Purpose: To understand the effect inflation has on parents and their ability to pay for their child’s education and activities.

Top Insights:

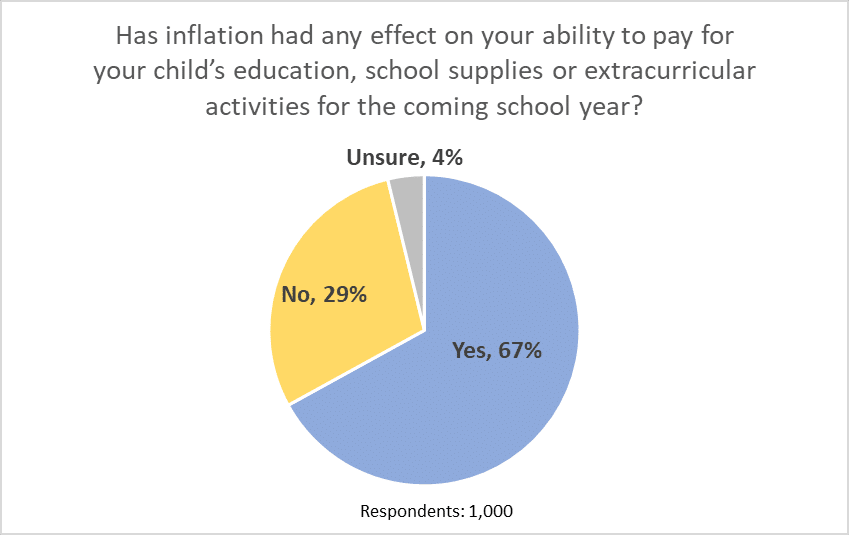

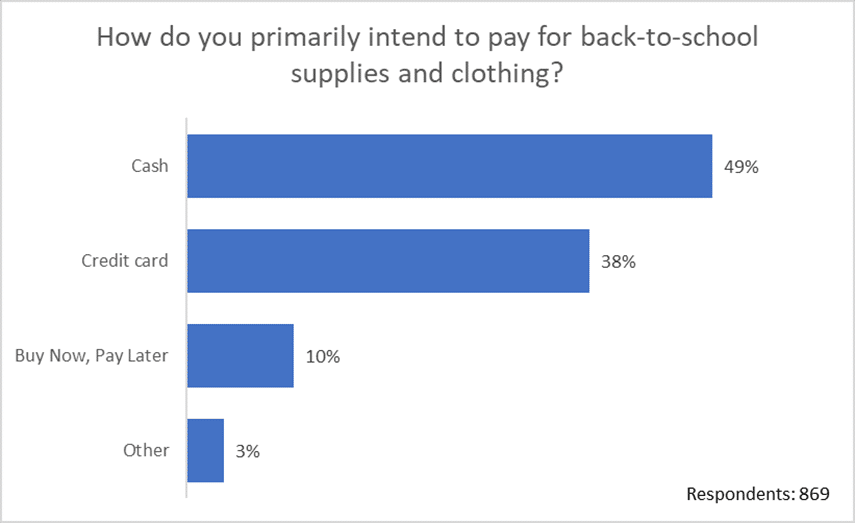

Another school year approaches and prices of goods have gone up due to inflation, which is affecting 67% of parents with children in grade school through college in their ability to pay for their child’s education, school supplies, or extracurricular activities.

Parents with children in grade school (Kindergarten – 12th grade)

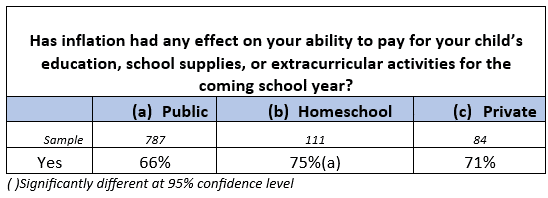

- Nearly half of grade school parents plan on using cash and 38% plan to use credit cards to pay for back-to-school supplies and clothing.

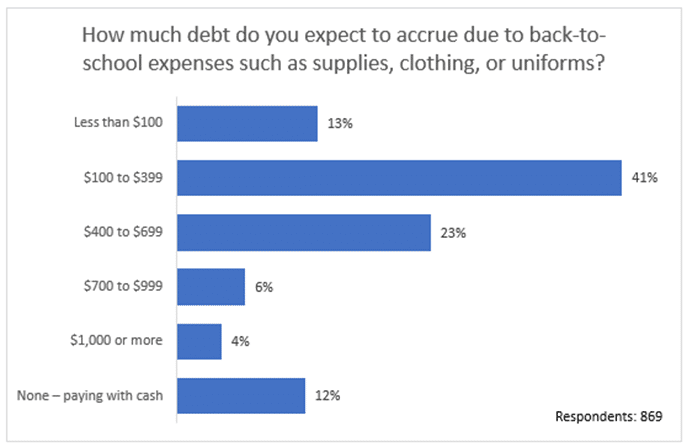

- Back-to-school expenses, such as supplies, clothing, and uniforms can add up, with 41% of parents expecting to accrue between $100-$399 in debt for it. Another 23% of parents plan on accruing $400-$699 in debt.

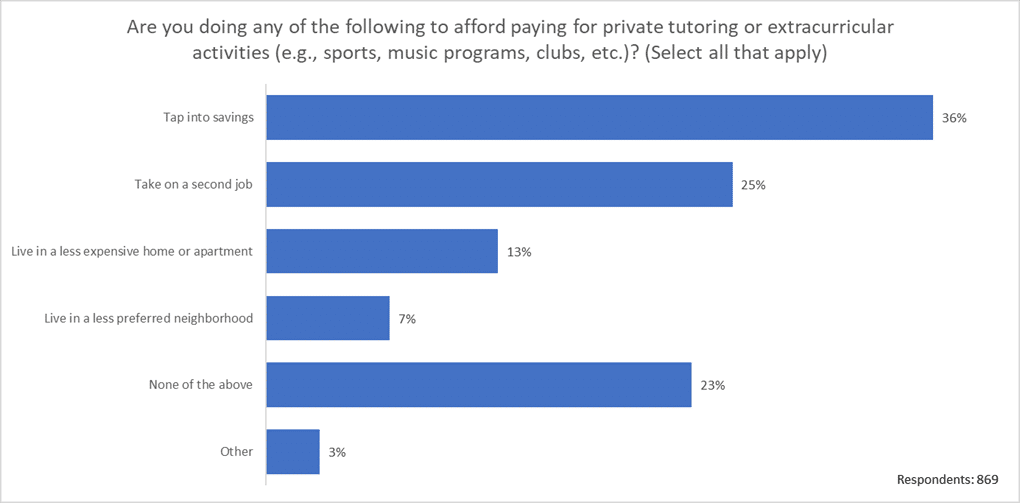

- Private tutoring and extracurricular activities (sports, music programs, clubs, etc.) can also get costly. So, 36% of grade school parents are tapping into their savings, as well as 25% of parents taking on a second job to help fund these activities for their children.

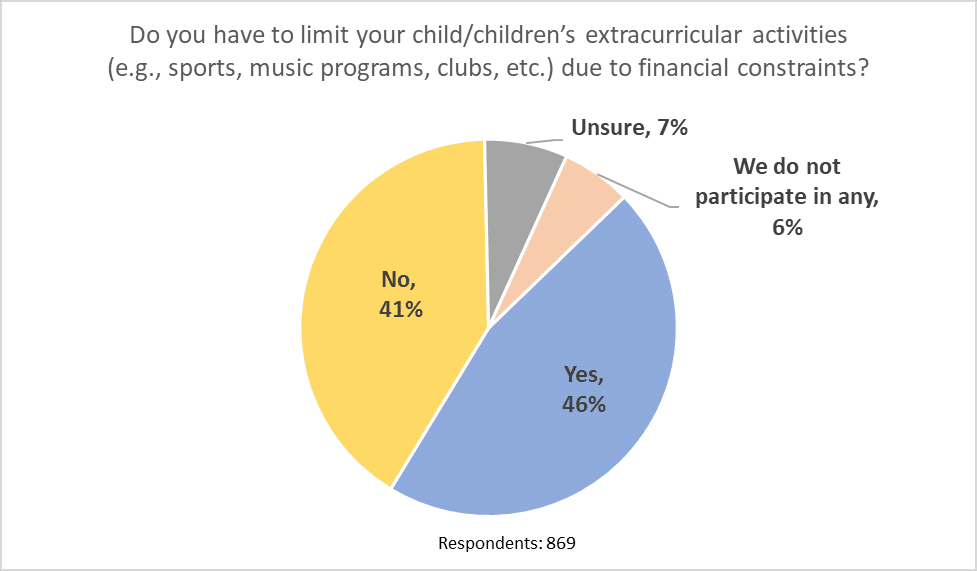

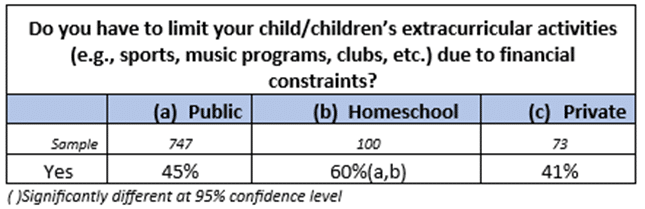

- 46% of parents are limiting their children’s extracurricular activities due to financial constraints.

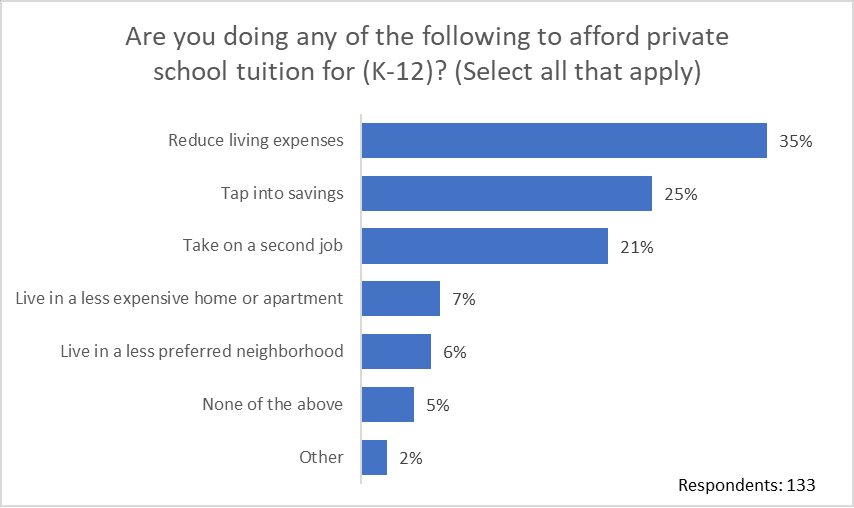

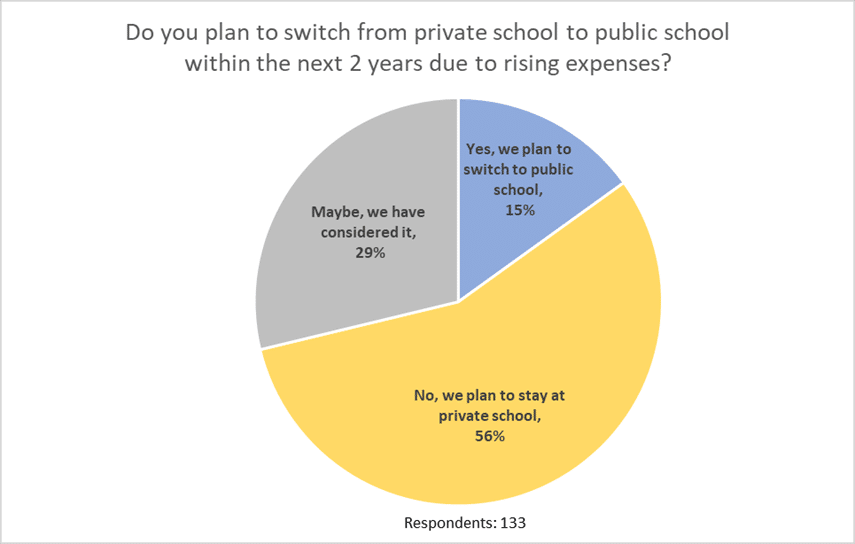

- With private school averaging $12,167 in the United States for grade school, 35% of parents are reducing their living expenses, 25% are tapping into their savings, and 21% are taking on a second job to afford the tuition. Public school could be an option for some, with 15% planning to switch to a public school and 29% considering it in the next two years.

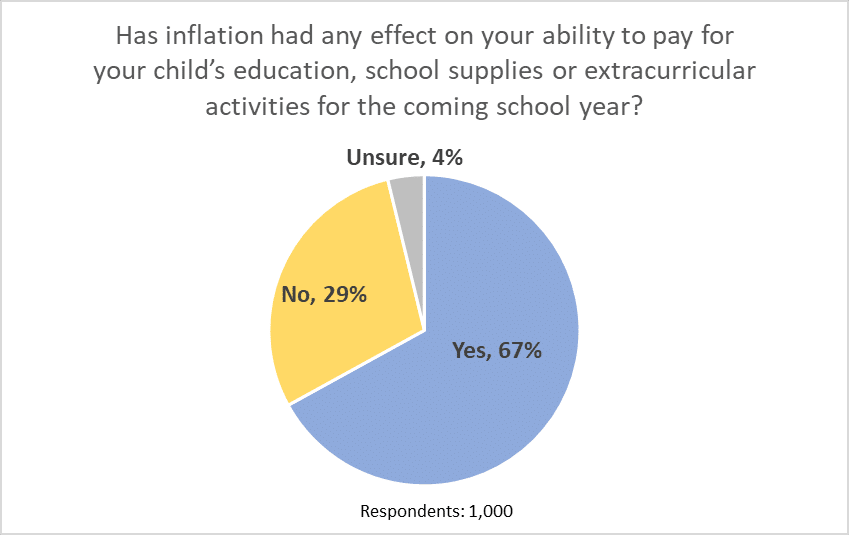

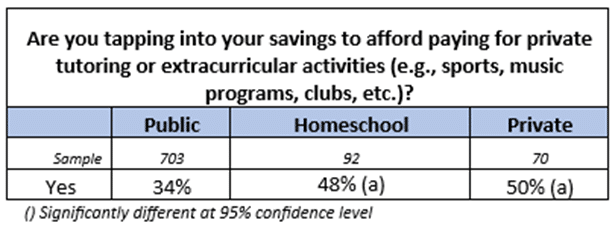

- Homeschool parents are significantly more affected by inflation, with 75% saying it affected their ability to pay for their children’s education, supplies, and extracurricular activities. The average cost to homeschool is anywhere from $500-$6,000 depending on how a parent structures it. 60% of these parents are significantly more likely to limit their children’s extracurricular activities compared to those in public or private school. 48% of homeschool parents are tapping into their savings to help pay for extracurricular activities.

Parents with children in college or trade school

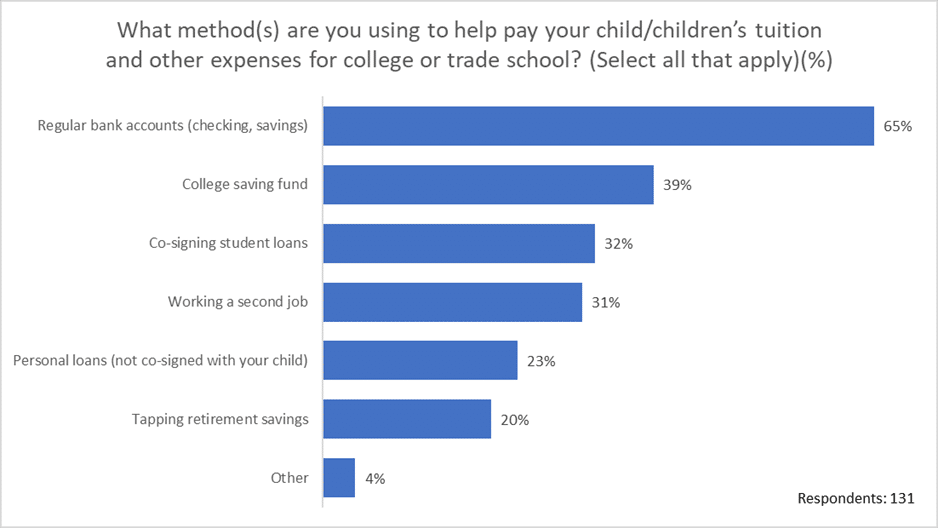

- The average tuition for US private colleges grew by 4% last year to just under $40,000 per year and public in-state school averages $10,500. As these prices for higher level education continue to increase, parents are making financial adjustments to their lives to help their children go to college or trade school. 31% of parents are taking on a second job and 20% are tapping into their retirement savings.

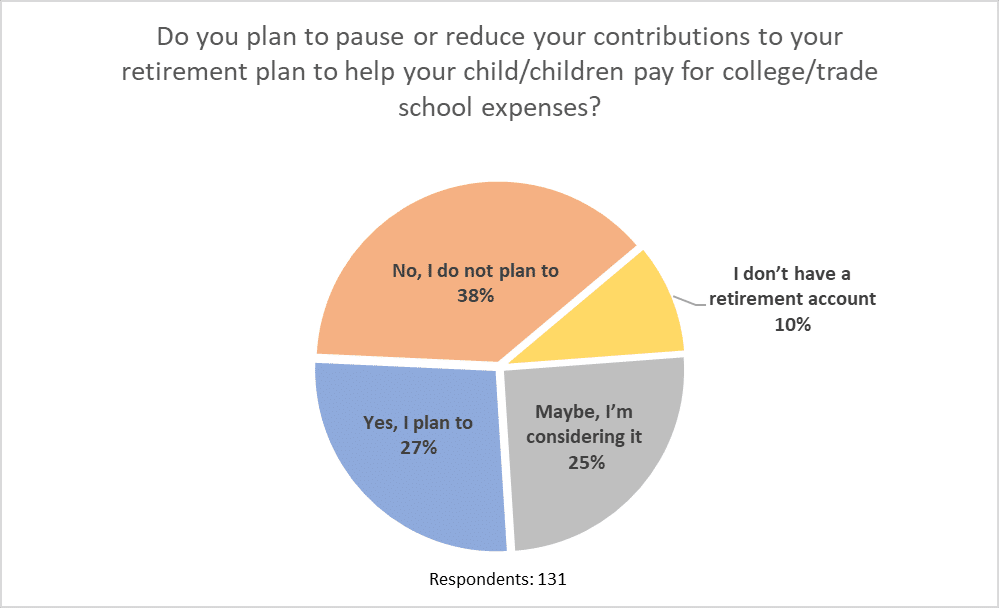

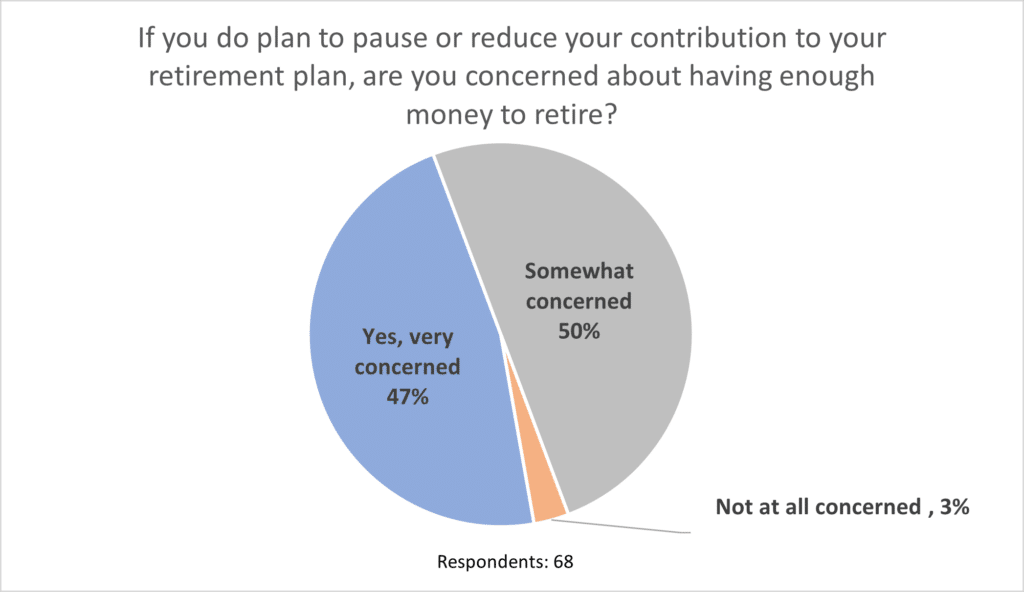

- 27% plan on pausing or reducing their contribution to their retirement plan while 25% are considering it. Within this group of parents, 47% are very concerned and 50% are somewhat concerned about having enough money to retire.

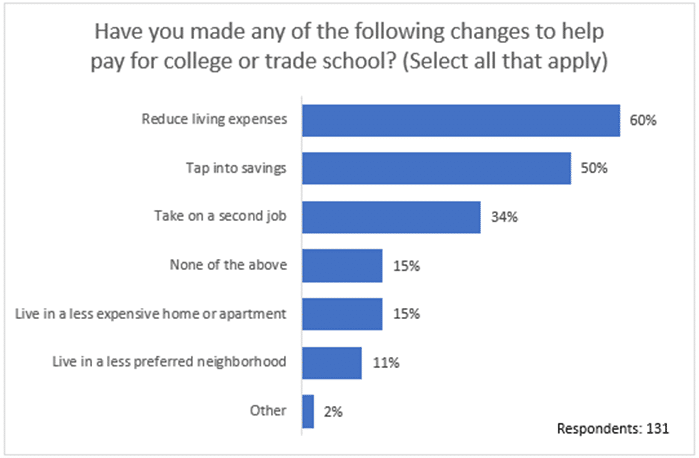

- Parents are making adjustments. For example, 60% are reducing living expenses and 50% are tapping into savings to help pay for college/trade school.

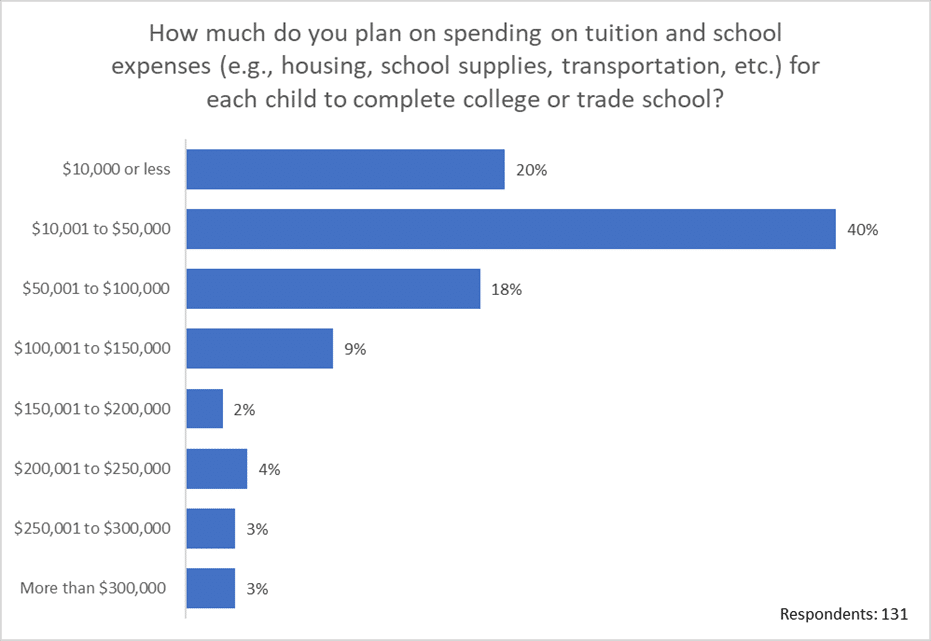

- 40% of college parents plan on spending about $10,000-$50,000 on tuition and school expenses while 20% plan to spend $100,000 or more to help their child complete college or trade school.

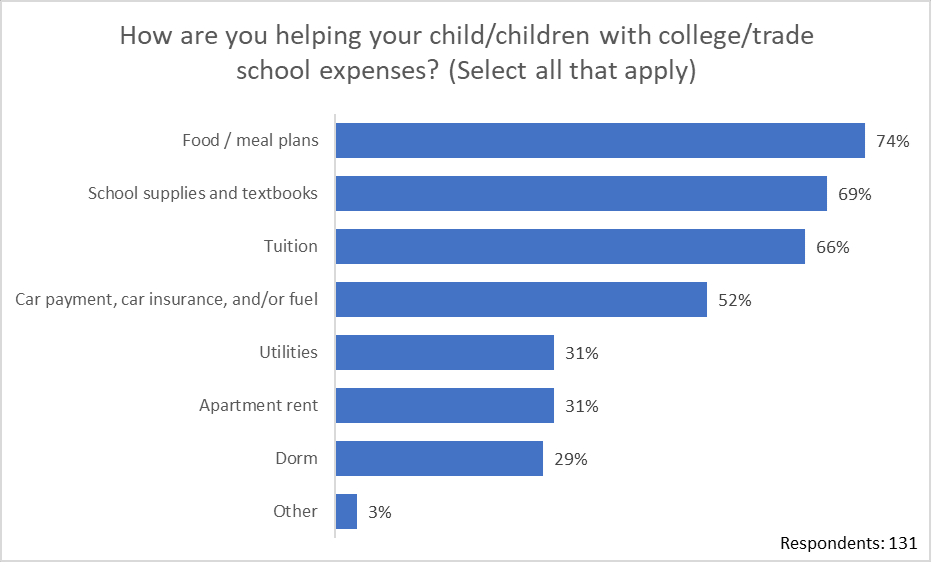

- Food and meal plans top the list at 74% on school expenses parents will help pay for, followed by tuition at 66%, and then car payments/insurance/fuel at 52%.

- While 65% plan on paying for college tuition and expenses through typical bank accounts, 39% are using college savings funds.

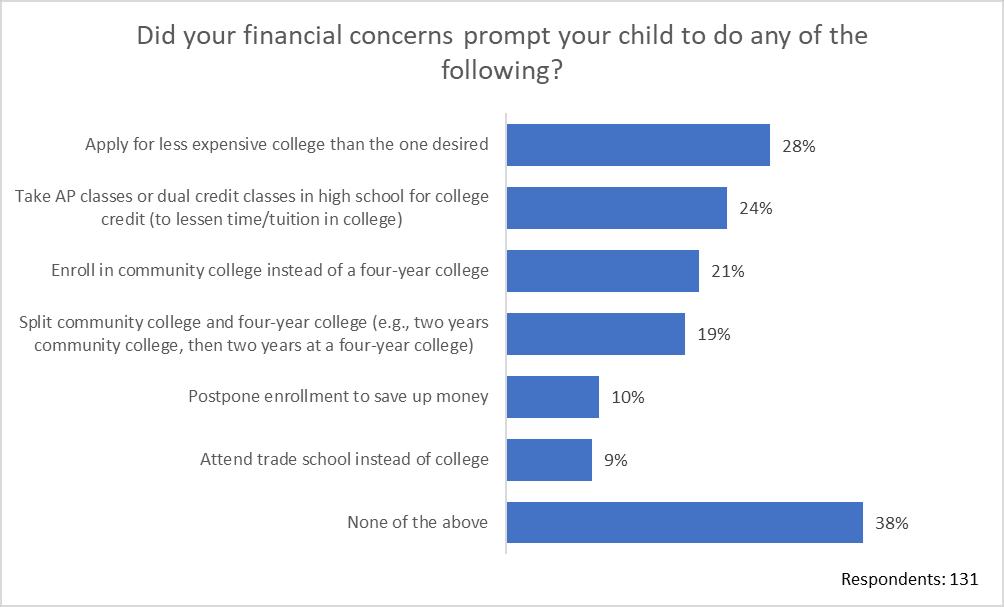

- Unfortunately, 28% of kids apply for less expensive college than the one desired due to financial concerns.

OVERALL (Grade school and College/Trade school)

Two-thirds of respondents say inflation has affected their ability to pay for their child’s education, school supplies, or extracurricular activities for the upcoming school year.

GRADE SCHOOL (Kindergarten thru 12th Grade)

- Parents who homeschool were significantly more likely than those with children in public school to say inflation affected their ability to pay for their child’s education, supplies, and activities for this upcoming school year.

- 75% of those who homeschool said inflation had an effect on their child’s education.

- Nearly 50% of grade school parents intend to use cash to pay for back-to-school supplies and clothing.

- 38% plan on using credit cards as payment.

Four out of ten grade school parents plan to accrue debt of about $100-$399 on back-to-school expenses.

- 36% of grade school parents are tapping into savings to help pay for private tutoring and extracurricular activities.

- Those who homeschool or do private school were significantly more likely to tap into savings than those in public school.

- One in four parents are taking on a second job.

- Overall, 46% of grade school parents must limit their child’s extracurricular activities due to financial constraints.

- Homeschool parents were significantly more likely to limit their children’s activities than those in public or private school.

PRIVATE SCHOOL

- 35% of those in private school are reducing living expenses to afford private school tuition.

- One out of five parents are taking on a second job.

- Nearly 30% of private school parents are considering switching from a private school to a public school in the next two years.

COLLEGE / TRADE SCHOOL

- At 74%, food and meal plans top the list of what parents will help their child with for college/trade school.

- 66% of parents are helping their child/children with their tuition for college/trade school.

- 65% of parents plan to help pay for college or trade school through a typical bank account.

- One in five parents plan on tapping into their retirement savings to help play for college/trade school.

- 30% of parents are taking on a second job to help pay.

- 40% of parents plan on spending about $10,000-50,000 on each child to complete their college/trade school.

- 27% of parents plan on pausing or reducing their contribution to their retirement plan to help pay for college/trade school expenses.

- 25% are considering pausing or planning to pause their retirement contributions.

Of those who plan to pause or reduce their contribution or retirement plan, 47% are very concerned, while 50% are somewhat concerned about having enough money to retire.

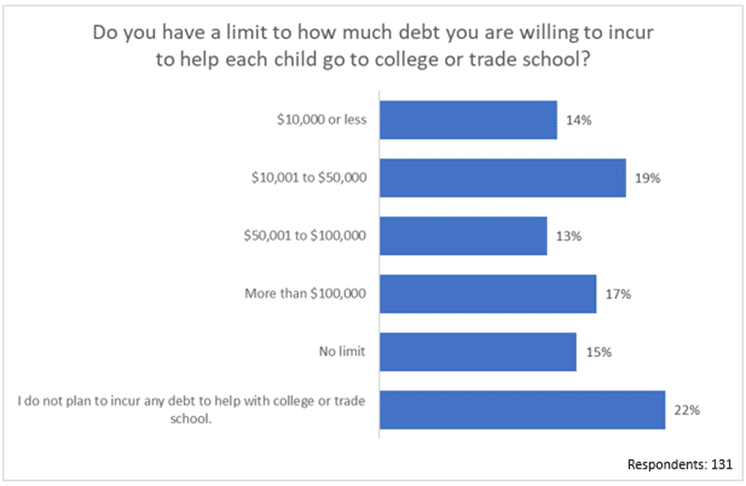

30% of parents plan to incur over $50,000 in debt to help pay for their child to go to college or trade school, with another 20% planning on $10,000-$50,000.

- 60% of college parents mentioned they reduced living expenses to help pay for their child’s college or trade school while another 50% are tapping into their savings.

- One in three college parents are taking on a second job.

28% of kids apply to a less expensive college than the one desired due to financial concerns.

Scope: Survey was conducted in July 2023 using Pollfish.com with 1,000 adults age 24+ with a child in grade school or college/trade school.