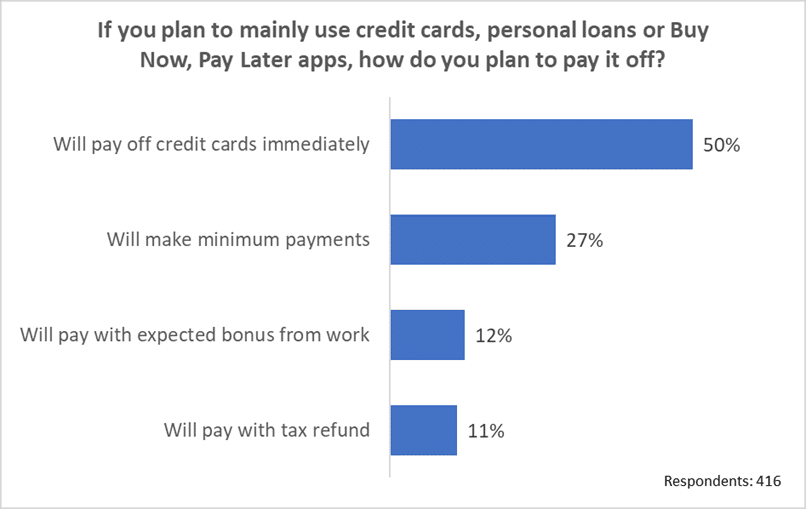

- One-third of respondents mentioned that their holiday spending would somewhat add to their current debt. However, 50% mentioned they will pay off credit cards immediately.

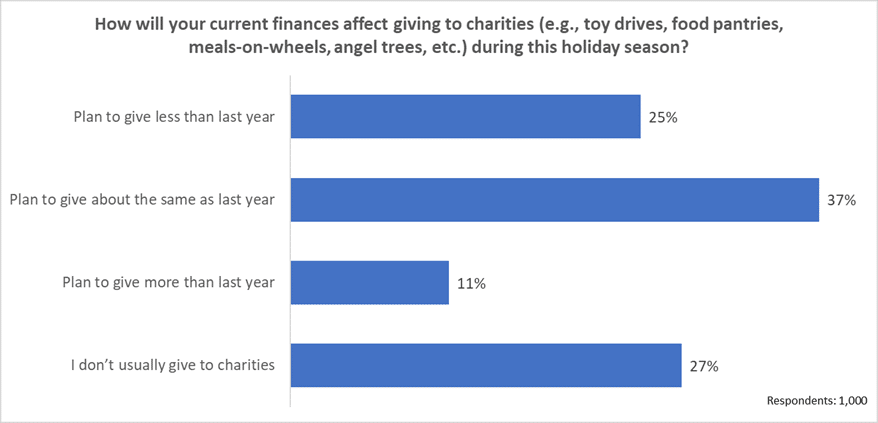

- Holiday season donations to charity, such as toy drives, food pantries, and meals-on-wheels, will remain the same amount as last year for 37% of respondents. Sadly, 25% mentioned they plan on giving less than last year due to their current finances this year.

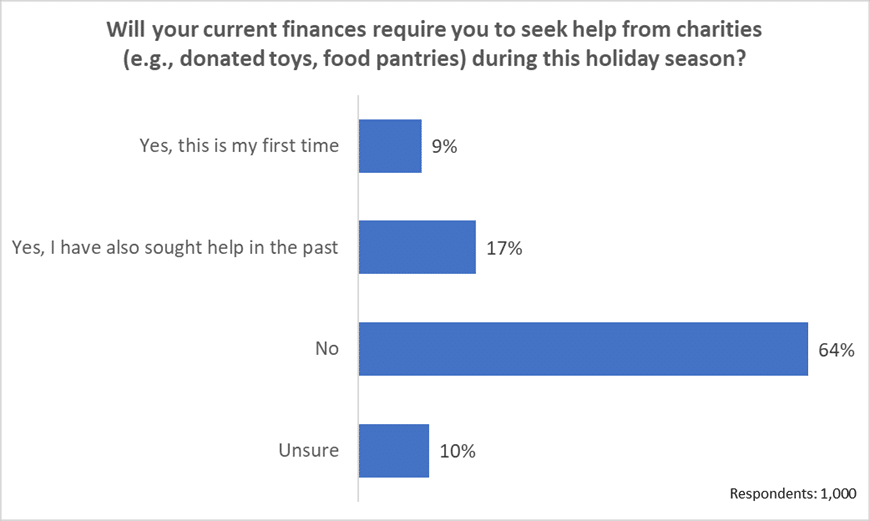

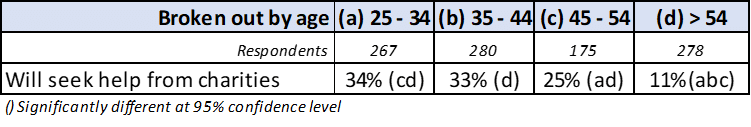

- 1 out of 4 people will be seeking help from charities this holiday season. Those between the ages of 25-44 were more likely to need help from charities compared to older groups.

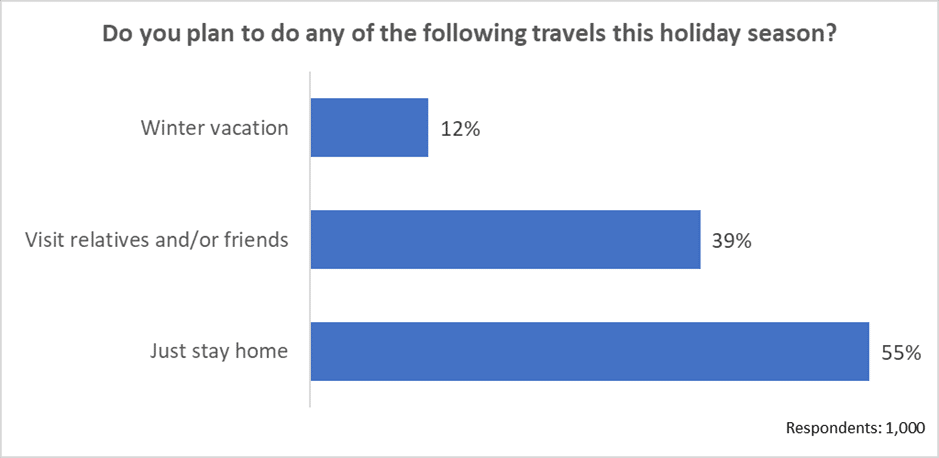

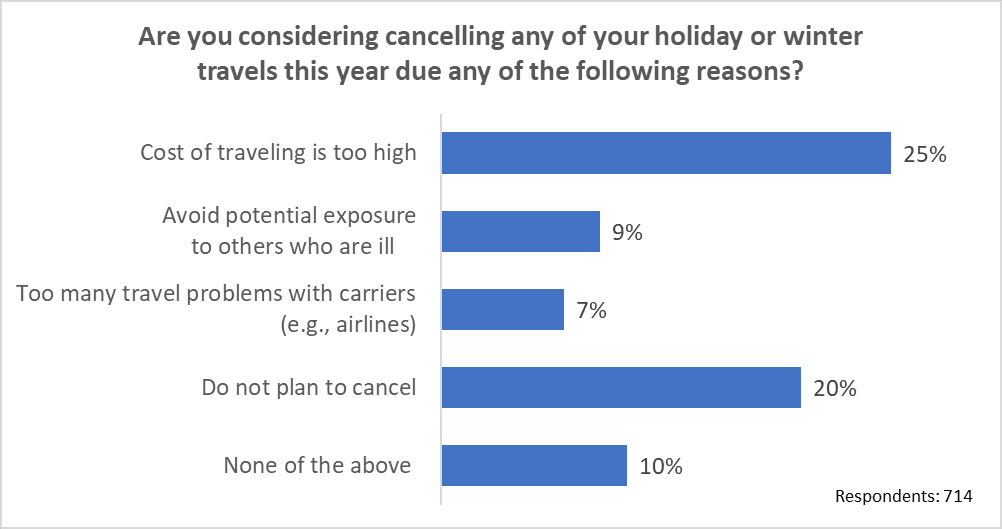

- Over half of the respondents plan on just staying home for the holiday season, while nearly 40% mentioned they will visit relatives and/or friends. Almost one quarter (24%) plan on spending less on traveling this year compared to last year. And 25% are considering cancelling their holiday travels due to the high cost of traveling.

40% of respondents believe the economy will get worse in the next six months.

Nearly 40% of respondents are Very or Extremely Concerned about their finances and paying for the upcoming holiday season.

- 68% mentioned Inflation is the leading reason why they are feeling financially stressed.

- Those under the age of 55 were more likely to mention they did not have enough money in savings compared to those over the age of 55.

- About one-third of respondents think their finances will get better in the next 6 months.

- Those between the ages of 25-44 were significantly more likely to mention they think their finances would get better compared to those older.

43% of respondents expect to spend less this year for the holiday season compared to last year.

For those that mentioned they plan to spend less this holiday season, need to save more money was the top reason, at 42%,

For those that mentioned they plan to spend more this holiday season, inflation was the top response at 47%.

44% of respondents plan on spending less than $400 on holiday-related items (gifts, food, décor, etc.).

One-third mentioned their holiday spending would somewhat add to current debt.

- To better manage holiday budgets this year, 43% mentioned they would most likely reduce or eliminate travel.

- Those between the ages of 45-54 were more likely to reduce or eliminate travel this year compared to all other age groups to better manage budgets.

- 68% of consumers plan to shop at Amazon.com as well as department stores/super centers.

- 37% plan to shop at discount variety stores such as Dollar Tree, General Dollar, etc.

- 47% of respondents plan on shopping at a resale/consignment store for holiday gifts.

- Those between the ages of 25-44 were significantly more likely to shop at these places compared to those of older age groups.

- For those who plan to shop at a resale or consignment store, 63% mentioned they plan to purchase clothing as holiday gifts.

- Over 50% mentioned they would get toys or hobby items for gifts.

- 34% mentioned they would use credit cards to finance their holiday spending this year.

- Those over the age of 54 were more likely to use credit cards to fund holiday spending compared to younger age groups.

- 30% mentioned they would use debit cards to finance their holiday spending.

- Those between the ages of 25-44 were more likely to use debit cards compared to older age groups.

For those using credit cards, personal loans, or Buy Now Pay Later apps for holiday purchases, half plan on paying credit cards immediately.

25% of respondents plan to give less than last year to charities this holiday season due to their current finances.

- 1 out of 4 respondents will seek help from charities this holiday season.

- Those between the ages of 25-44 are more likely to need help from charities compared to older age groups.

- Over half of respondents plan to just stay home for the holiday.

- Nearly 40% plan to travel for the holiday season to visit relatives and/or friends.

24% plan to spend less than last year on traveling for the holiday season compared to last year.

25% are considering cancelling their holiday or winter travel this year because the cost of traveling is too high.

Scope: Survey was conducted in October 2023 using Pollfish.com with 1,000 adults in the U.S. over the age of 24.