Study Shows: Pervasive credit card usage is driving higher balances and increased fraud

Our recent survey of 1,002 consumers in the United States revealed a strong reliance on credit cards for everything from airfare and hotels, to gas and even household bills. This reliance on credit cards is fast becoming an important part of American society and crosses all generations, even as the cultural debate between “Boomers” (55 —73 years) and “Millennials” (23 – 38 years) rages on. There are some distinct differences between the generations that are rooted in fact, but reliance on credit cards is common to them both. This reliance has driven higher, expensive balances and an increase in fraud, but opportunities for credit card companies as reliance shows no signs of slowing.

Reliance on credit cards is not a generational concern

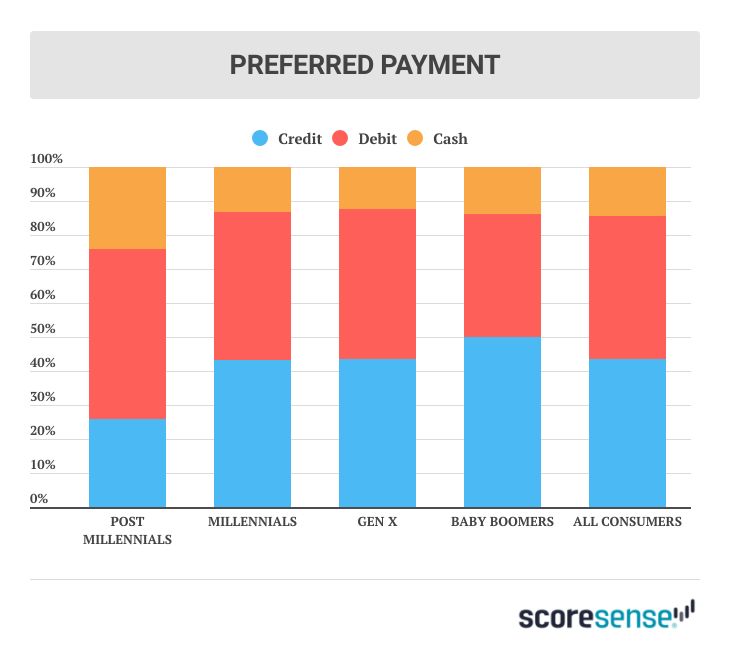

Owning multiple credit cards is becoming as common as owning a smartphone. 44% of all consumers, and half of Baby Boomers, prefer using their credit cards for everyday purchases.

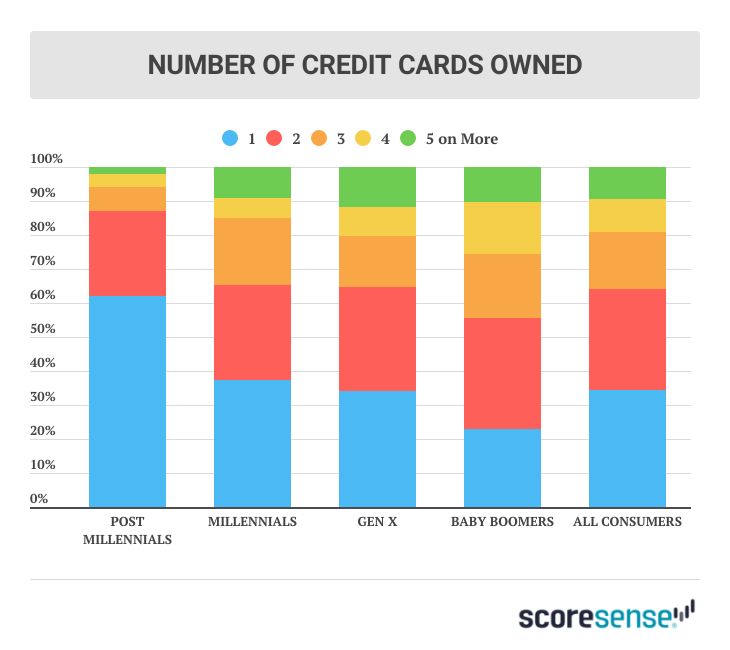

Over one-third of all consumers own at least 3 credit cards. Boomers have the most cards, and highest propensity to use those cards, but all generations are using credit cards as a regular payment option for a variety of purposes.

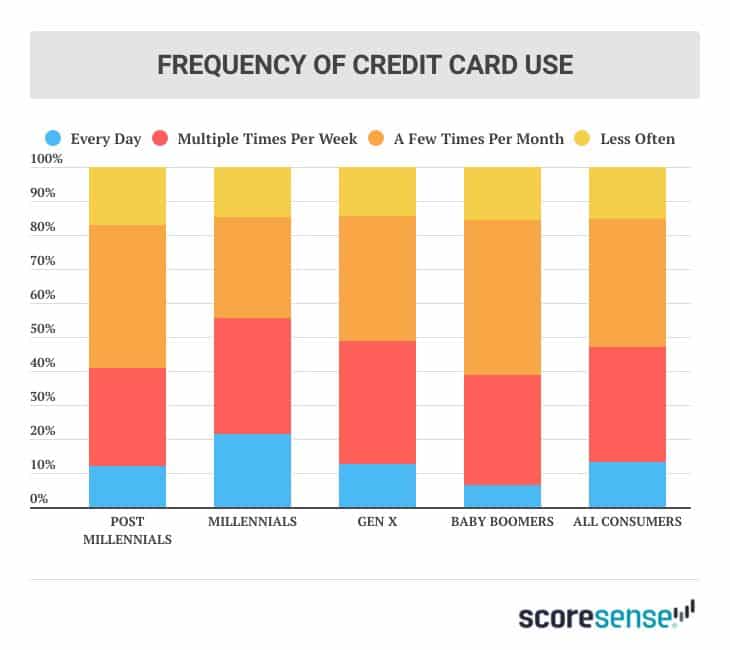

In addition, almost half of consumers use their cards multiple times per week or more often.

Credit Limits Keep Expanding

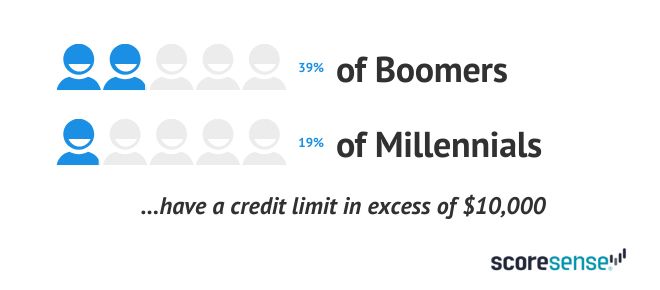

As high usage continues, credit card companies continue to offer higher limits to appease our credit card-hungry society .

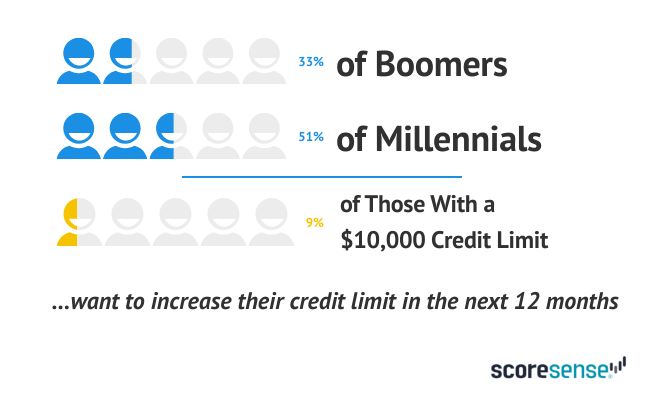

Additionally, 24% of Millennials chose an additional credit card for a higher credit limit.

Increased credit limits do not necessarily lead or equate to better credit

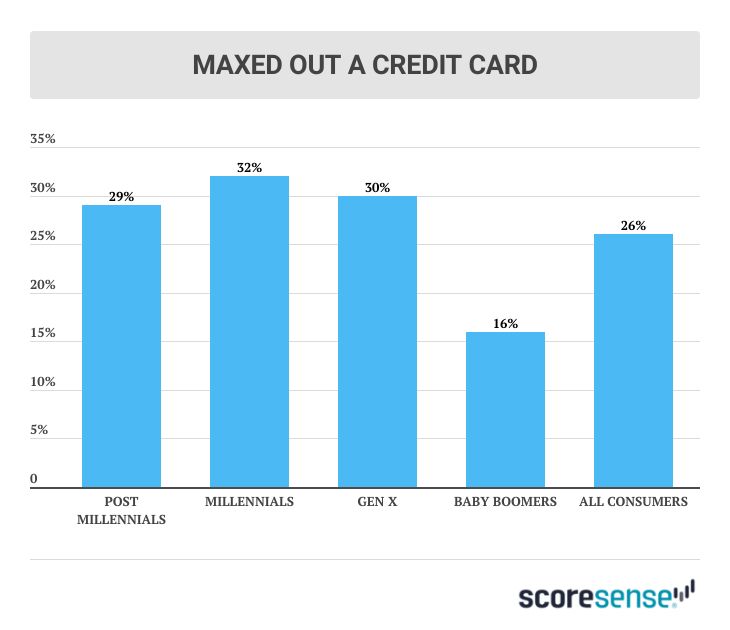

Despite the increase of large credit limits across all generations, over a quarter of consumers have maxed out at least one card in their lifetime.

Additionally, 11% of Boomers and 33% of Millennials pay the minimum, or less than the minimum payment each month, leading to inflated interest and detrimental impacts on credit scores. 23% of all consumers have also used a credit card cash advance in the last 12 months. 28% of consumers have consolidated their credit card debt through card transfers, but 64% continued to use the old card after transferring the debt to a new card, leading to high and growing balances.

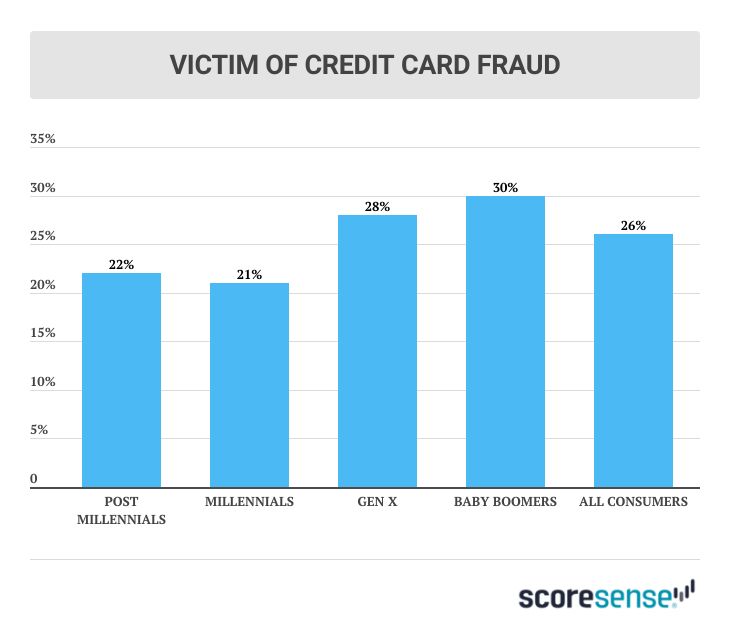

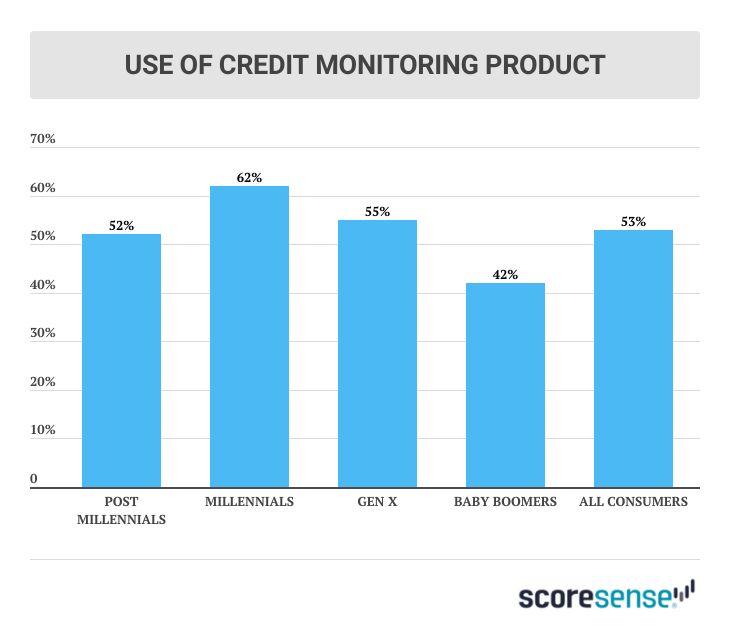

Credit card fraud is rising; credit monitoring is not

The pervasiveness of credit card use has spawned an increased concern around credit card fraud. Our study shows that 26% of all consumers, and 30% of Baby Boomers, have been a victim of credit card fraud. Despite the risk, only 53% of all consumers, and 42% of Baby Boomers, use a credit monitoring product to keep an eye on their credit. The good news: 54% of Baby Boomers and 76% of Millennials have reviewed their credit report within the last month and understand the importance of keeping an eye on their credit.

There is a disconnect between knowledge of interest rates and the self-reported importance of low-interest rates.

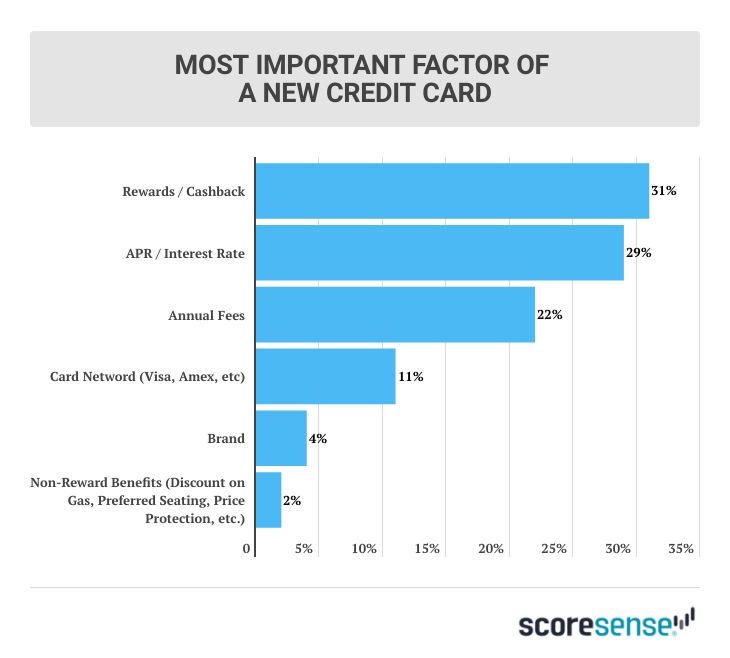

When asked about the interest rate on their cards, only 42% were able to identify their average interest rate, despite a whopping 75% carrying a balance on at least one card. This is in stark contrast to the universal usage and preference for credit cards. Consumers who prefer to use their cards, have plenty of credit limit to spend, usually only make the minimum payment, and have a propensity to max out their cards, but don’t know their interest rate, is a recipe for disaster. All this despite APR being the #2 most important factor for choosing a new credit card.

Additionally, only 55% know the late payment fee for their cards, and only 39% know the penalty APR for a late payment. This is especially important as 13% of all consumers, and 21% of Millennials have missed a credit card payment in the last 12 months.

This lack of knowledge of an important part of their financial life has the ability to drive a lifetime of debt that only appears to be increasing.

Methodology

This study was conducted for ScoreSense by Panel Consulting Group. Surveys were collected during December 2019, among a sample of 1,002 respondents aged 18+. The margin of error for total respondents is +/-3.1% at the 95% confidence level.