The benefits of charitable giving have long been documented, from the pragmatic impact that generosity has on the recipient to the emotional significance such actions have on the soul.

Now research has found that another common characteristic among charitable givers: good credit scores. While this correlation may seem random at first, understanding why the link exists makes perfect sense. Read on to learn why charitable givers have higher credit scores than non-givers.

Snapshot of Charitable Giving

In 2018, Americans gave $427.7 billion to charitable causes, a 7% increase from the previous year. (Figures from 2019 have yet to be published.) Income, changes in tax laws that promoted higher returns, and causes close to the heart, including faith-based donations, all had an impact on where, why and how much people donated.

Last year, the 100 top charities — including United Way, Feeding America, Salvation Army and Habitat for Humanity — collectively received donations totaling $51.5 billion (which translates into 12% of all charitable donations).

However, all donators, regardless of how strongly they feel about climate change or mitigating hunger, fulfill one requirement for giving. They have the financial means to contribute.

Good Credit Promotes Philanthropy

When people prioritize philanthropy, often it’s because they’ve budgeted their income in ways that allow them to share some of their funds. Further, those who prioritize how their funds are allocated tend to be conscientious of spending habits.

Both realities are also tied to good credit scores, which is backed by qualitative research.

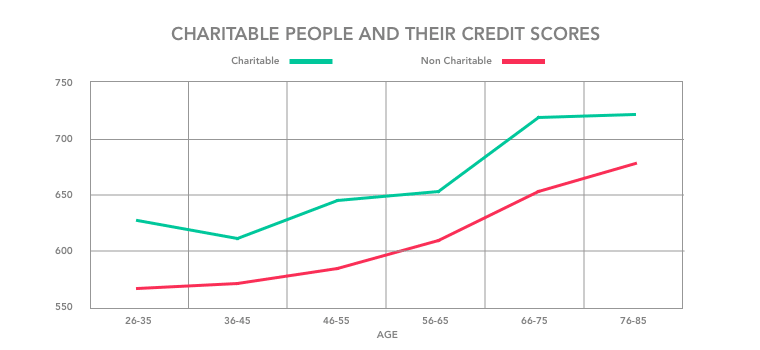

ScoreSense researchers analyzed data of 3,535 consumers between May 2019 and December 2019. The analysis revealed that those who donate to charity have an average credit score of 675 to 700. Those who don’t give have an average credit score range of 600 to 625.

“Positive credit scores are a signal of financial health, which leads to less stress and more happiness,” explains Brian Sullivan, vice president of marketing at ScoreSense. “People who are happier and healthier tend to contribute to philanthropic causes.”

Credit Score Trends

ScoreSense’s analysis of credit scores showed that there were far more people in the lower ranges than the upper ranges, spotlighting the opportunity for consumers to learn how certain actions can impact their credit scores, and finances in the short and long term.

“A low credit score can mean the difference between paying a few hundred dollars in interest to a few thousand dollars over the course of the loan,” Sullivan says. “The more money you can save in interest rates, the more you’ll have for discretionary spending and charitable giving.”

Individuals can also do “good works” for their credit scores with these credit knowledge tips:

- Make credit card and loan payments on time, every time. Payment history accounts for 40% of credit scores.

- Avoid credit card churning or opening up many different lines of credit. Every time you apply for a credit card, the creditor makes an inquiry to see your credit reports. Inquiries account for up to 5% of your score, and too many inquiries may have a negative impact.

- Instead of closing older credit cards, consider leaving them open and use them to make a one-time purchase. Credit age accounts for up to 10% of your credit score.

- Pay down debt. Outstanding debt is 35% of your credit score. Work toward having a 30% or less credit utilization ratio, which is the amount of debt you owe compared to how much credit you have.

“Credit scores in the higher range offer a wealth of opportunities,” Sullivan says. “Make good scores a priority, and then parlay that good into other purposes, too.”