scoresense

In The News

Highlighted

FEATURE

ScoreSense’s Brian Sullivan featured on FOX San Antonio

"1 in 4 consumers use tax refunds to pay debt," says ScoreSense credit expert Brian Sullivan.

He says delinquencies are even up by 24%, "as more stress has been put on the budgets, people happen to use their credit cards to pay for everyday purchases."

FEATURE

Lifetime's Balancing Act: Helping you make sense of your credit

ScoreSense, with Montel Williams, helps us understand how credit works, what affects it, and what credit scores really mean. While credit can seem overwhelming, a clear resource that explains everything makes it much less intimidating.

PRESS MENTION

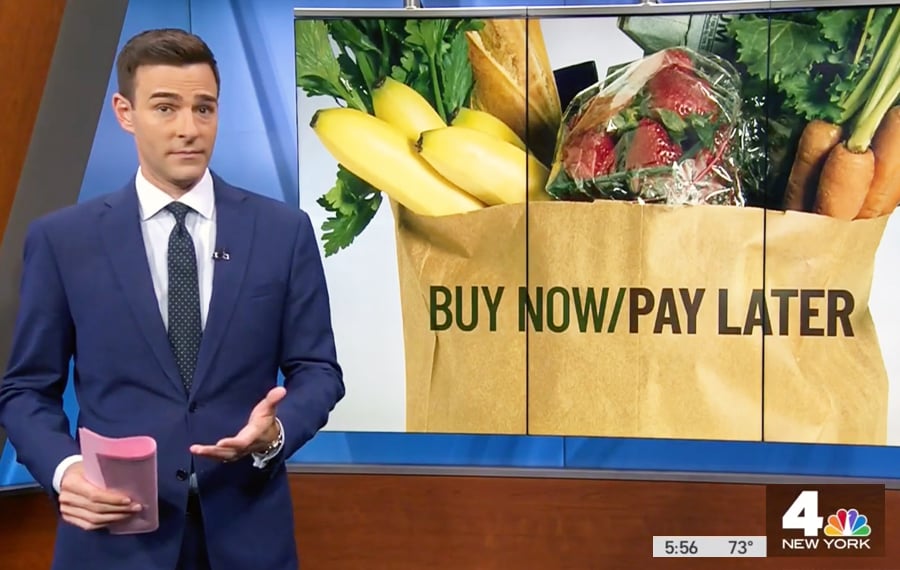

NBC New York: ScoreSense warns consumers about the risks of "buy now, pay later"

The Consumer Financial Protection Bureau will regulate “Buy Now, Pay Later” services, which have grown with higher grocery prices. These loans let shoppers split payments but may come with high fees and interest. Experts warn about hidden fees and unclear terms. While helpful, BNPL can become a financial burden. Lenders now face new federal oversight.

Informational Interviews

INTERVIEW

ScoreSense explains medical debt reporting changes to Telemundo LA

“Previously, medical debt stayed on your credit report for 7 years as charged off or past due. Now, it can be removed sooner, which should boost your credit score once settled debts are taken off,” said Carlos Medina, VP of Operations and Corporate Development at One Technologies.

INTERVIEW

ScoreSense warns NBC Bay Area viewers about "buy now, pay later"

If you’re wondering how you’ll pay for everything this holiday season, many stores will say they’ve got you covered with a small loan right there at the register. Consumer Investigator Chris Chmura says, "Stop and think."

INTERVIEW

ABC 11 Raleigh: Benefits and dangers of "buy now, pay later" for holiday shopping

ABC 11 in Raleigh, North Carolina, turned to ScoreSense to help inform its viewers about Buy Now, Pay Later programs.

Carlos Medina of ScoreSense, which offers credit monitoring, says, "Consumers have to read the fine print because these loans can go anywhere from 0% with no charge at all, and depending on the number of months, up to 30% and sometimes even higher."

INTERVIEW

FOX News San Antonio talks to ScoreSense about tax refunds

Many Americans are receiving smaller tax refunds this year, making it harder to pay debts. More are using credit cards for daily expenses, causing more delinquencies. Some now owe money instead of getting refunds, increasing their debt. With credit card rates up to 30%, experts advise paying off high-interest debts first, but smaller refunds may continue to be a problem next year.

INTERVIEW

FOX News San Antonio relies on ScoreSense expertise

A recent consumer ScoreSense survey showed that 55% of respondents are using coupons, 57% are buying on sale to save, and over 45% are buying store-brand products instead of name-brand products.

INTERVIEW

FOX 26 Houston: Improving credit scores for homebuyers

Credit experts say home buyers are hurting their credit and finances in this real estate market. ScoreSense's Carlos Medina joins FOX 26's Heather Sullivan for tips on how credit really works and how to improve your credit score.

INTERVIEW

Telemundo Dallas and ScoreSense talk negotiating apartment leases

INTERVIEW

ScoreSense discusses deferred payments with Consumer Affairs

Carlos Medina, senior vice president of operations and business development for One Technologies, which owns the credit monitoring product ScoreSense, noted that "buy now, pay later" (BNPL) offers are another type of deferred payment option to consider. With a BNPL promotion, a consumer can split a purchase into installment payments.

INTERVIEW

ScoreSense and Telemundo Los Angeles talk about "buy now, pay later"

"Buy now, pay later" options make shopping easier, but come with risks. High interest, tricky returns, and missed payments can add costs or hurt credit. Track spending closely. Used wisely, these plans can help credit, but poor use can cause trouble.

Media Features

FEATURE

FOX 5 Atlanta: The pros and cons of "buy Now, pay later" offers

‘Buy now, pay later’ programs are popular and favored by retailers, but they may not be right for you. ScoreSense found 44% of its members used ‘buy now, pay later’—and 73% of them defaulted.

FEATURE

One-fifth of consumers blew holiday budgets and credit delinquencies are increasing, survey shows

New Credit Card Accounts, Usage, Debt, and Late Payments Rise in the Wake of Increased Holiday Spending and Inflation, according to Credit Market Analysis by ScoreSense

FEATURE

ScoreSense’s Brian Sullivan featured on FOX San Antonio

"1 in 4 consumers use tax refunds to pay debt," says ScoreSense credit expert Brian Sullivan.

He says delinquencies are even up by 24%, "as more stress has been put on the budgets, people happen to use their credit cards to pay for everyday purchases."

FEATURE

Lifetime's Balancing Act: Helping you make sense of your credit

ScoreSense, with Montel Williams, helps us understand how credit works, what affects it, and what credit scores really mean. While credit can seem overwhelming, a clear resource that explains everything makes it much less intimidating.

FEATURE

Bad credit spending habits on the rise since summer, says ScoreSense analysis

Consumers are increasingly opening lines of credit, financing purchases, and paying late, according to a recent analysis of customer credit activity from ScoreSense, a credit score monitoring product. The analysis reveals a "steppingstone" trend.

FEATURE

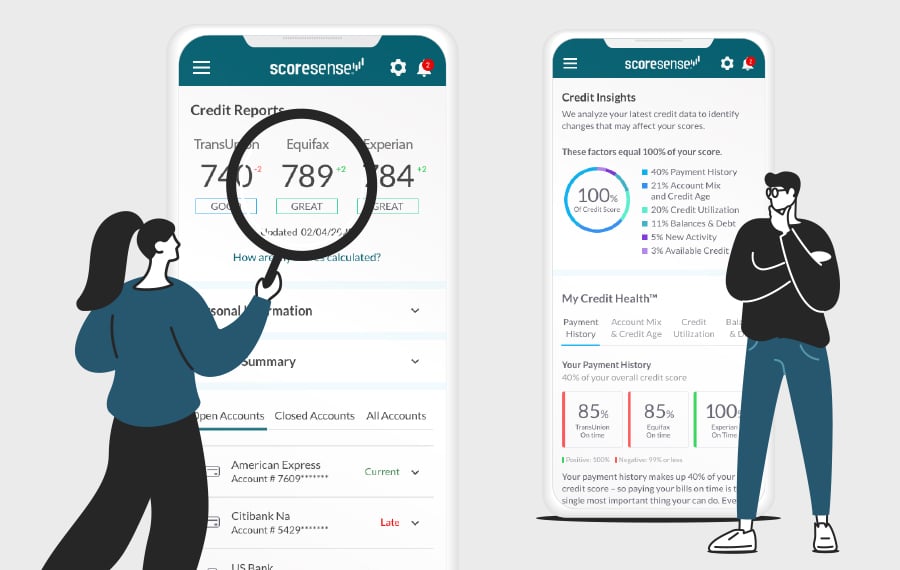

ScoreSense featured on CardRates.com

ScoreSense helps consumers understand and manage their credit reports by offering expert guidance and support. Its specialists assist with credit disputes and provide personal consultations, making it easier for customers to monitor their credit health.

FEATURE

PlanAdviser features ScoreSense retirement survey data

A ScoreSense survey found 30% of Americans worry credit card debt could delay retirement, followed by medical (29%) and mortgage debt (26%). Thirty percent said debt would not delay their retirement.

FEATURE

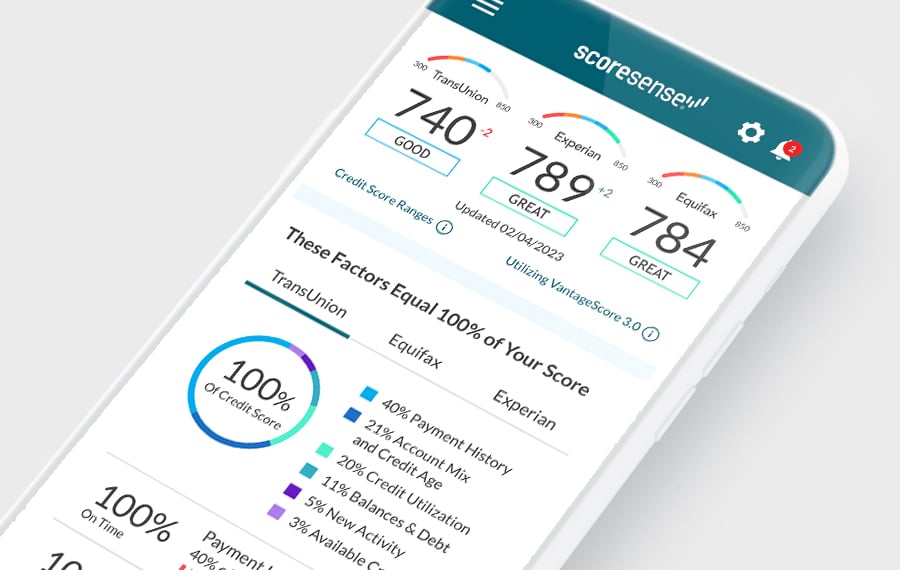

ScoreSense featured on BadCredit.org

Credit bureaus report different scores, impacting loans and insurance. ScoreSense consolidates all three scores, provides insights, alerts users to changes, and aids in identity theft protection. It connects users with credit specialists and emphasizes the importance of credit knowledge.

FEATURE

FOX Business features ScoreSense inflation survey

As summer approaches, many Americans are planning vacations and other leisure activities. But inflation is holding many of them back this year, according to a ScoreSense survey.

Press Mentions

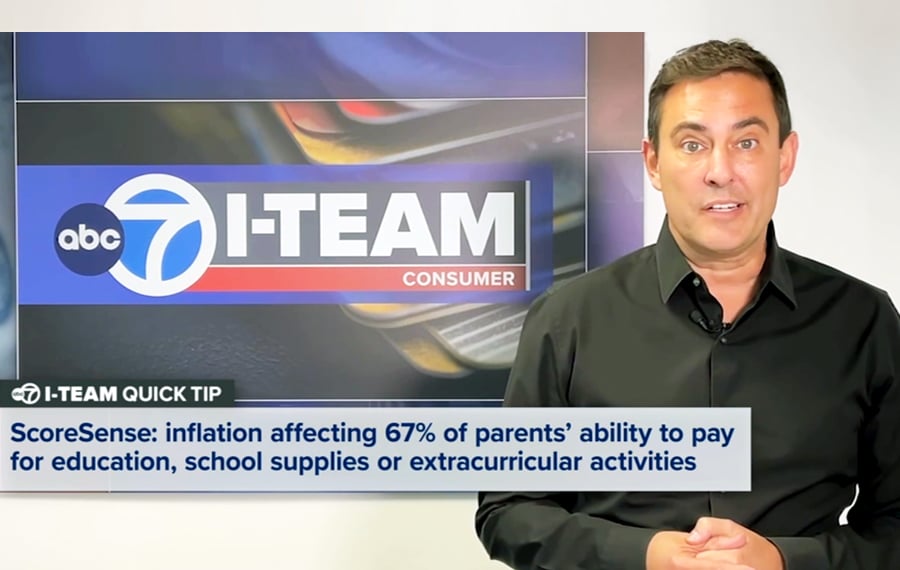

PRESS MENTION

ScoreSense offers back-to-school savings tips to Chicago’s ABC 7 viewers

Here's a quick tip to save on school expenses. According to financial experts at ScoreSense, inflation is affecting 67% of parents with students in grade school and college, when it comes to education, school supplies, or extracurricular activities.

PRESS MENTION

FOX Business shares ScoreSense back-to-school survey data

Amid economic uncertainty, the back-to-school season could have a significant impact on the wallets of American families with children, according to a ScoreSense survey, a product of One Technologies.

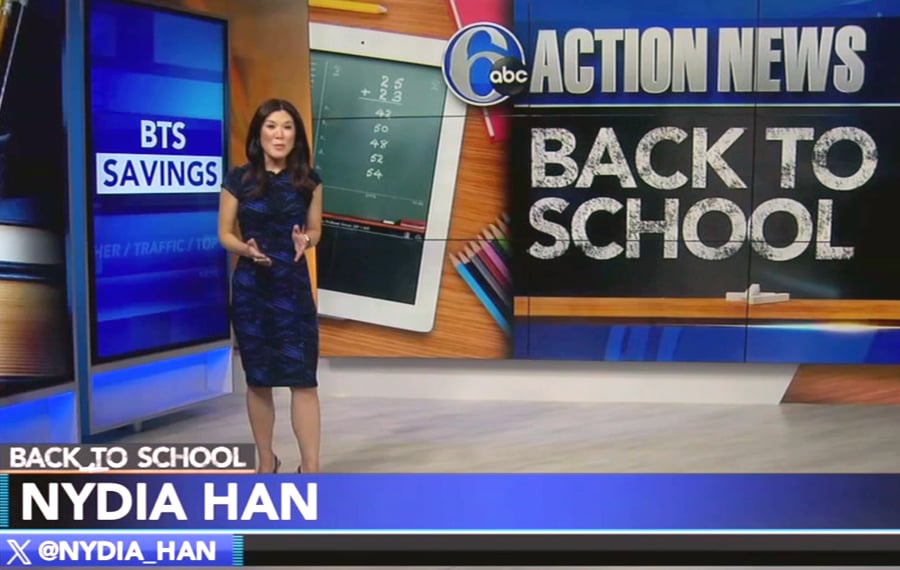

PRESS MENTION

New Jersey’s ABC 6 shares ScoreSense data on back-to-school inflation

Many students and their families look forward to back-to-school shopping, but this inflationary economy is putting a damper on spending. A new survey by ScoreSense reveals inflation is impacting school spending for 67% of parents.

PRESS MENTION

Furniture Today publishes ScoreSense survey data

A ScoreSense survey found that 72% of people are worried about a possible recession this year, especially those 64 and older. About half reported financial stress; 48% blamed inflation. Other reasons included economic instability (11%), not enough savings (11%), and personal debt (9%).

PRESS MENTION

NBC New York: ScoreSense warns consumers about the risks of "buy now, pay later"

The Consumer Financial Protection Bureau will regulate “Buy Now, Pay Later” services, which have grown with higher grocery prices. These loans let shoppers split payments but may come with high fees and interest. Experts warn about hidden fees and unclear terms. While helpful, BNPL can become a financial burden. Lenders now face new federal oversight.

PRESS MENTION

Retail industry magazine publishes ScoreSense holiday shopping survey results

Forty-seven percent of respondents used credit cards to fund their holiday spending, and one in five respondents intend to pay off their bills with federal tax refunds, according to a post-holiday spending survey by ScoreSense, a credit monitoring product.

PRESS MENTION

El Diario NY highlights ScoreSense’s holiday spending research

Given the high inflation and fears of a recession in the U.S. economy, a ScoreSense survey found that 41% of holiday shoppers plan to spend less than last year on gifts, decorations, and holiday travel this year.

PRESS MENTION

ScoreSense holiday shopping data featured on Univision

A new consumer survey by ScoreSense found that 4 out of 10 people in the United States plan to spend less on shopping, decorations, and travel during the holiday season because they fear for their financial future. In fact, those who responded to the poll made it clear they intended to pay in cash to avoid going into debt with credit cards.

PRESS MENTION

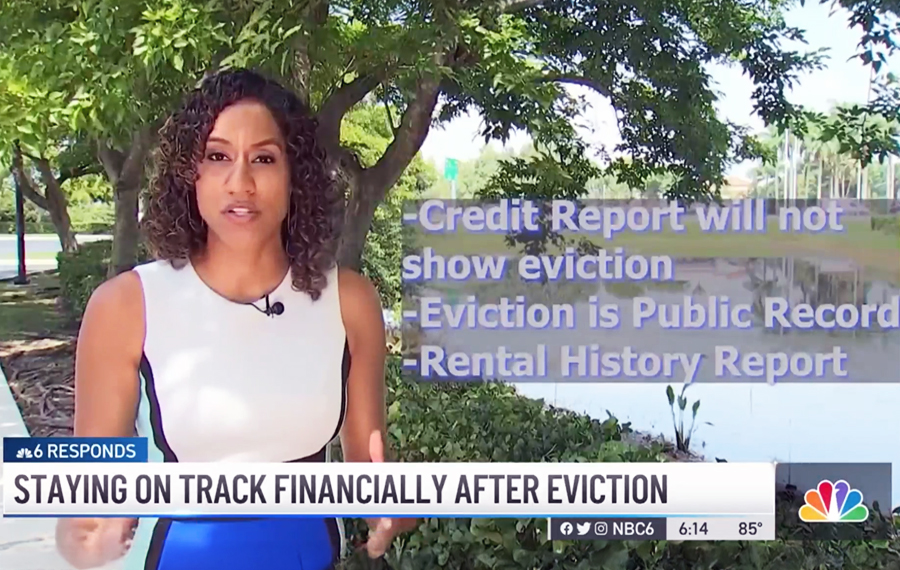

Staying on track financially after eviction

What steps can you take to secure another rental after being evicted? NBC 6 Responds’ Sasha Jones reports, with a discussion from ScoreSense credit expert Carlos Medina.

PRESS MENTION

Yahoo! Finance: Half of Americans delay summer plans due to inflation

In turn, 50% of Americans say they are canceling or postponing vacation trips due to financial challenges, according to a ScoreSense survey. Of those not canceling entirely, one in three respondents said they plan to spend less on expensive vacation locations.

PRESS MENTION

ScoreSense offers NBC readers advice for car shopping in a tough market

Before visiting a dealer, talk to your bank or other lenders to see how much they’re willing to finance, and at what interest rate, emphasized Carlos Medina, senior vice president of business operations for ScoreSense, a consumer credit information service.

PRESS MENTION

Why credit scores might drop: ScoreSense shares with US News

"If the changes to your report are accurate, you should develop a plan to pay off your debt and work with your financial institution to prevent any further drop to your score," says Carlos Medina, senior vice president at One Technologies, which provides the consumer credit information platform ScoreSense.

What's Your Three Credit Scores?

Credit Scores & Reports From All Three Bureaus, Instantly!**